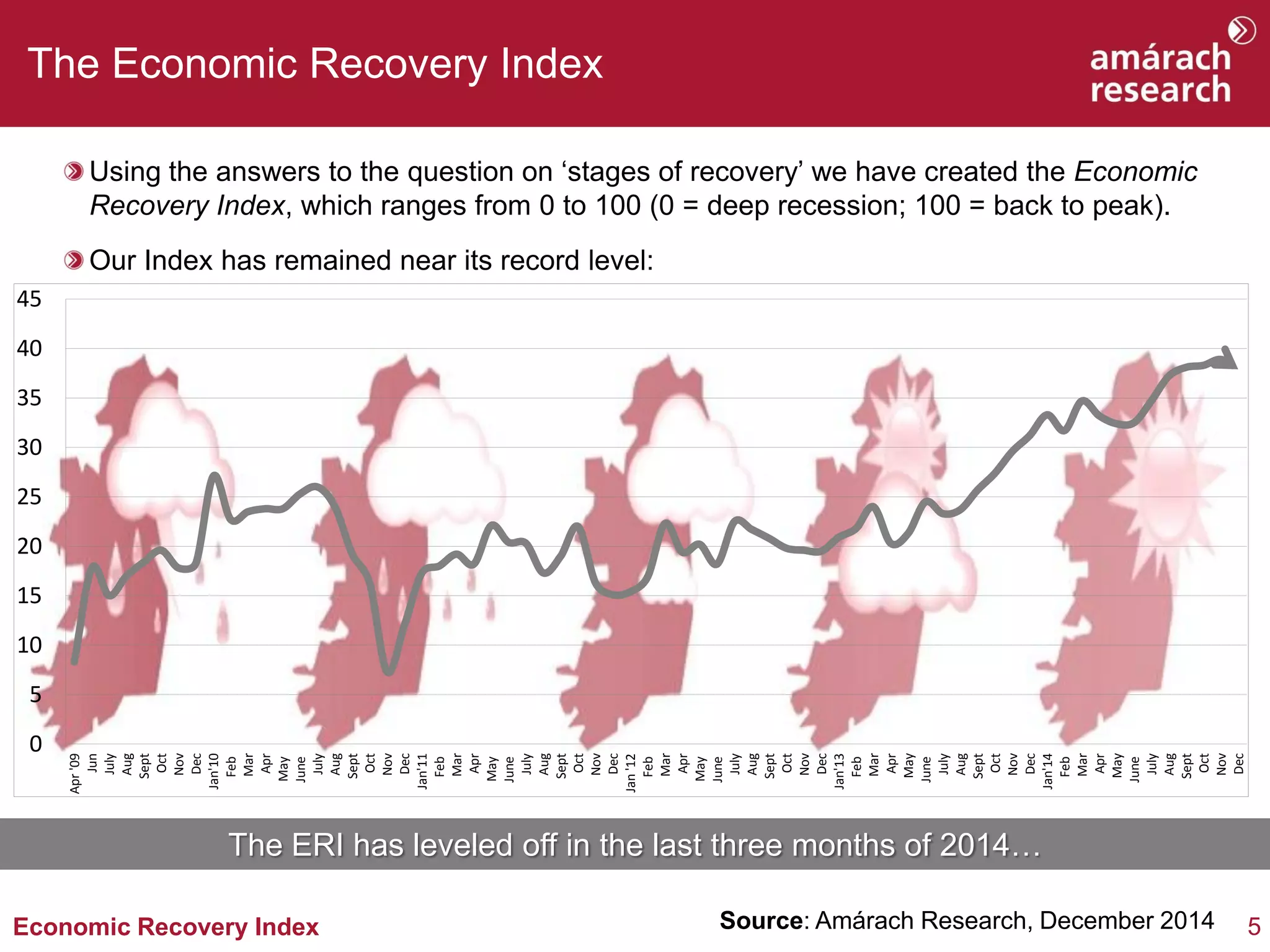

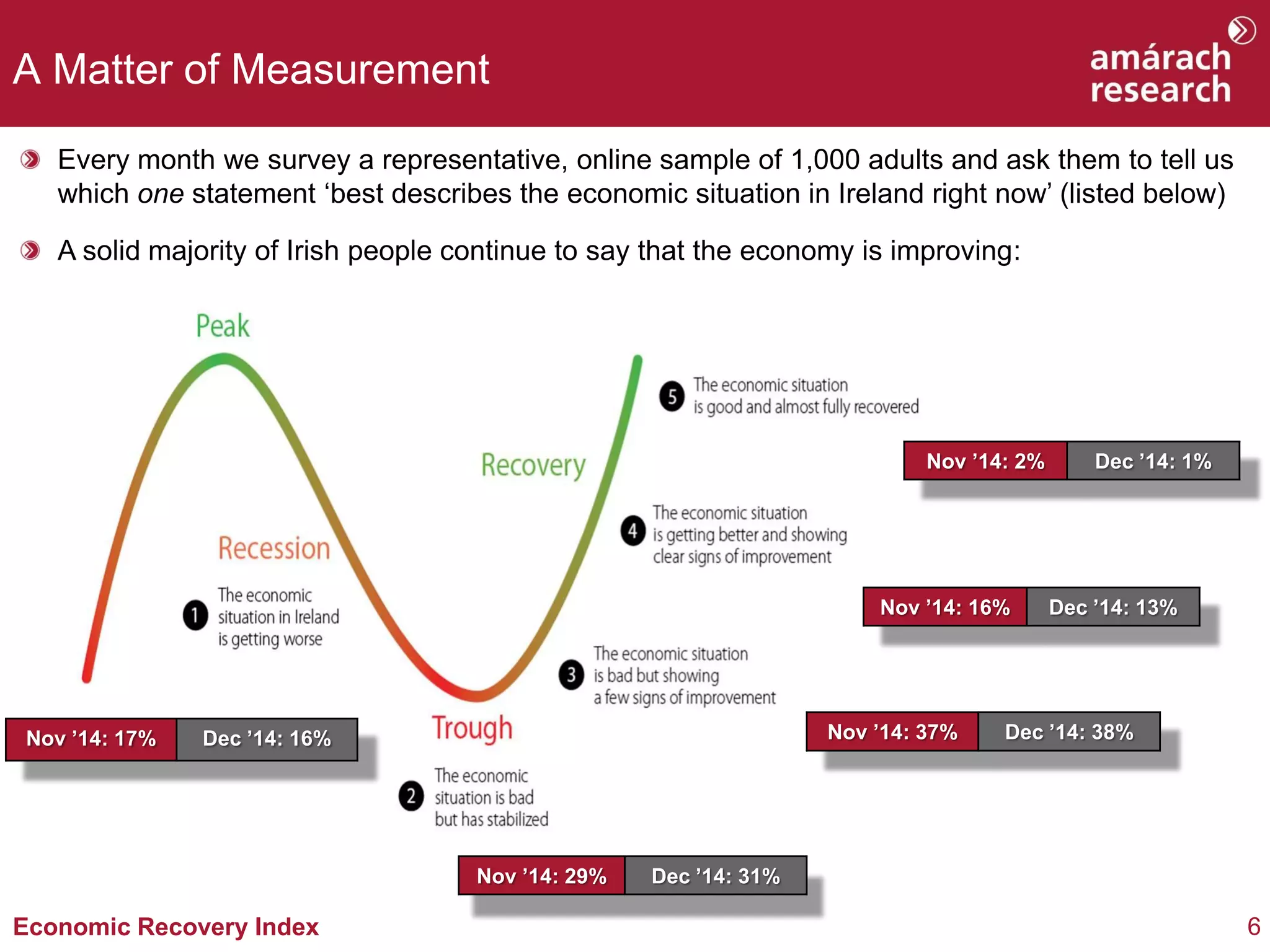

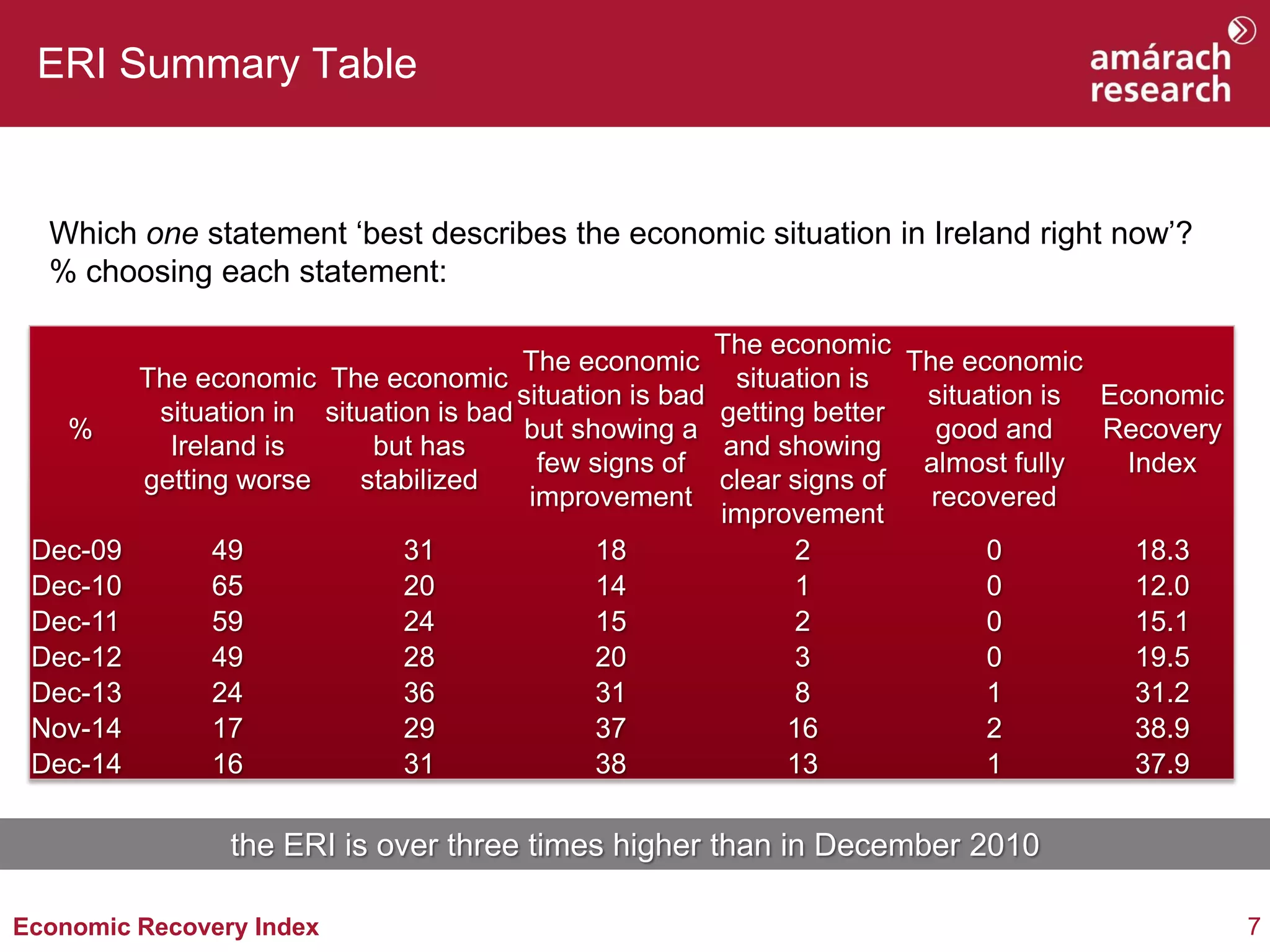

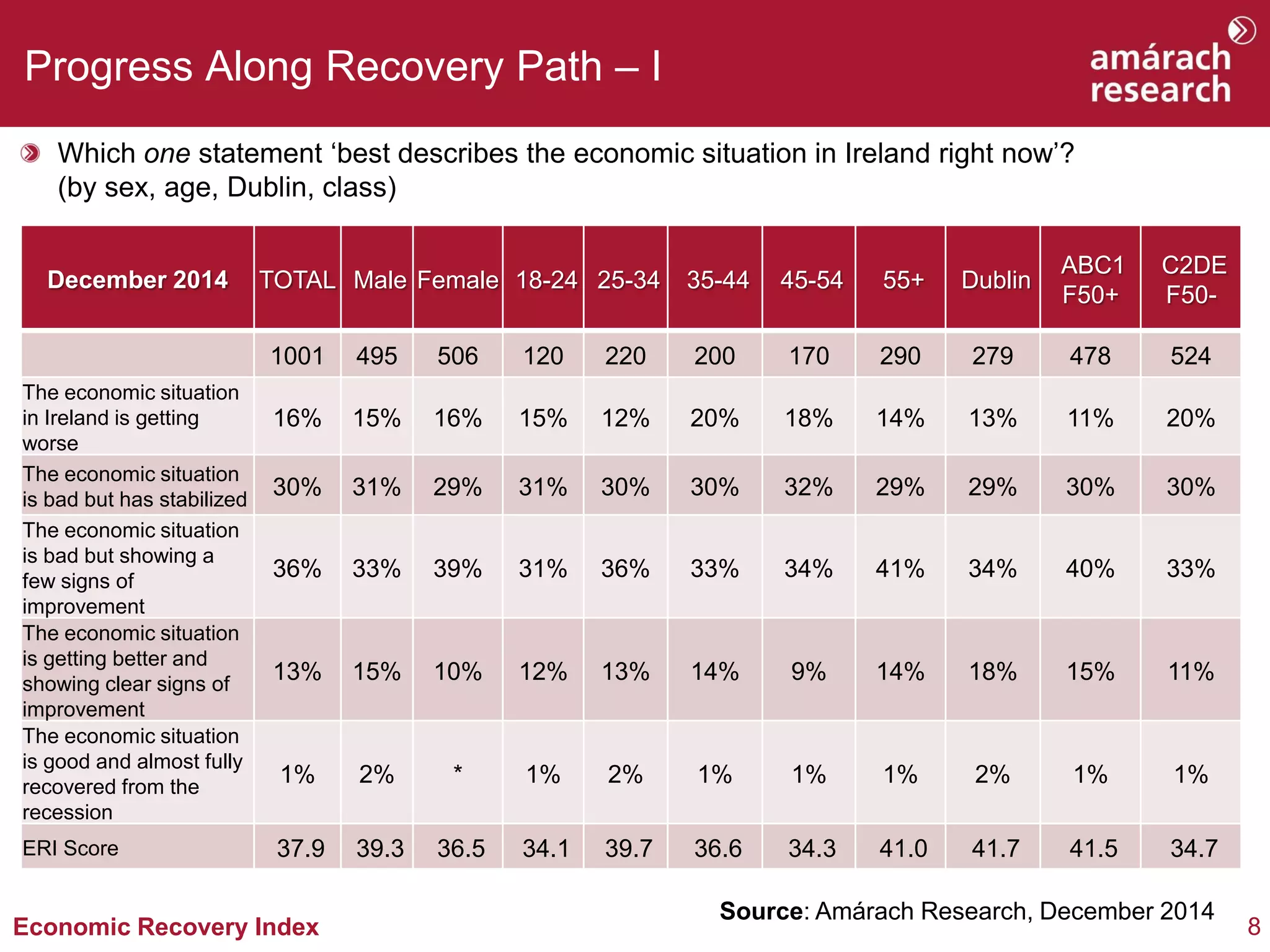

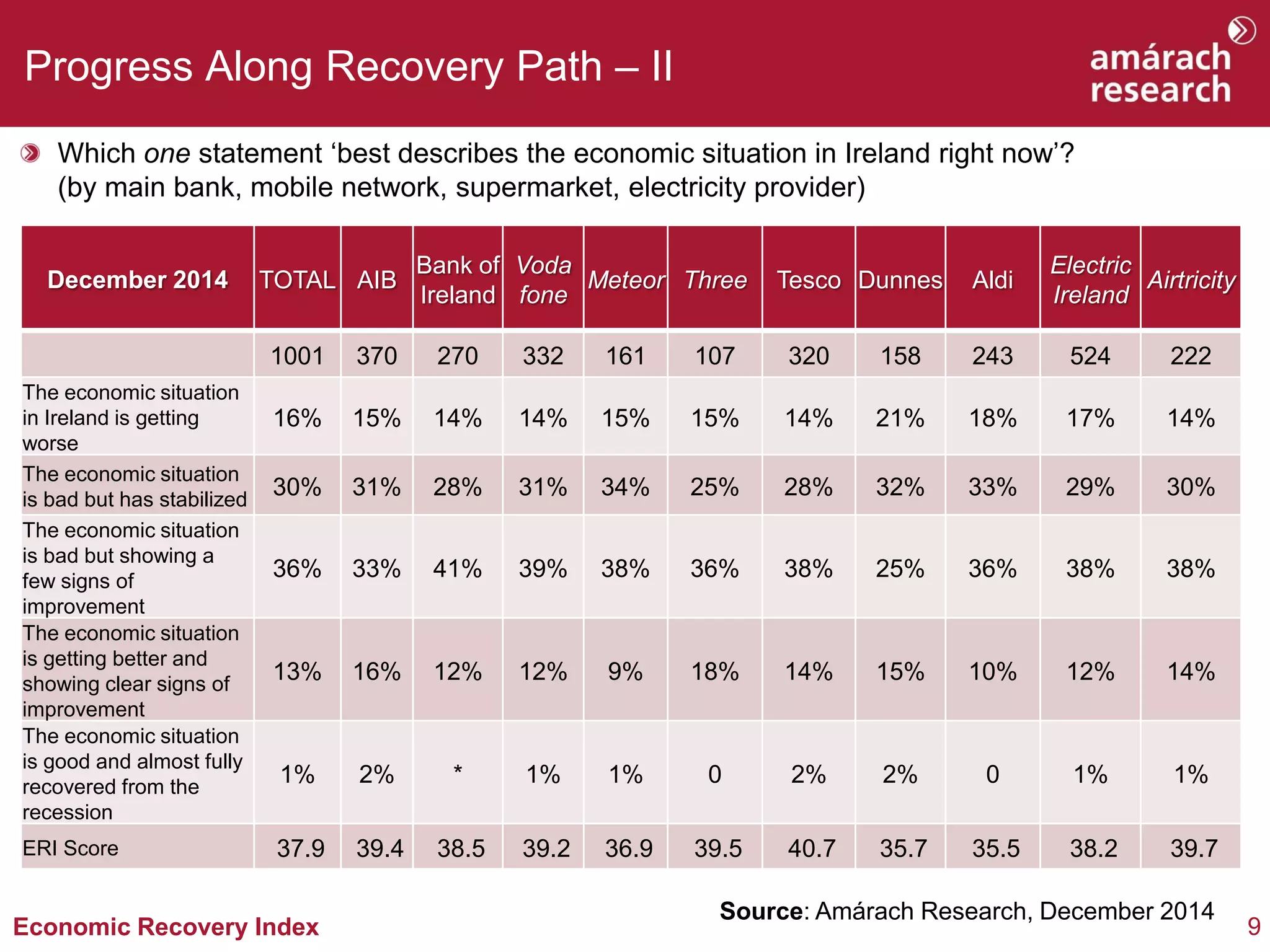

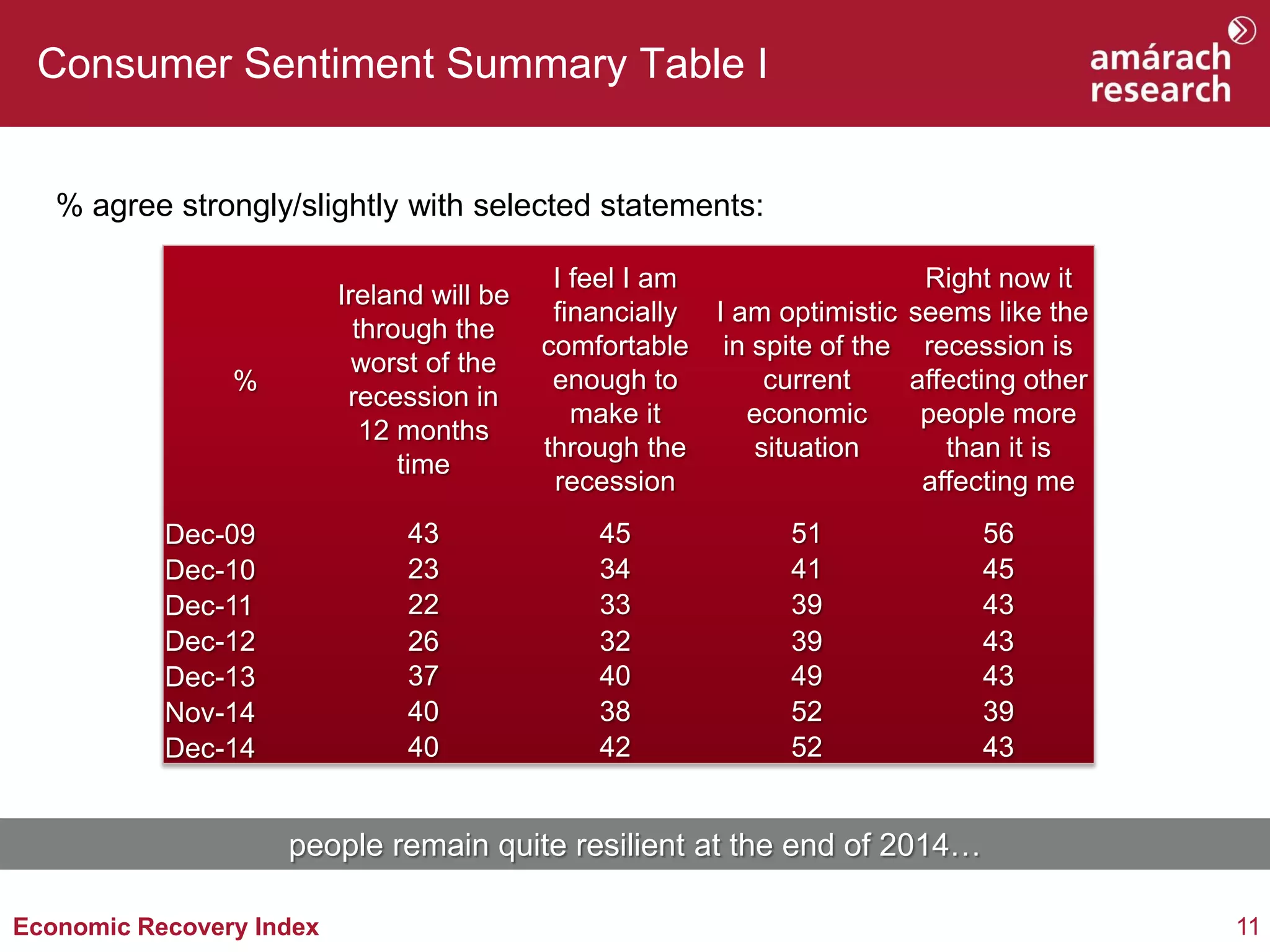

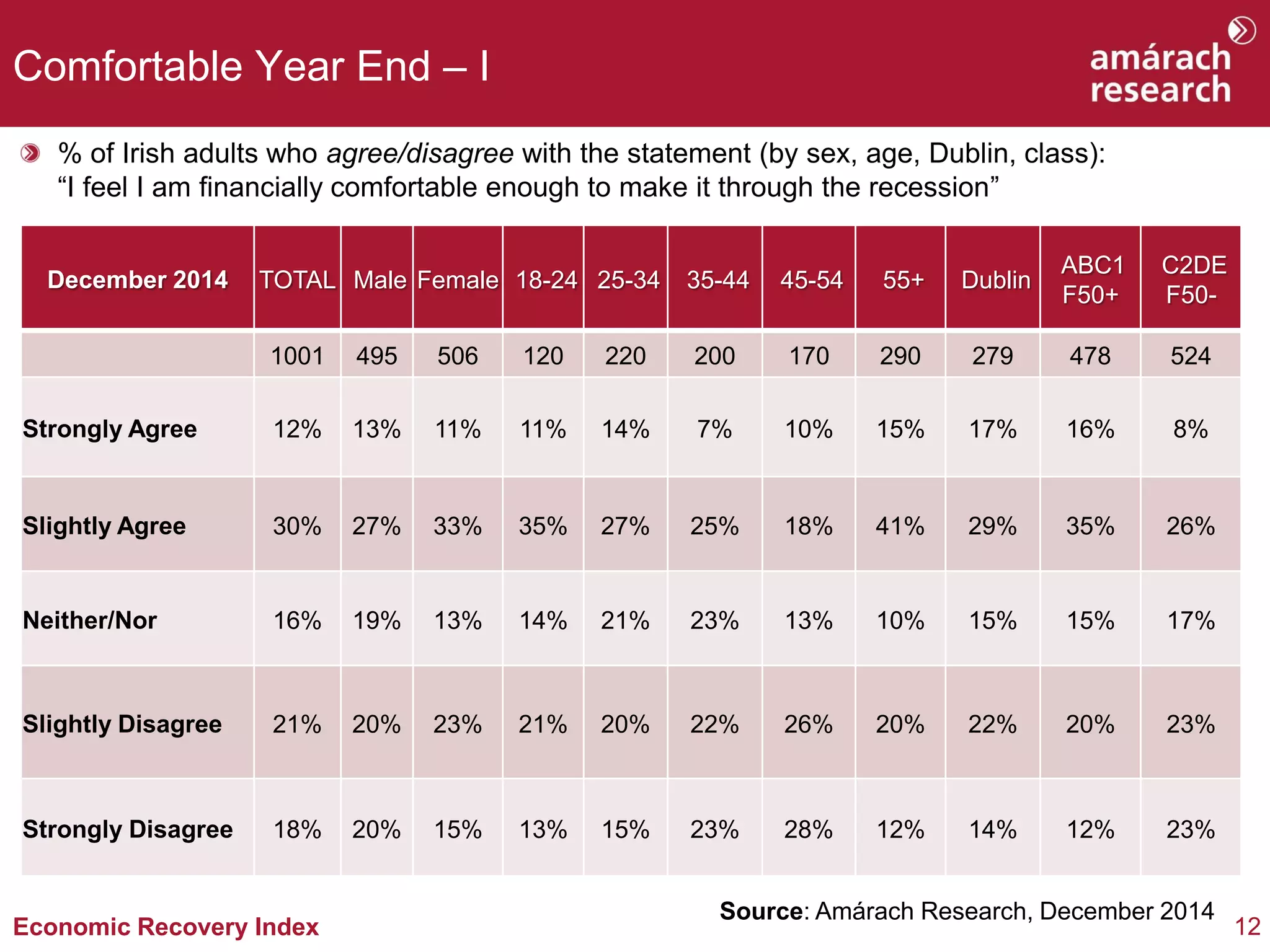

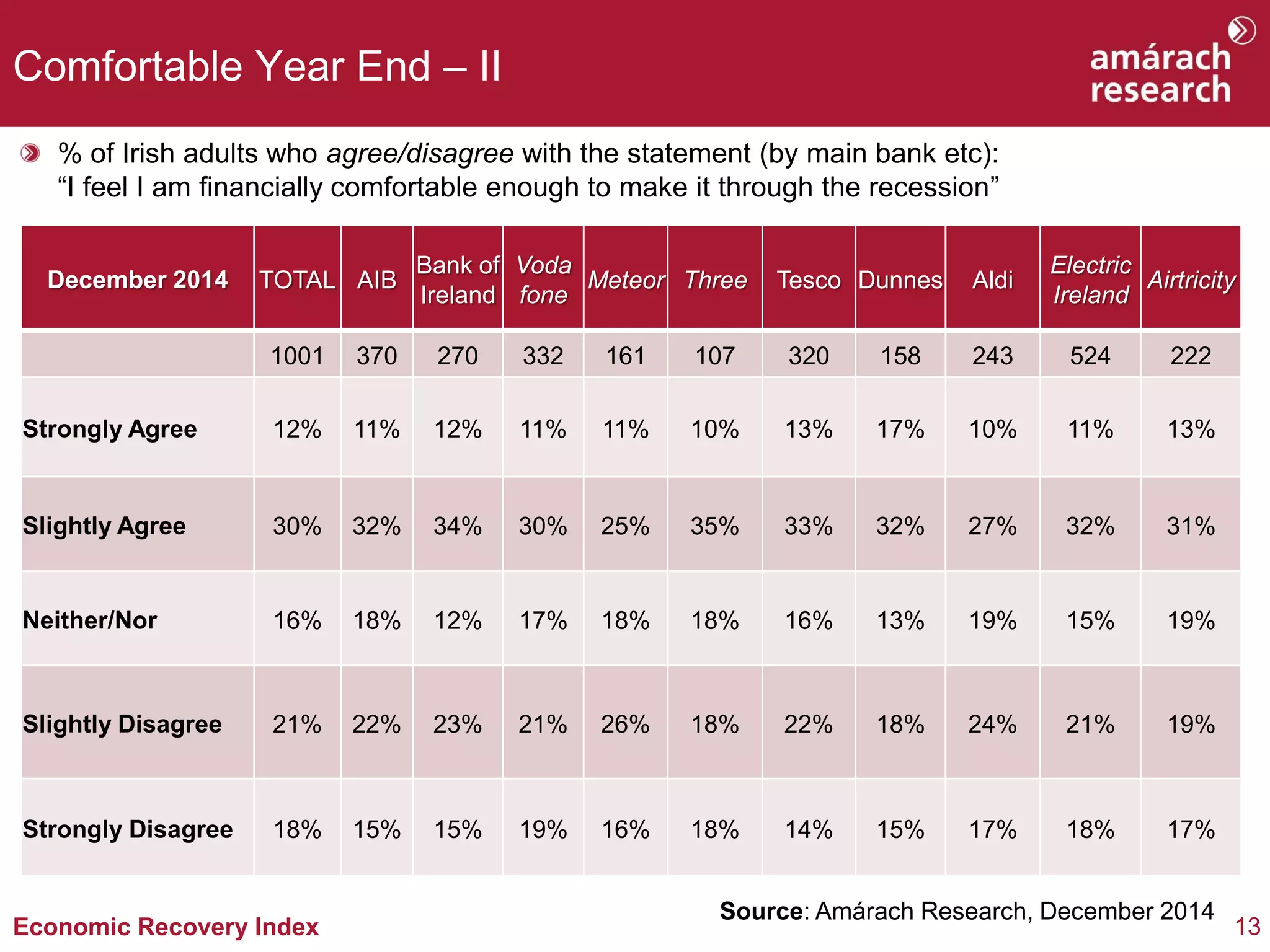

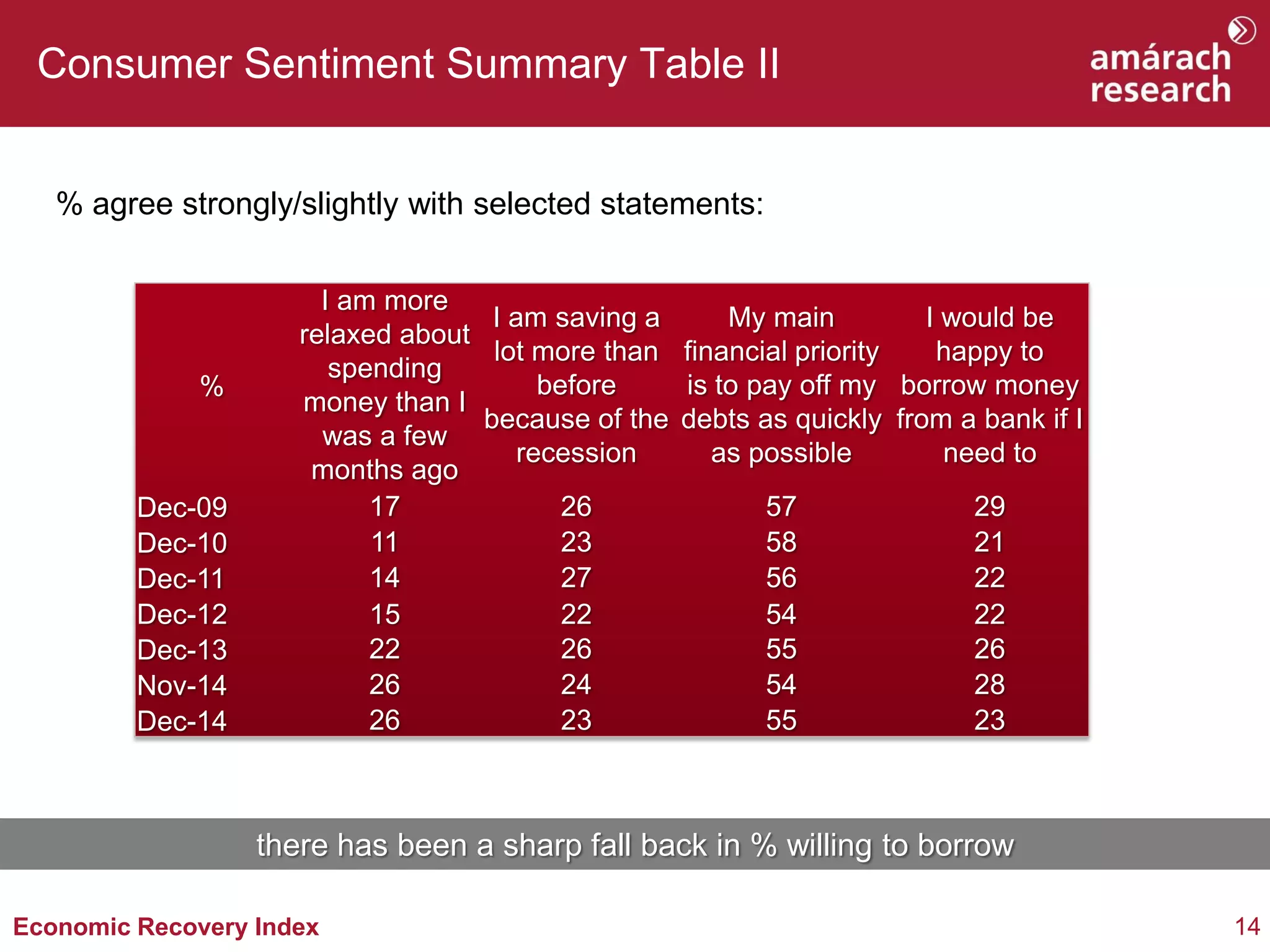

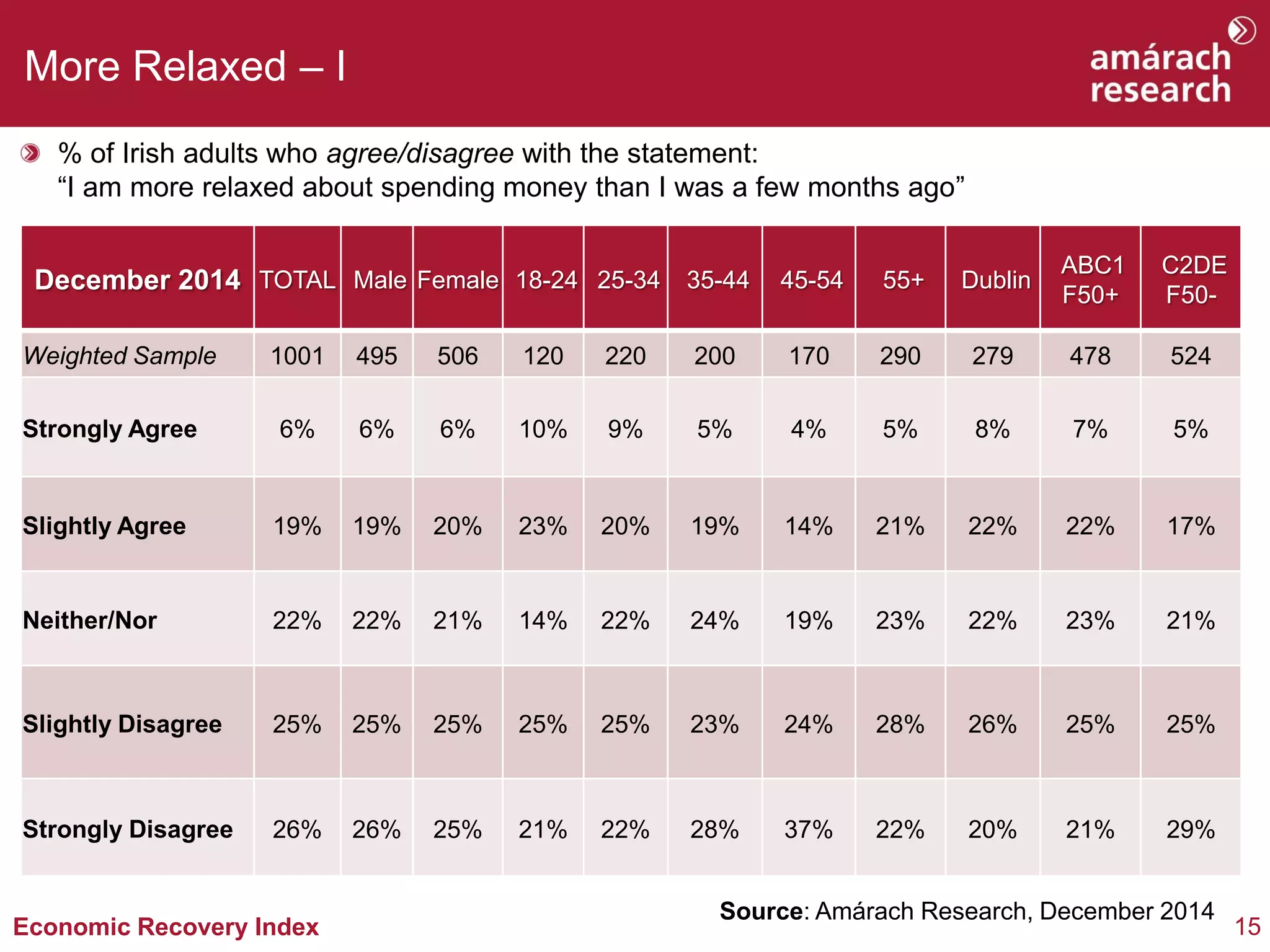

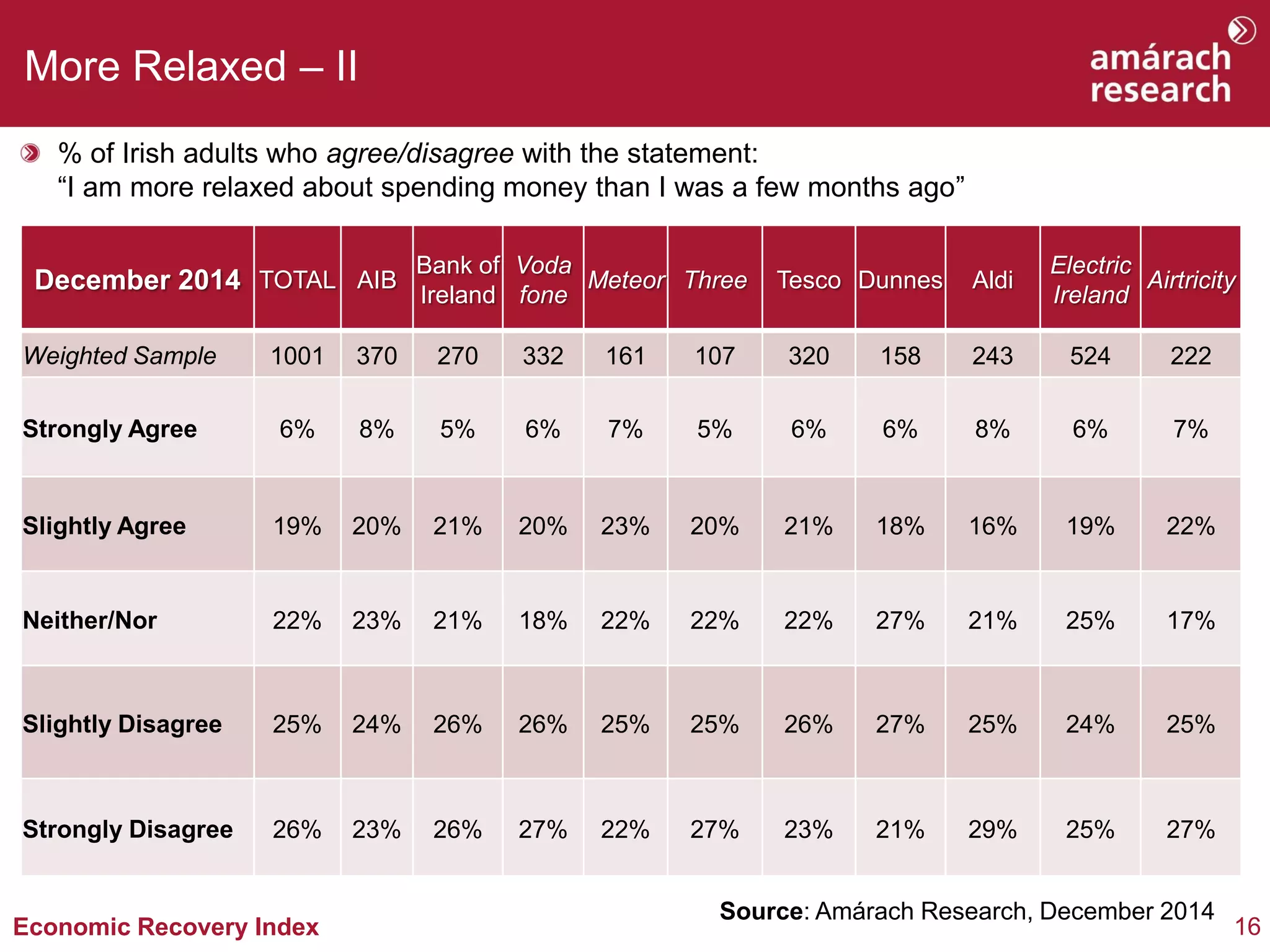

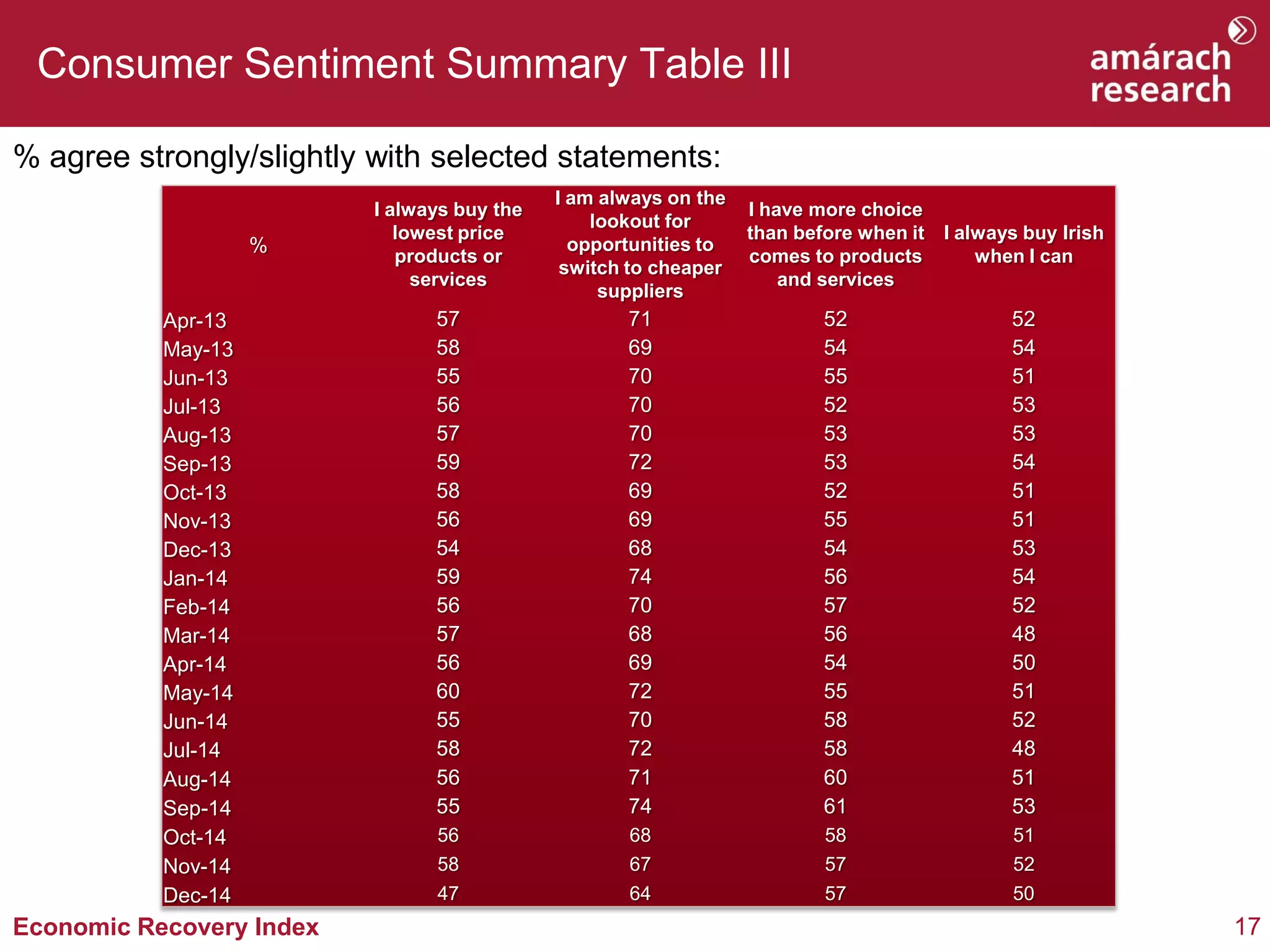

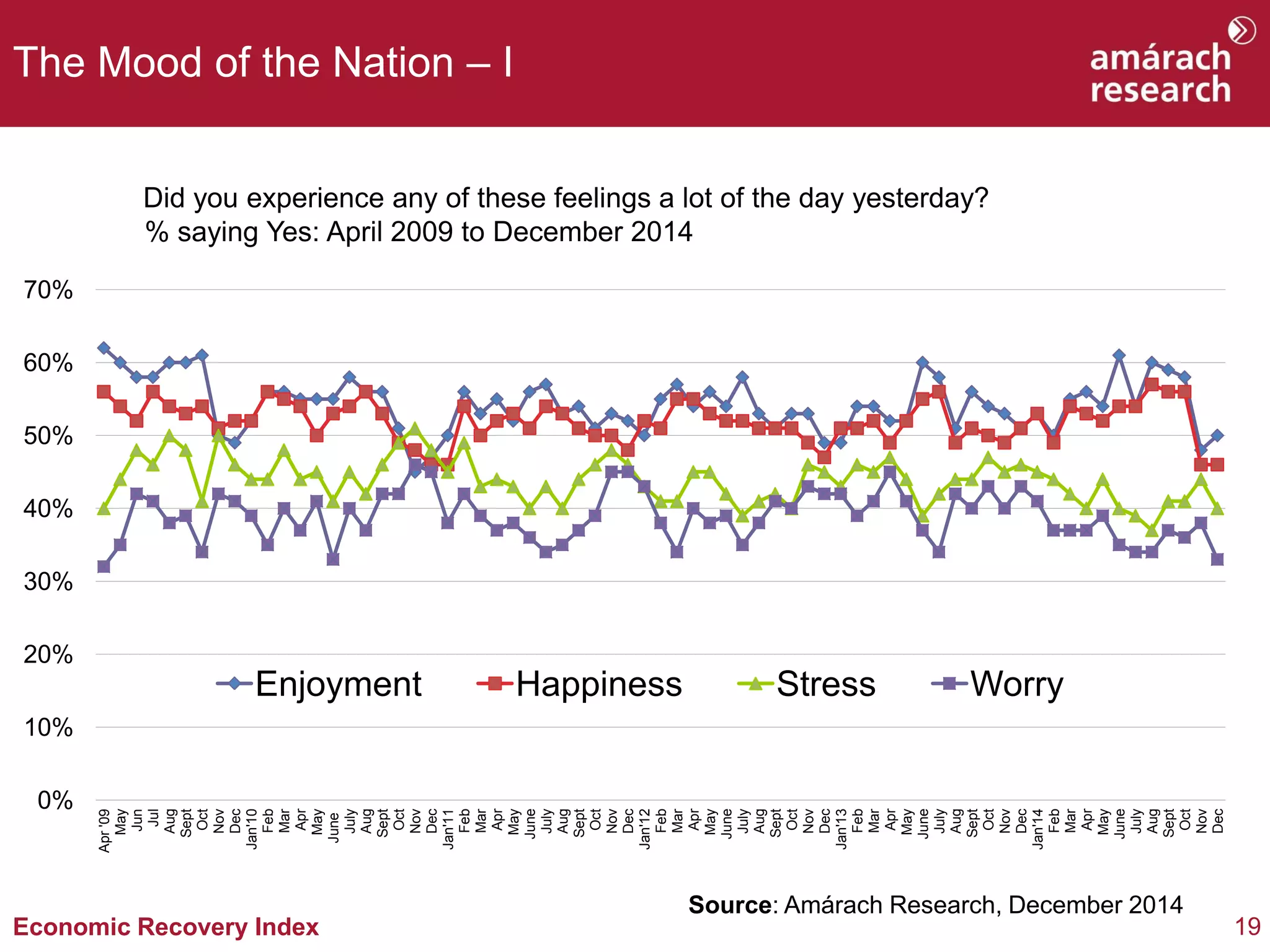

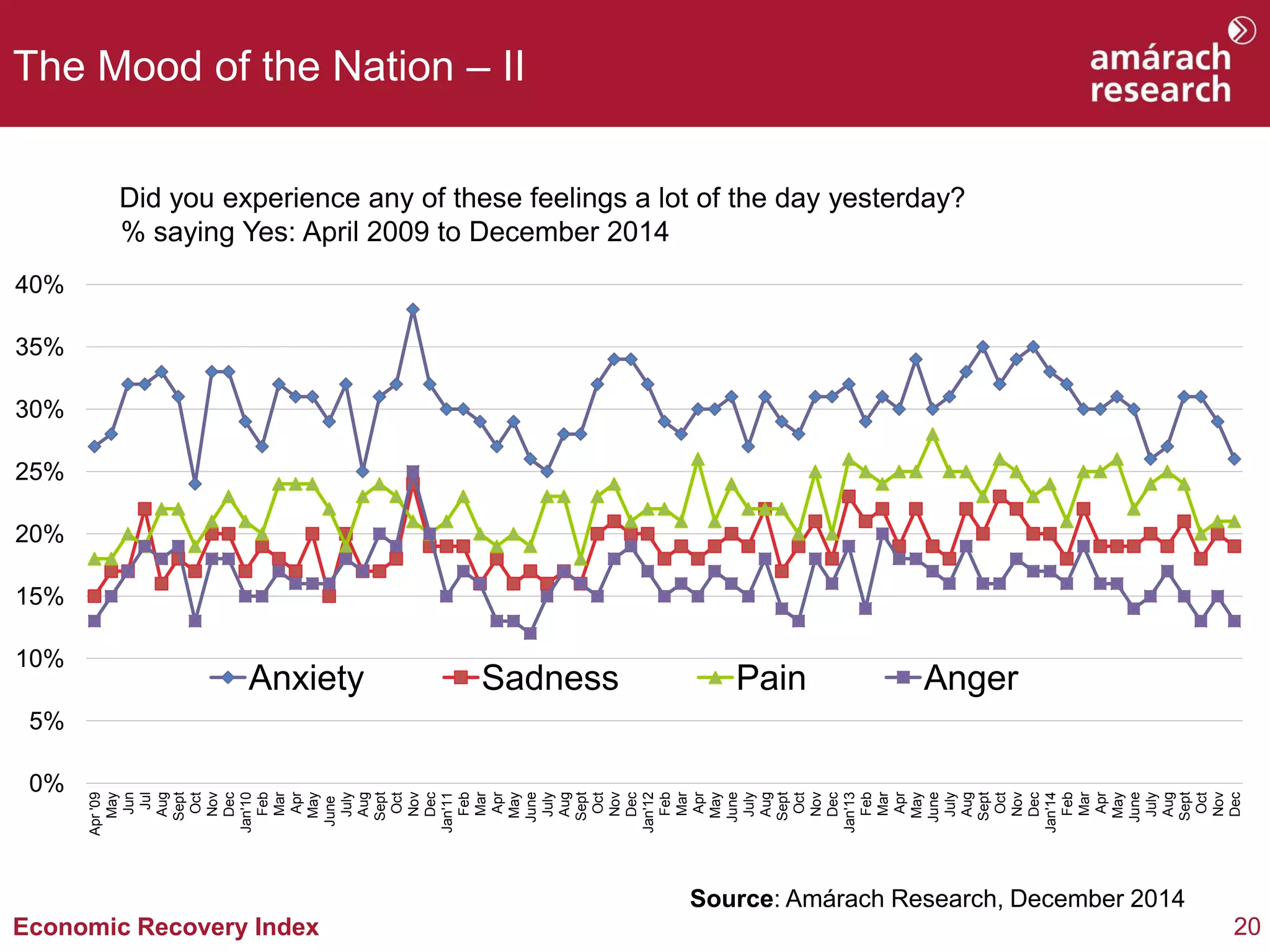

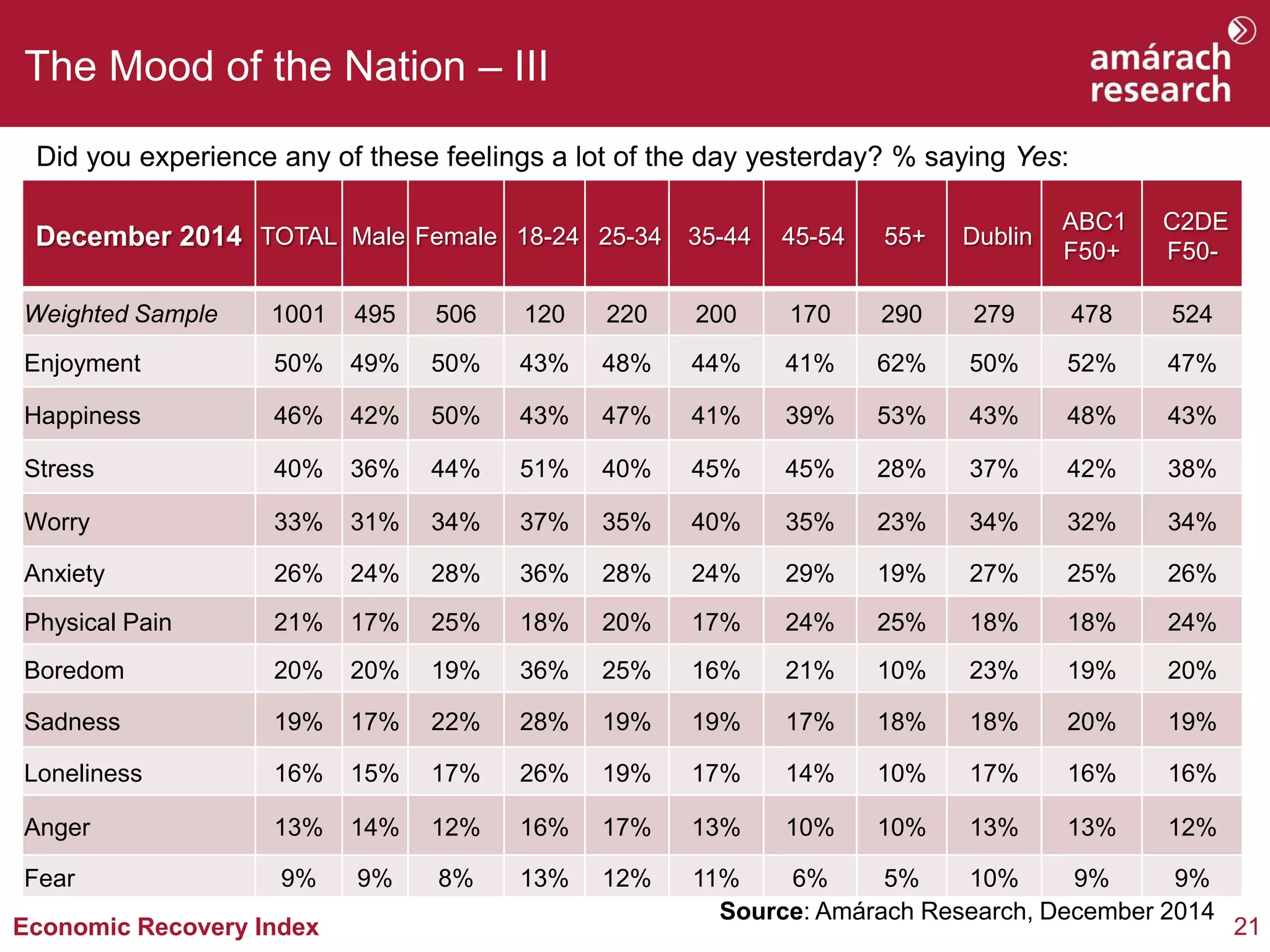

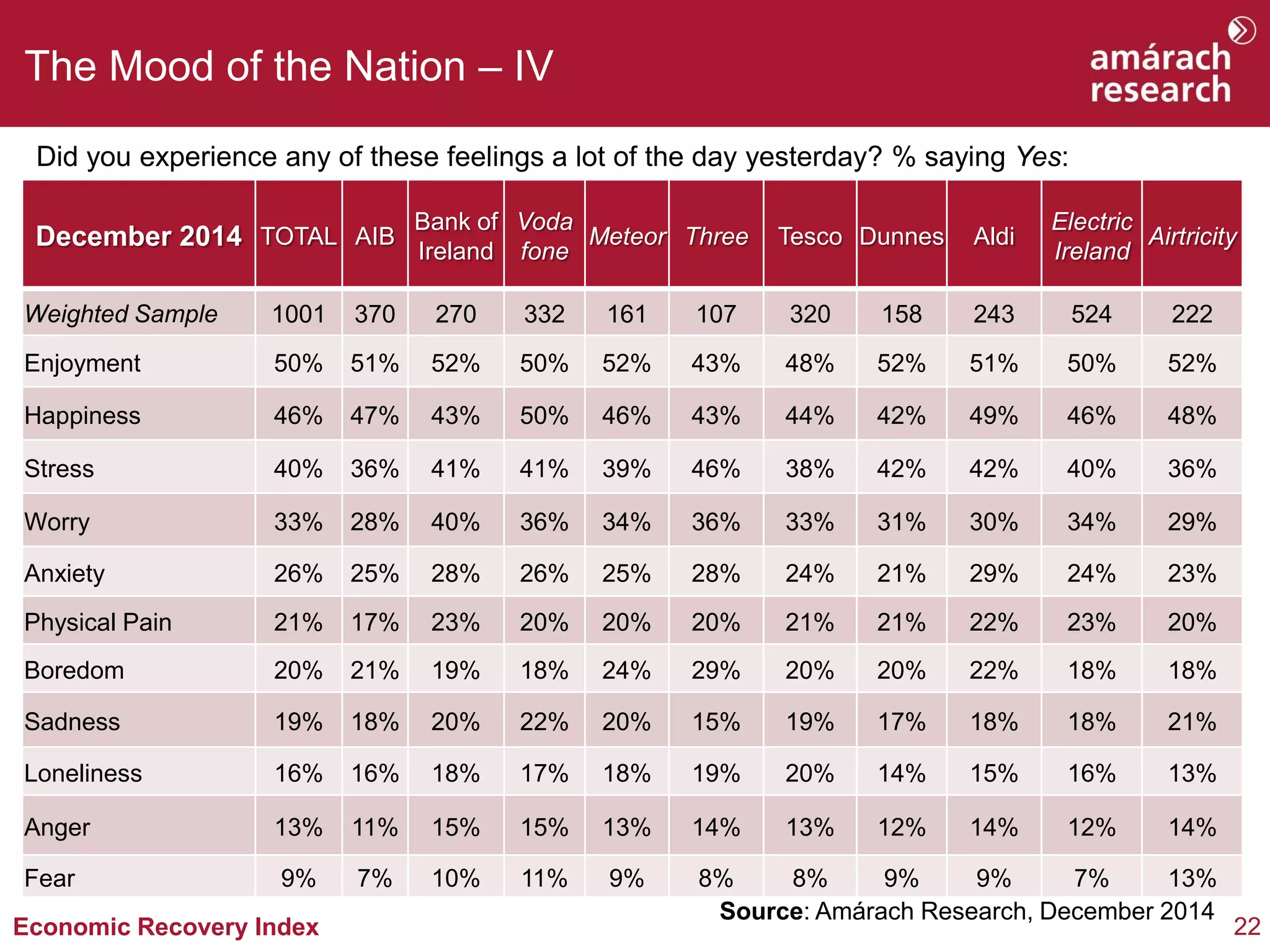

The document provides an analysis of Ireland's economic recovery index from December 2014. It finds that while consumer sentiment has improved significantly from the depths of the recession, the mood has remained steady in recent months with the index leveling off at the end of the year. Some positive trends are noted, such as reduced price sensitivity, but also challenges like loneliness among young people. The analysis breaks down responses by demographics and service providers to help businesses plan for 2015. In summary, the report examines Ireland's economic and consumer recovery but finds the mood has stabilized over the last few months of 2014.