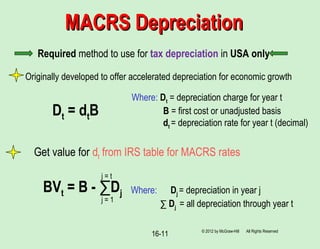

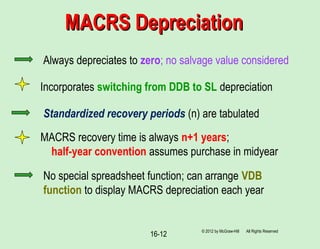

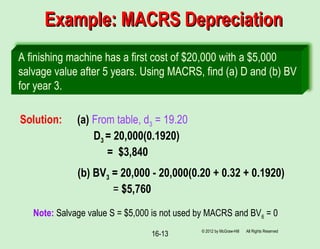

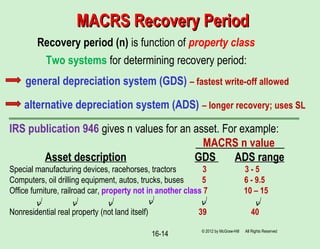

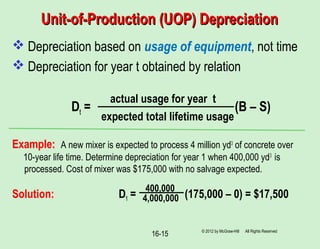

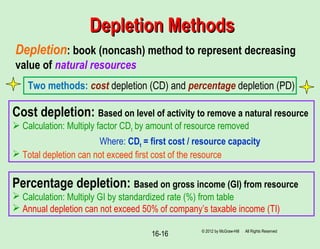

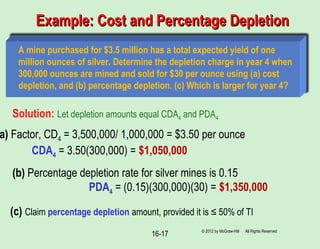

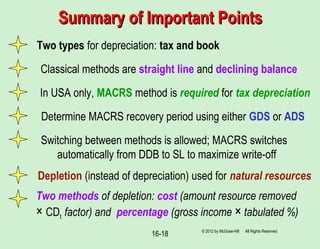

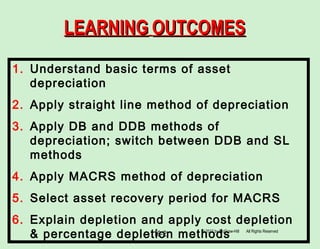

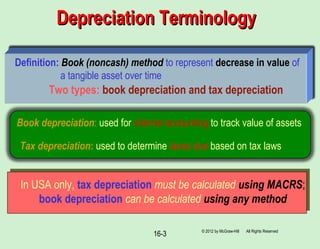

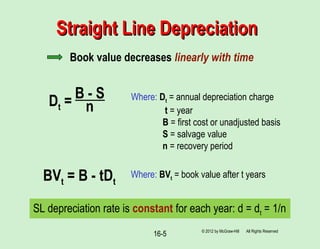

The document discusses various methods for depreciating assets and depleting natural resources over time. It defines key terms, outlines learning outcomes, and provides examples of calculating depreciation using straight line, declining balance, double declining balance, and MACRS methods. It also covers cost depletion and percentage depletion methods for natural resources.

![Switching Between Depreciation MethodsSwitching Between Depreciation Methods

Switch between methods to maximize PW of depreciation

PWD = ∑ Dt (P/F,i%,t)

A switch from DDB to SL in latter part of life is usually better

Can switch only one time during recovery period

16-10 © 2012 by McGraw-Hill All Rights Reserved

t = 1

t = n

Procedure to switch from DDB to SL:

1) Each year t compute DDB and SL depreciation using the relations

DDDB = d(BVt-1) and DSL = BVt-1 / (n-t+1)

2) Select larger depreciation amount, i.e., Dt = max[DDDB, DSL]

3) If required, calculate PWD

Procedure to switch from DDB to SL:

1) Each year t compute DDB and SL depreciation using the relations

DDDB = d(BVt-1) and DSL = BVt-1 / (n-t+1)

2) Select larger depreciation amount, i.e., Dt = max[DDDB, DSL]

3) If required, calculate PWD

Alternatively, use spreadsheet function VDB(B,S,n,start_t,end_t) to determine Dt](https://image.slidesharecdn.com/chapter16-depreciationmethods-140315184134-phpapp01/85/Chapter-16-depreciation-methods-10-320.jpg)