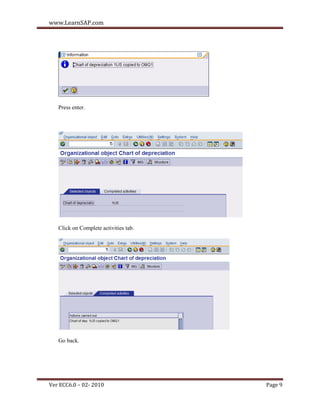

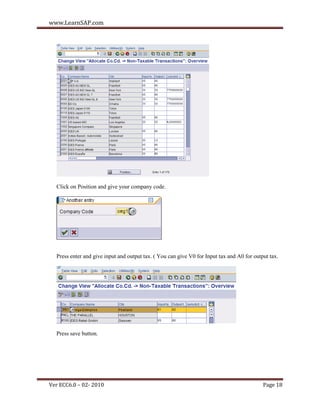

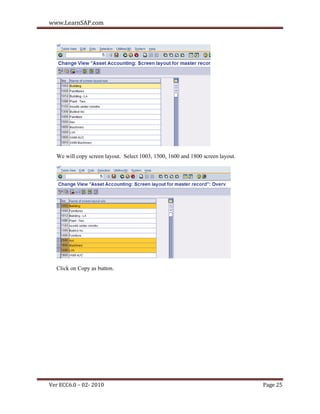

The document provides an overview of asset accounting configuration in SAP. It discusses copying a reference chart of depreciation and customizing it by deleting unnecessary depreciation areas. It also covers assigning input tax indicators for non-taxable asset acquisitions and assigning a chart of depreciation to a company code. The document contains step-by-step instructions for completing these configuration tasks in SAP.