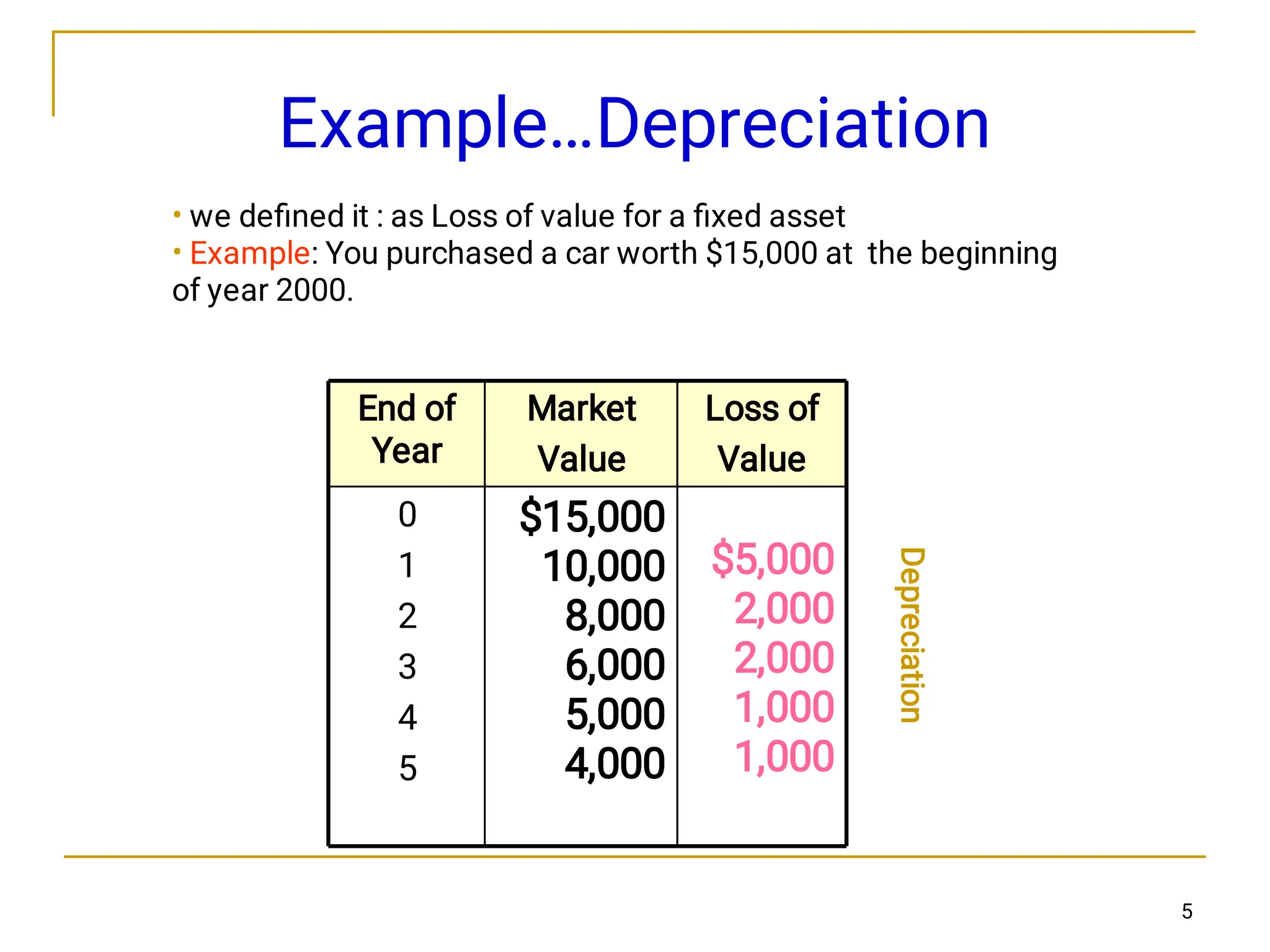

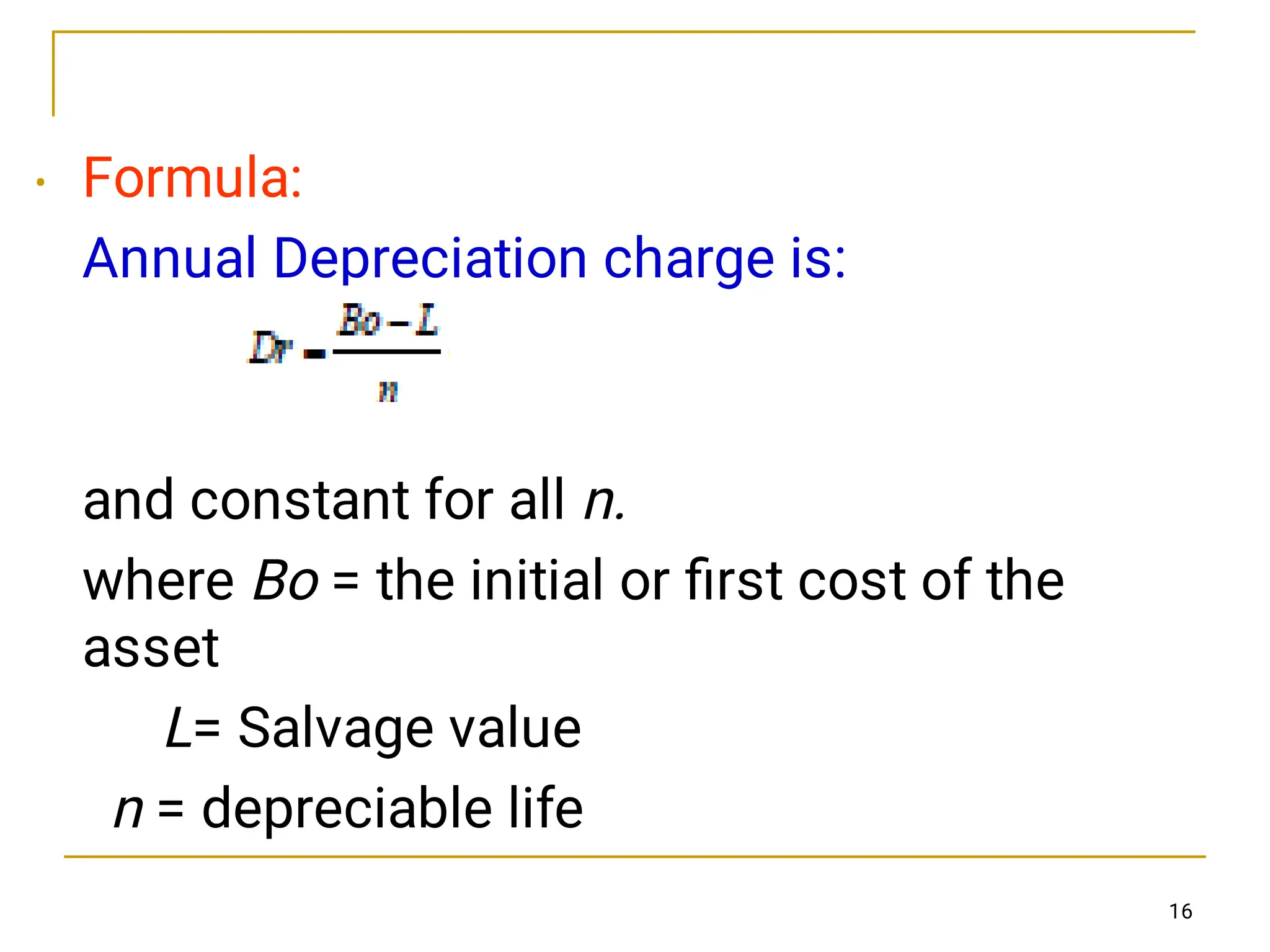

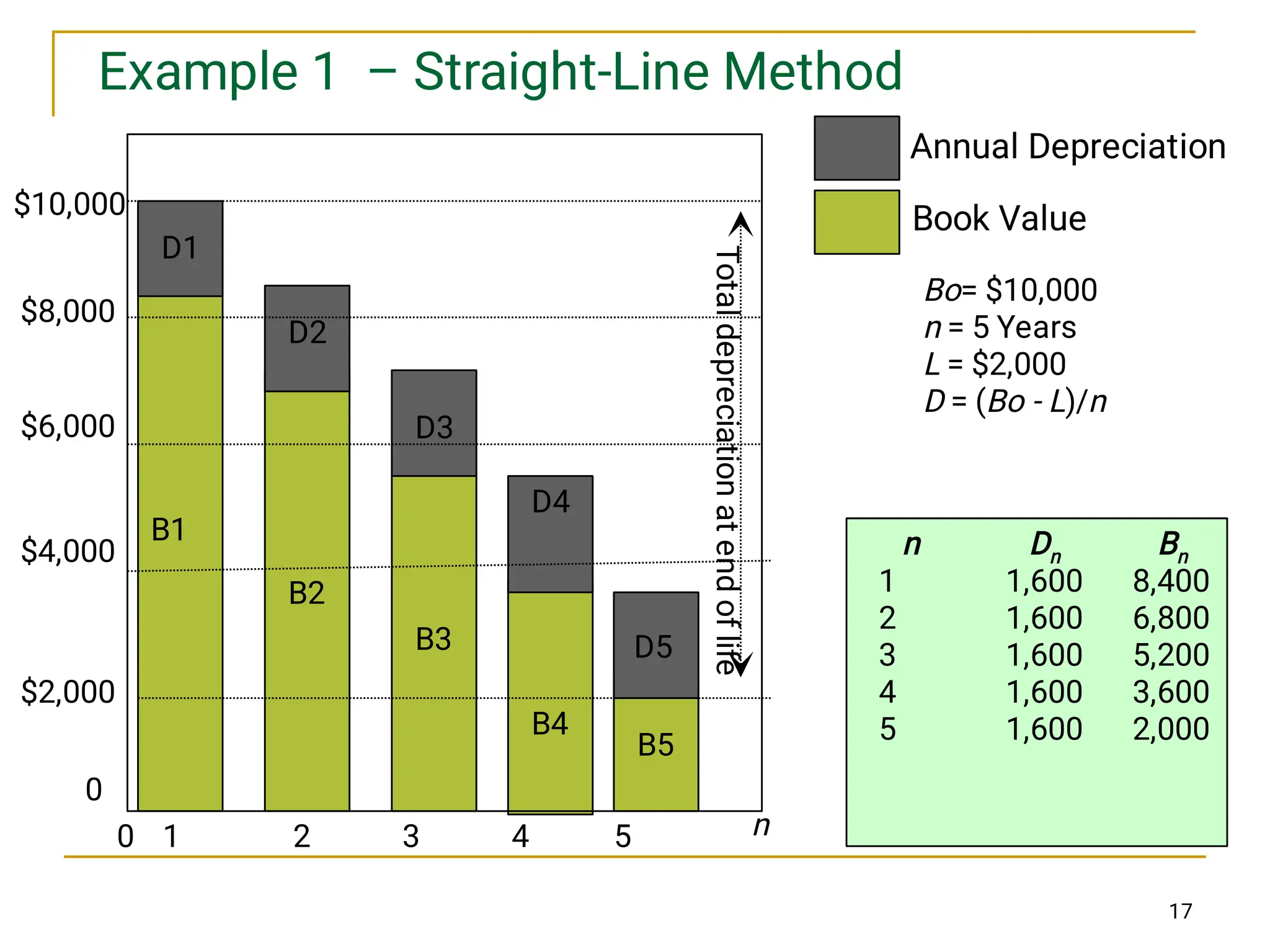

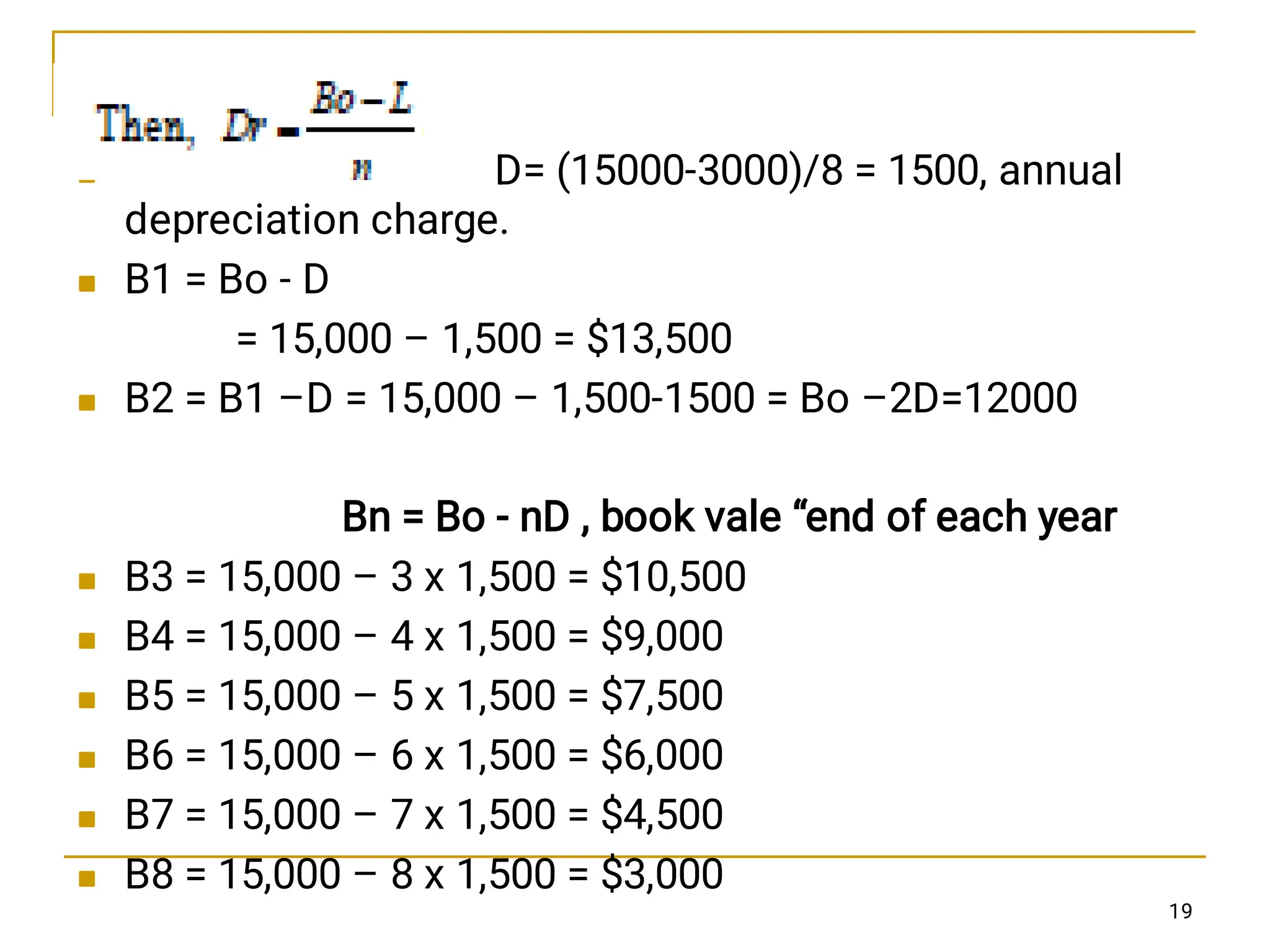

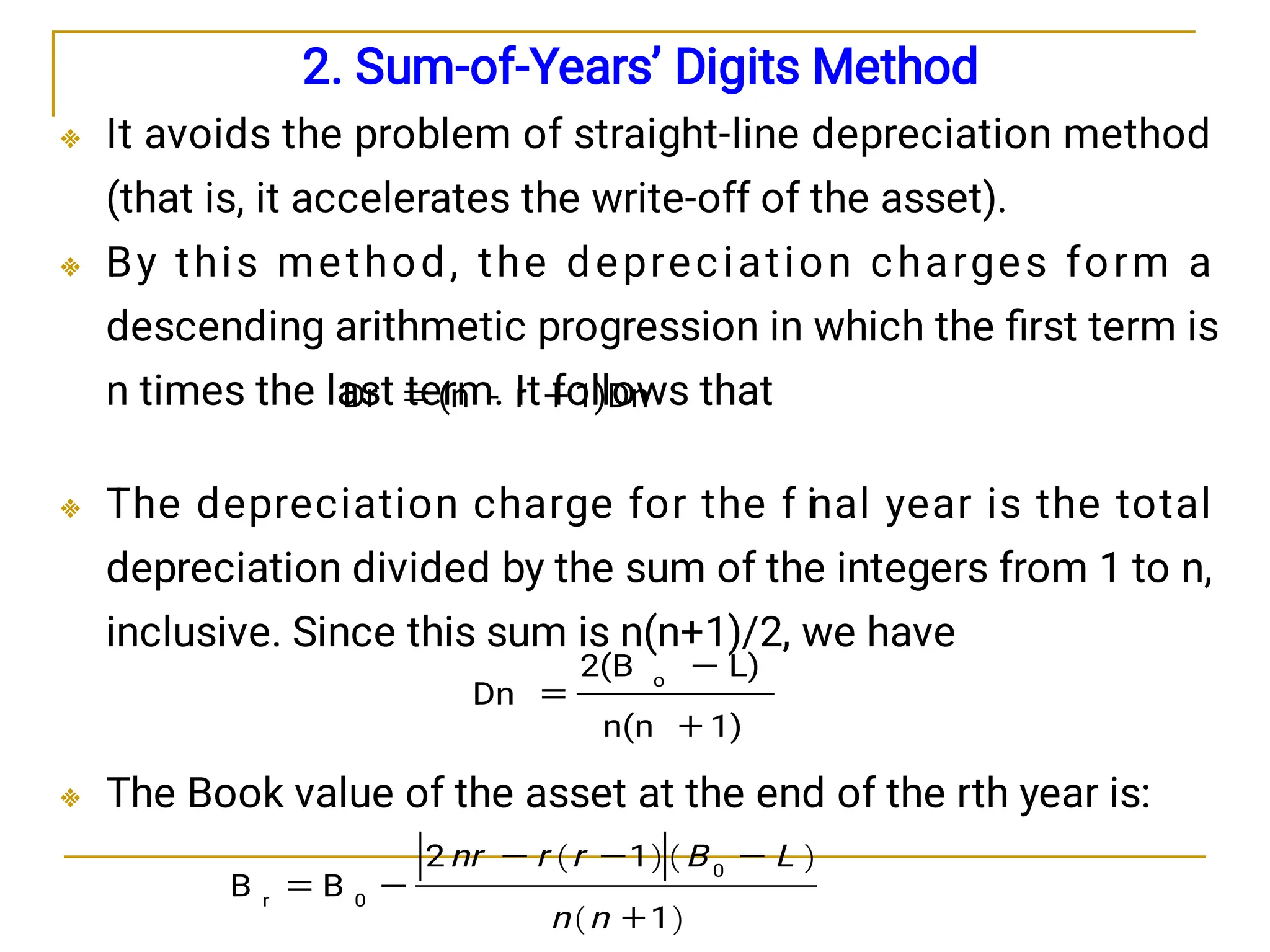

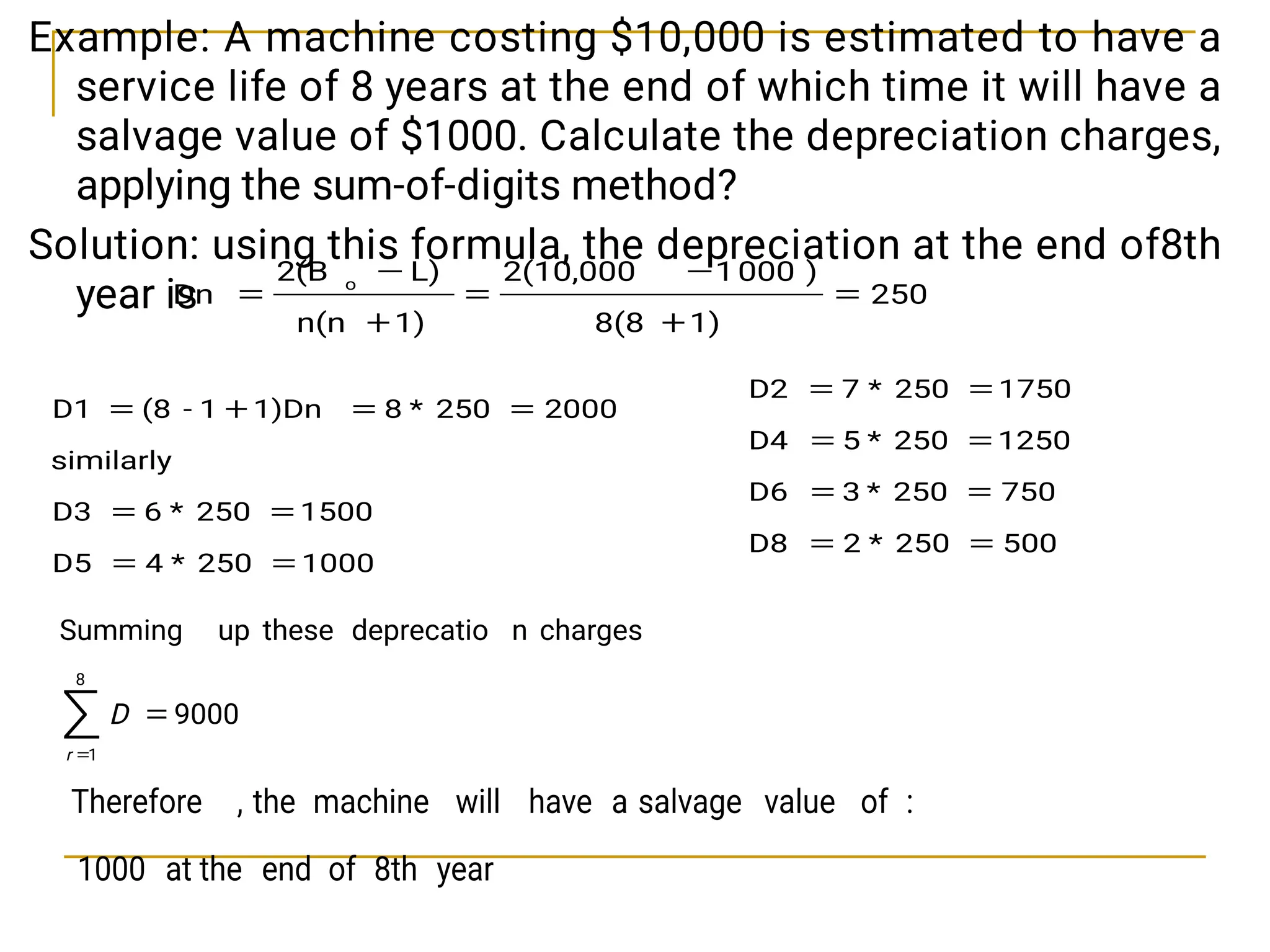

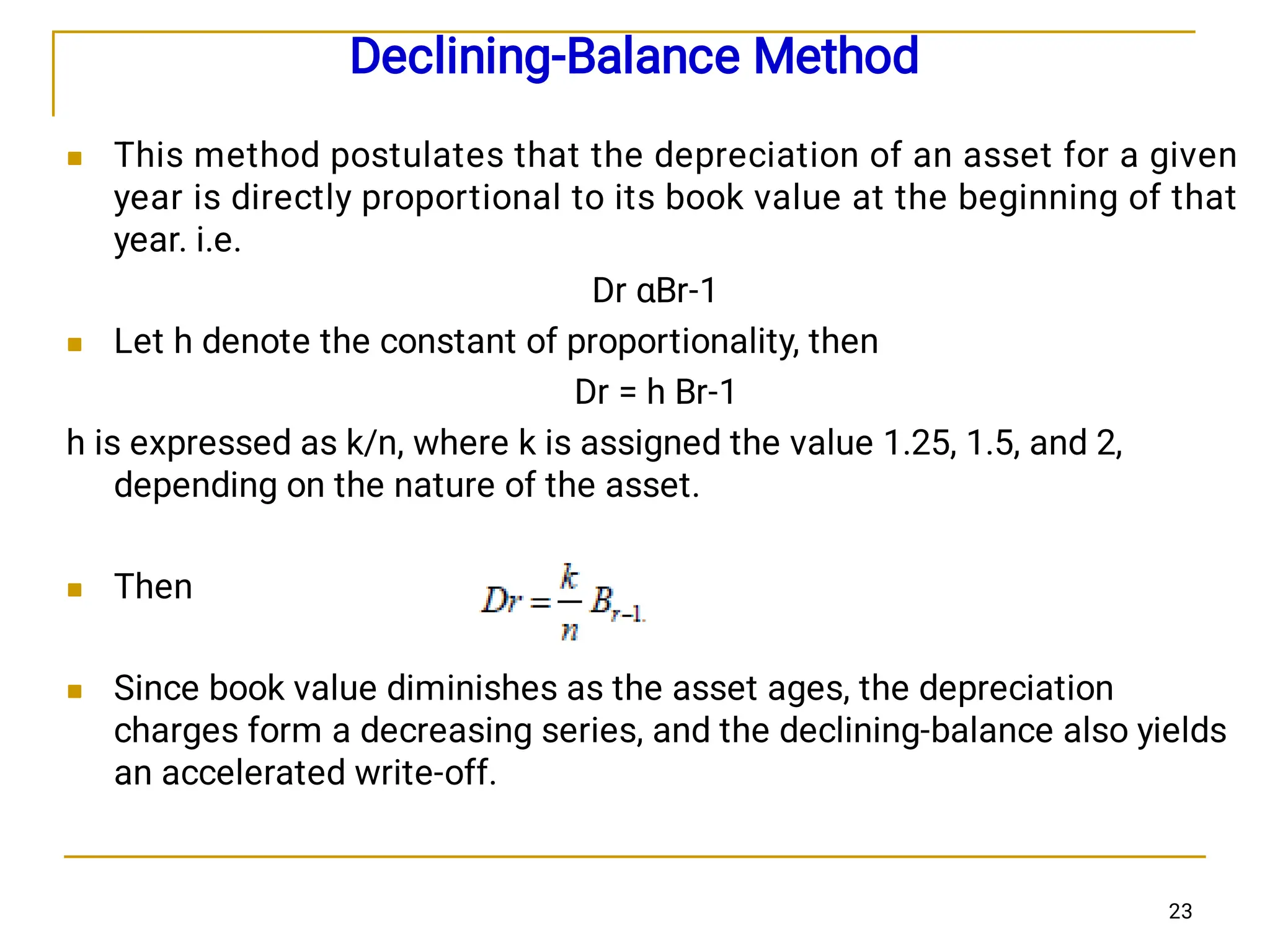

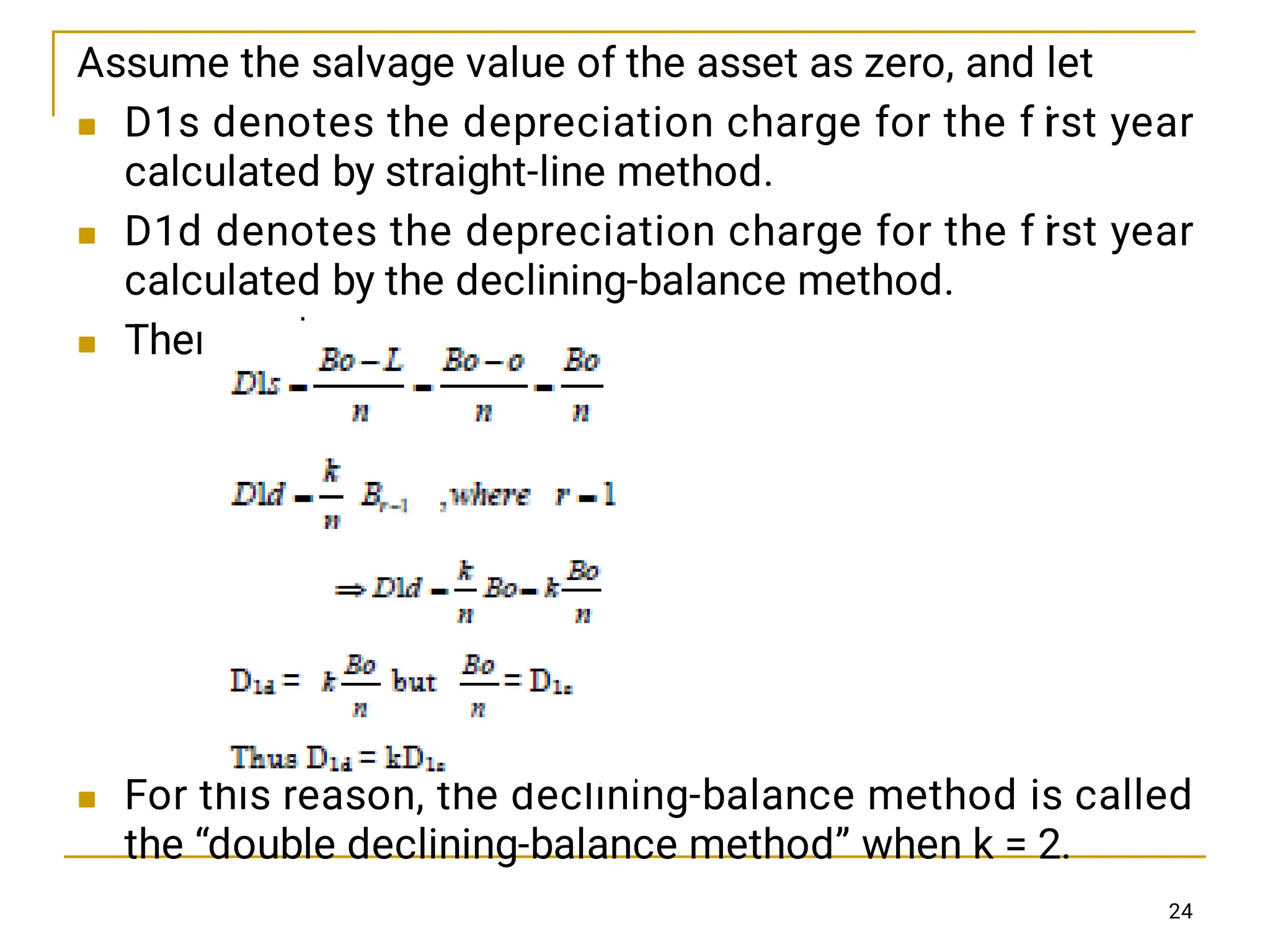

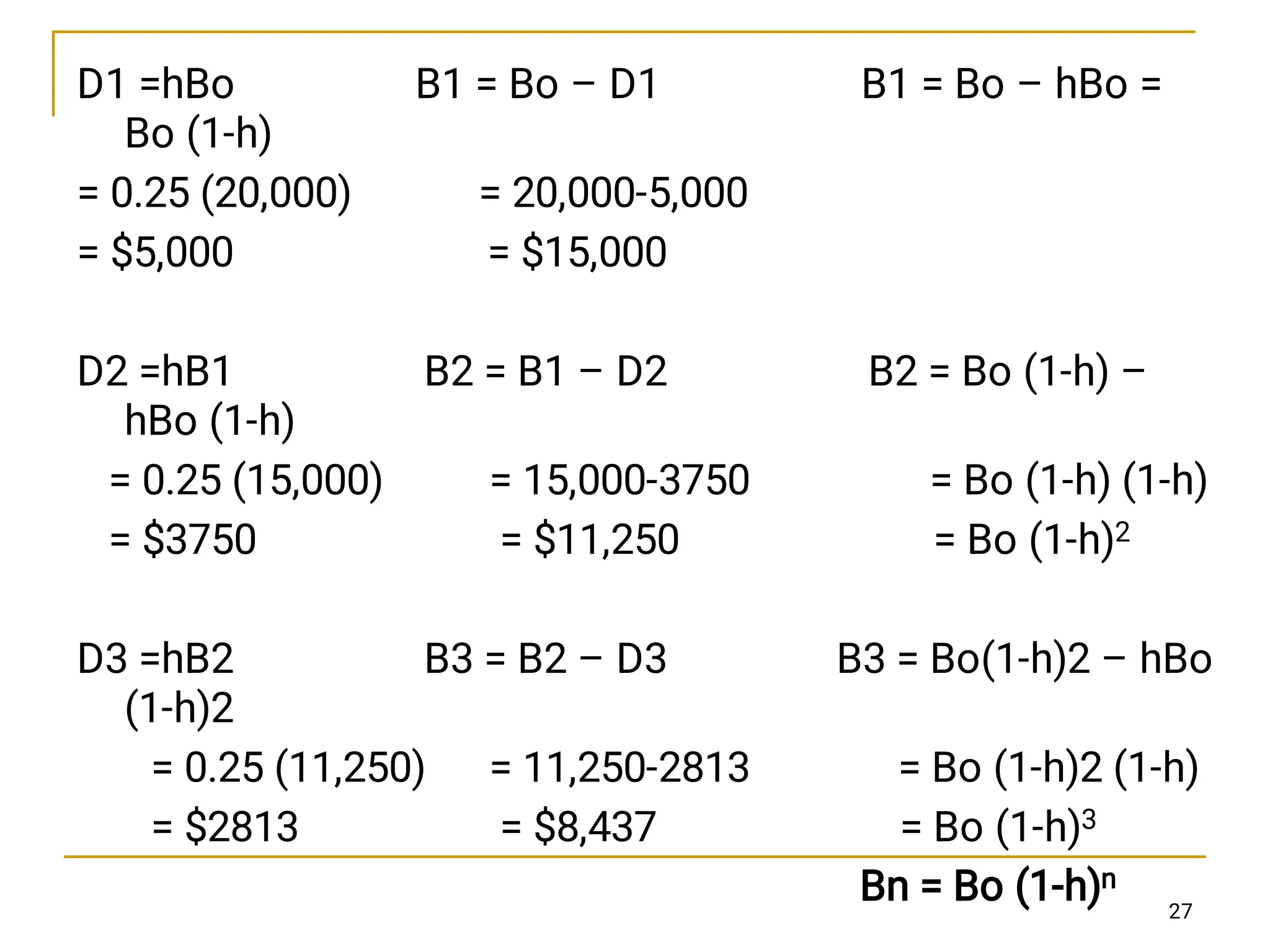

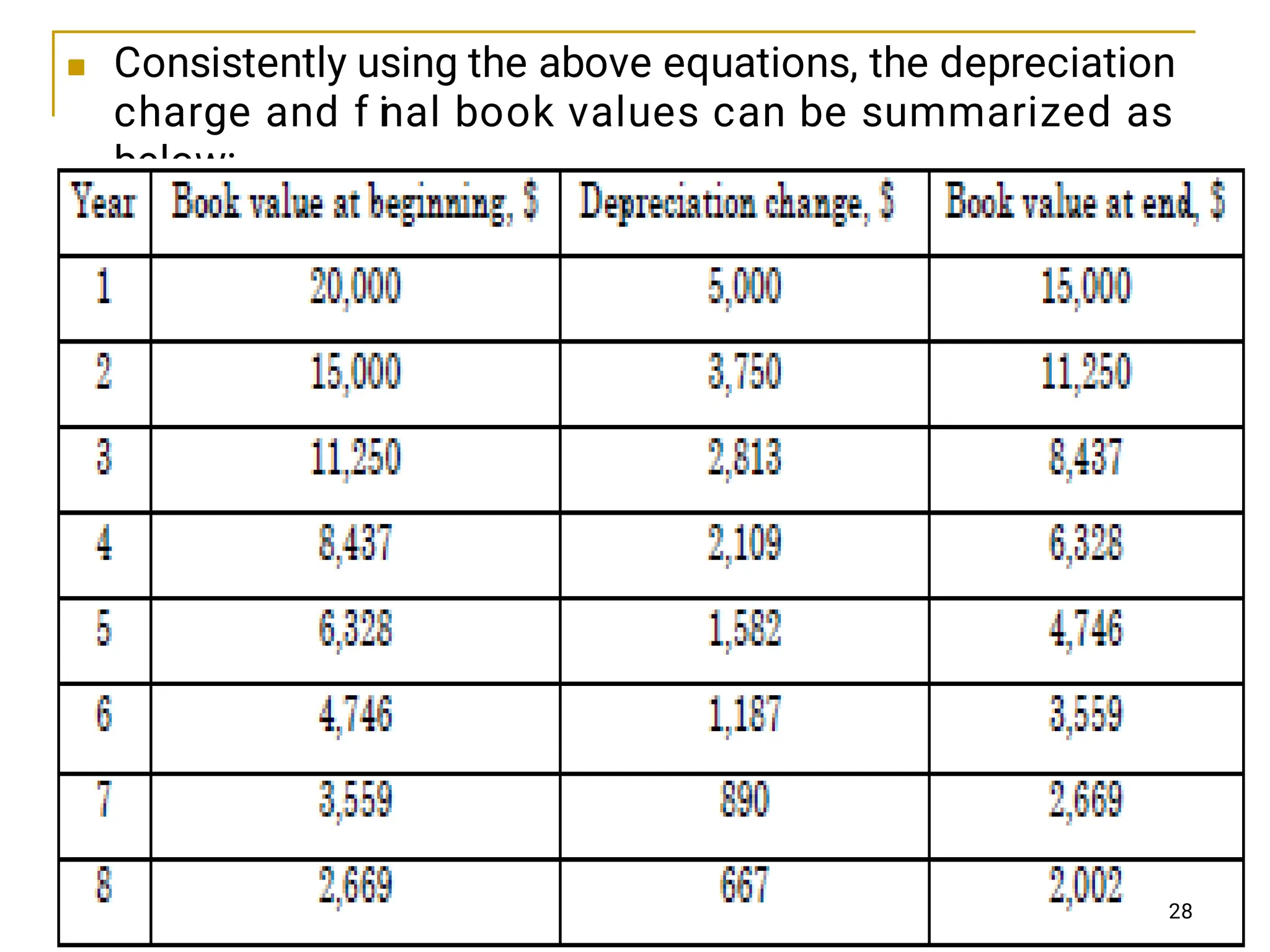

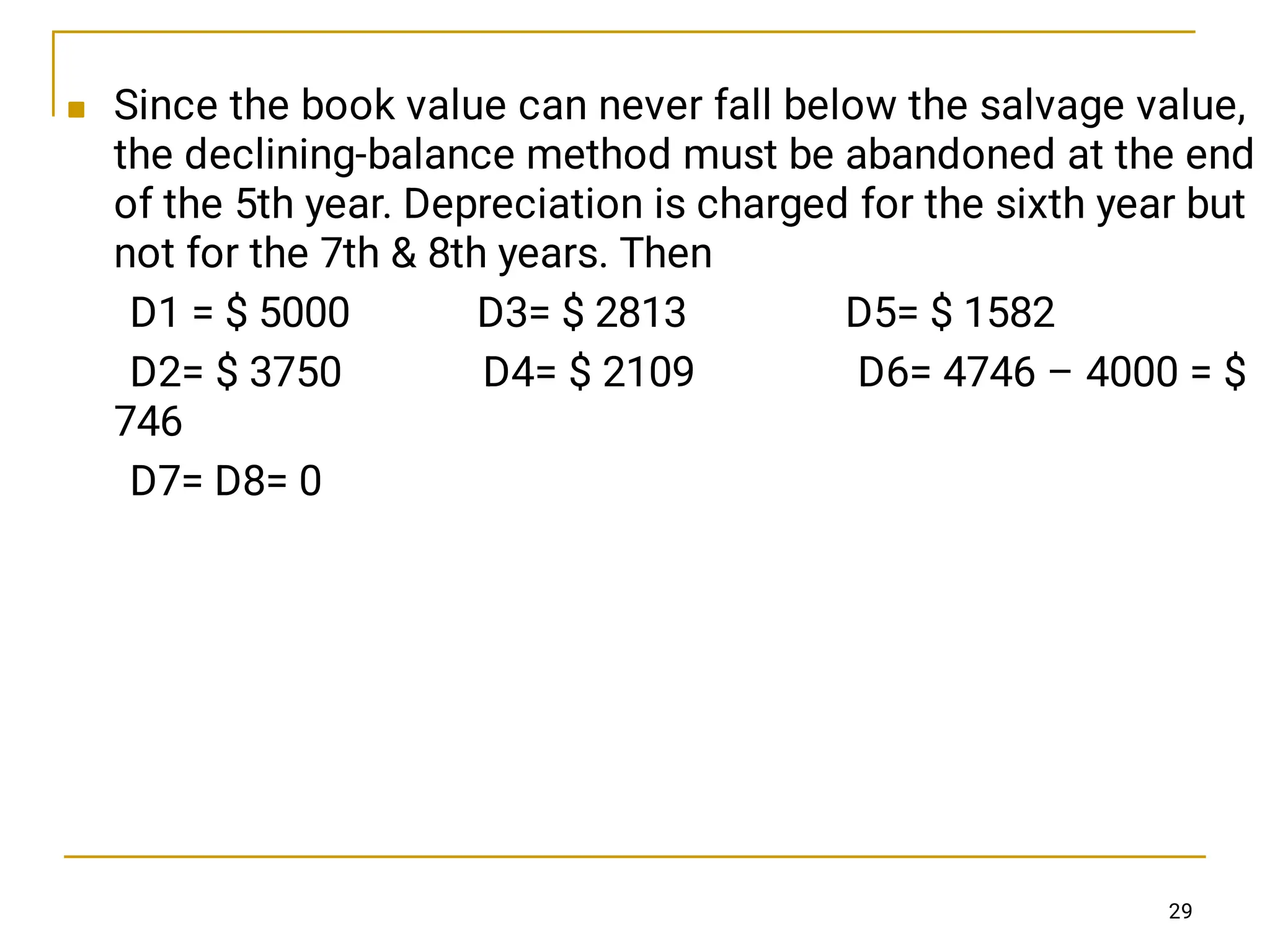

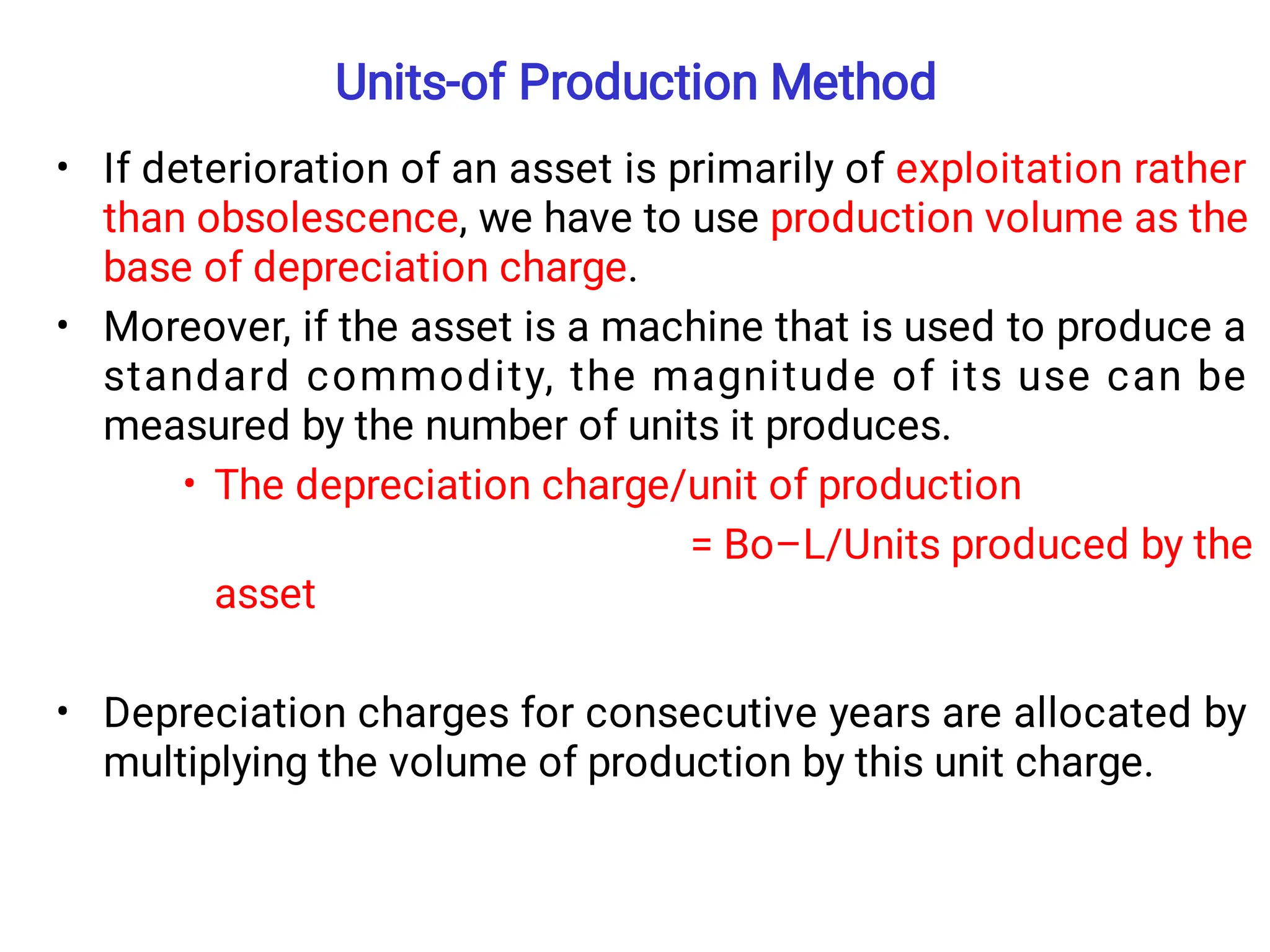

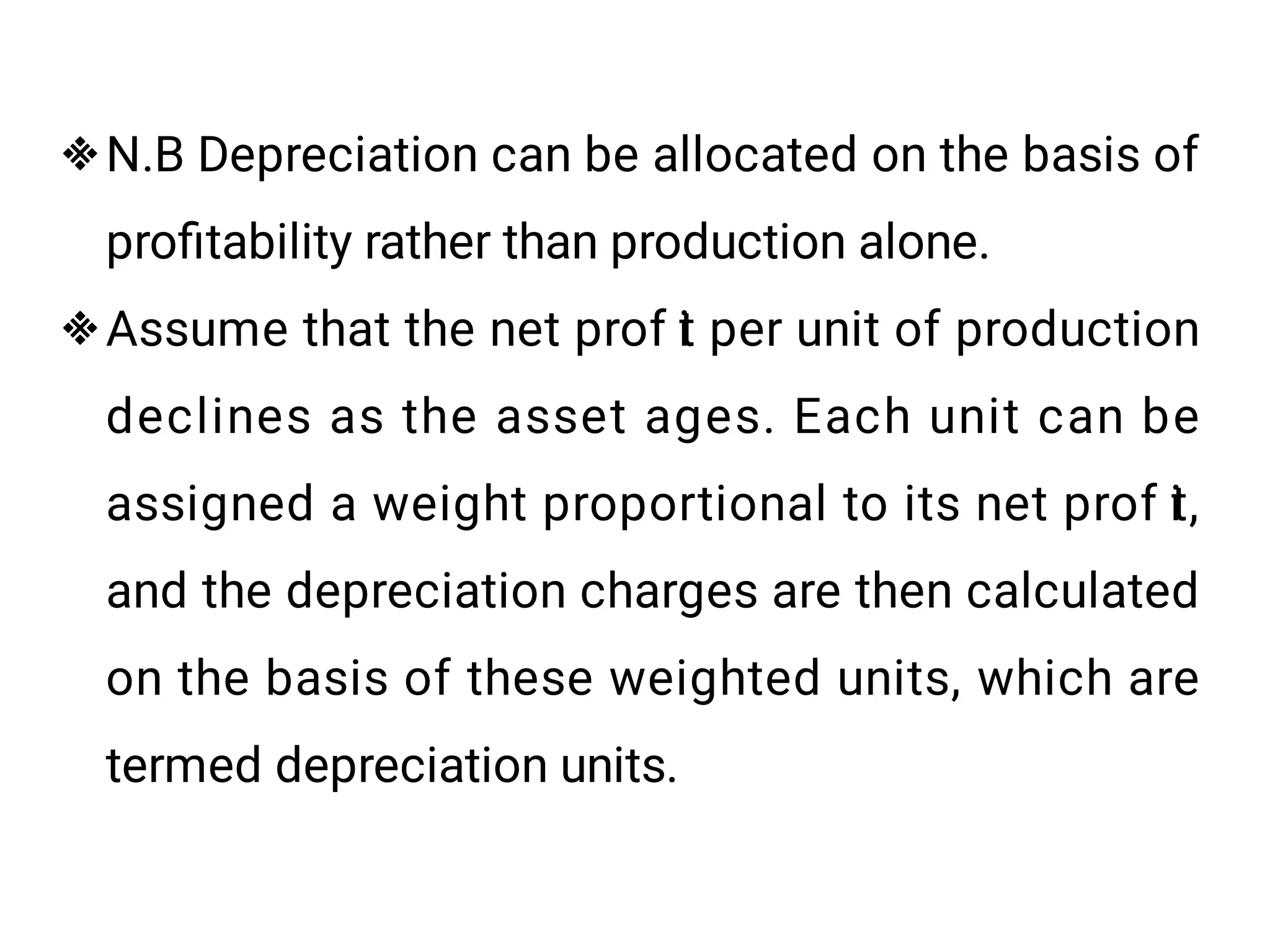

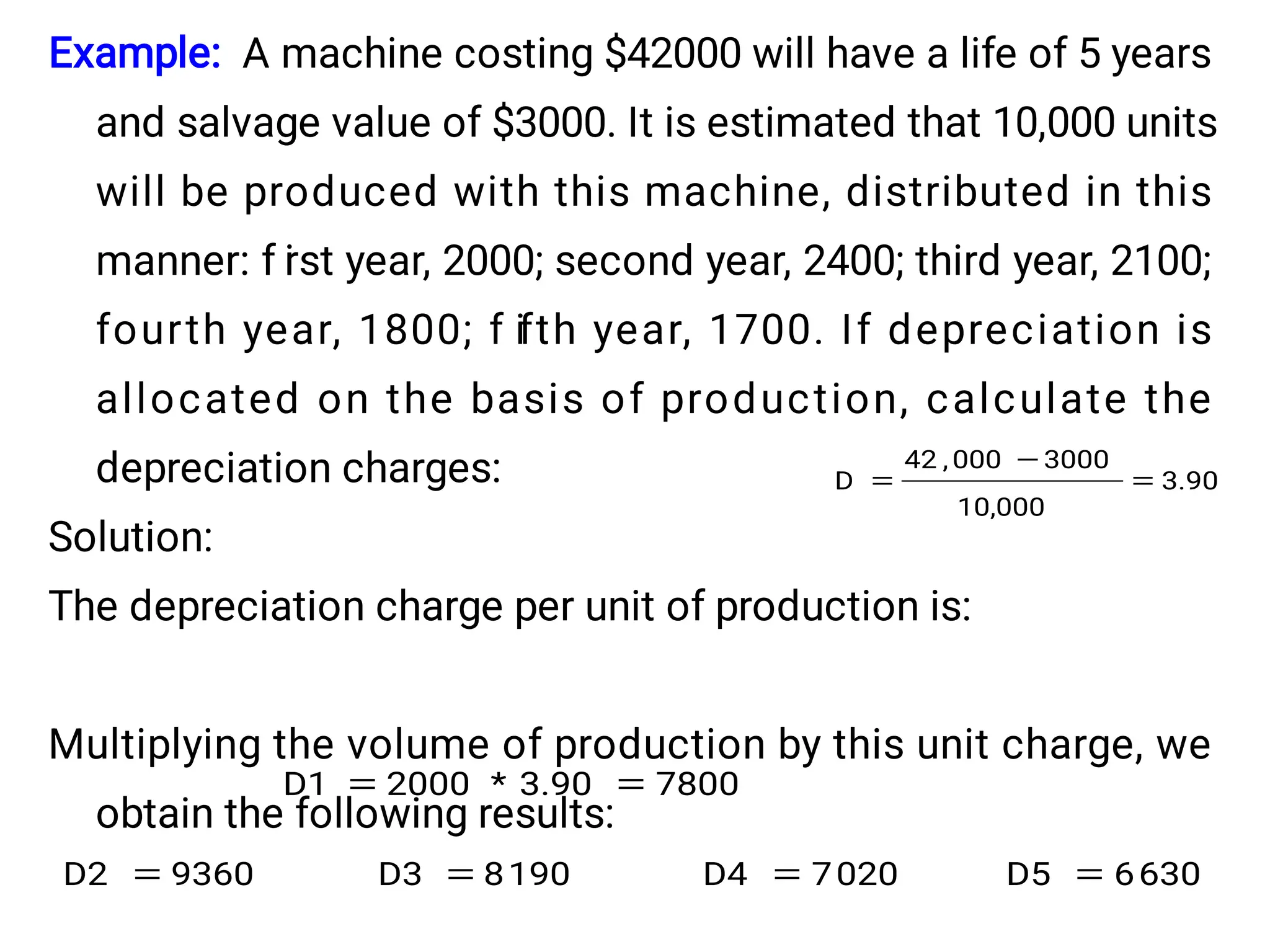

This chapter discusses depreciation and its impact on income taxes, explaining various methods of calculating depreciation, such as straight-line, declining-balance, and sum-of-years' digits. It highlights the importance of understanding asset depreciation for tax purposes, noting that depreciation reduces taxable income and ultimately affects economic decision making. The chapter also emphasizes that all tangible assets used for business purposes are subject to depreciation over time.