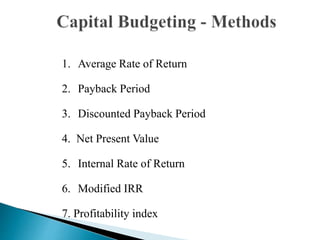

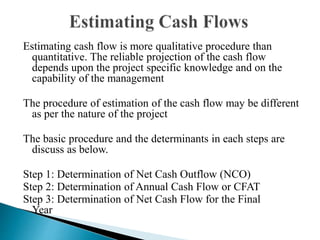

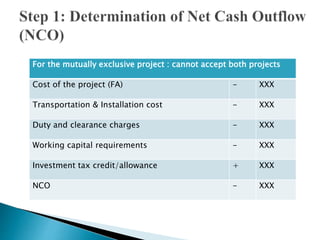

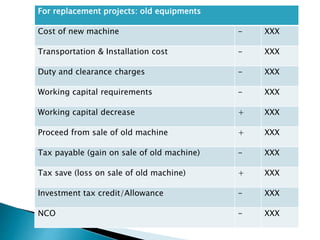

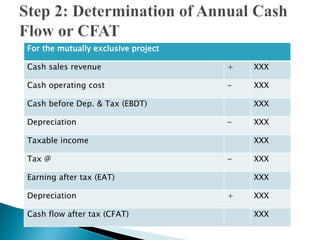

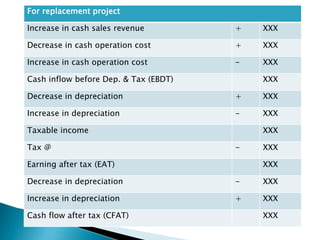

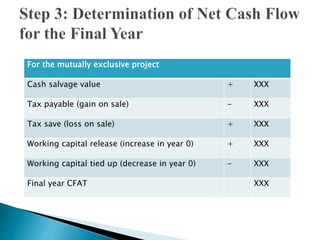

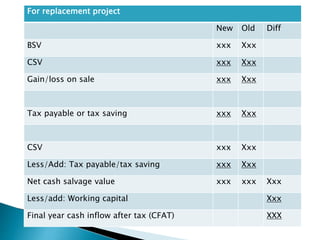

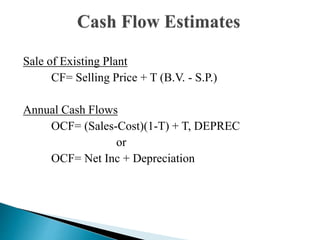

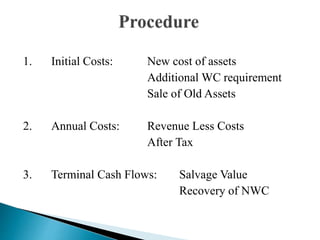

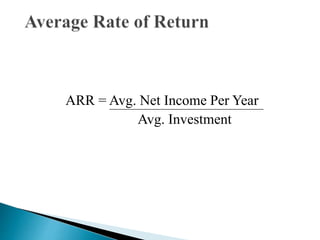

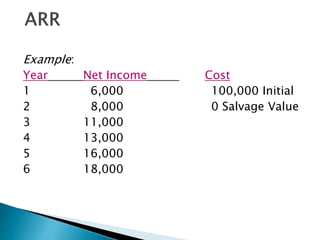

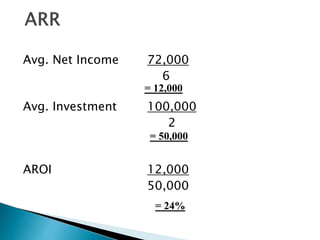

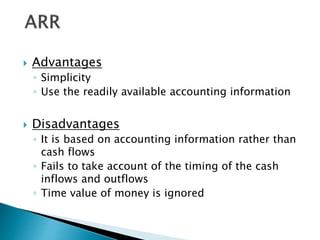

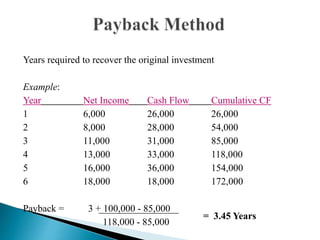

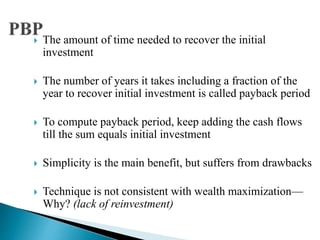

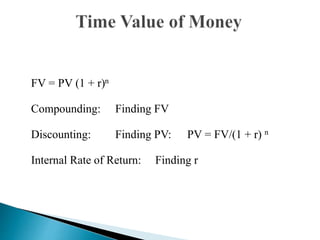

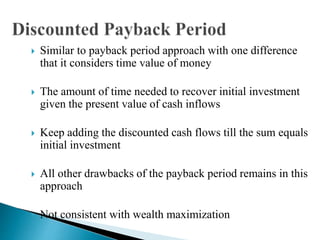

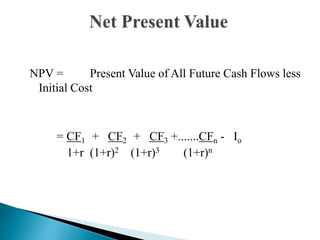

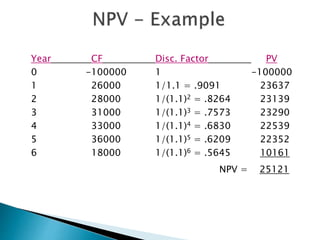

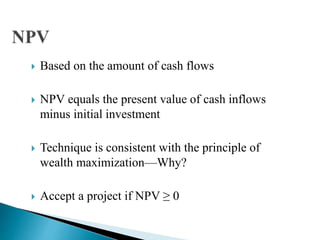

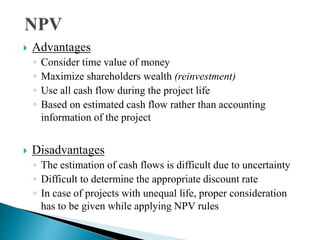

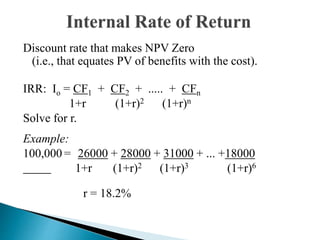

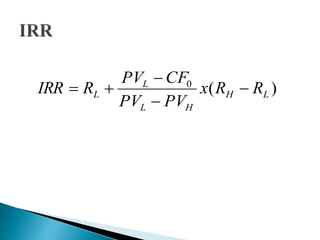

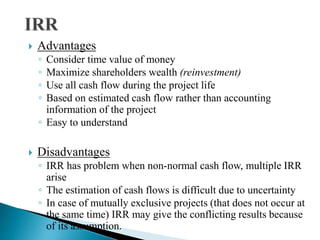

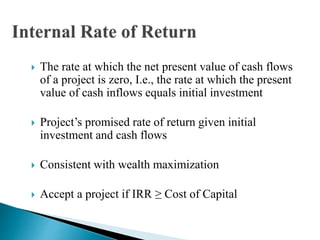

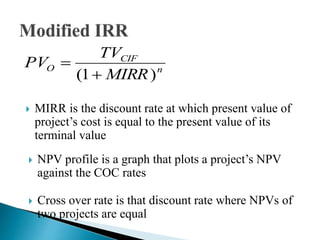

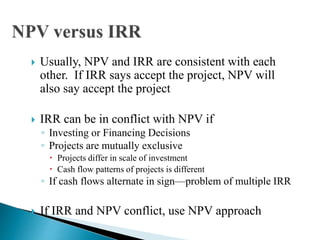

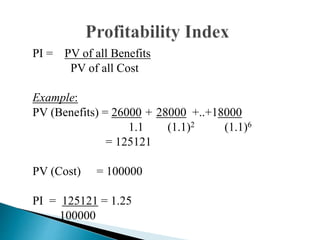

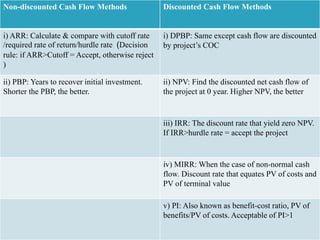

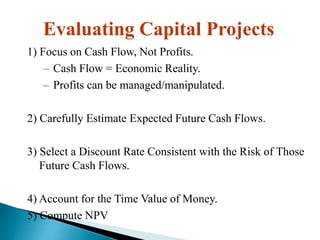

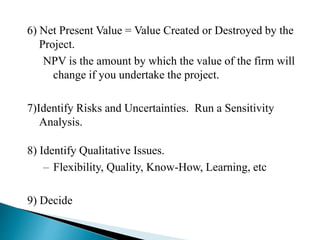

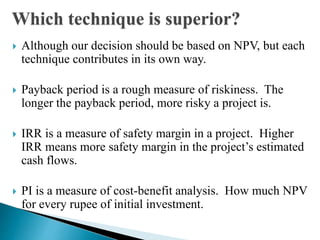

The document discusses various capital budgeting techniques for evaluating investment projects. It outlines steps for estimating cash flows, including determining net cash outflows, annual cash flows, and final year cash flows. It then explains several evaluation techniques like average rate of return, payback period, discounted payback period, net present value, internal rate of return, and profitability index. The techniques consider factors like time value of money, risk, and whether the technique is consistent with maximizing shareholder wealth. NPV is highlighted as the preferred technique, though others provide supplementary insights into risk, costs, and returns.