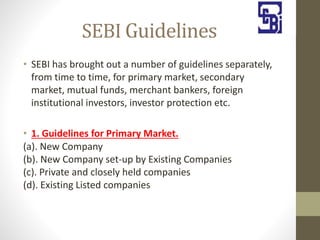

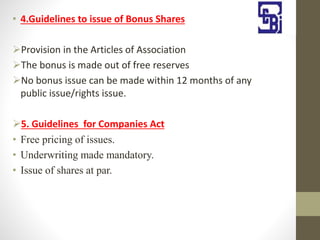

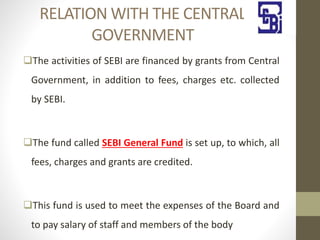

The Securities and Exchange Board of India (SEBI) was established in 1988 as an interim administration body and given statutory powers in 1992 through the SEBI Act. SEBI is chaired by C B Bhave and is responsible for regulating the securities market and protecting investors. SEBI's objectives include regulating stock exchanges, controlling insider trading, and protecting investors. It undertakes regulatory functions like registering intermediaries and developmental functions like investor education. SEBI has guidelines for primary and secondary markets and regulates foreign institutional investors. It faces challenges from cross-border trading and demanding investors.