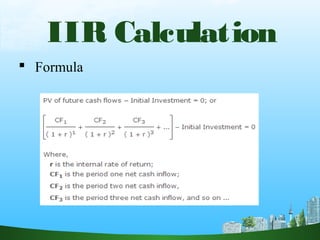

The document outlines key concepts in investment evaluation including payback period, time value of money, and internal rate of return (IRR). It emphasizes the importance of understanding payback periods for both even and uneven cash flows, as well as the decision-making criteria for investments. Additionally, it discusses the implications of time value on future and present cash flows, demonstrating how these concepts can impact investment decisions.