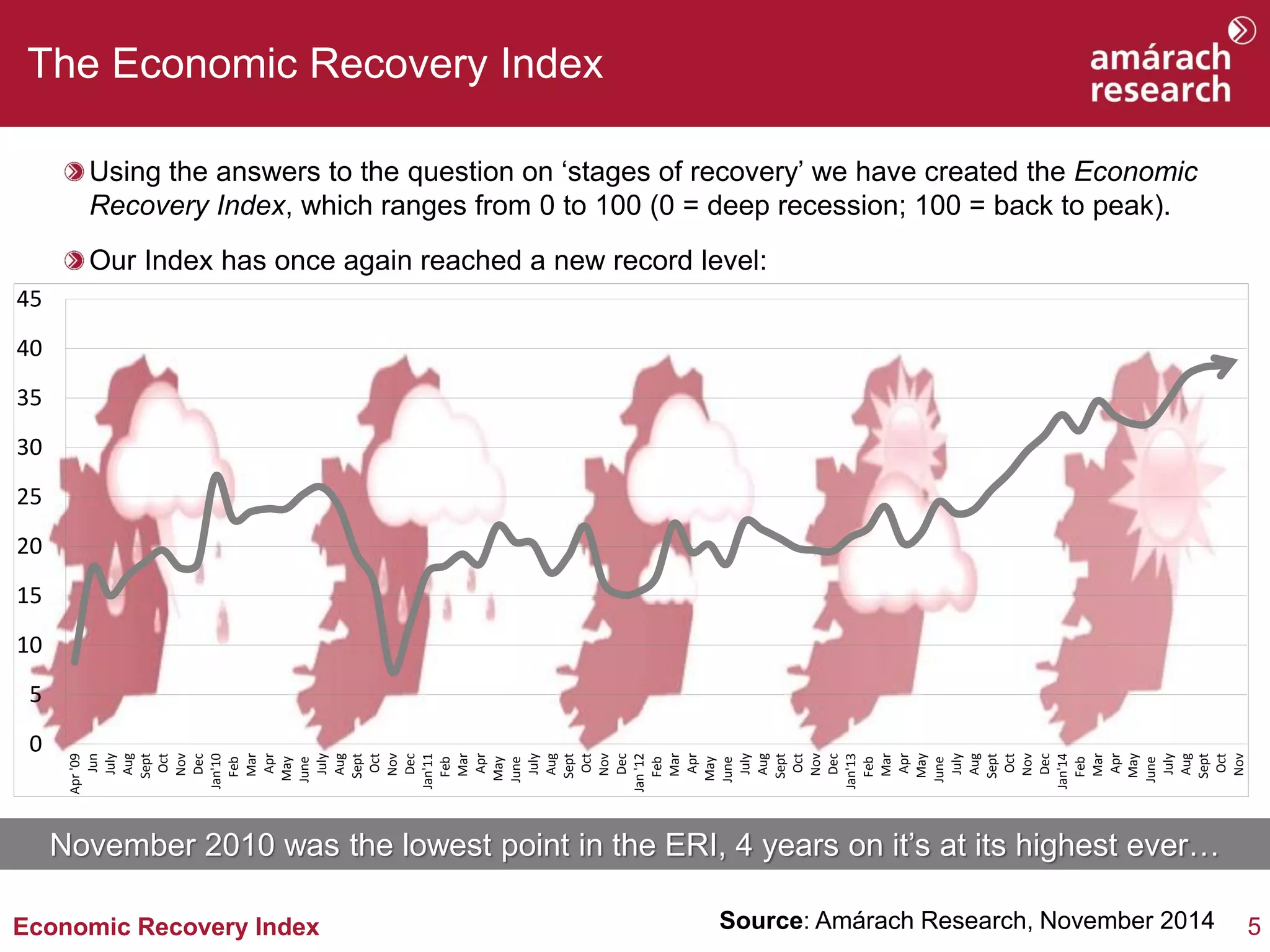

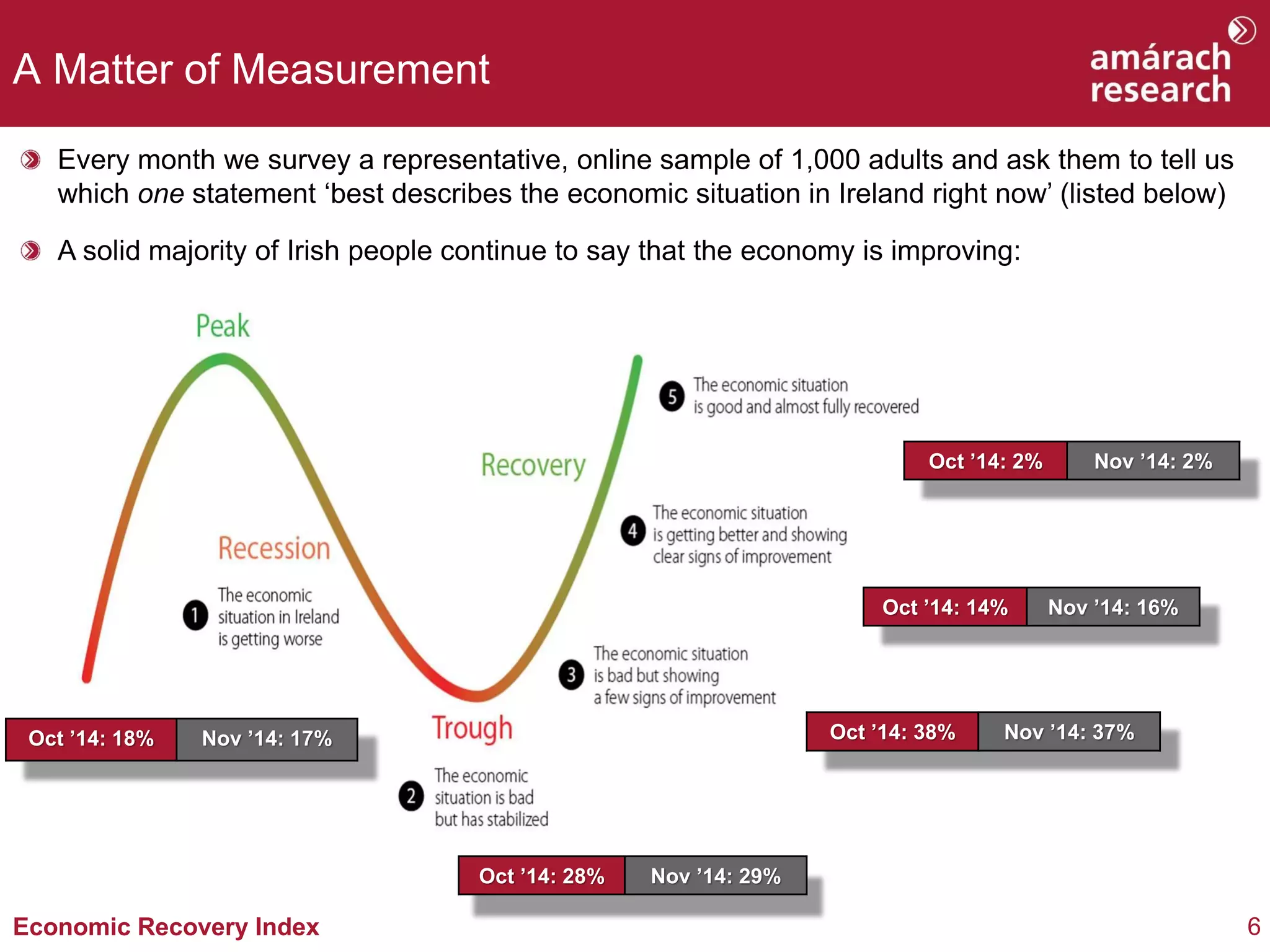

The document summarizes the findings of an Economic Recovery Index (ERI) survey conducted in November 2014 in Ireland. It finds that:

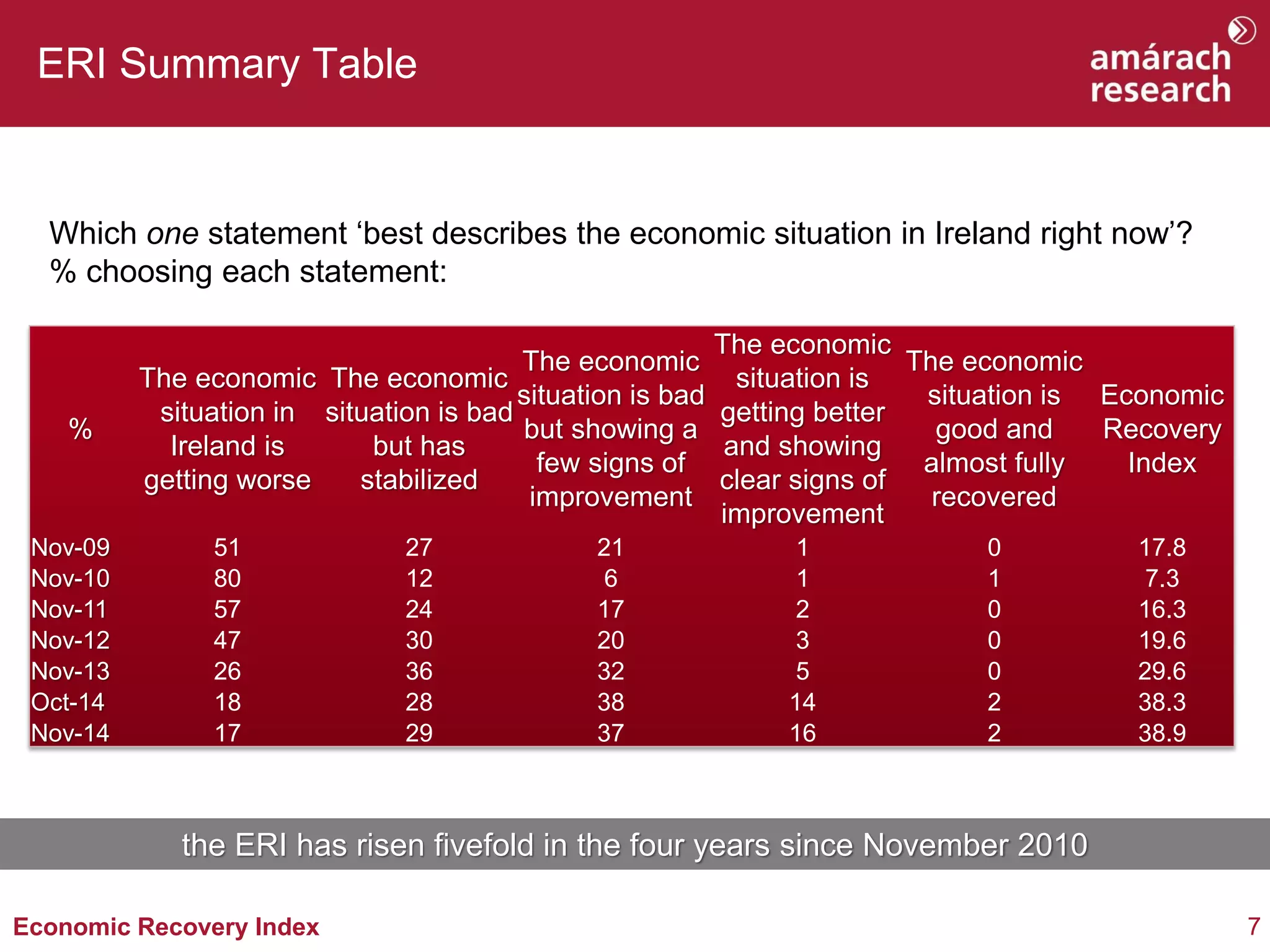

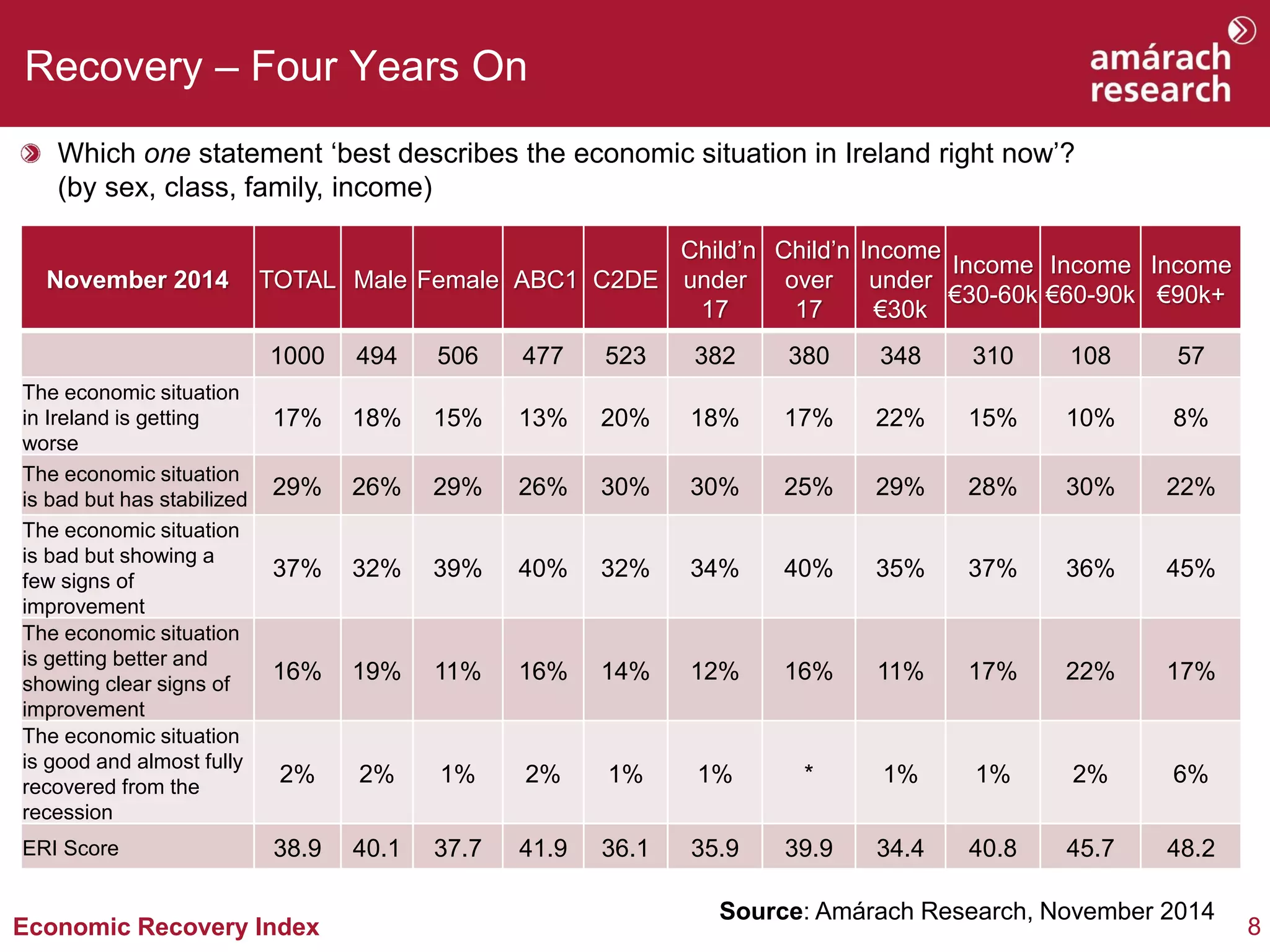

1) The ERI has reached its highest level since measurements began in 2009, indicating economic recovery is continuing.

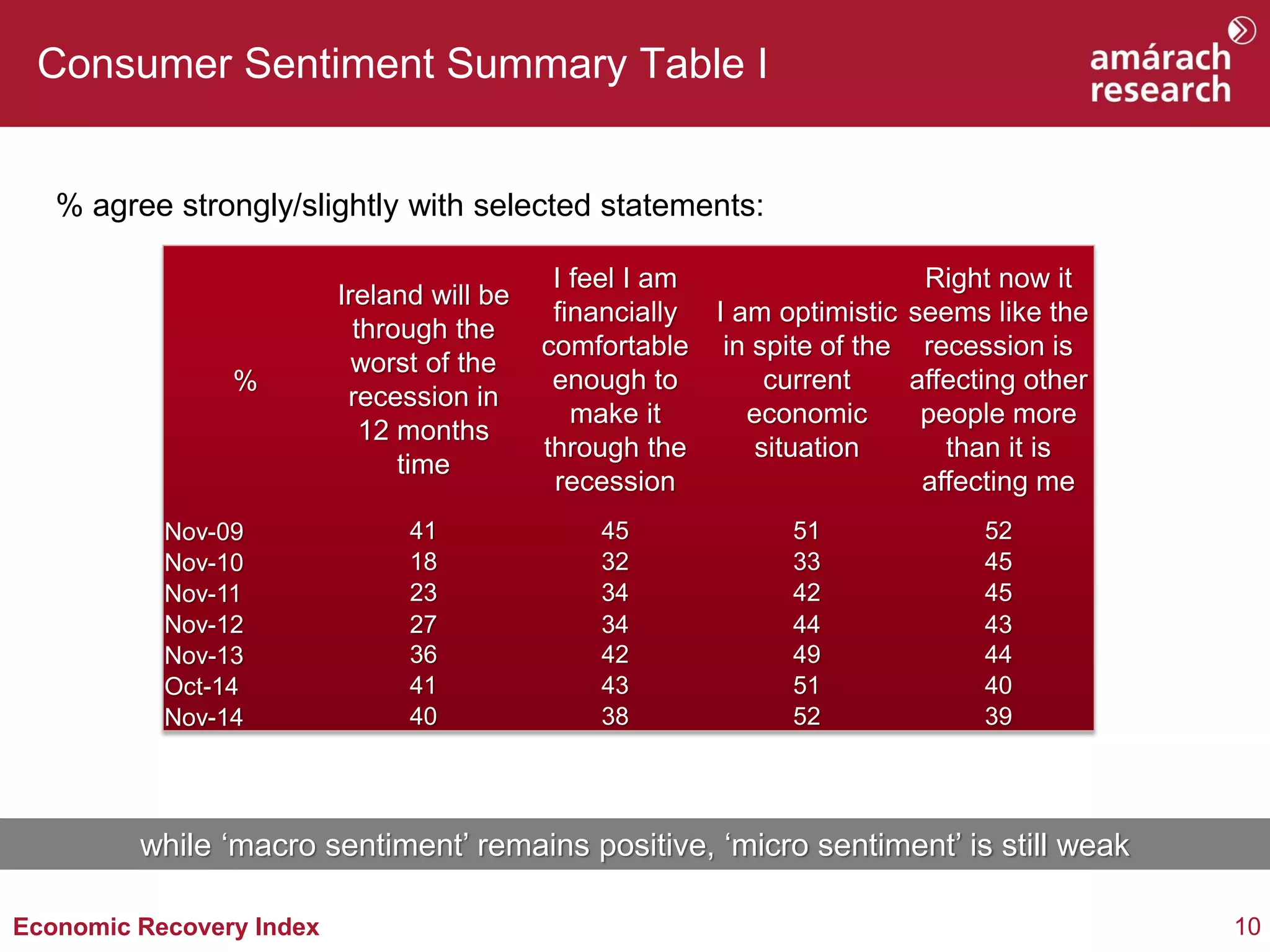

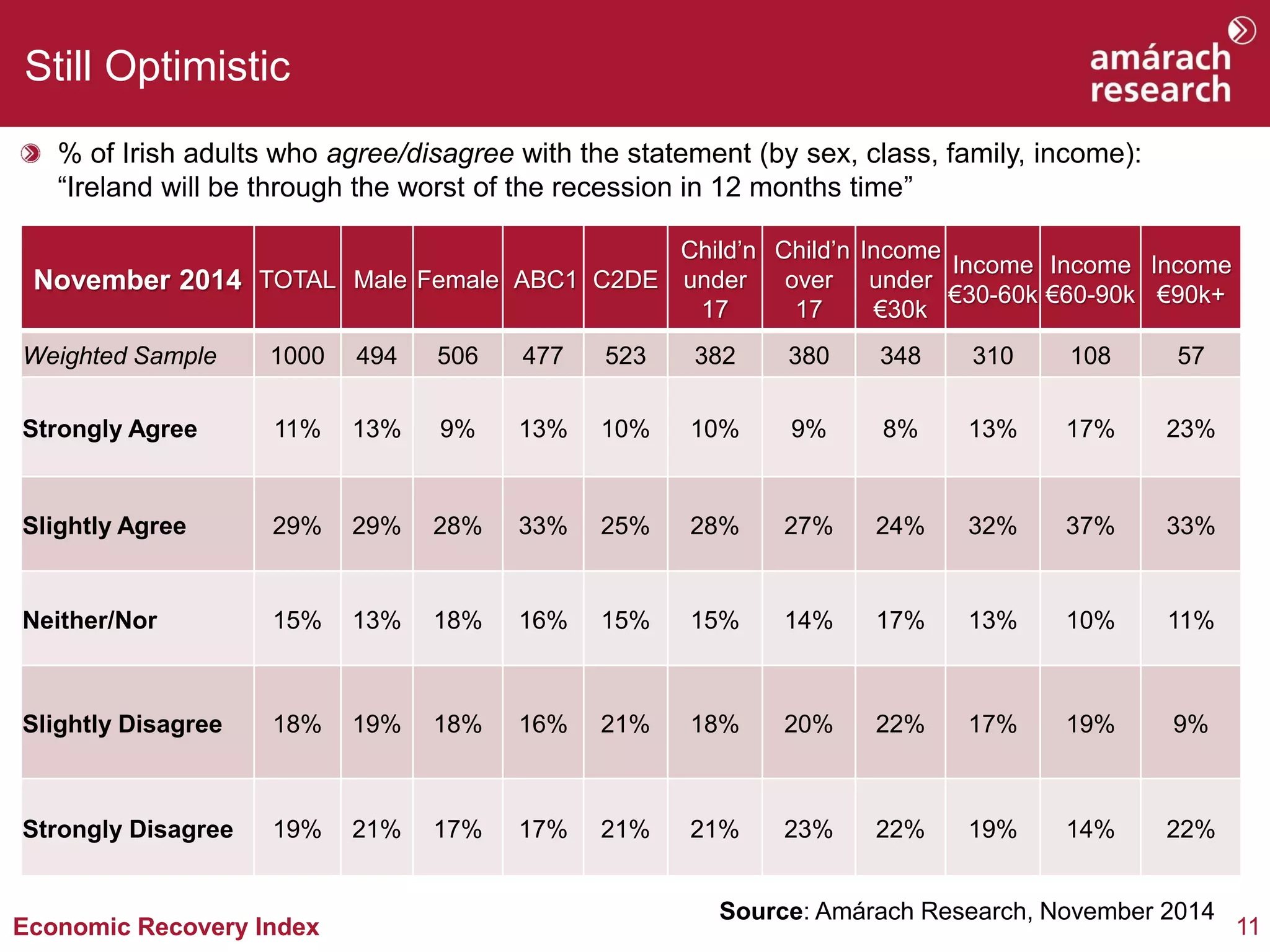

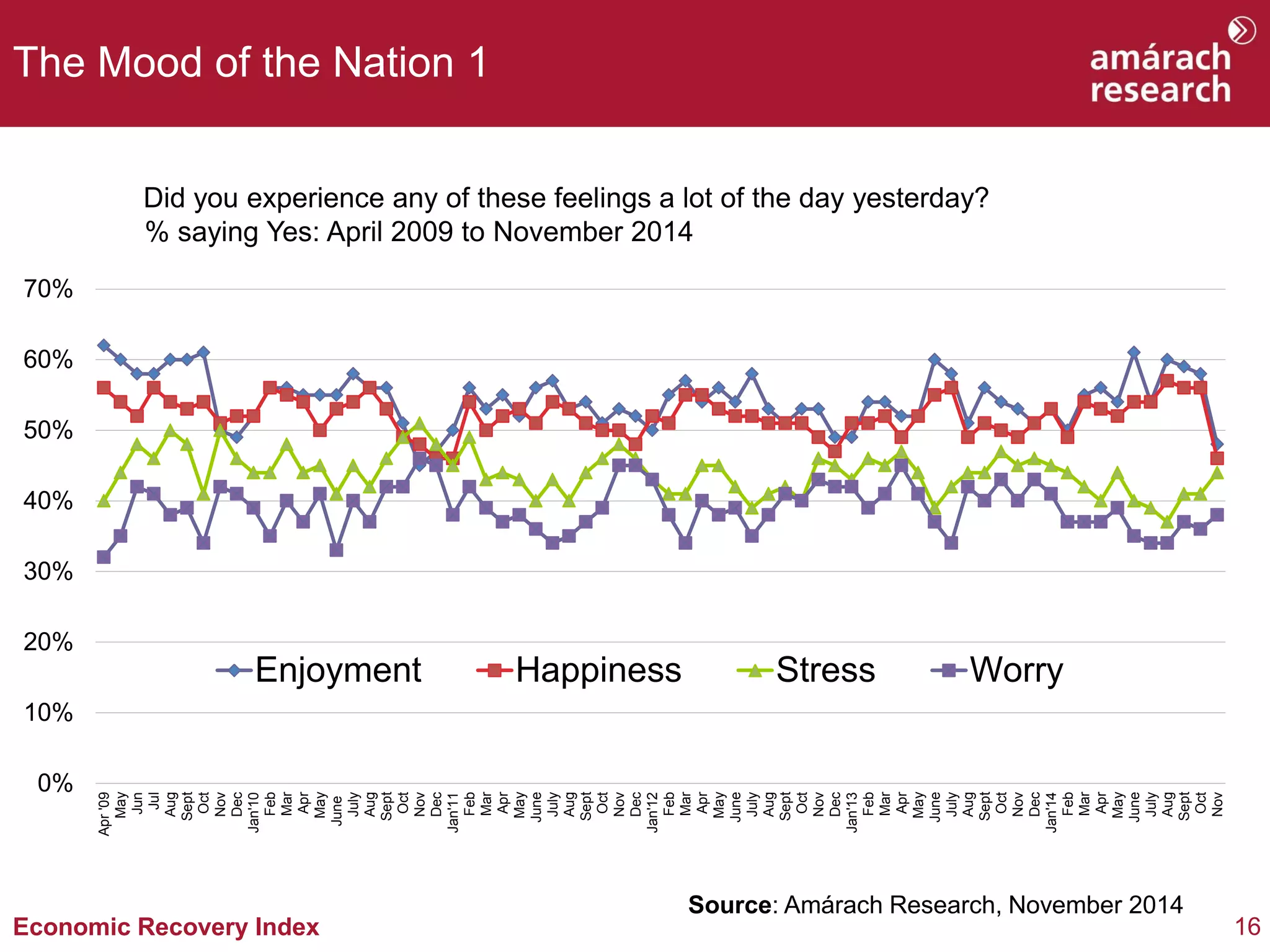

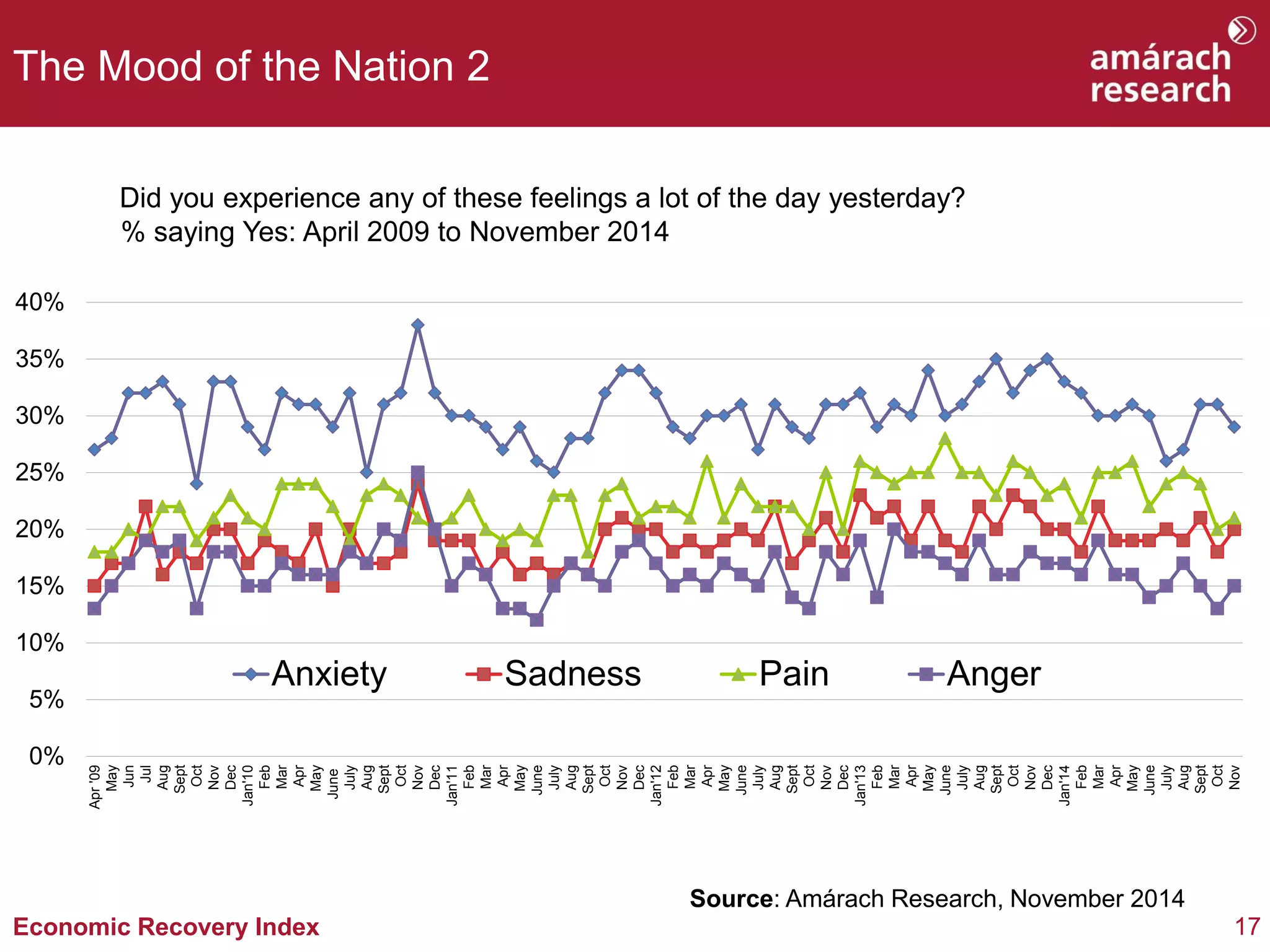

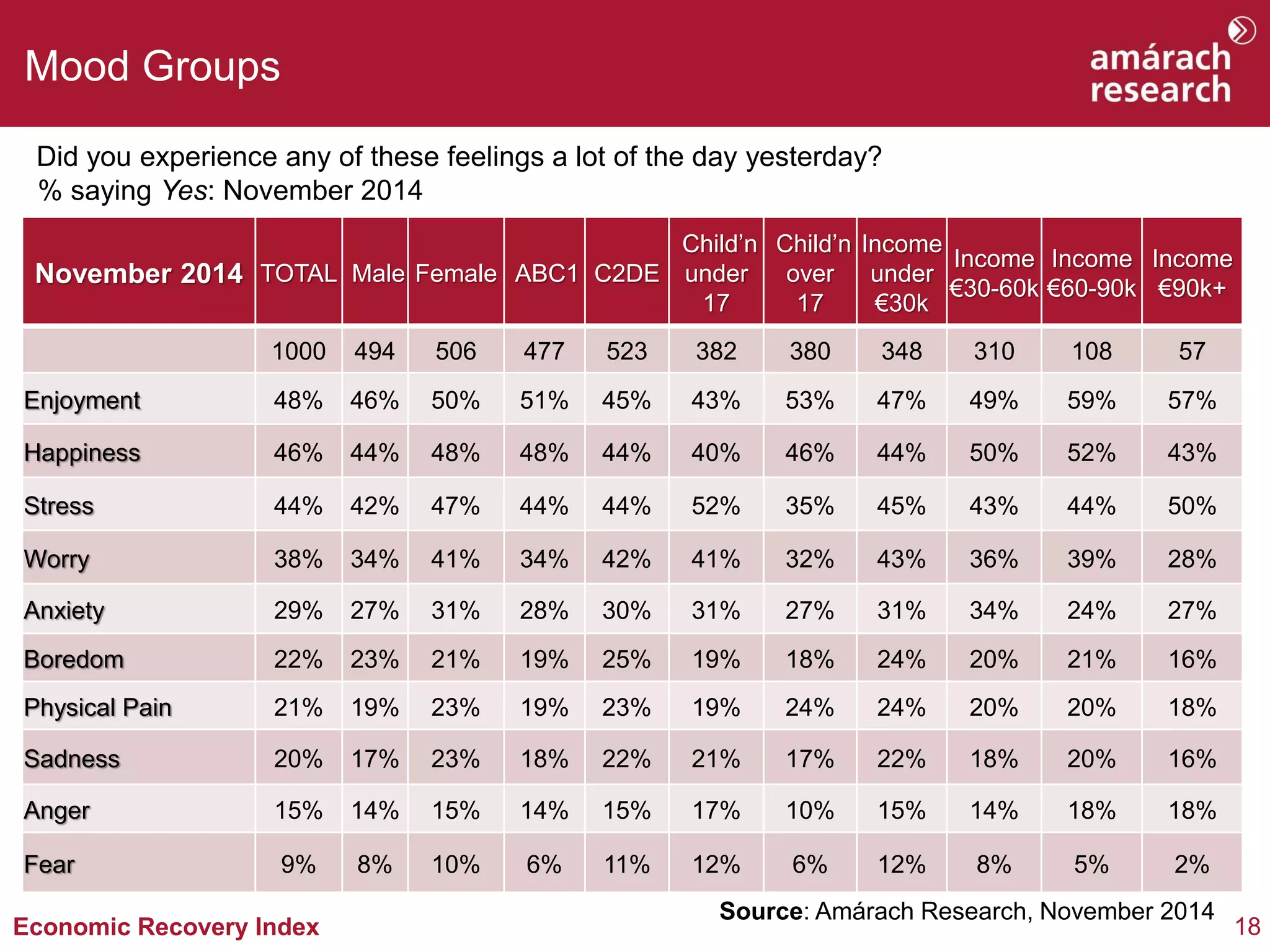

2) However, some measures of emotional well-being remain fragile, with many still experiencing stress and worry.

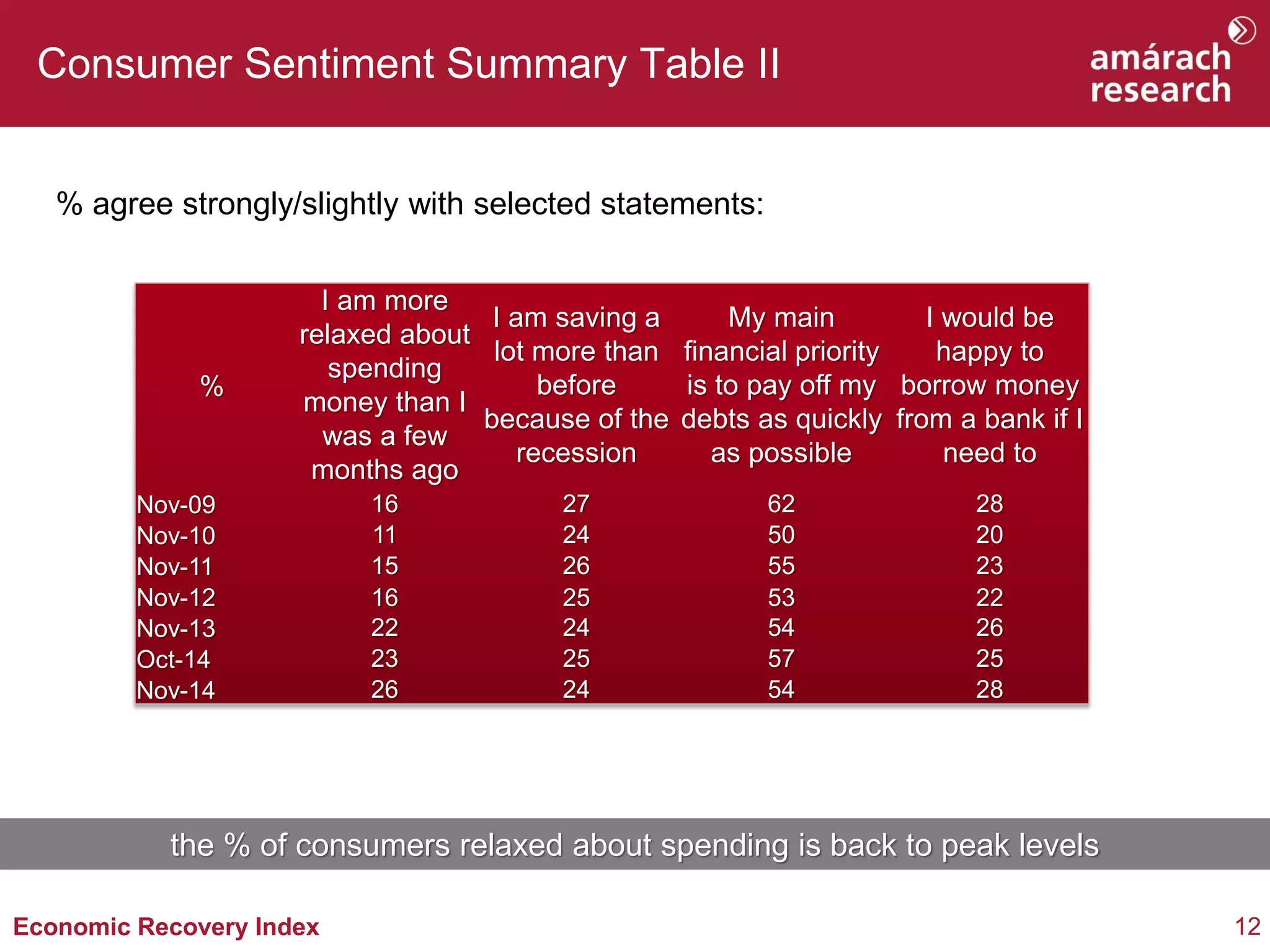

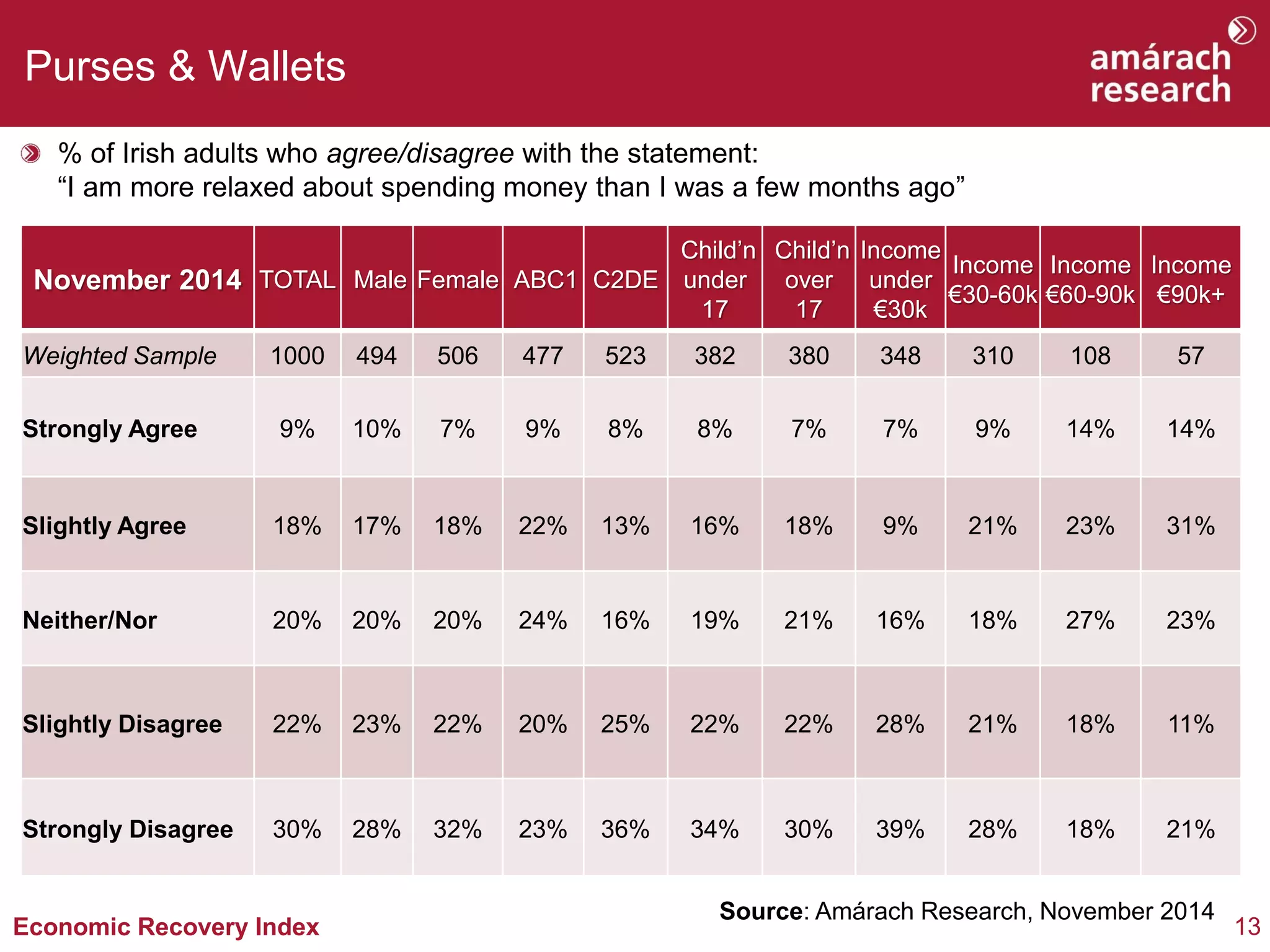

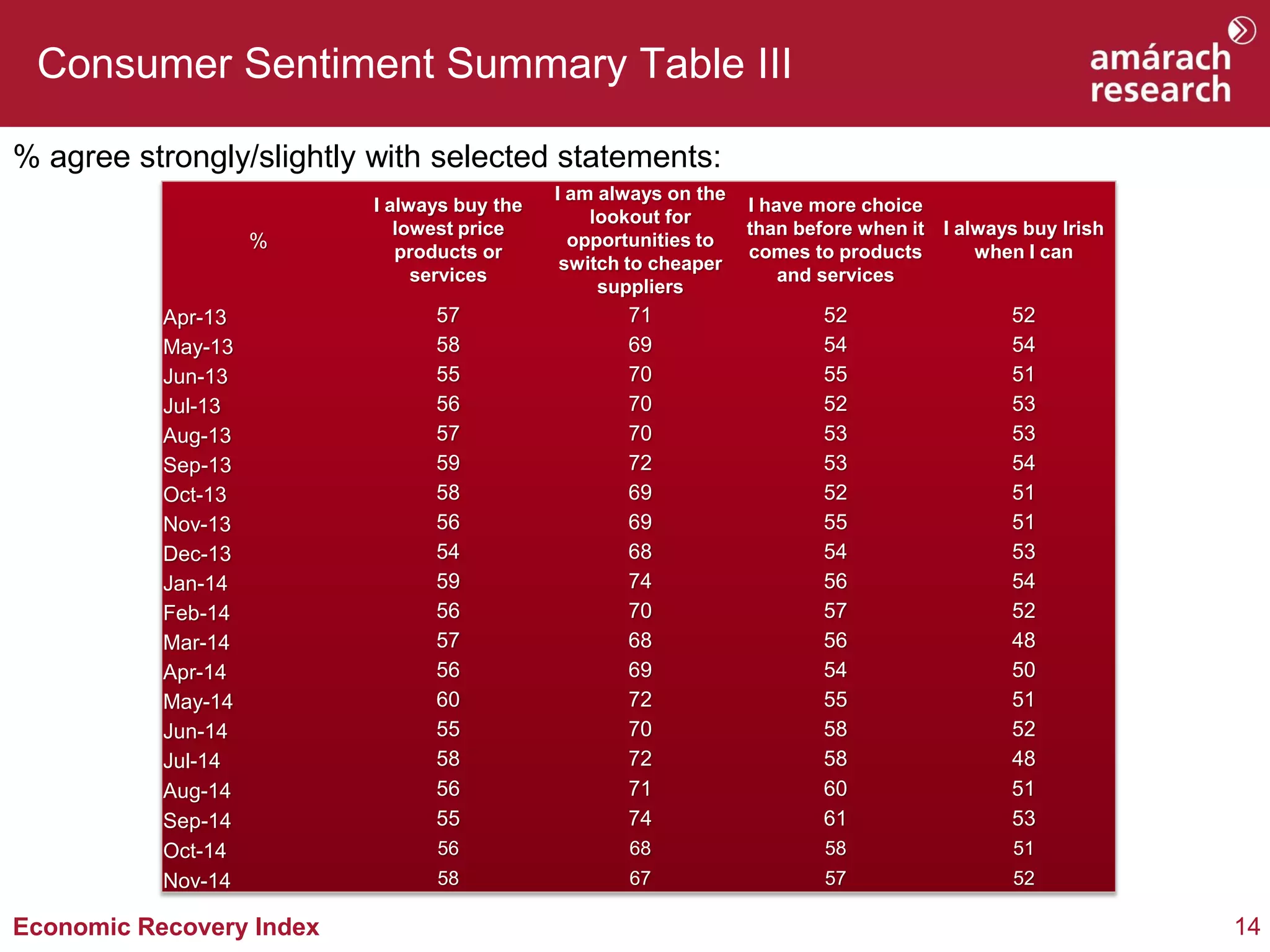

3) Consumer willingness to spend is back to pre-recession levels, boding well for Christmas shopping but likely from savings rather than borrowing.