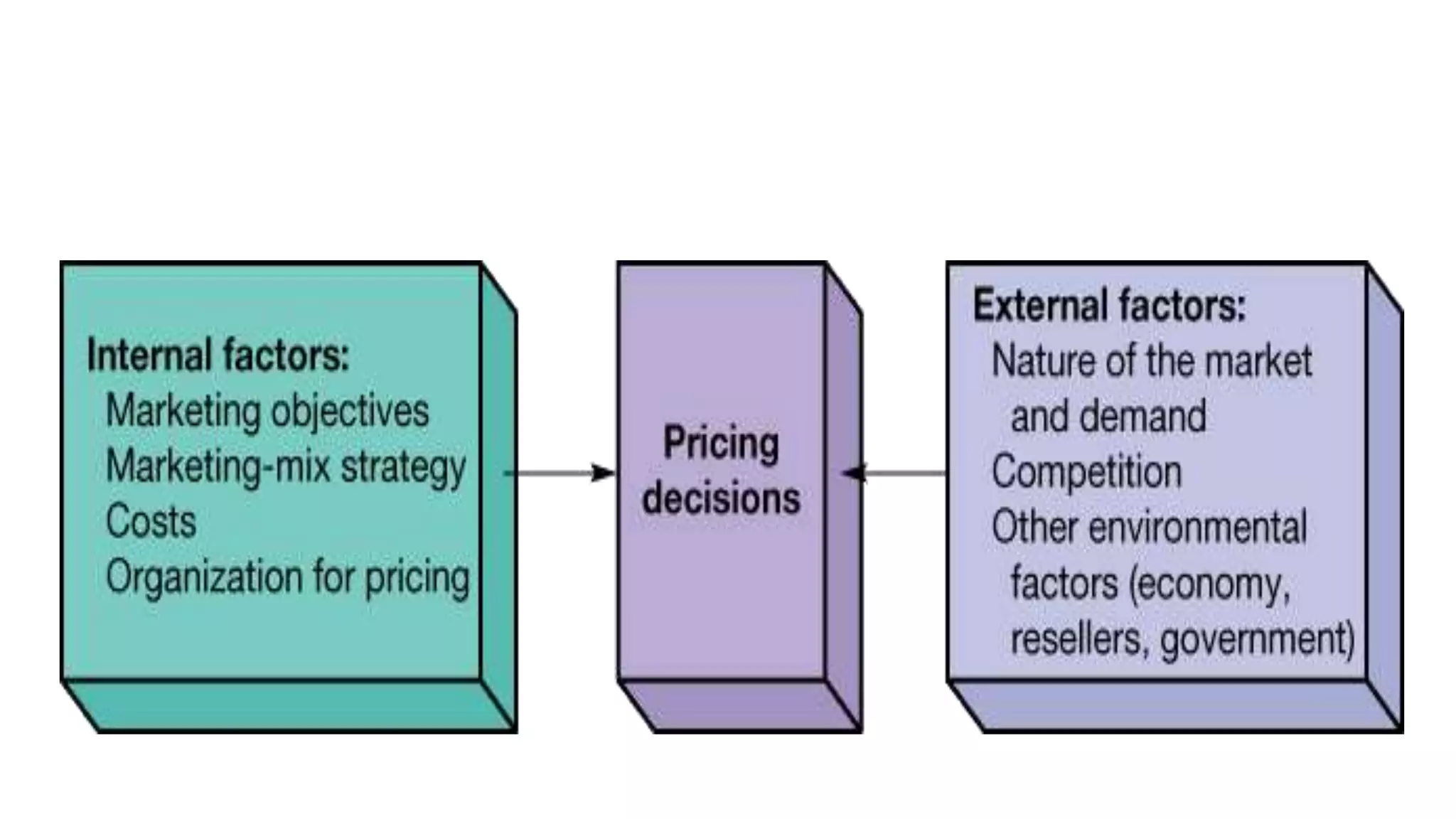

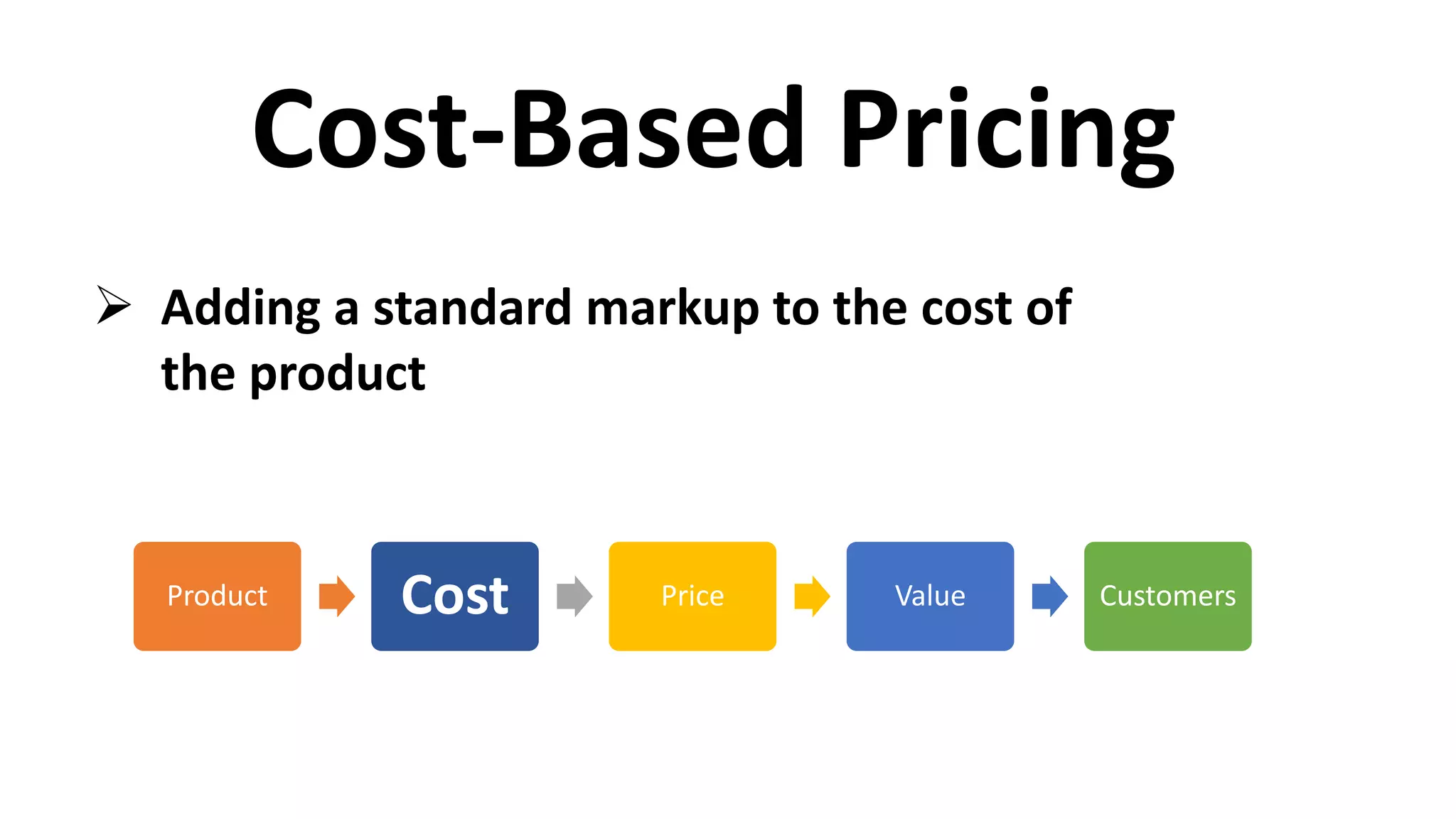

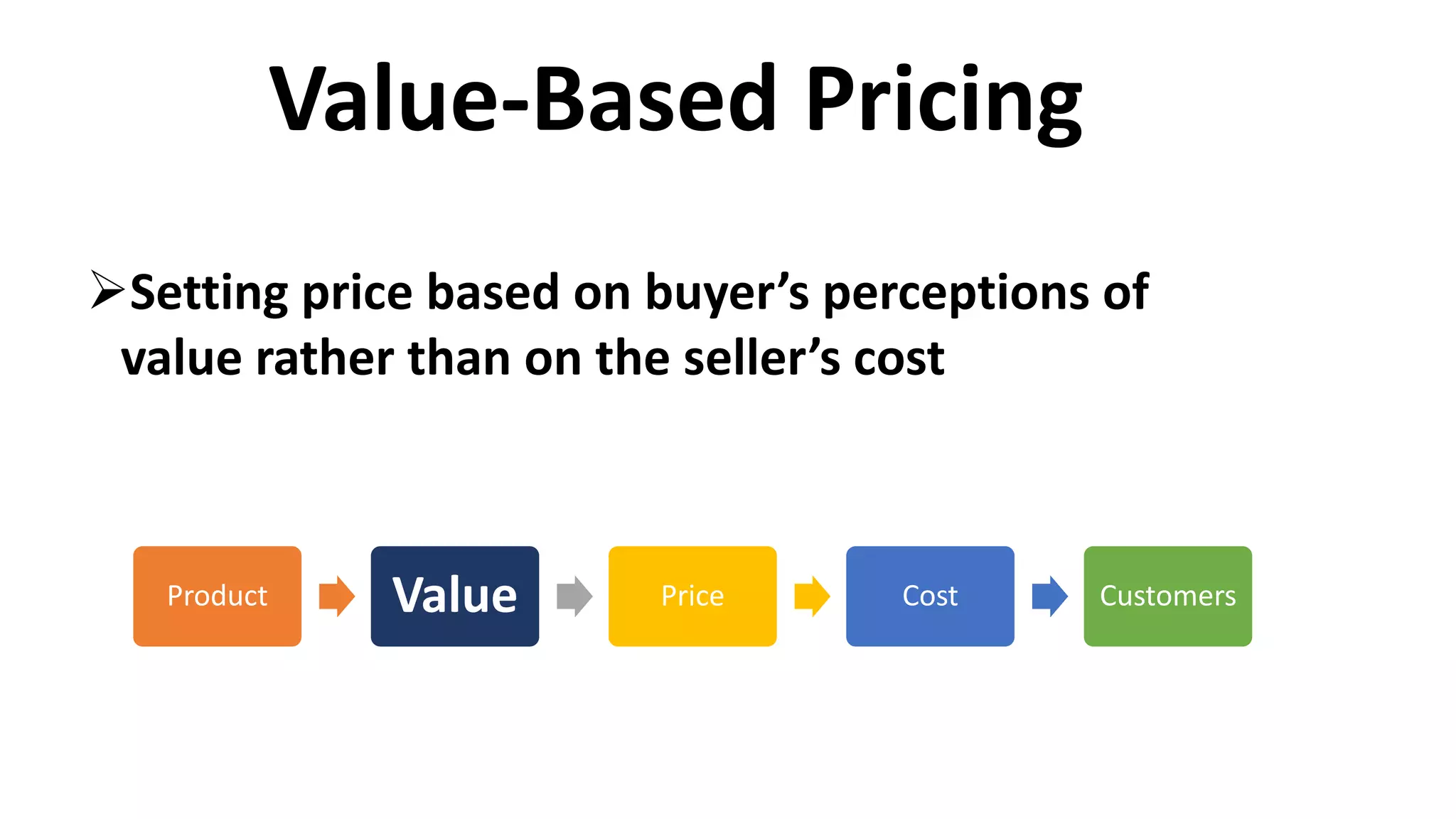

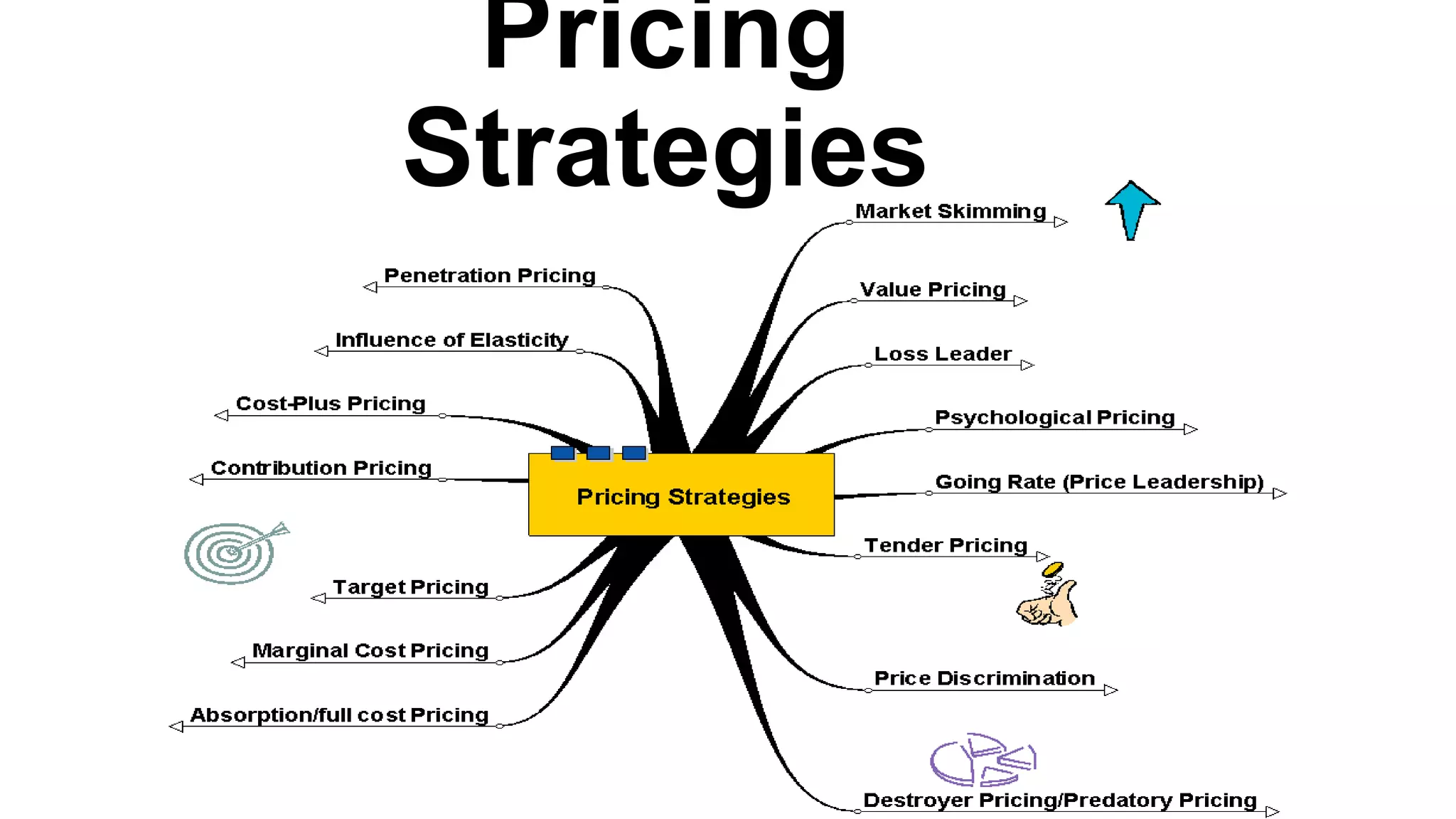

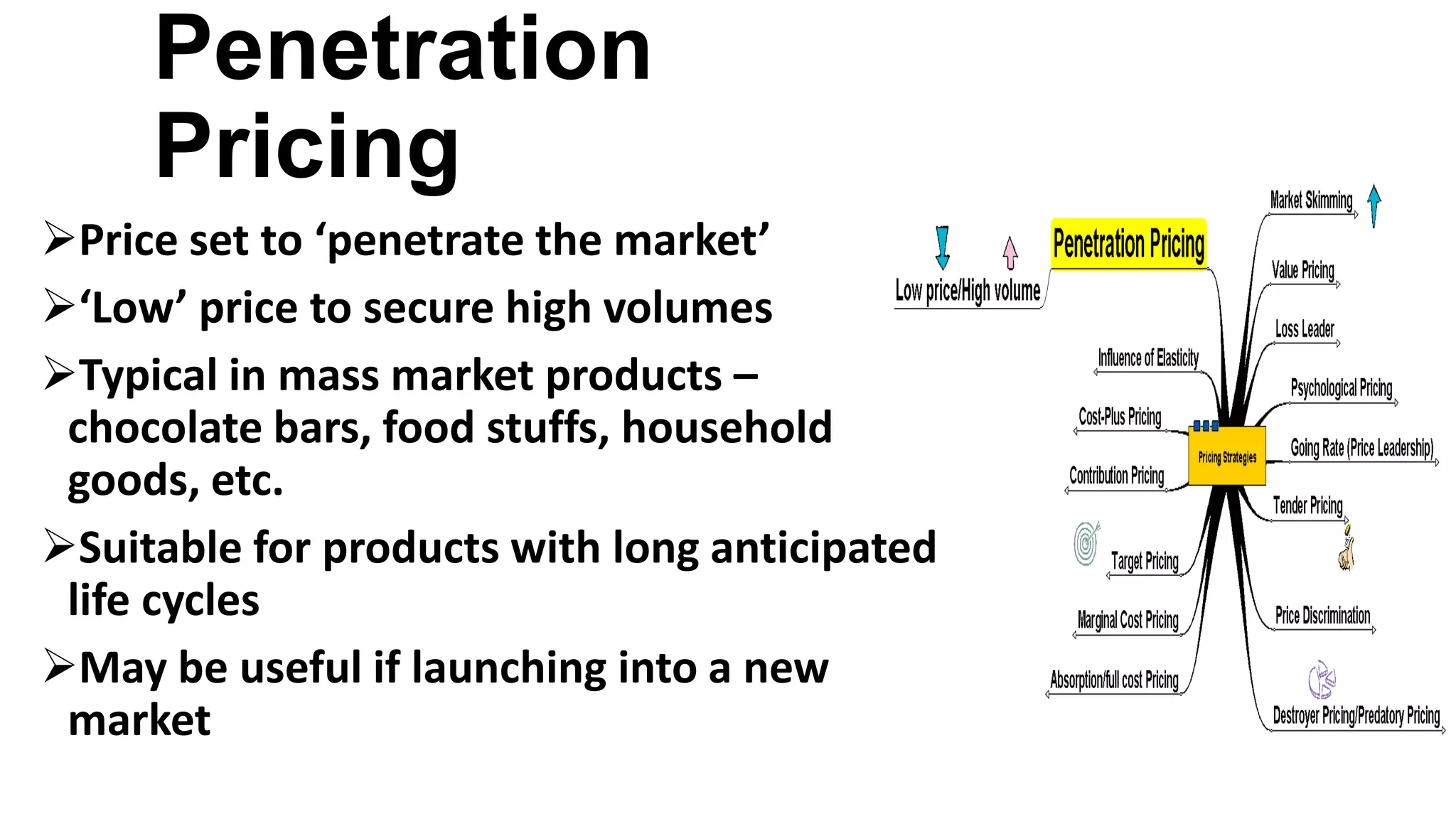

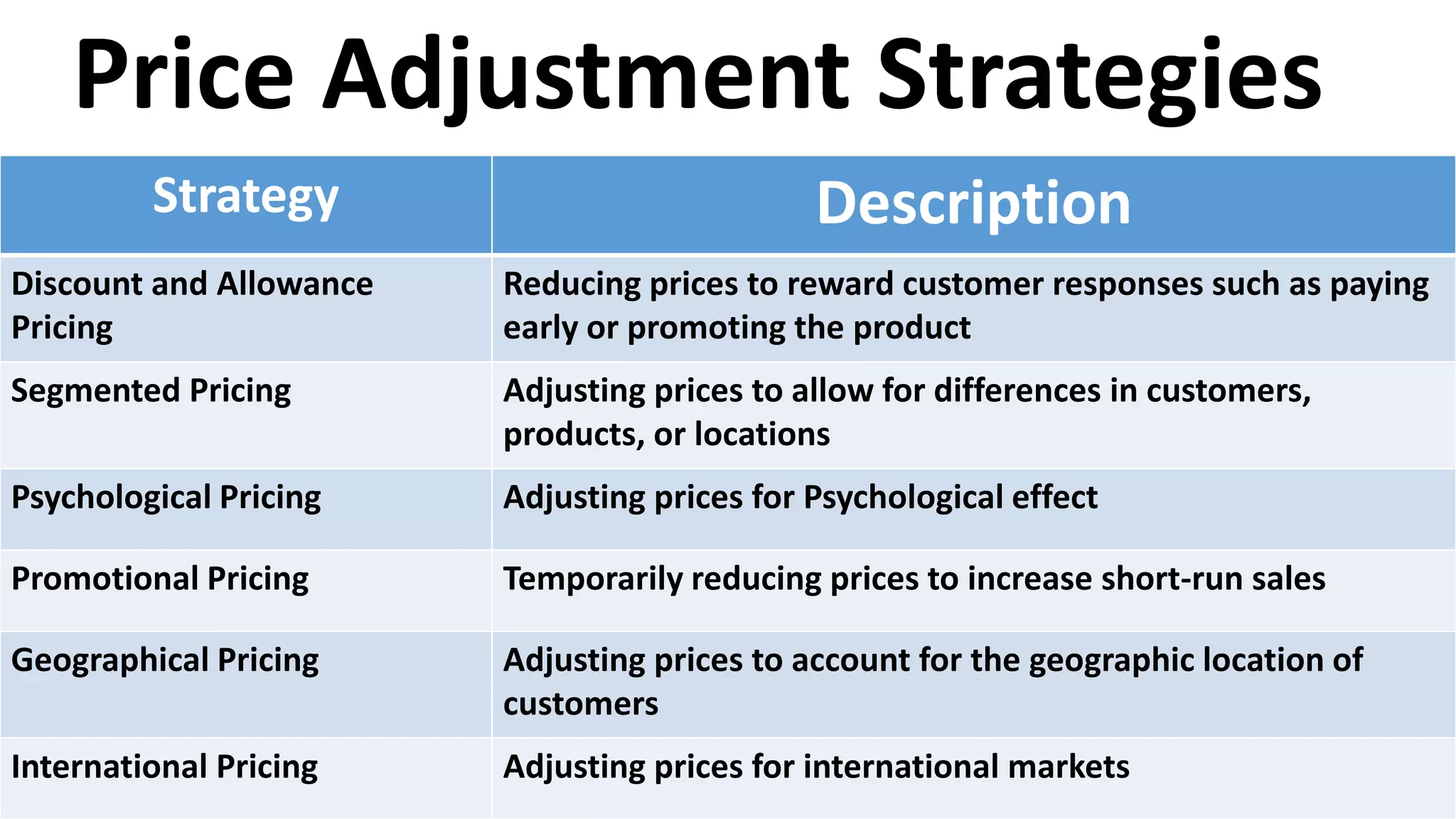

Price is determined by several factors including costs, customer perceived value, and competition. There are three main approaches to pricing: cost-based pricing which adds a markup to costs, value-based pricing based on customer perceptions, and competition-based pricing which matches competitors' prices. Other pricing strategies include penetration pricing to gain market share, market skimming to extract profits from early adopters, loss leader pricing to attract customers, and psychological pricing to influence perceptions. Product line, bundle, and segmented pricing are also used to target different customer groups.