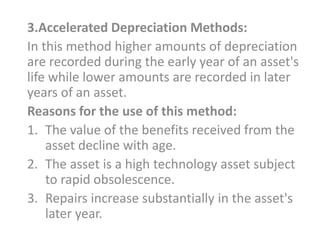

Depreciation is allocating the cost of plant and equipment over its useful life. It is a non-cash expense that allows the decreasing value of a capital asset to be deducted from taxes. There are several methods to calculate depreciation including straight-line, units-of-production, and accelerated methods. Partial year depreciation must also be calculated if an asset is placed into service during an accounting period.

![Double declining balance method

• To apply the double-declining-balance (DDB) method,

calculate the straight-line depreciation rate.

• ie divide 100% by the number of useful life,

• Eg 100%/5 20%,

• Then multiply that rate by 2

• 20% × 2 = 40%

• Next, apply, the DDB rate to the assets book value.

• Ignore salvage value.

• The formula is = [2× straight line rate × asset cost –

accumulated depreciation]](https://image.slidesharecdn.com/depreciation21-150401070655-conversion-gate01/85/Depreciation-2-1-19-320.jpg)

![Double declining balance method

• Under this method, it is relatively easy to

determine depreciation for a partial year and

then for subsequent full years.

• For example

• Partial year depreciation for 1997 is (Rs 7600 ×

0.4 × 1/3) = Rs 1,013.

• For subsequent years, use the regular procedure

for computation.

• eg 1998, depreciation would be = [(Rs 7600- Rs

1,013) × 0.4] = Rs 2,635.](https://image.slidesharecdn.com/depreciation21-150401070655-conversion-gate01/85/Depreciation-2-1-30-320.jpg)