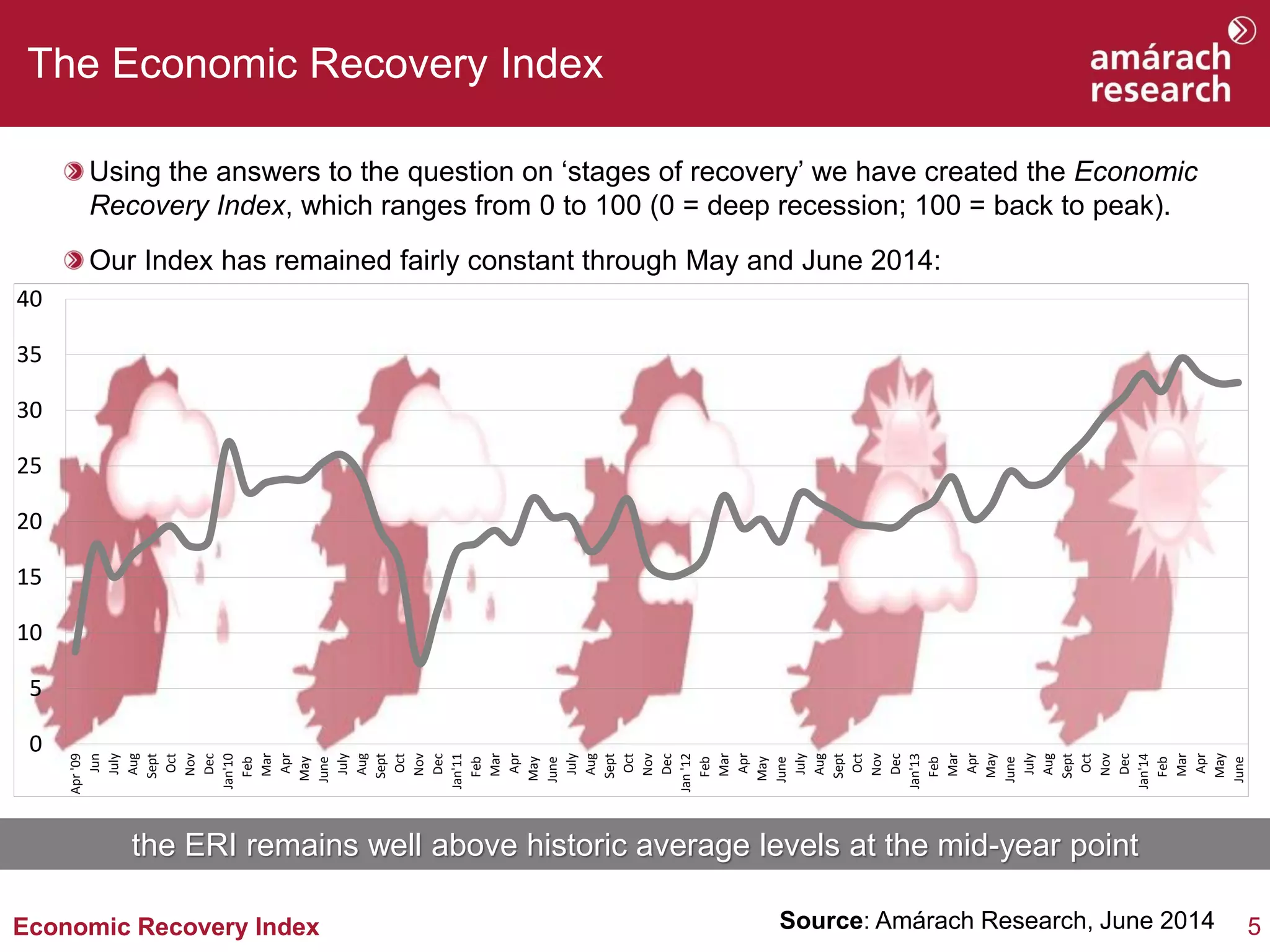

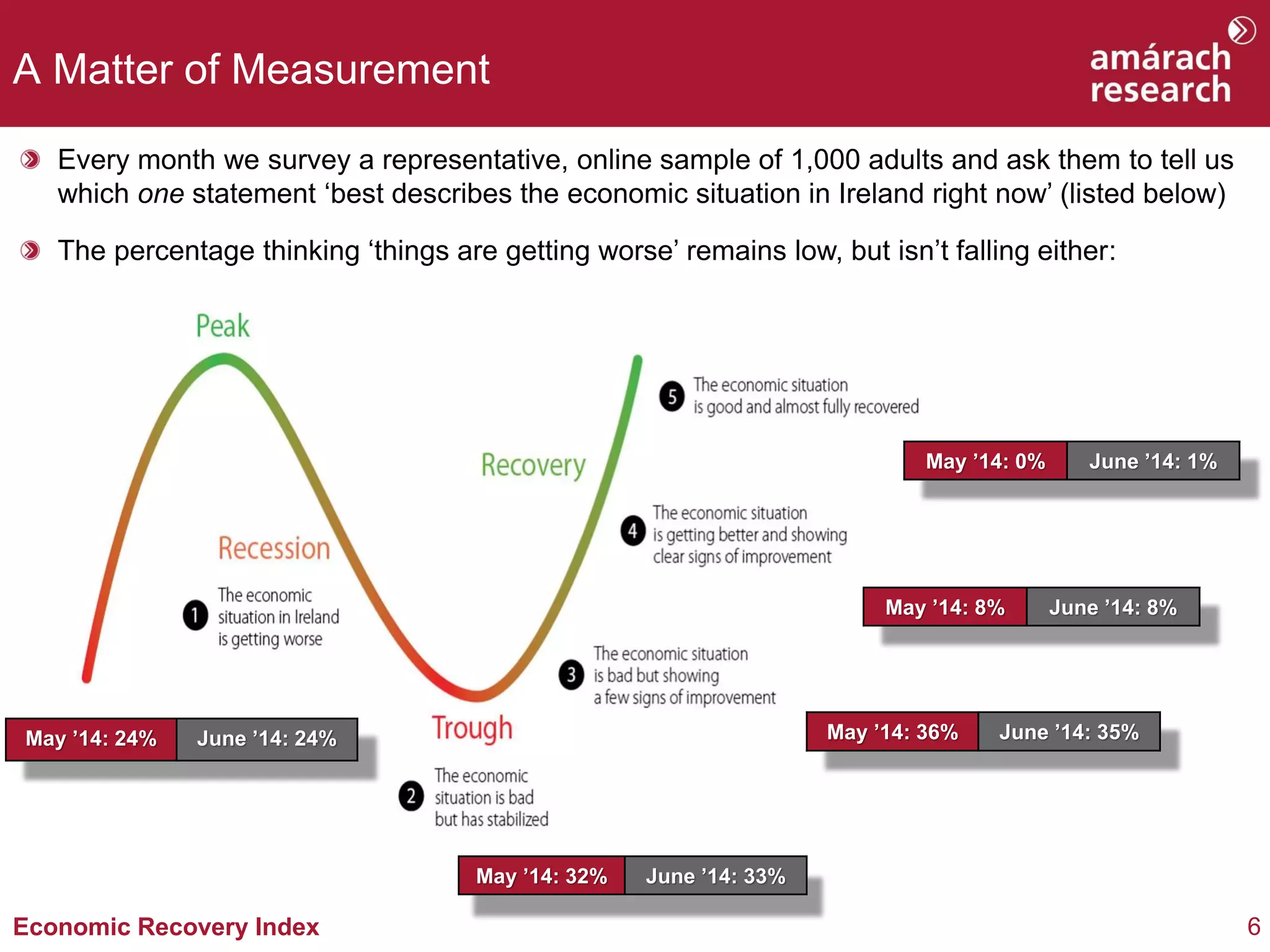

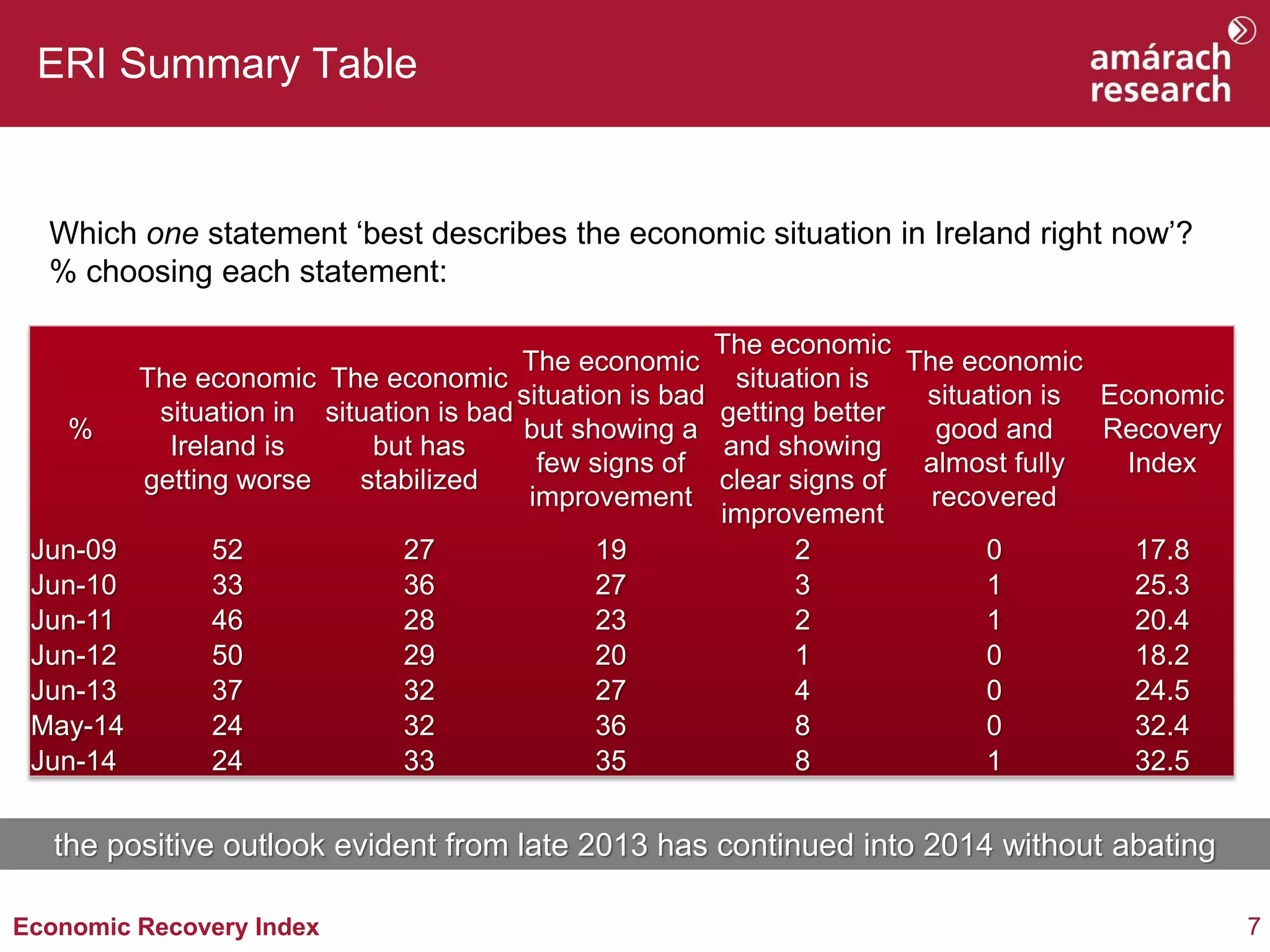

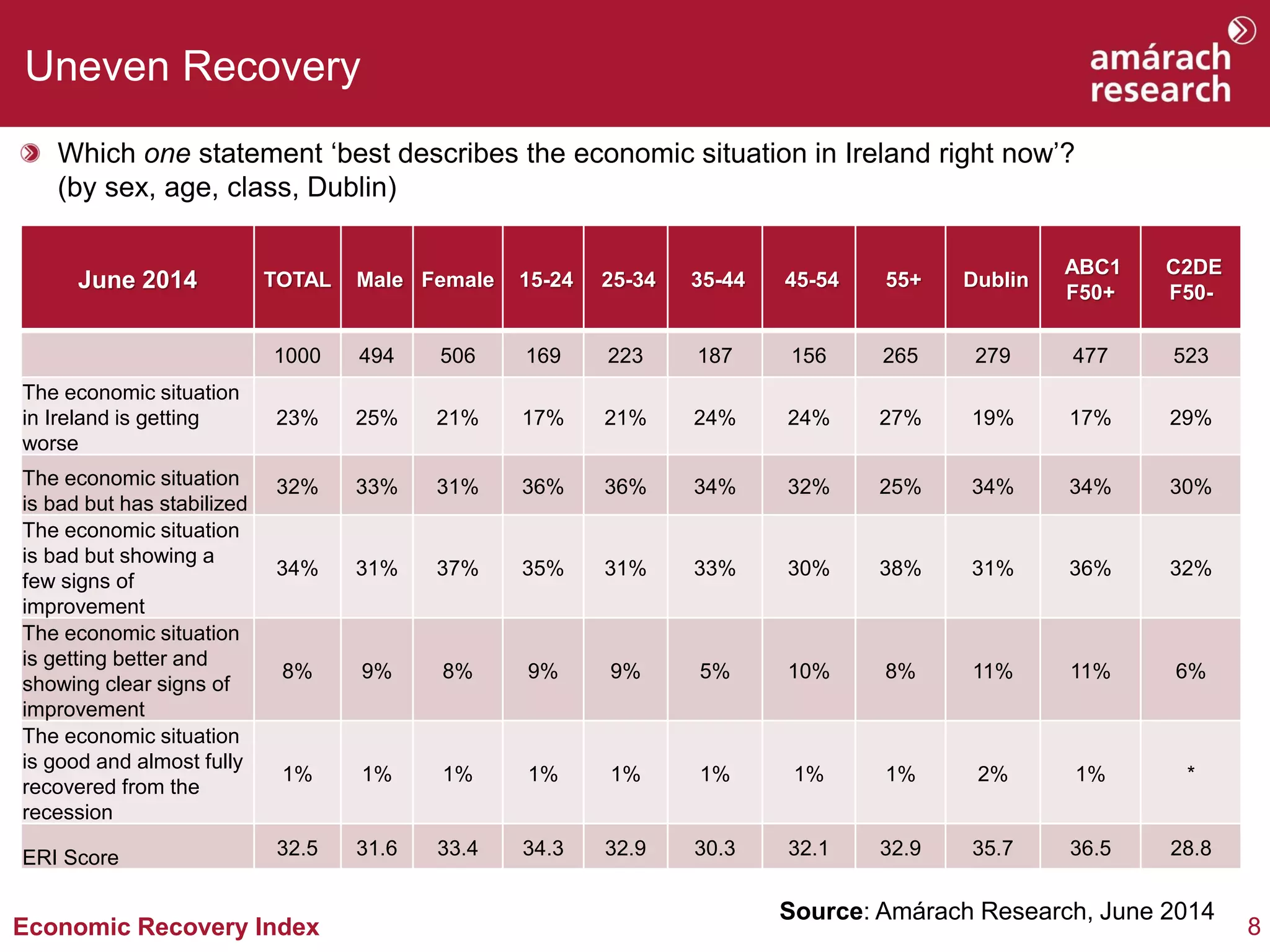

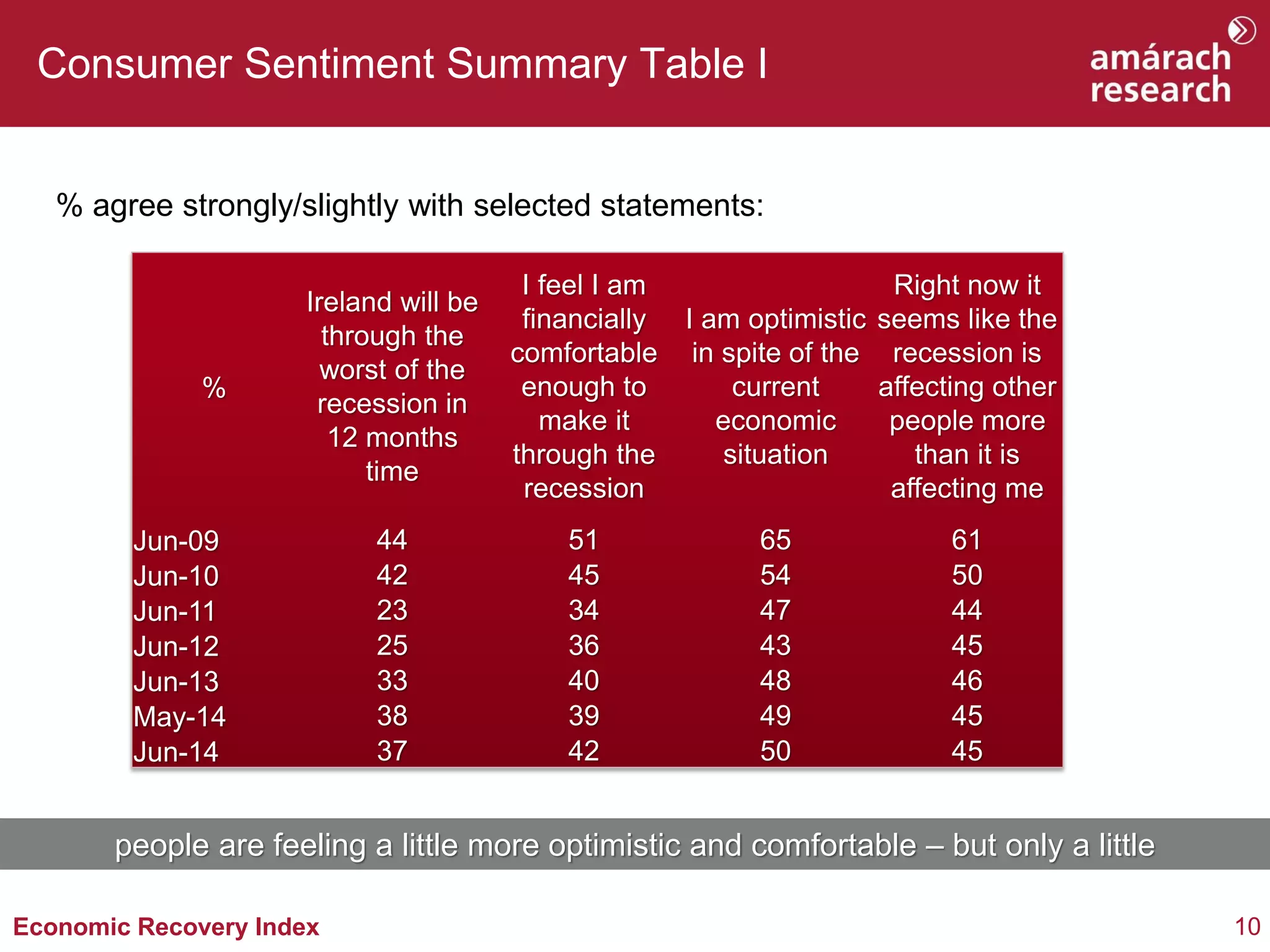

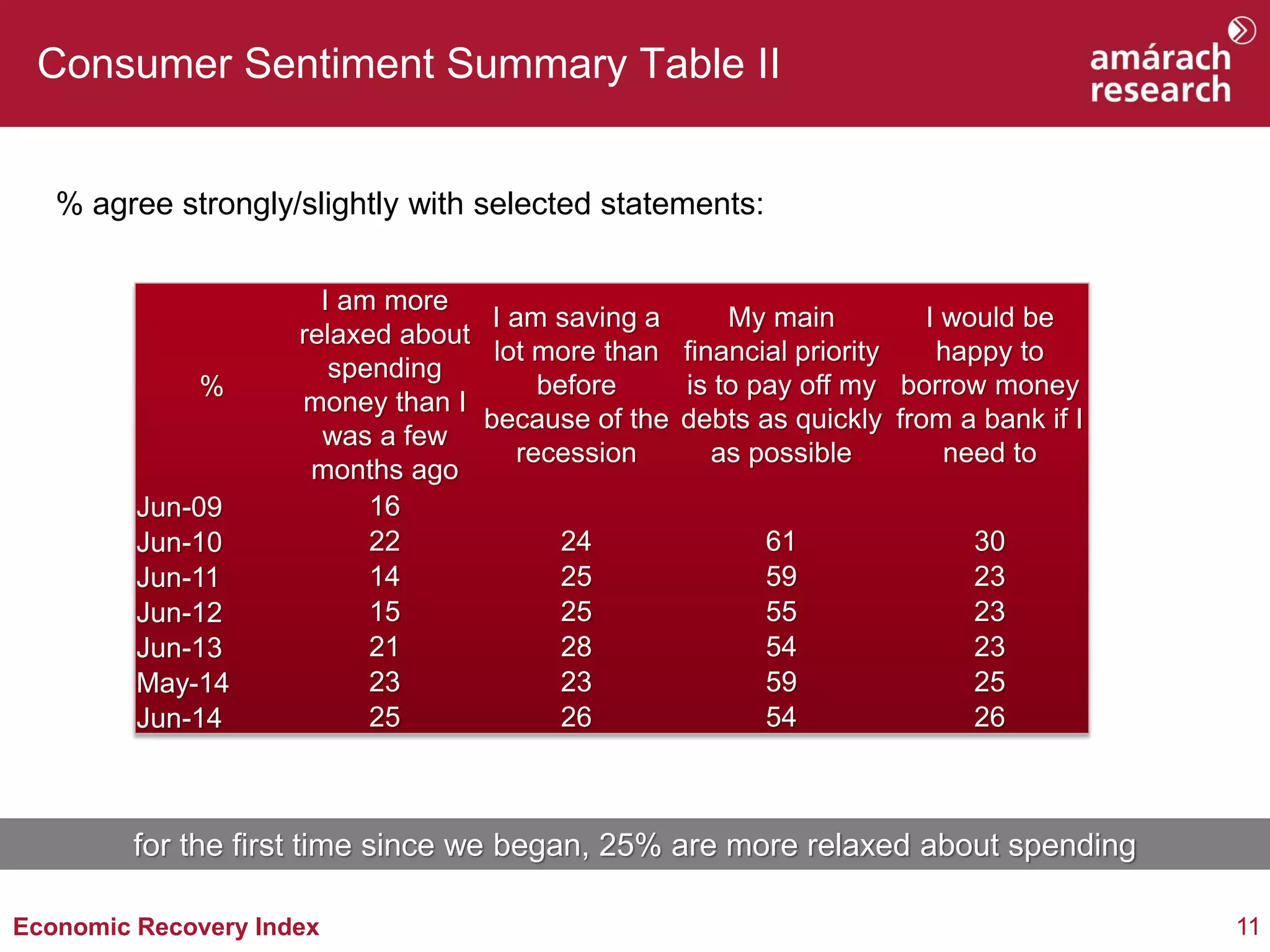

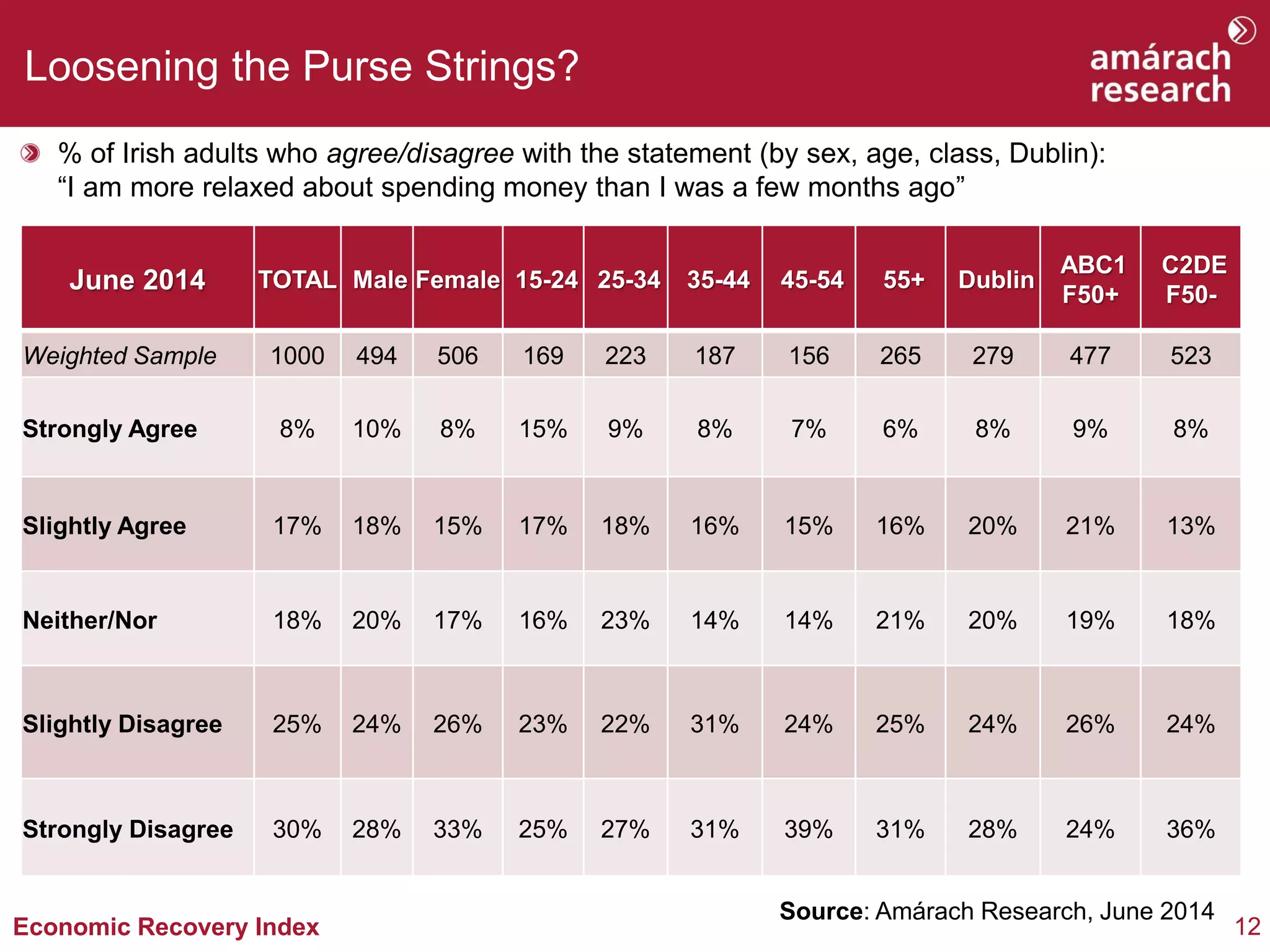

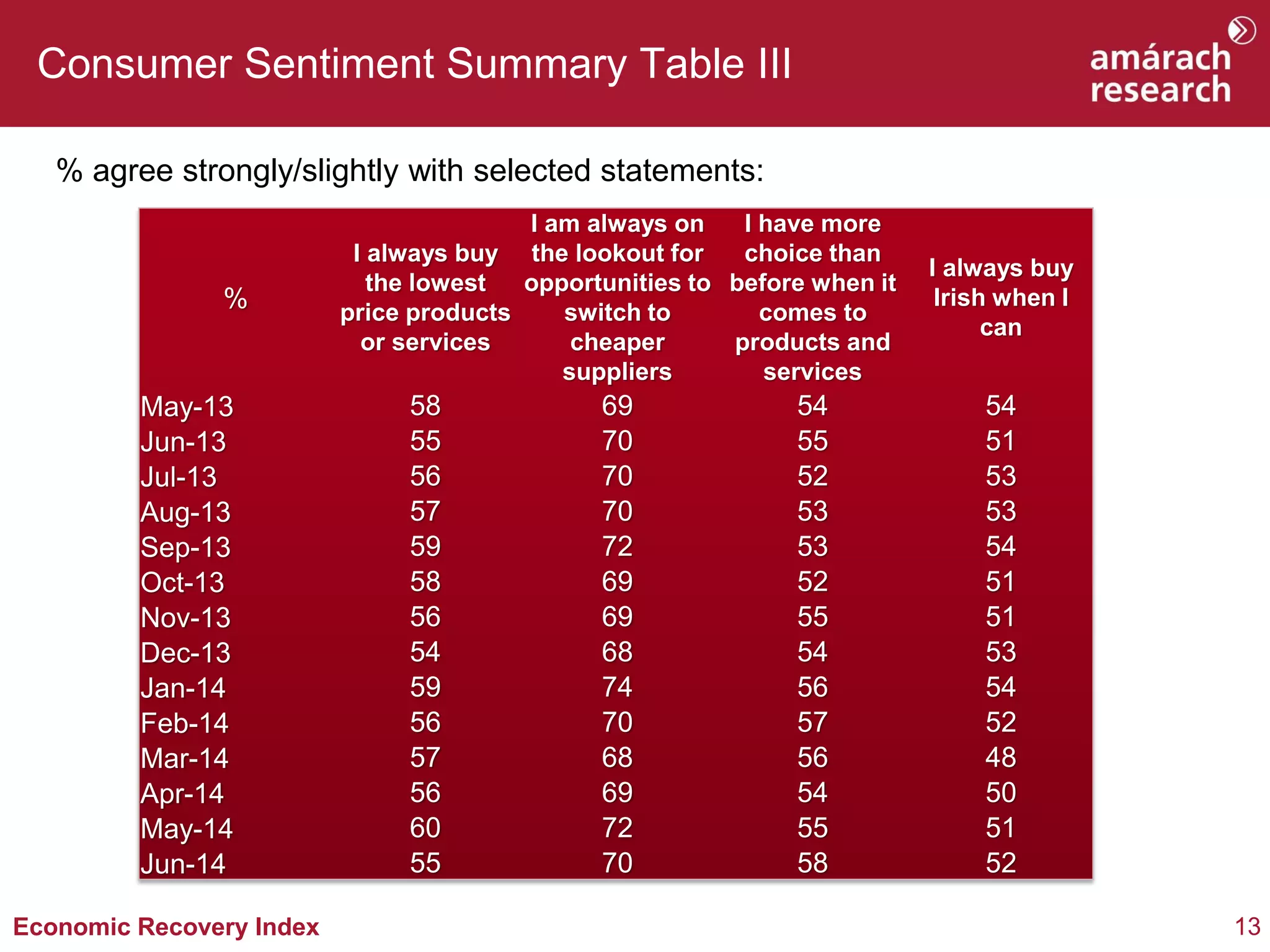

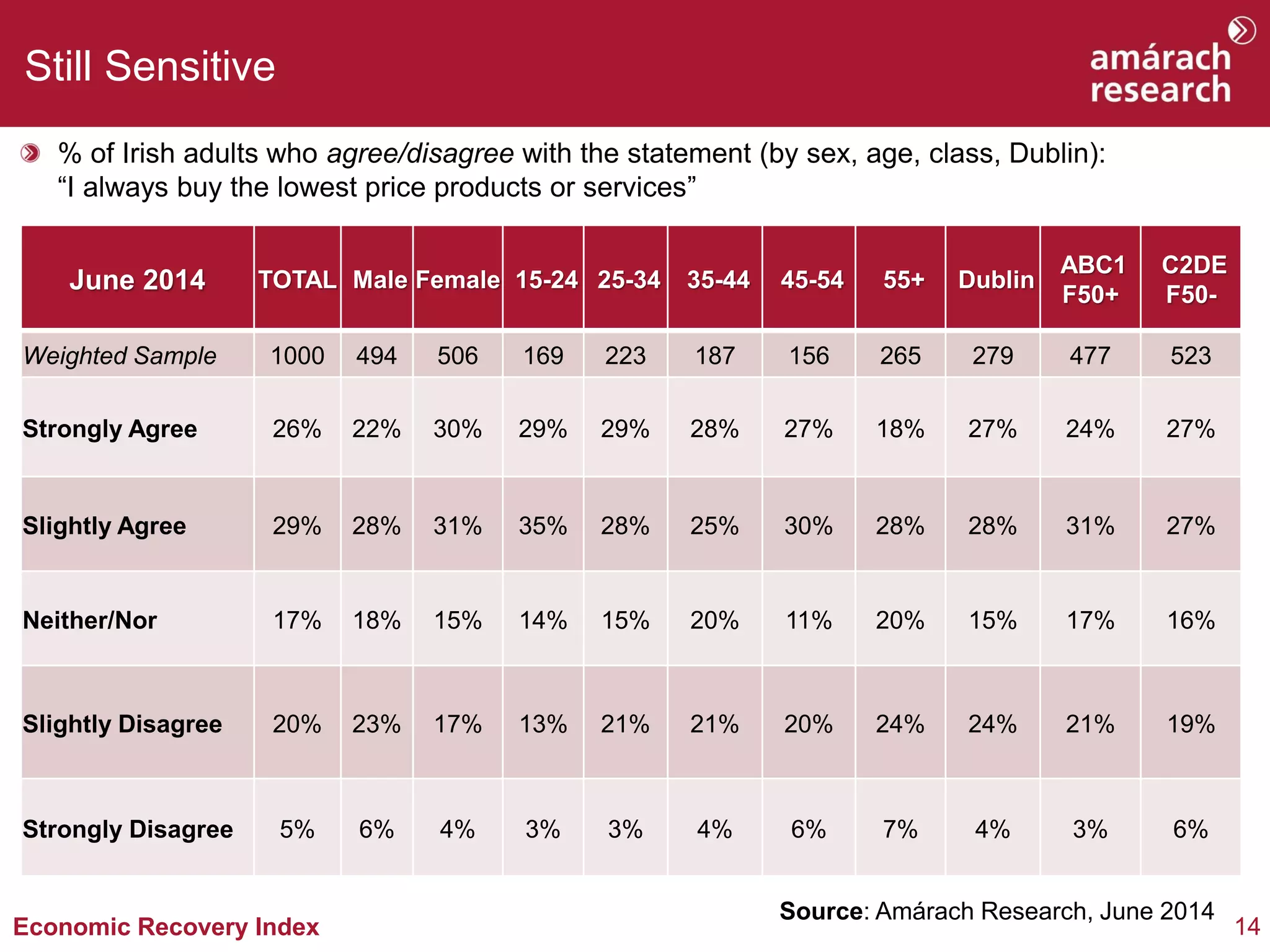

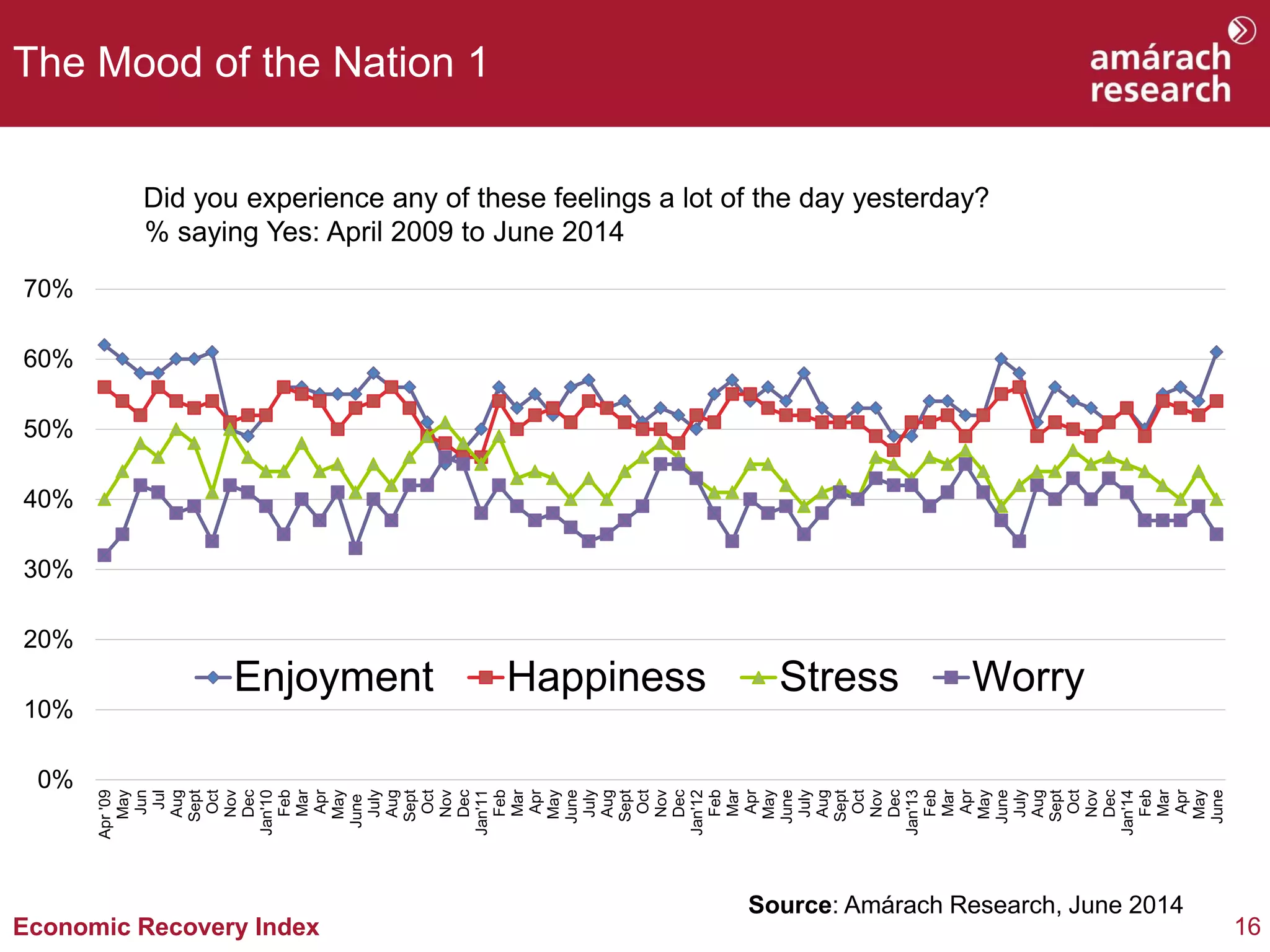

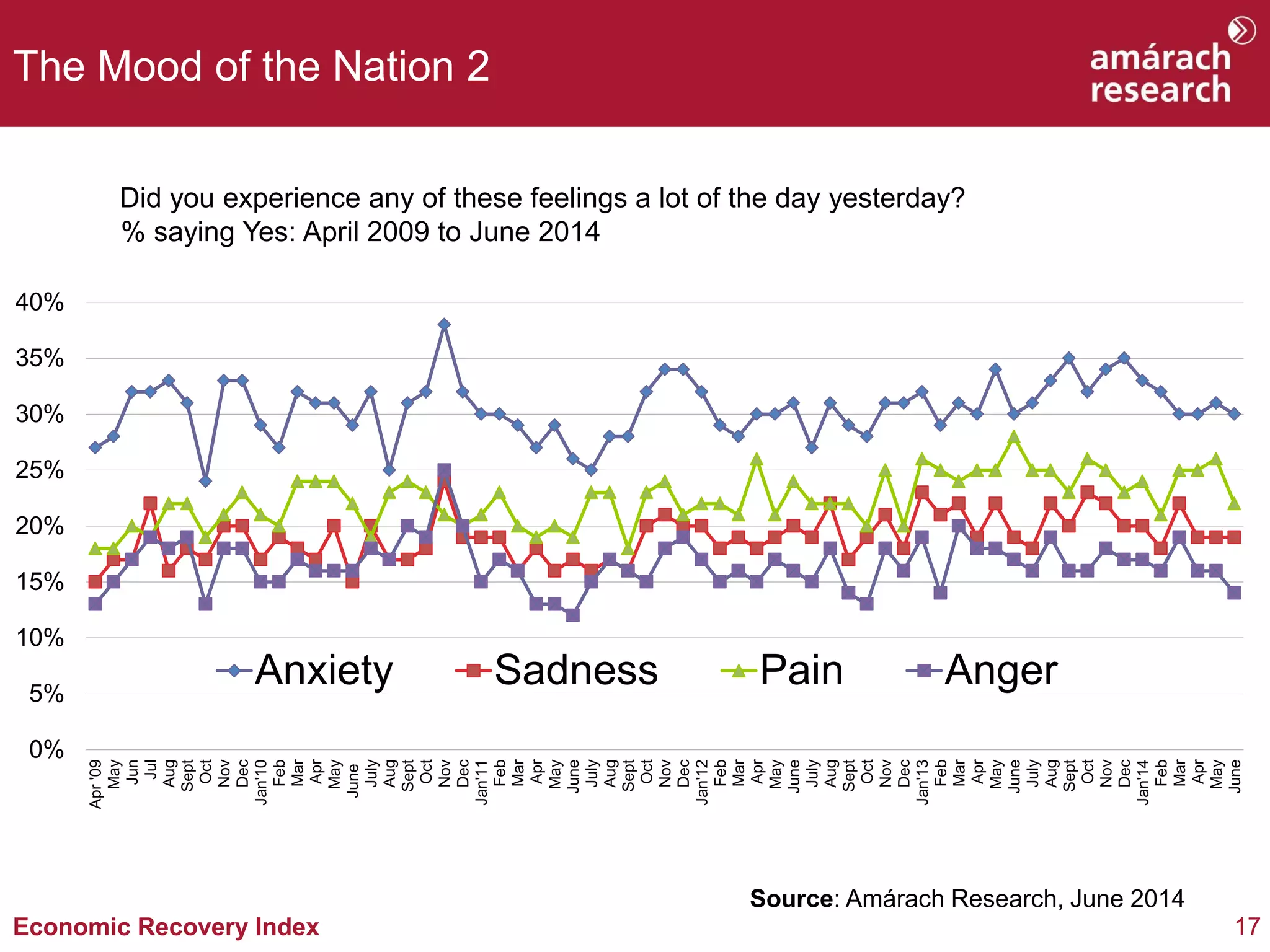

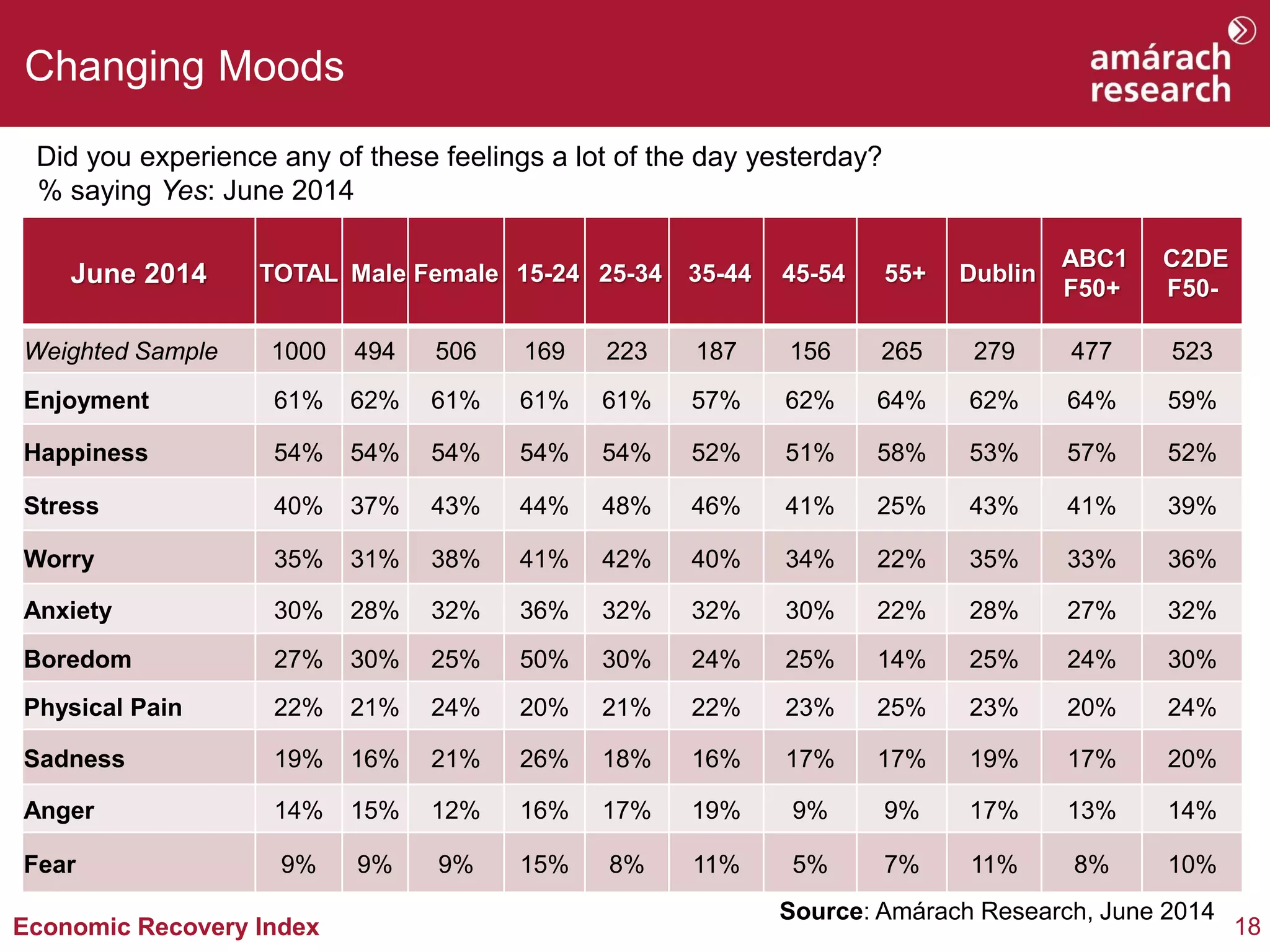

The June 2014 Economic Recovery Index from Amárach Research shows signs that consumer sentiment in Ireland is gradually improving. The index remained steady this month, and more consumers report feeling optimistic and comfortable financially. For the first time in the survey, 25% of consumers feel more relaxed about spending money. However, many consumers still prioritize paying off debts and seek out low prices. Overall, the results suggest a cautious but continuing recovery in consumer mood.