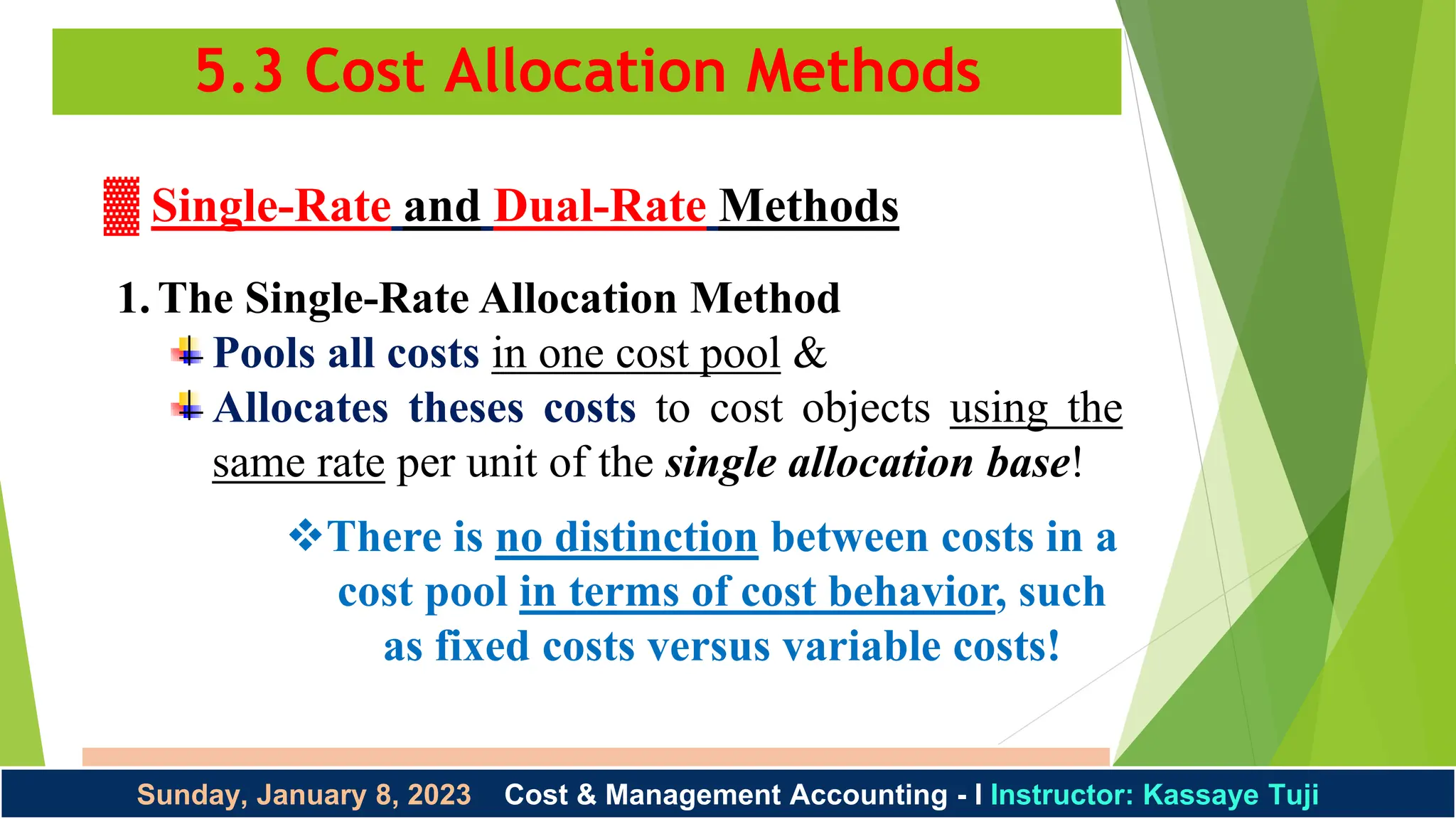

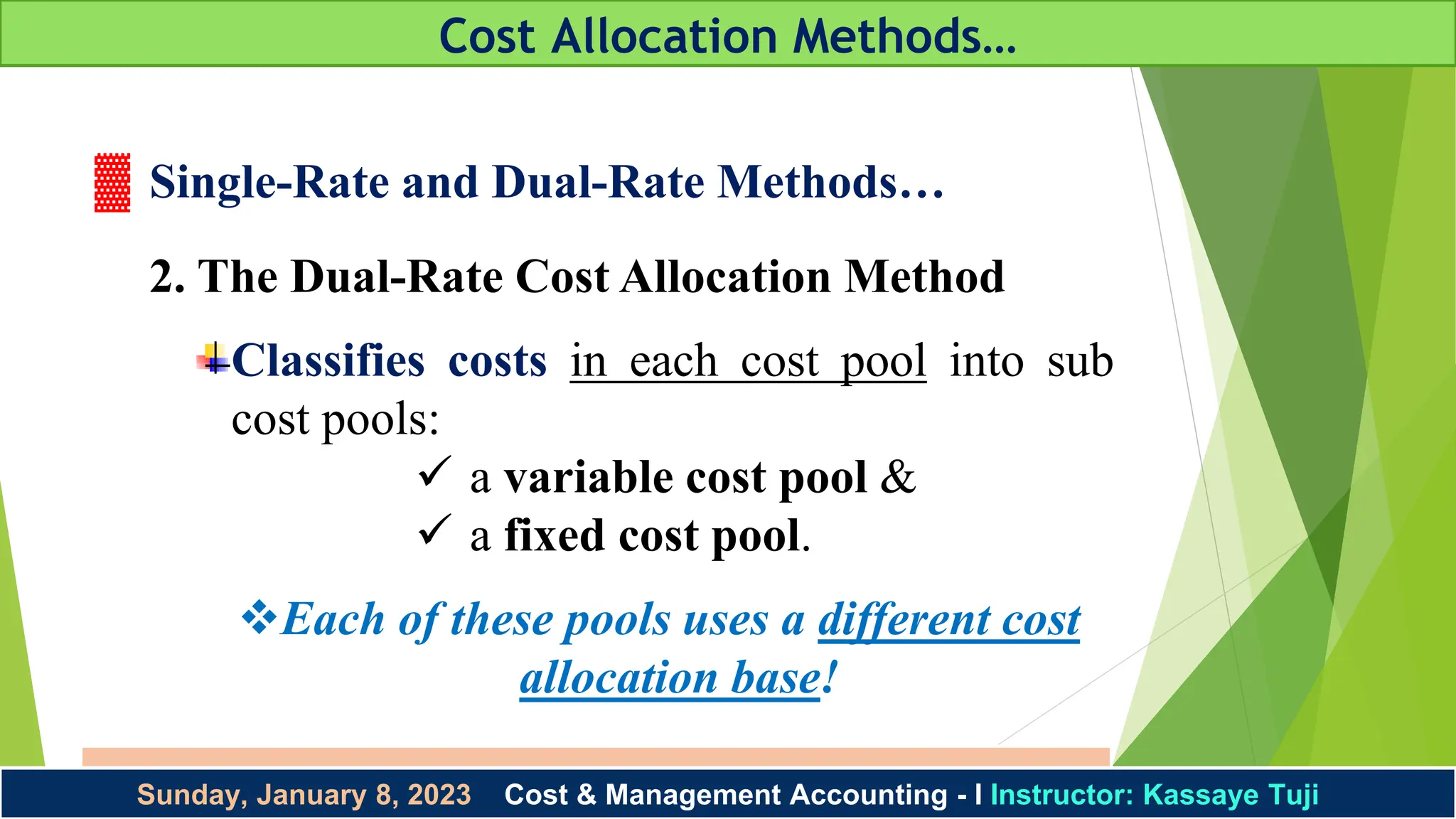

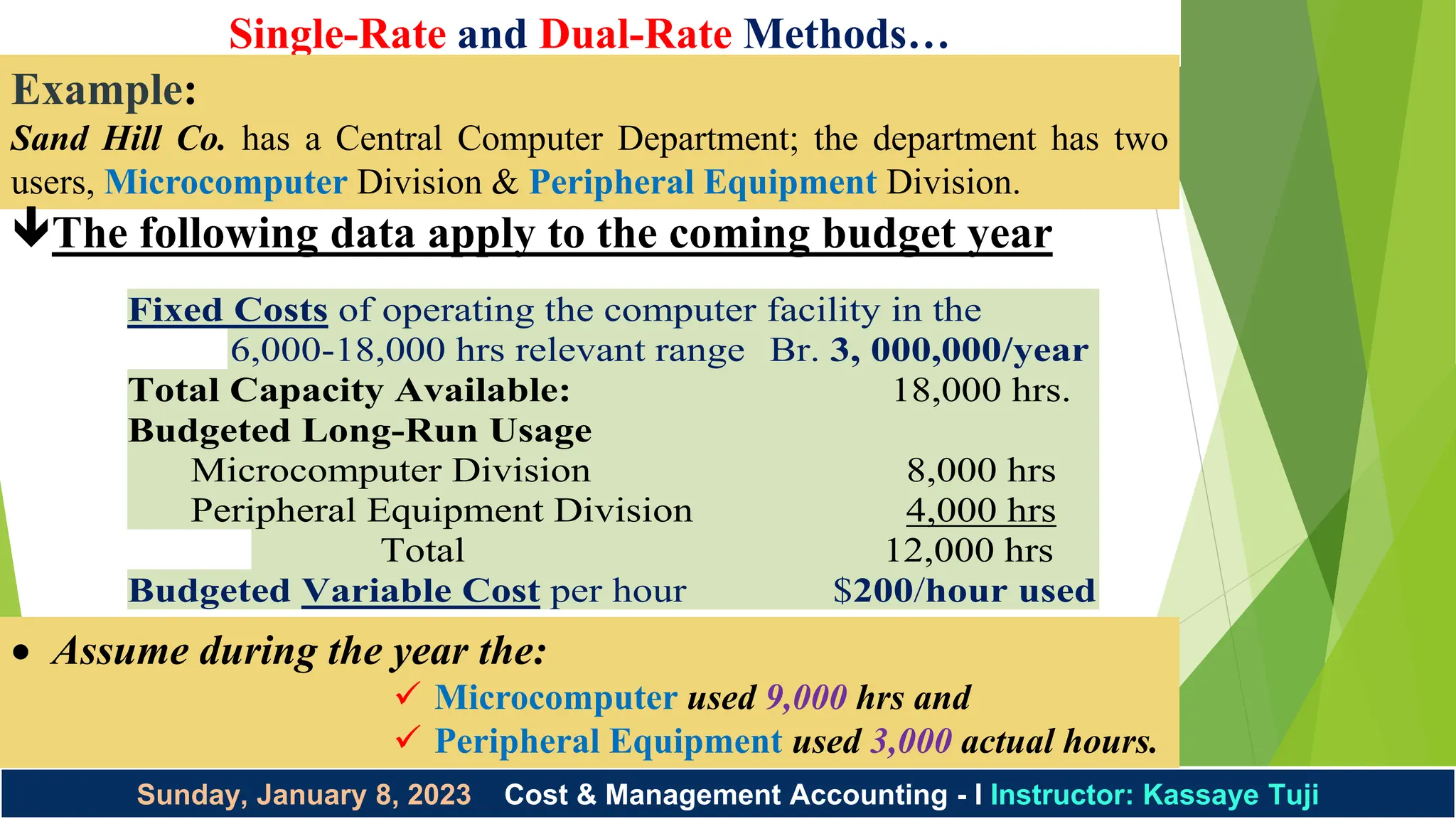

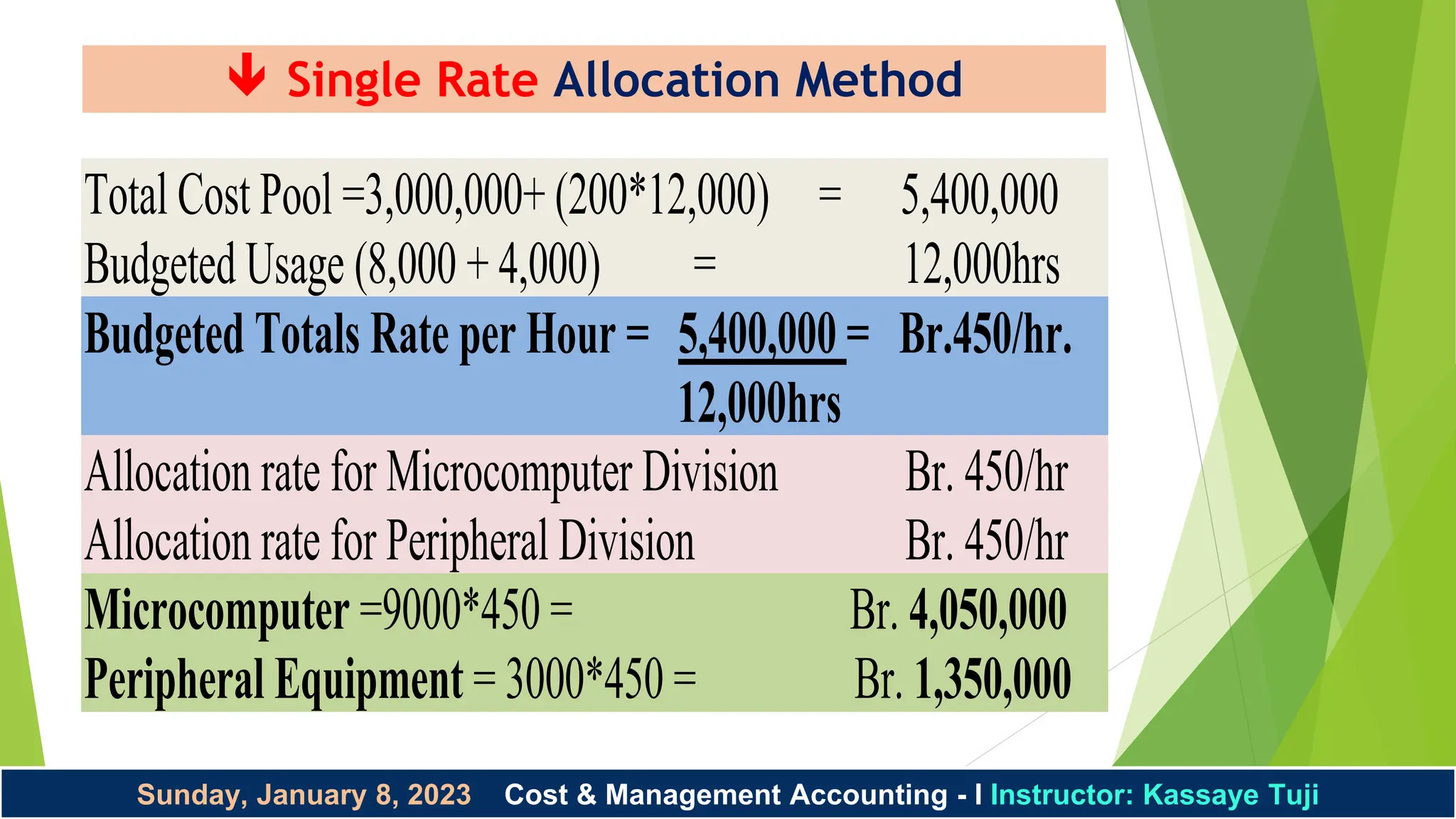

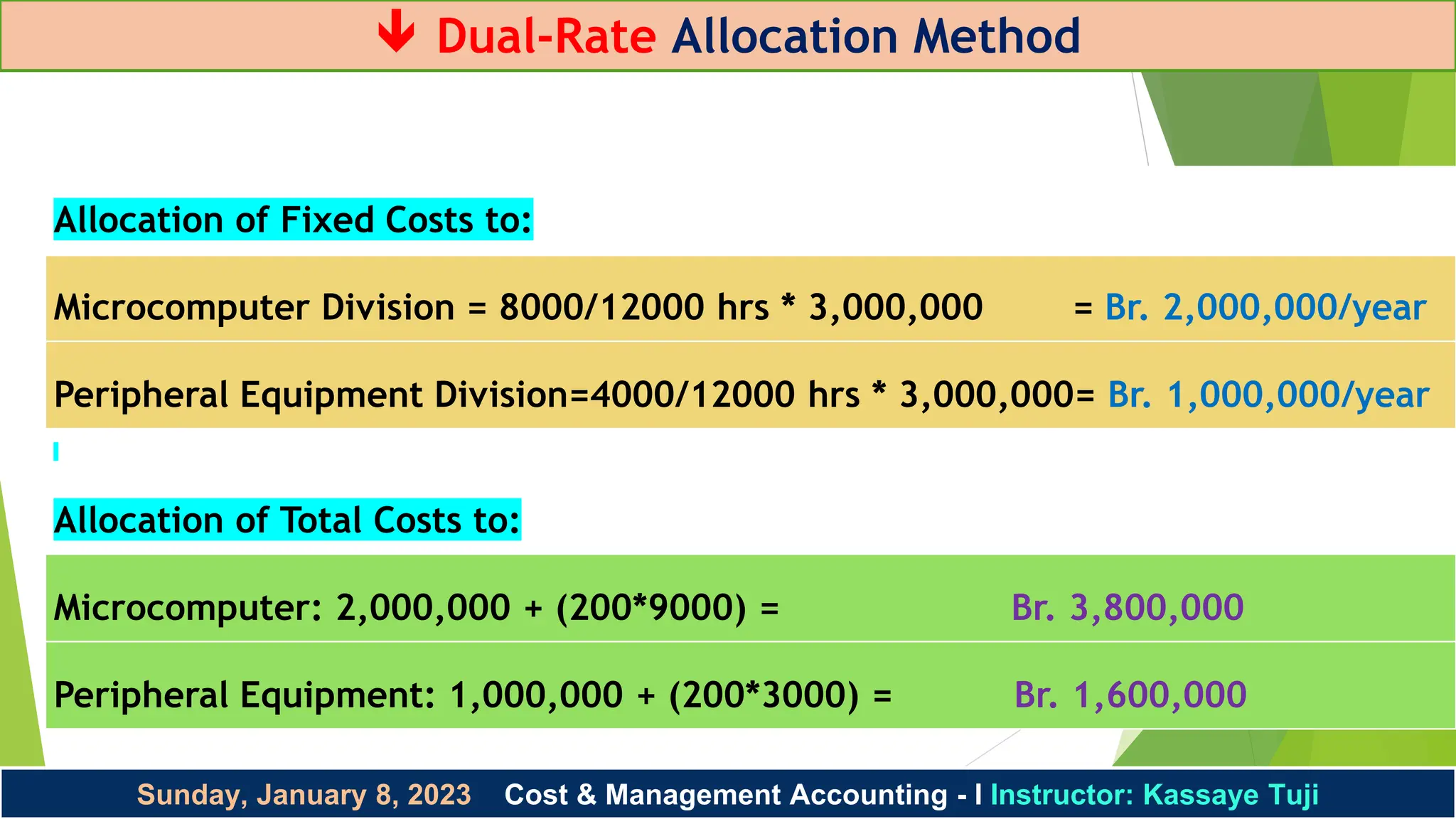

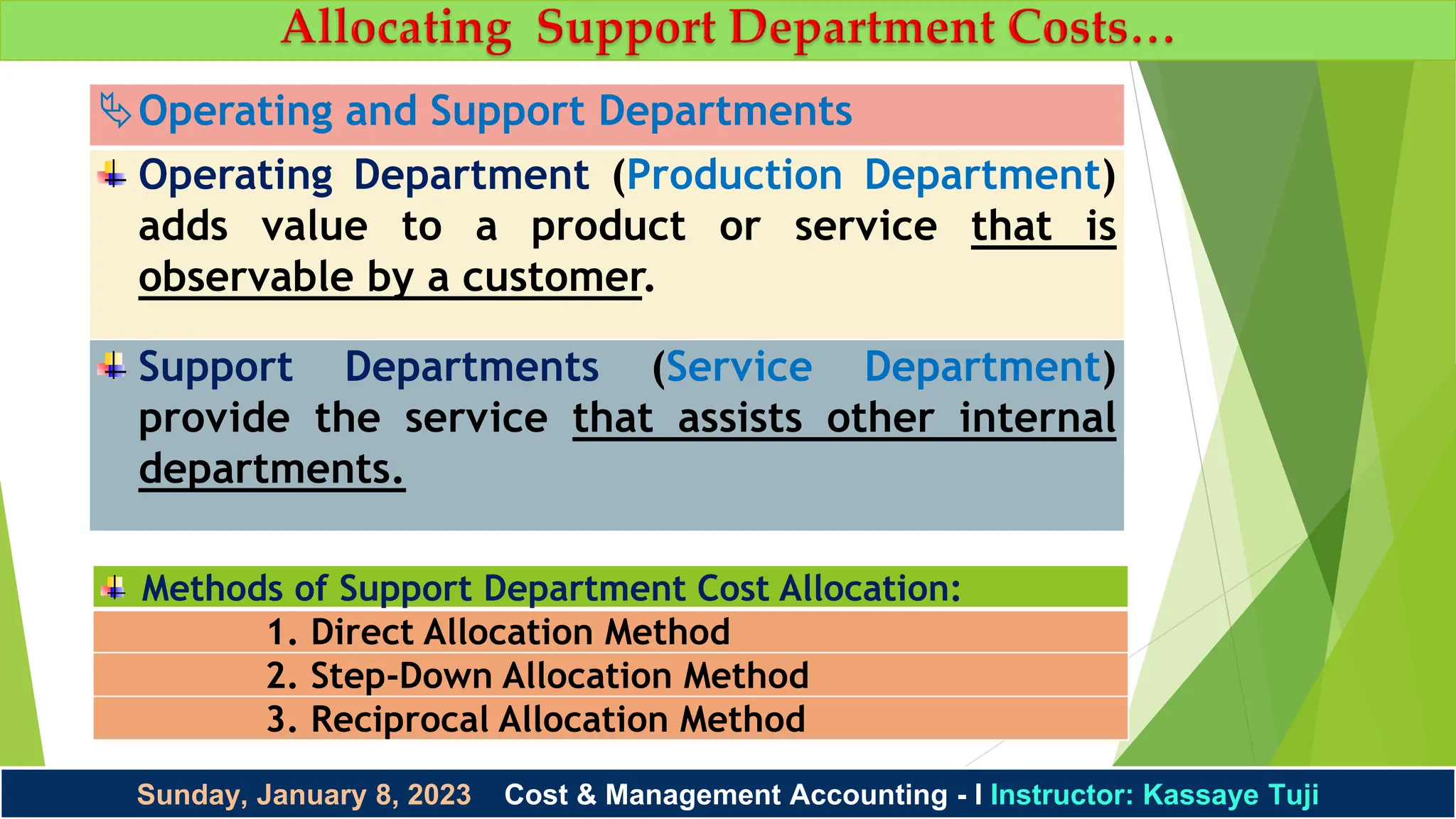

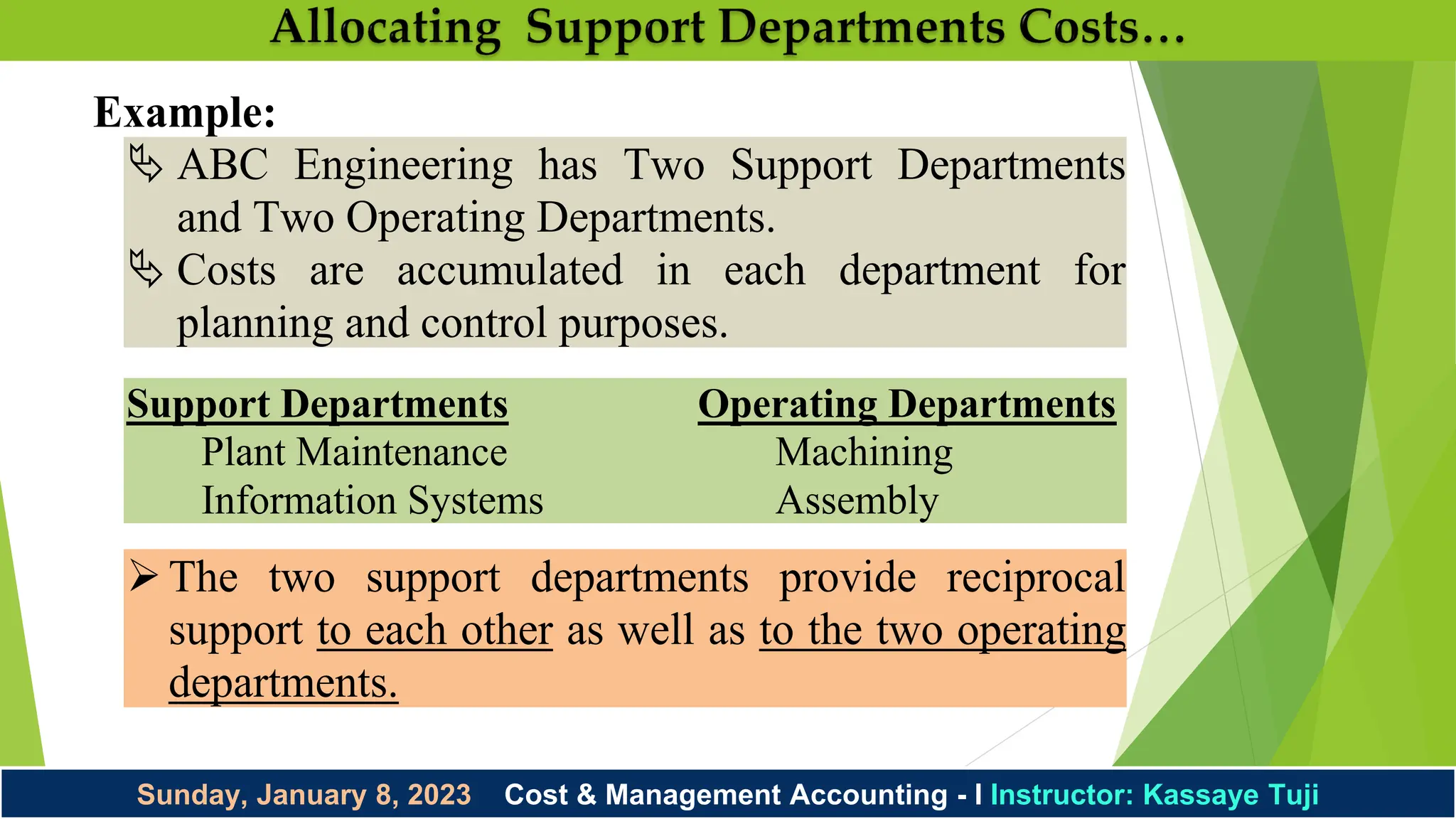

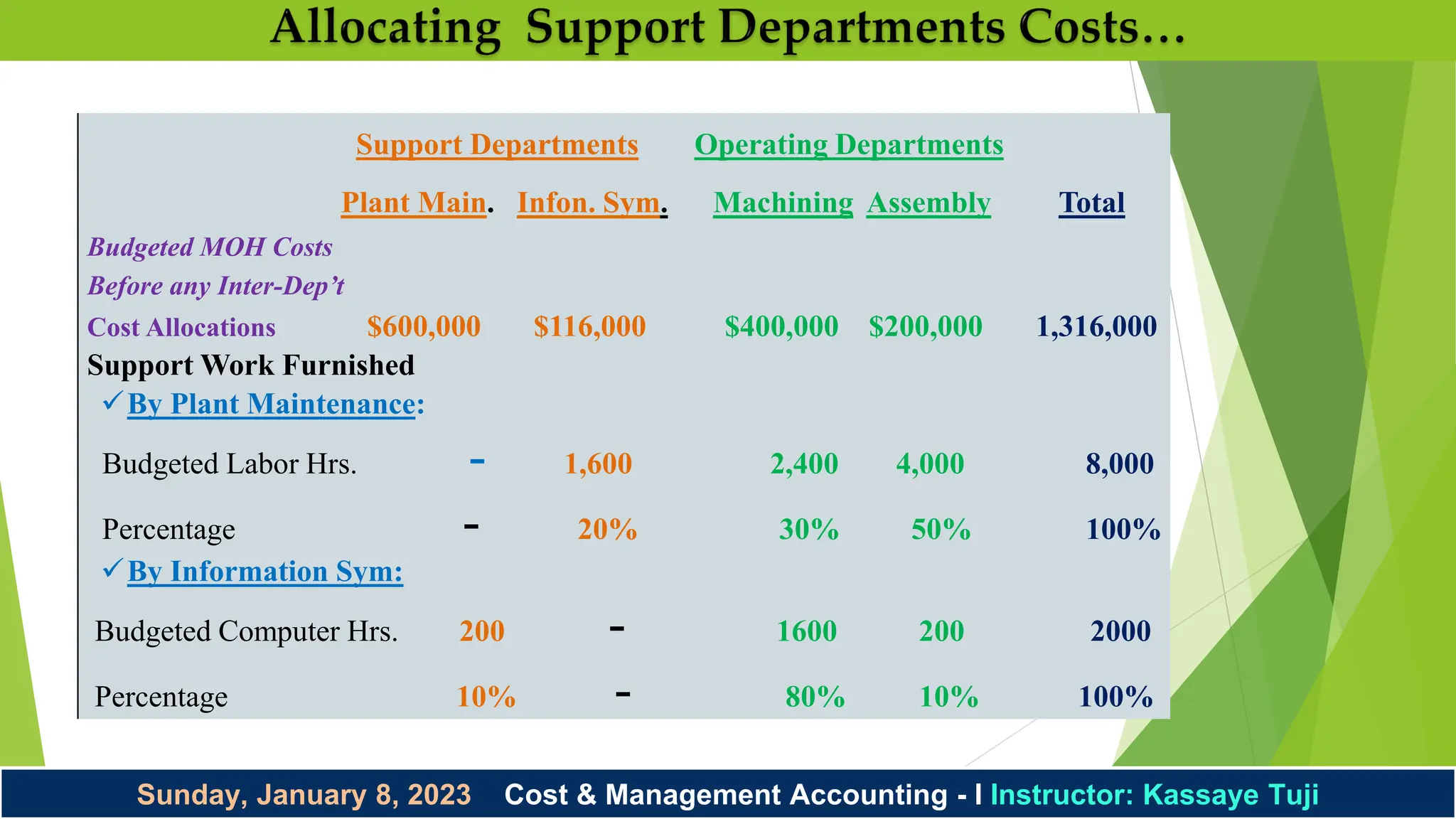

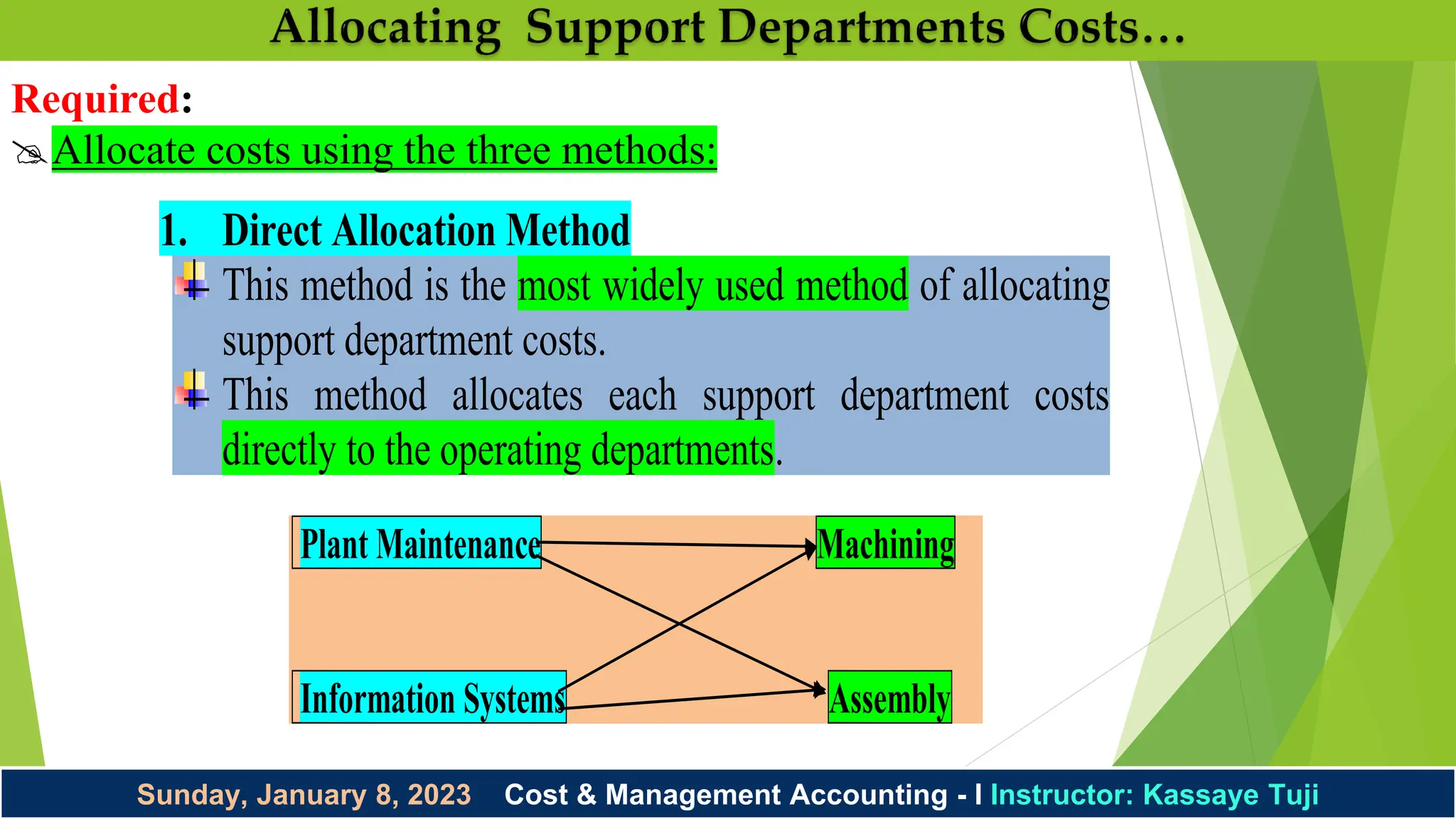

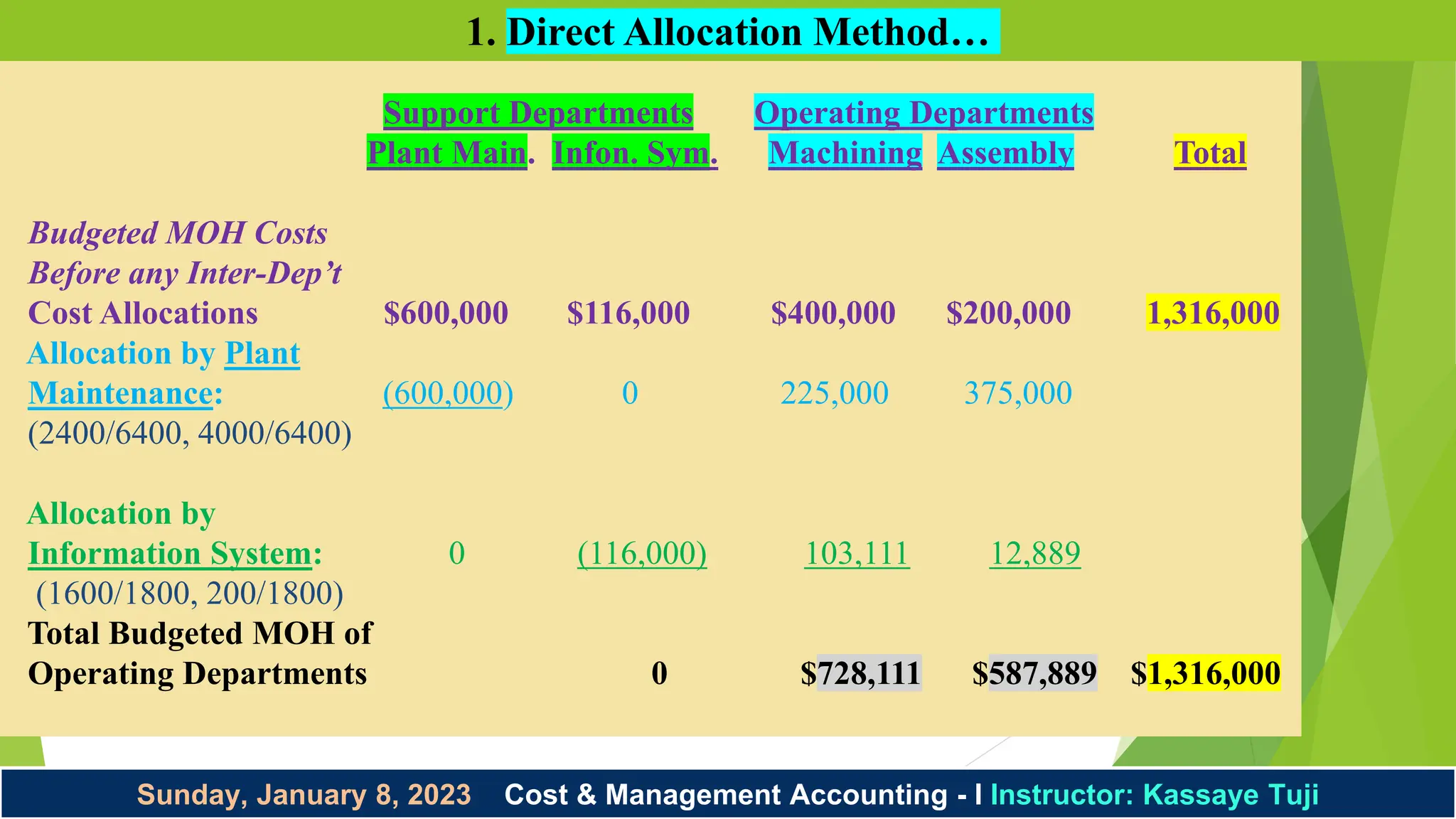

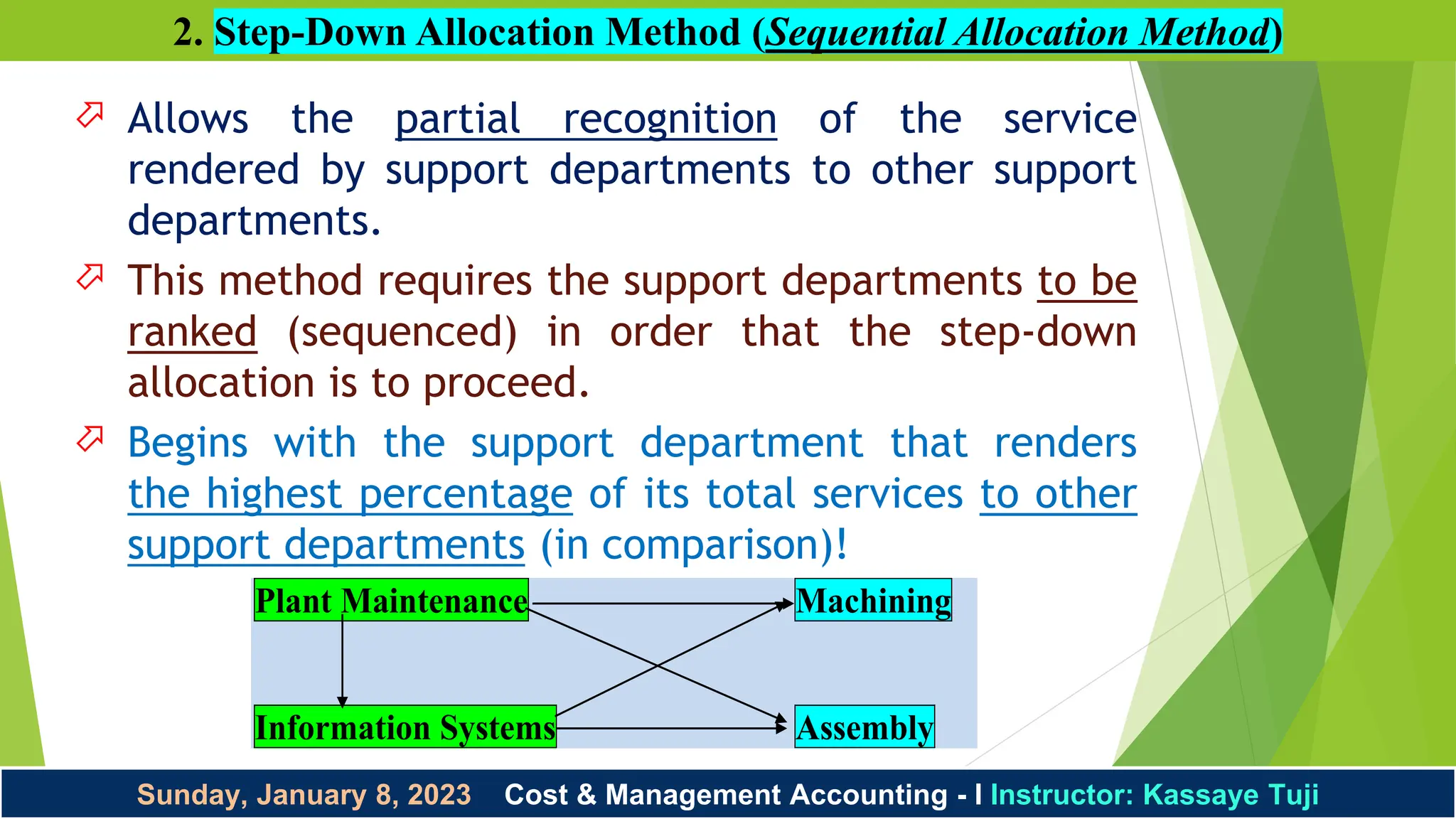

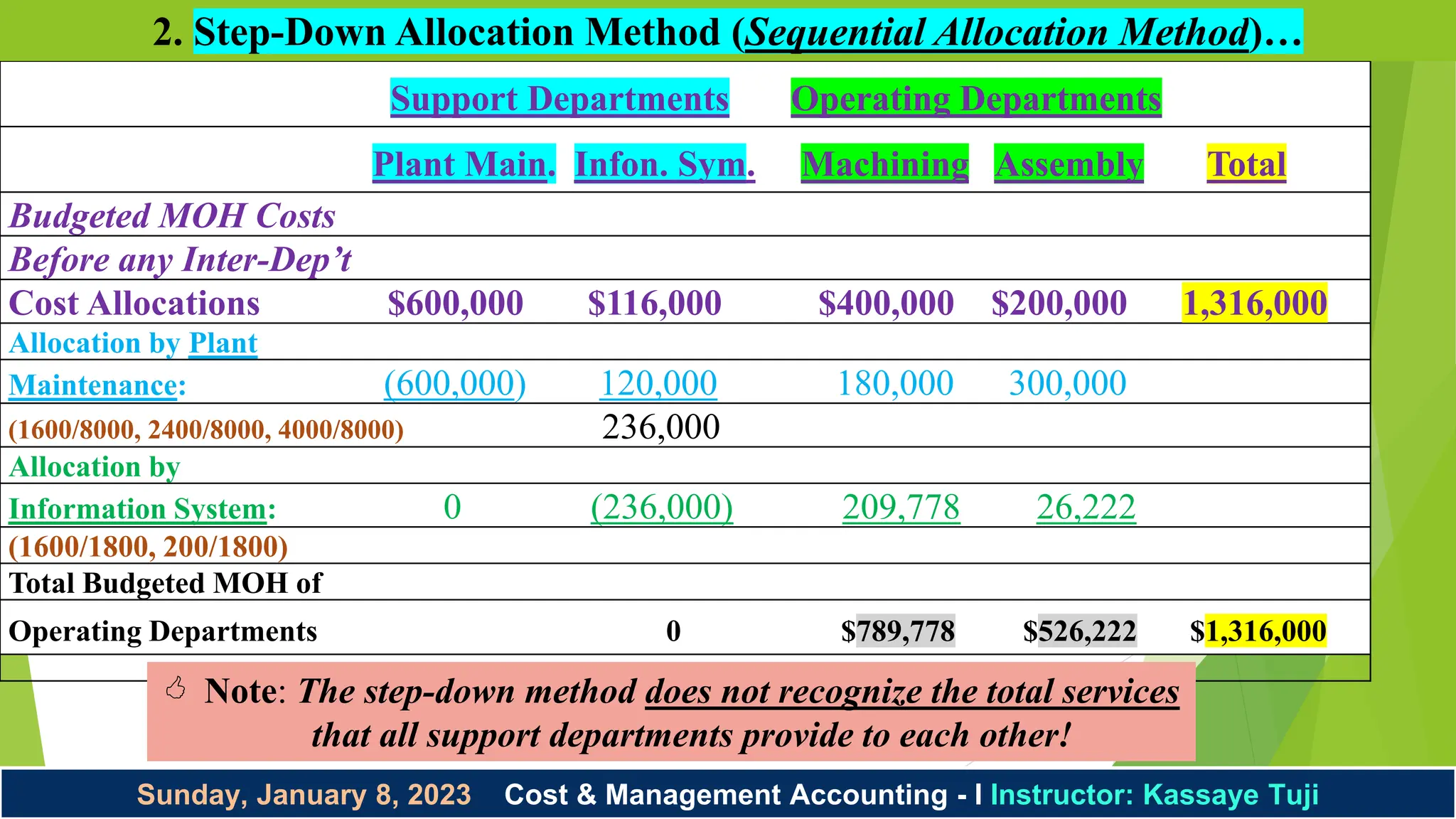

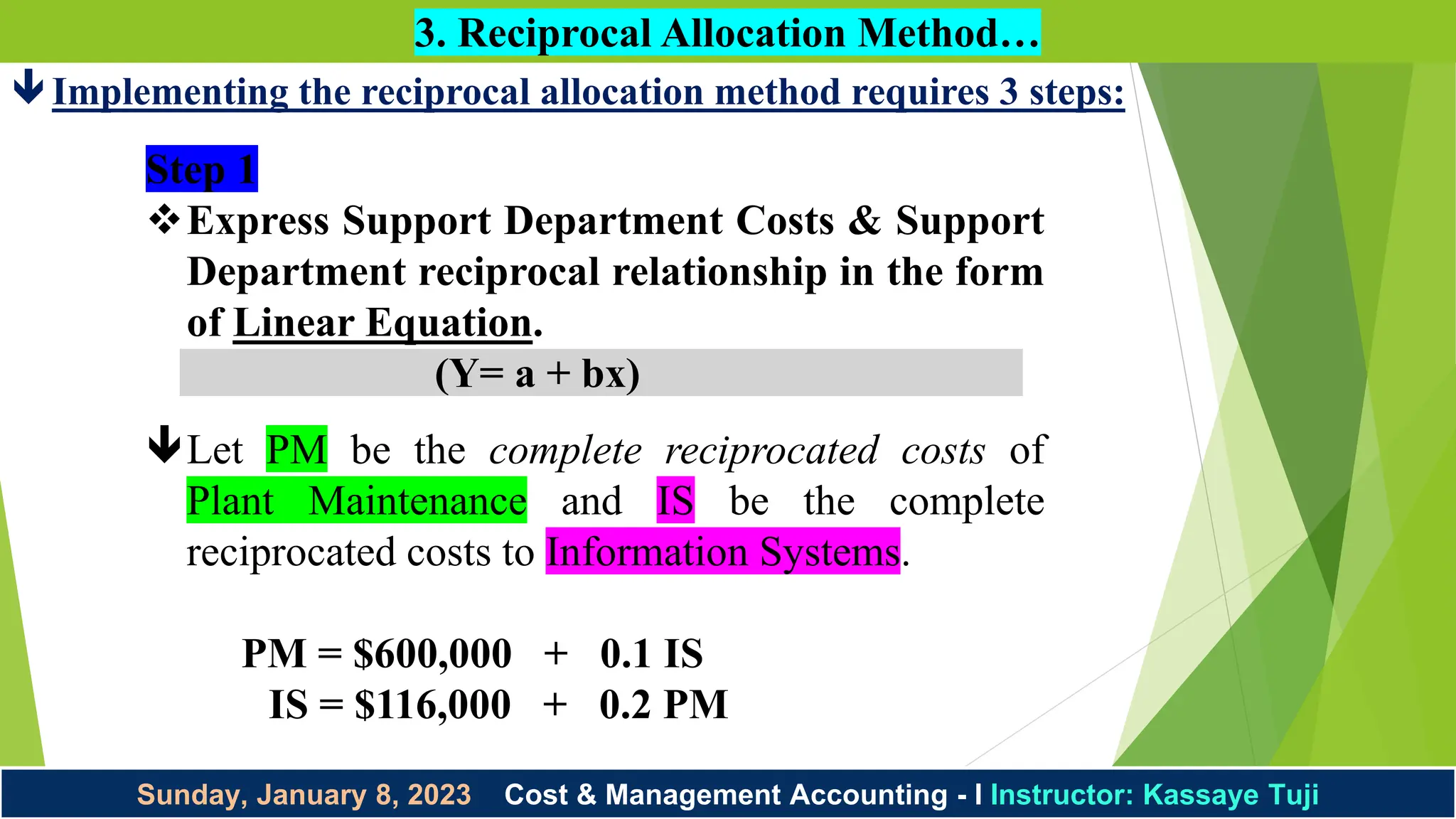

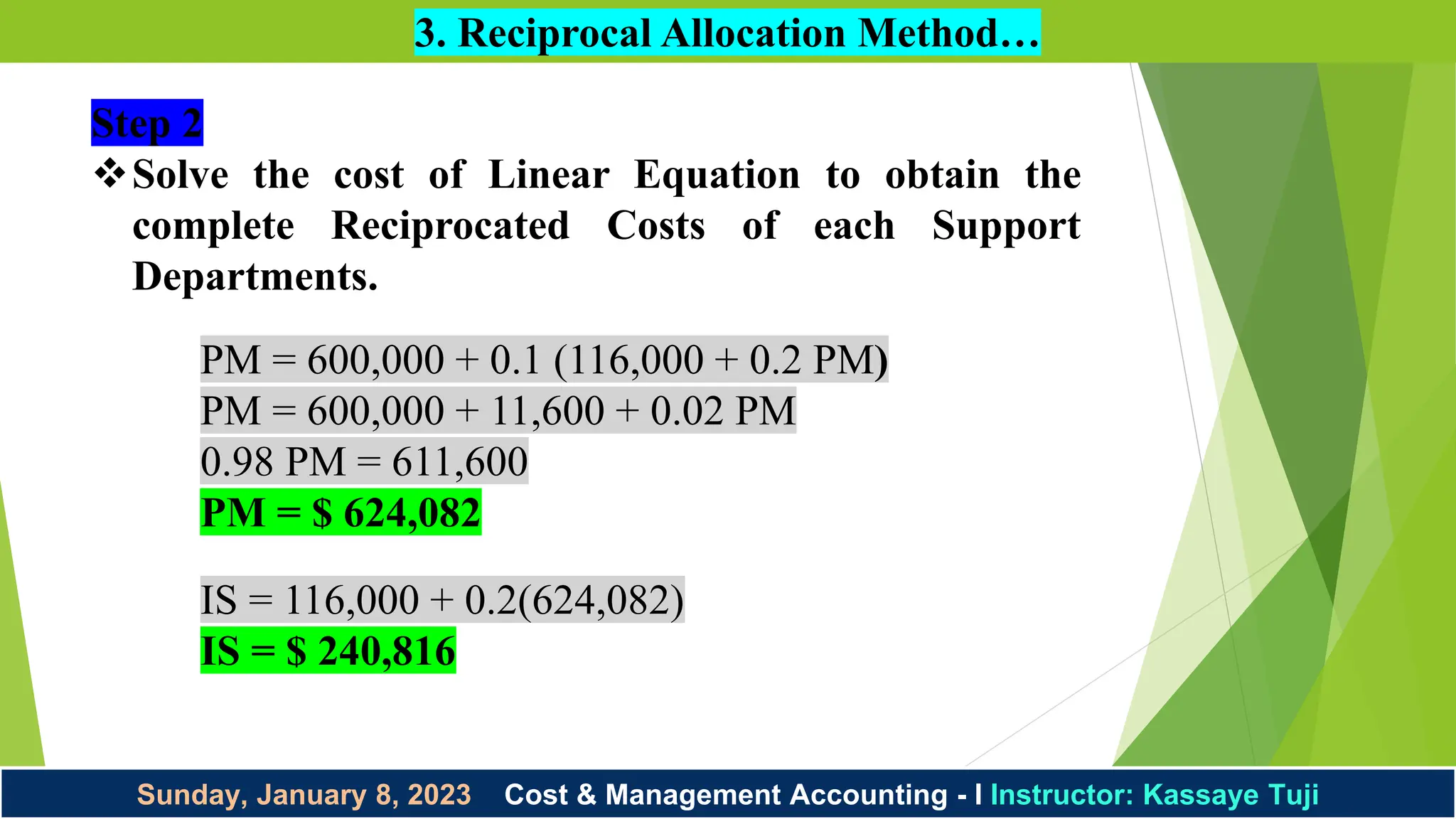

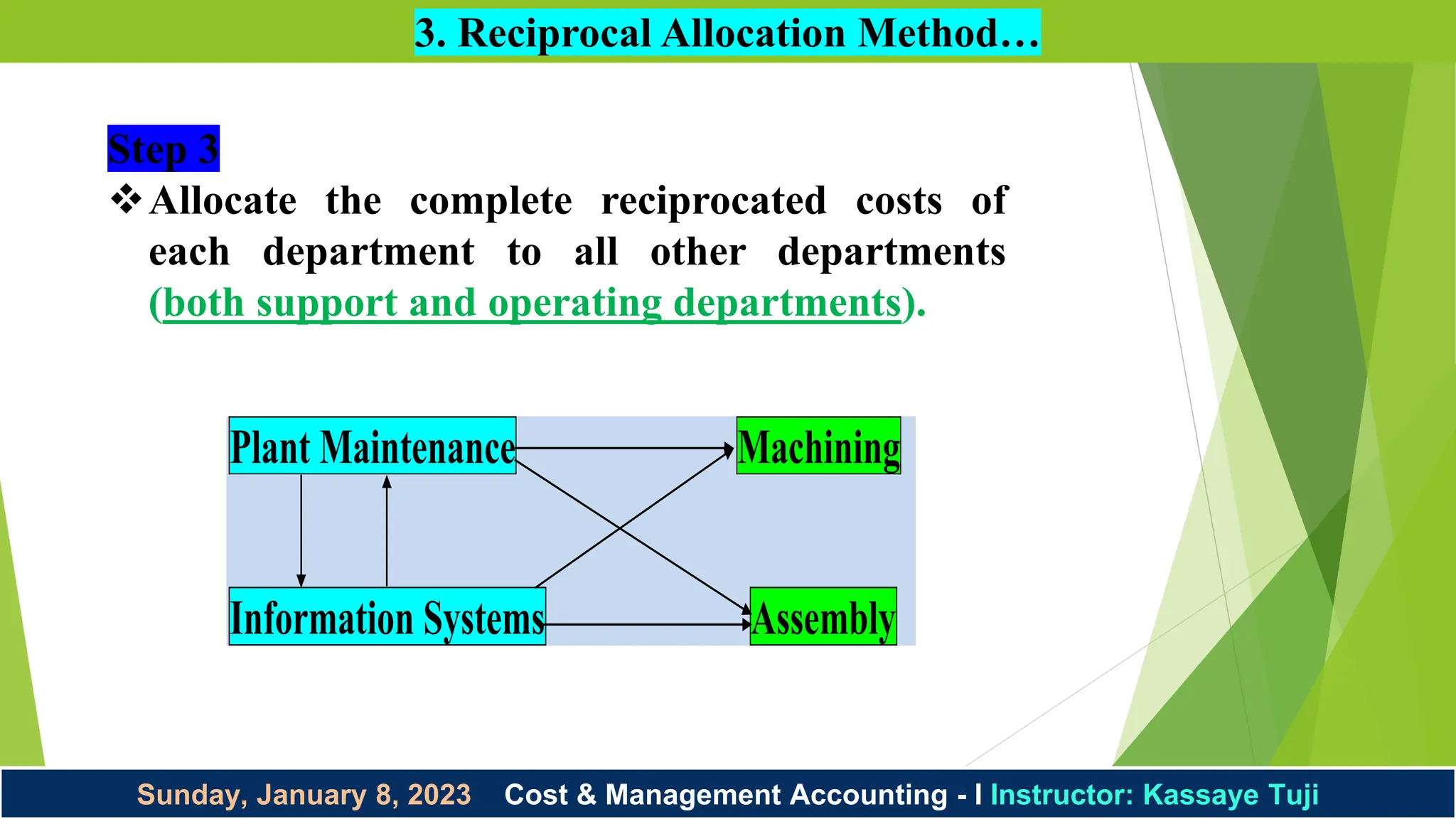

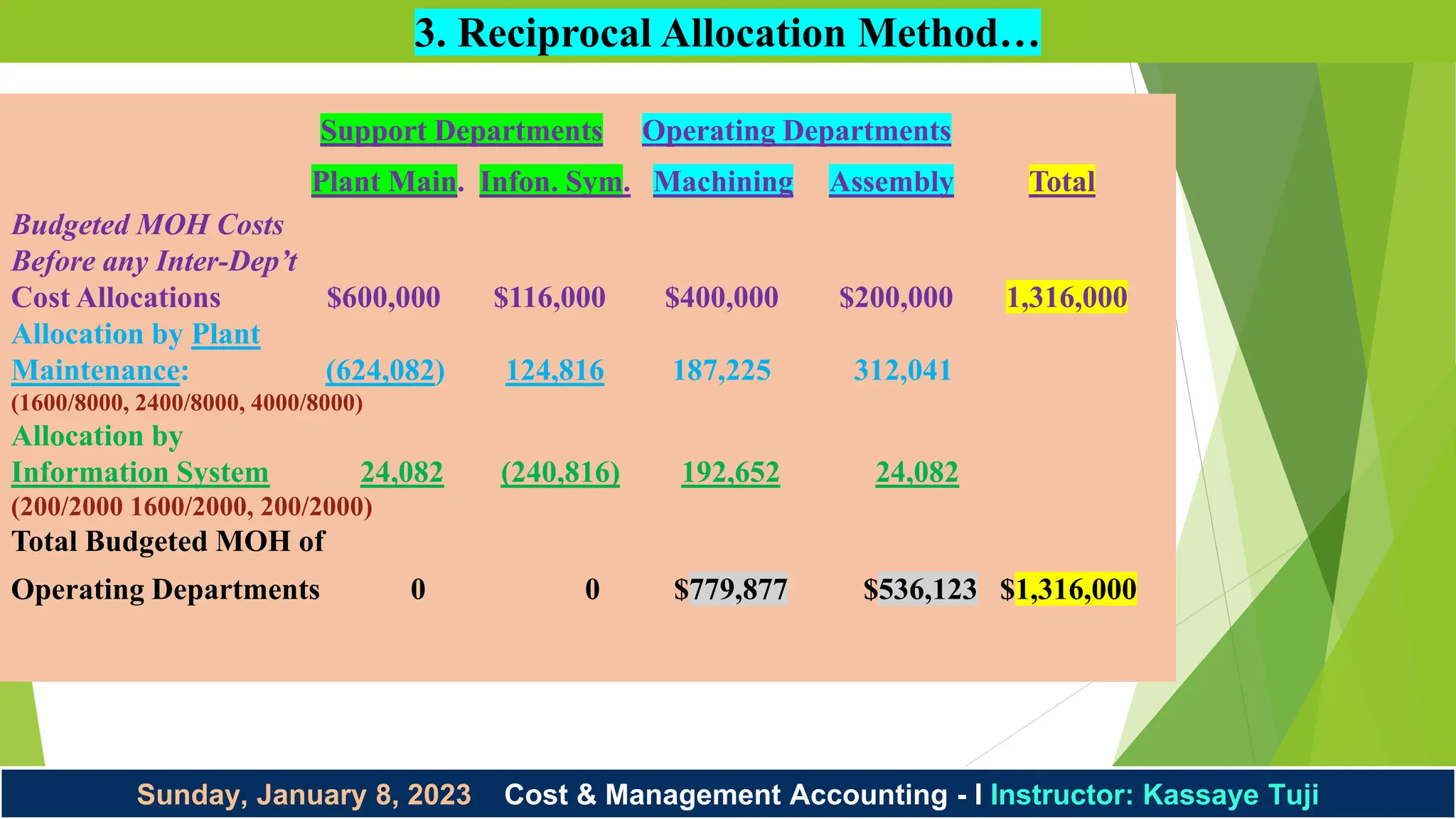

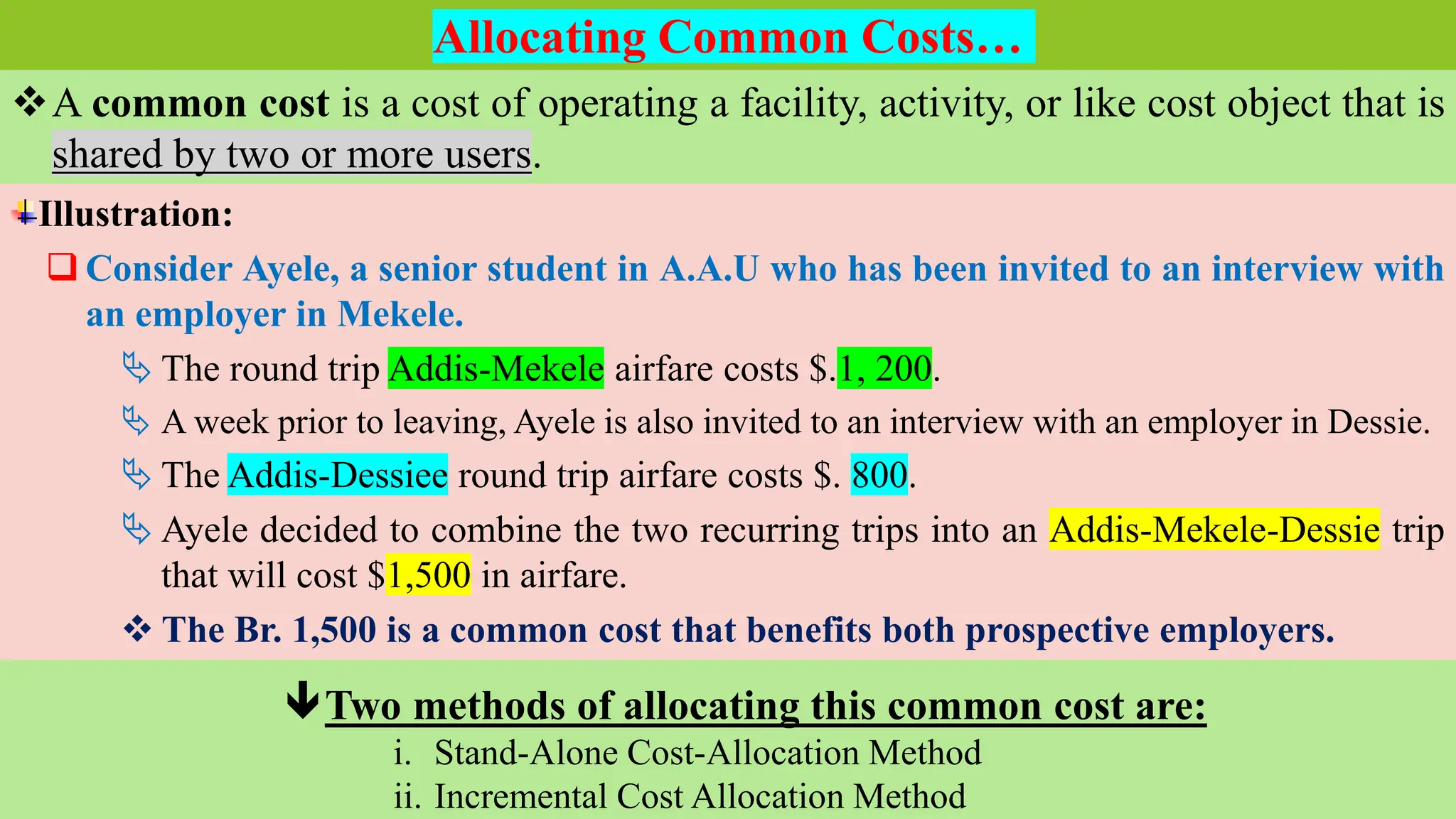

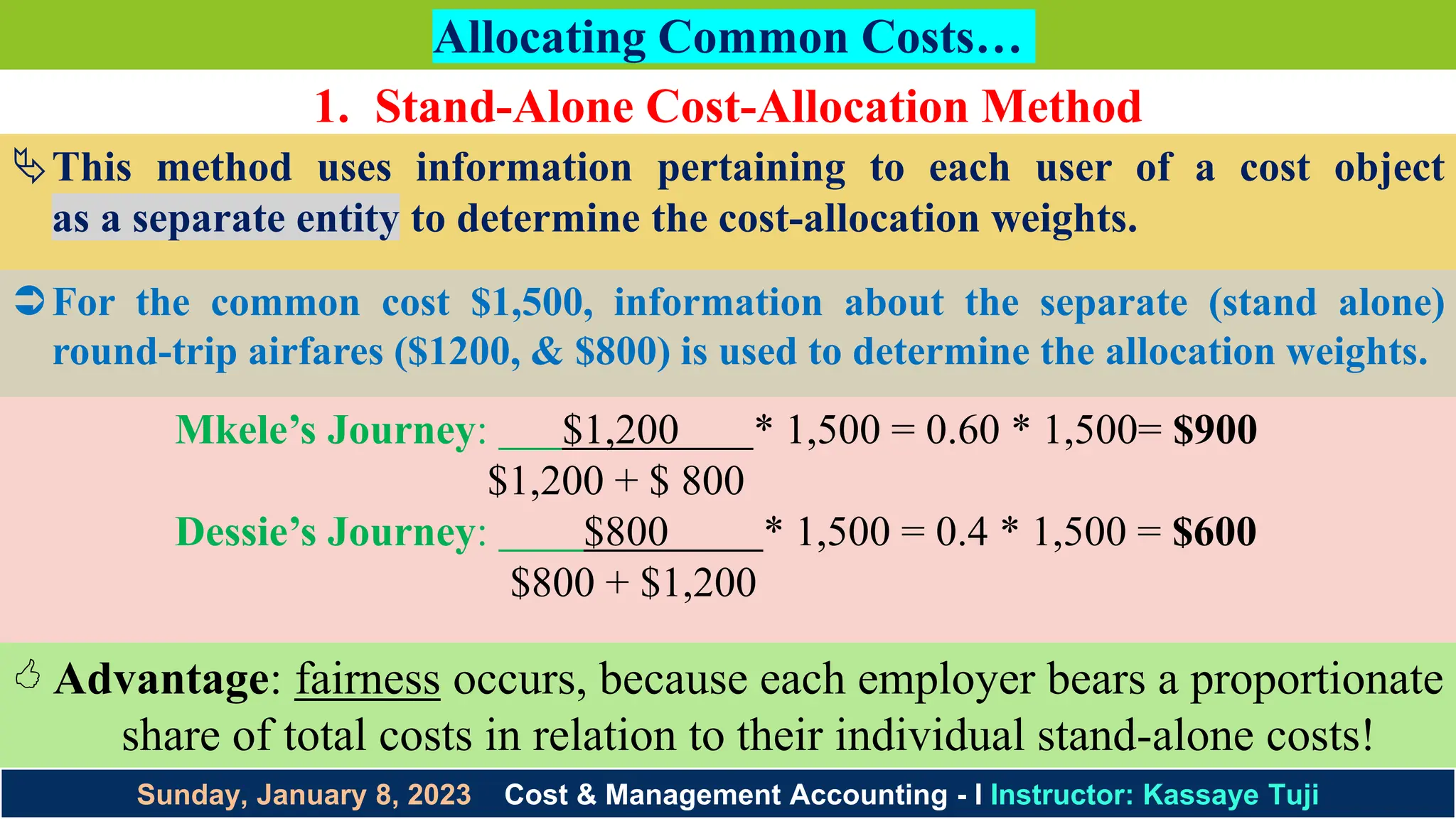

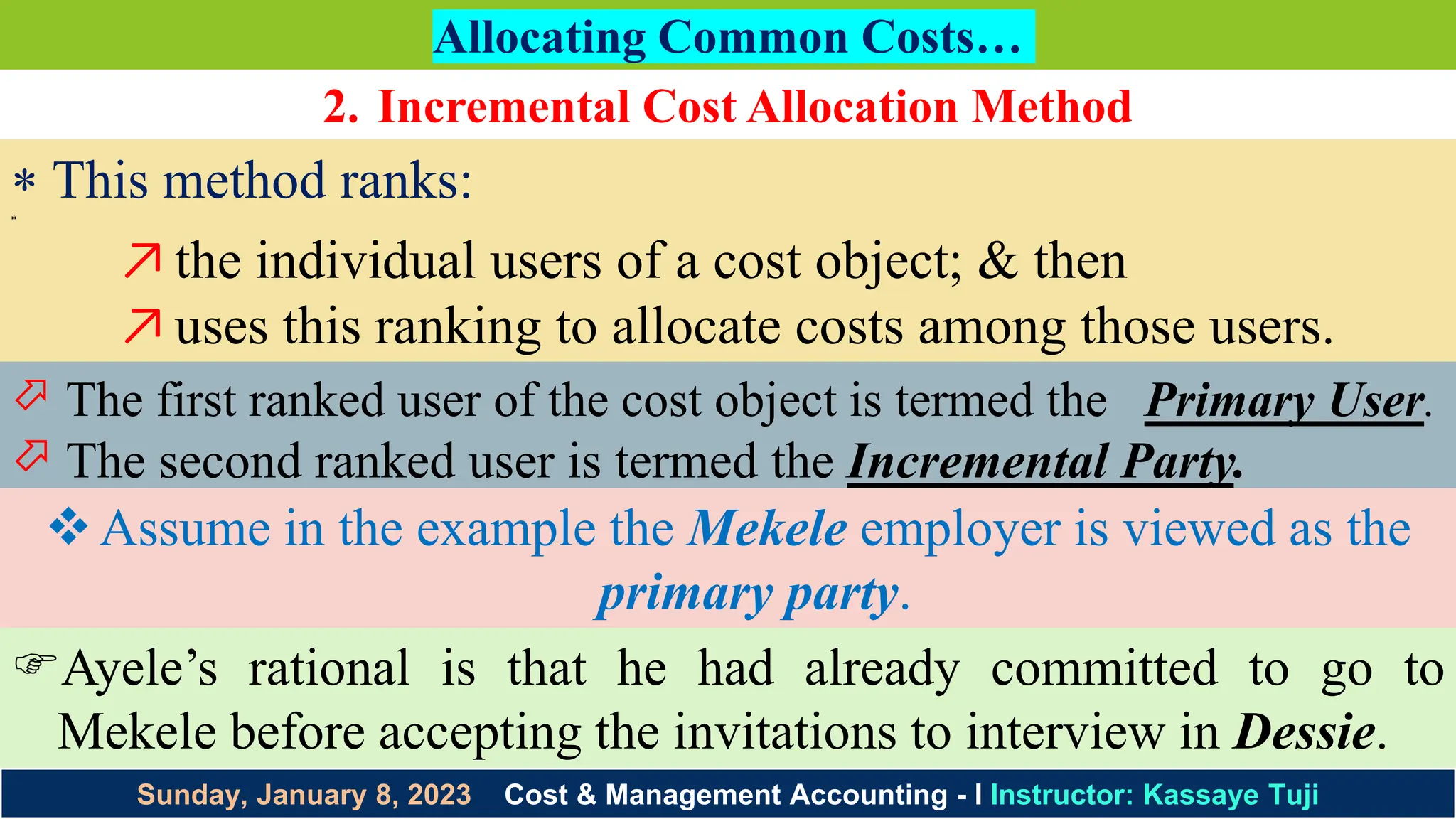

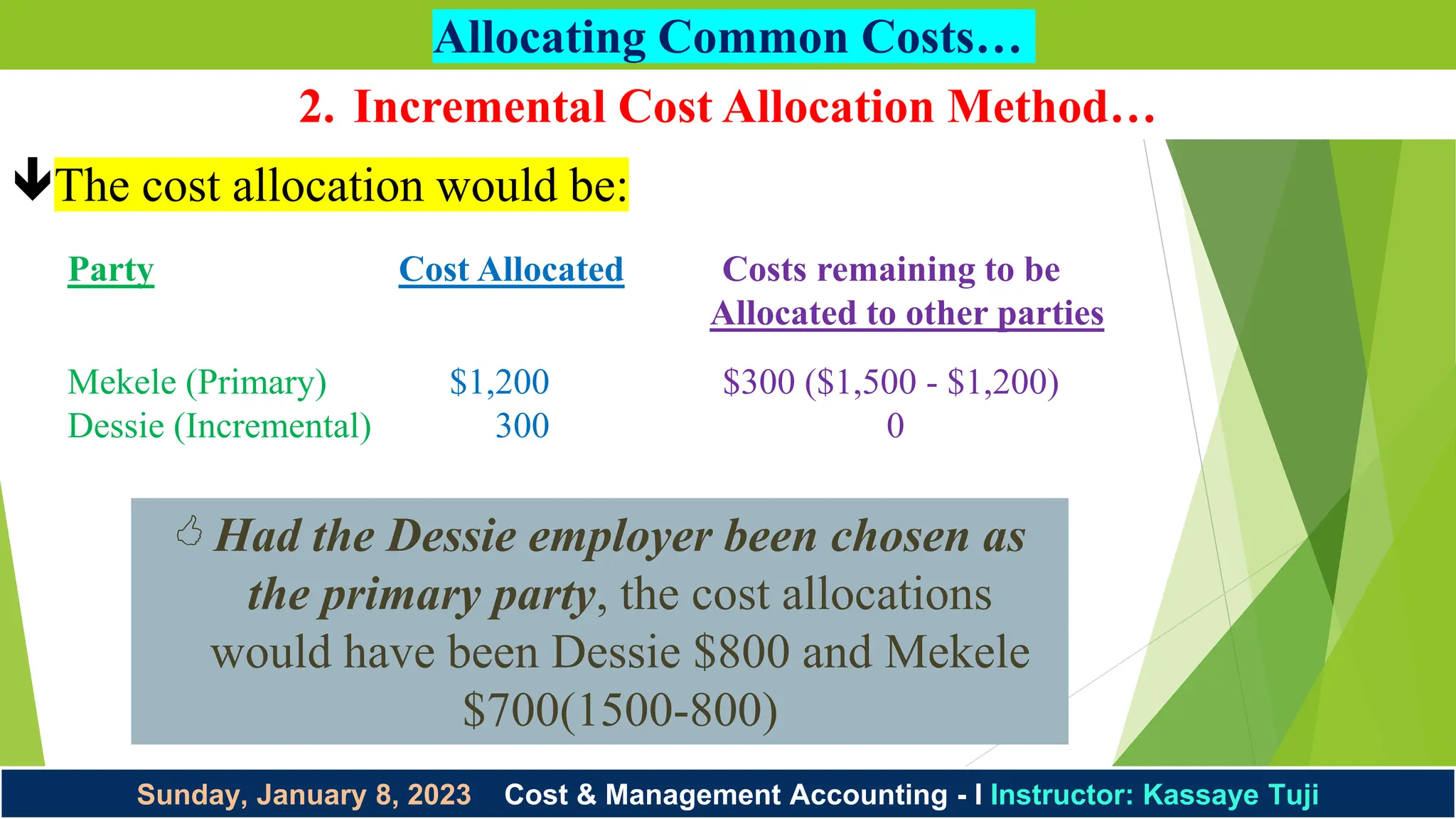

The document discusses cost allocation within cost and management accounting, defining cost pools, cost objects, and various methods of allocation. It outlines single-rate and dual-rate methods, as well as different approaches to allocate support department costs including direct, step-down, and reciprocal methods. Additionally, it addresses common costs and their allocation using stand-alone and incremental methods, highlighting their advantages and disadvantages.