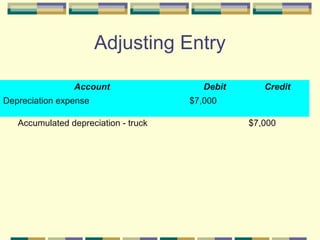

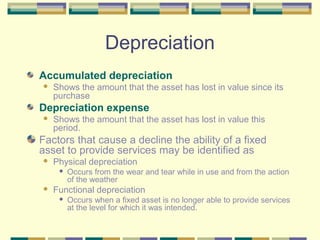

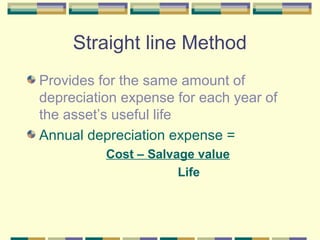

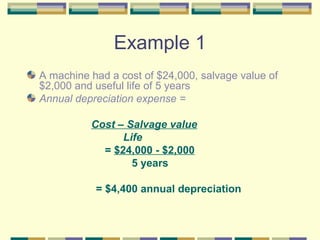

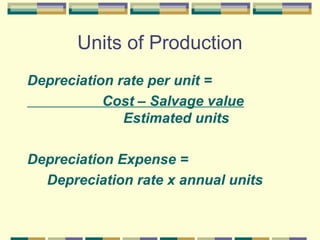

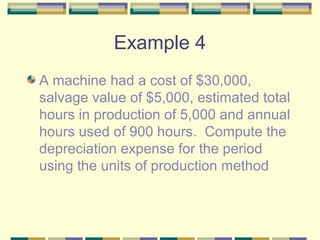

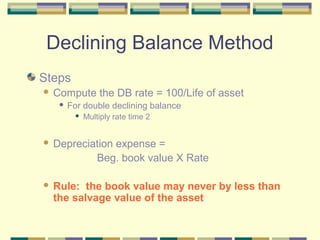

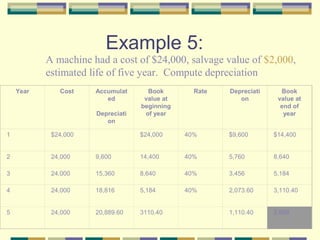

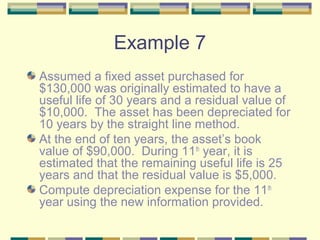

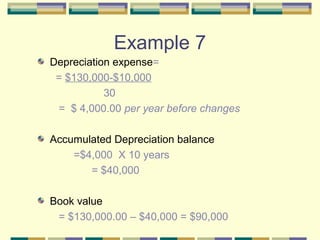

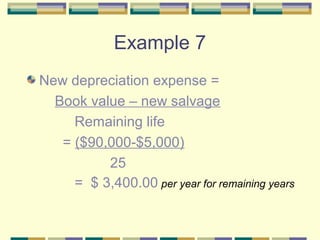

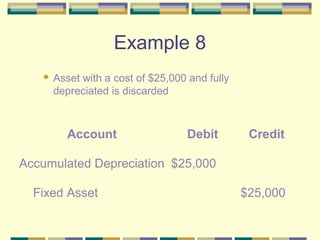

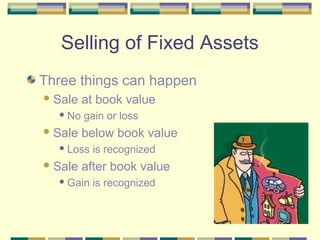

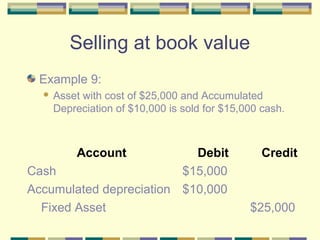

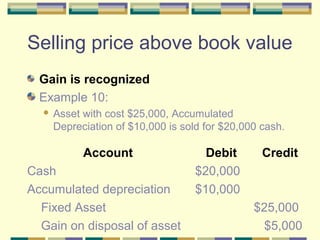

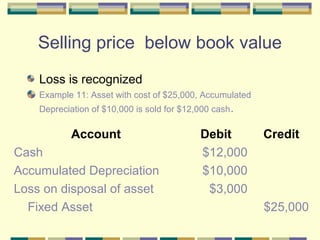

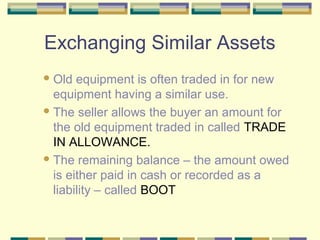

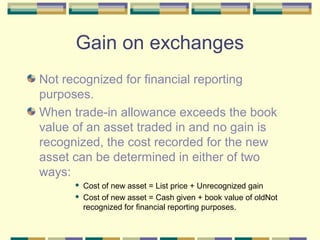

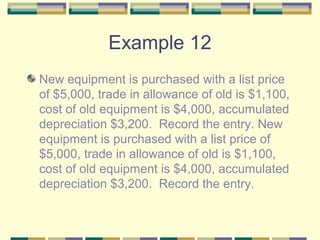

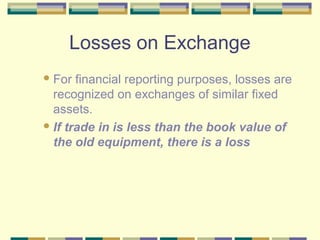

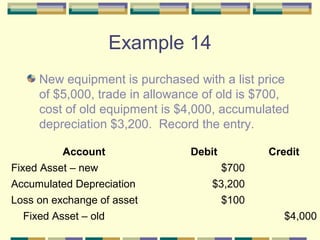

The document explains the accounting for depreciation of fixed assets, detailing how assets lose value over time and the systematic transfer of their costs to expense accounts. It covers different depreciation methods such as straight line, declining balance, and units of production, providing examples for each method. Additionally, the document discusses the disposal of fixed assets, including selling, trading in, and accounting for gains or losses, as well as the revision of depreciation estimates.