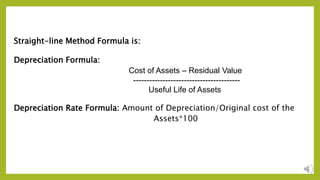

This document discusses various methods for calculating depreciation of assets. It begins by defining depreciation as the reduction in value of an asset over its useful life due to factors like normal wear and tear. The document then outlines several common methods for calculating depreciation, including the straight-line method, written down value (diminishing balance) method, annuity method, sinking fund method, and production unit method. For each method, it provides the depreciation calculation formula. The document concludes by listing some key features of depreciation calculations.