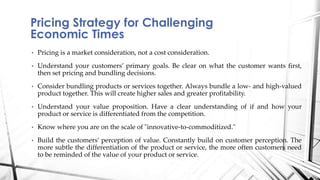

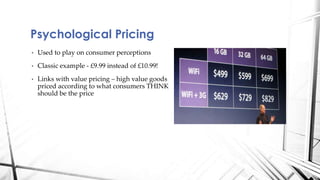

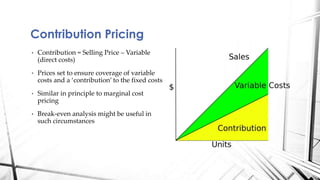

The document discusses various pricing strategies that businesses can utilize to maximize profitability and market share. It outlines objectives related to pricing, factors influencing pricing decisions, and different approaches like value pricing, psychological pricing, and penetration pricing. Additionally, it emphasizes the importance of understanding customer perception and market dynamics when determining the best pricing strategy.