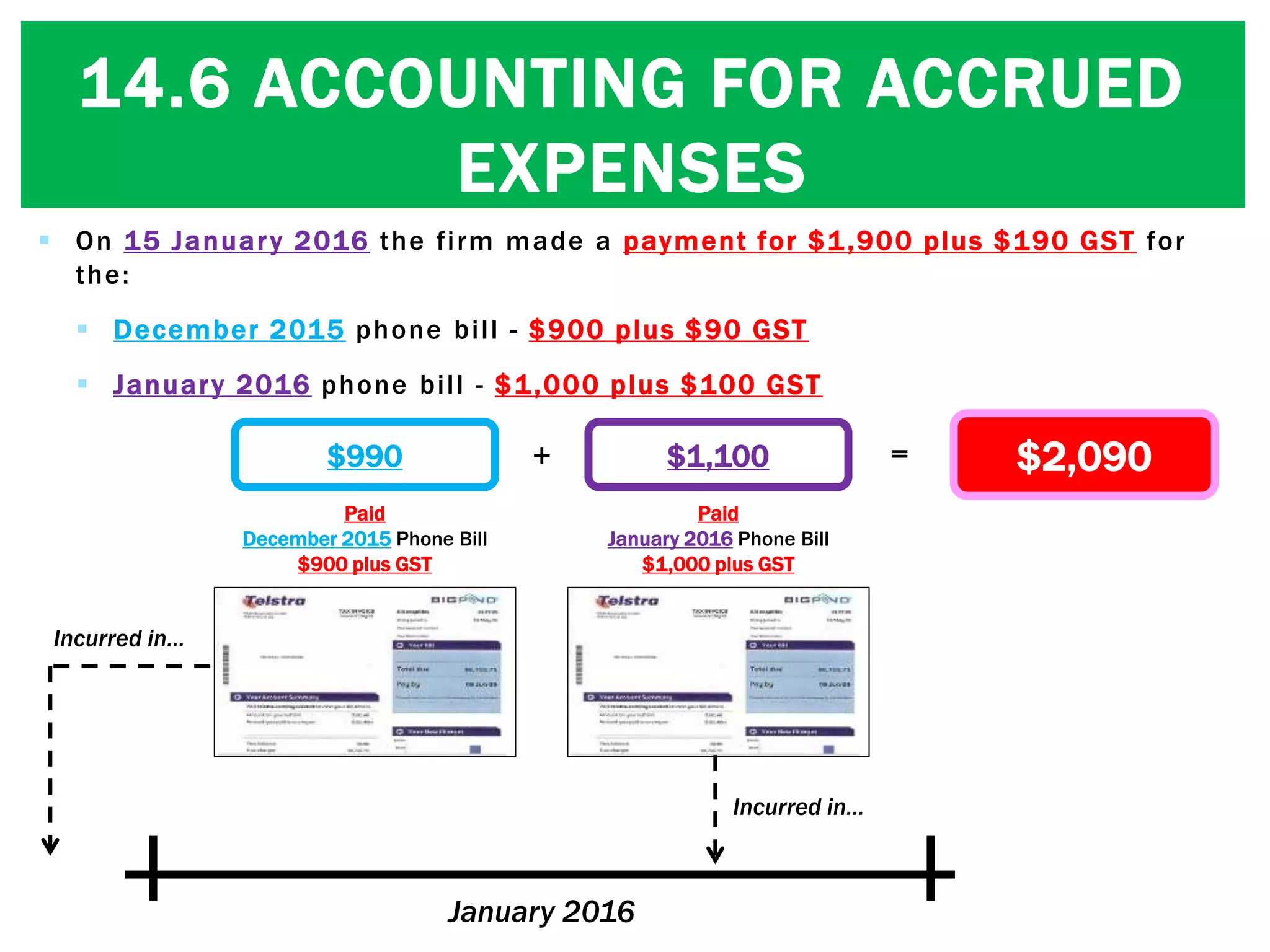

The document discusses accounting for accrued expenses. It provides an example of a firm that accrued $900 for unpaid December telephone expenses. A journal entry is made on December 31st to record this as an expense and current liability. In January, the firm pays $2,090 for the December and January phone bills. This payment is recorded by debiting various expense accounts and crediting cash. The accrued amount reduces the current liability account.

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

14.6 ACCOUNTING FOR ACCRUED

EXPENSES

Recording an accrued expense

For the year ended 31 December 2015, a firm had paid telephone expenses of

$8,000 for the period

2015

EXPENSE $8000

Telephone Expense [E]

31 Dec Cash at Bank 8000

31 Dec Accrued Telephone Exp. 900

Telephone Expense [E]

31 Dec Cash at Bank 8000

31 Dec Accrued Telephone Exp. 900](https://image.slidesharecdn.com/14-150517121742-lva1-app6892/75/14-6-Accounting-for-Accrued-Expenses-2-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

A balance-day adjustment is required in the General Journal to record

the $900 of accrued telephone expenses

Telephone Expense [E]

31 Dec Cash at Bank 8000

31 Dec Accrued Telephone Exp. 900

Accrued Telephone Expenses [L]

31 Dec Telephone Expenses 900

General Journal

Date Account DEBIT CREDIT

31 Dec Telephone Expense [E] 900

Accrued Telephone Expense [L] 900

General Journal

Date Account DEBIT CREDIT

31 Dec Telephone Expense [E] 900

Accrued Telephone Expense [L] 900

Telephone Expense [E]

31 Dec Cash at Bank 8000

31 Dec Accrued Telephone Exp. 900

General Journal

Date Account DEBIT CREDIT

31 Dec Telephone Expense [E] 900

Accrued Telephone Expense [L] 900

Accrued Telephone Expenses [L]

31 Dec Telephone Expense 900

14.6 ACCOUNTING FOR ACCRUED

EXPENSES](https://image.slidesharecdn.com/14-150517121742-lva1-app6892/75/14-6-Accounting-for-Accrued-Expenses-4-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The Telephone Expense account can now be closed to calculate profit

Telephone Expense [E]

31 Dec Cash at Bank 8000

31 Dec Accrued Telephone Exp. 900 31 Dec Profit & Loss Summary 8900

8900 8900

General Journal

Date Account DEBIT CREDIT

31 Dec Profit & Loss Summary 8900

Telephone Expenses 8900

Profit & Loss Summary [OE]

31 Dec Telephone Expense 8900

General Journal

Date Account DEBIT CREDIT

31 Dec Profit & Loss Summary 8900

Telephone Expenses 8900

Profit & Loss Summary [OE]

31 Dec Telephone Expense 8900

General Journal

Date Account DEBIT CREDIT

31 Dec Profit & Loss Summary 8900

Telephone Expenses 8900

Telephone Expense [E]

31 Dec Cash at Bank 8000

31 Dec Accrued Telephone Exp. 900 31 Dec Profit & Loss Summary 8900

8900 8900

14.6 ACCOUNTING FOR ACCRUED

EXPENSES](https://image.slidesharecdn.com/14-150517121742-lva1-app6892/75/14-6-Accounting-for-Accrued-Expenses-5-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

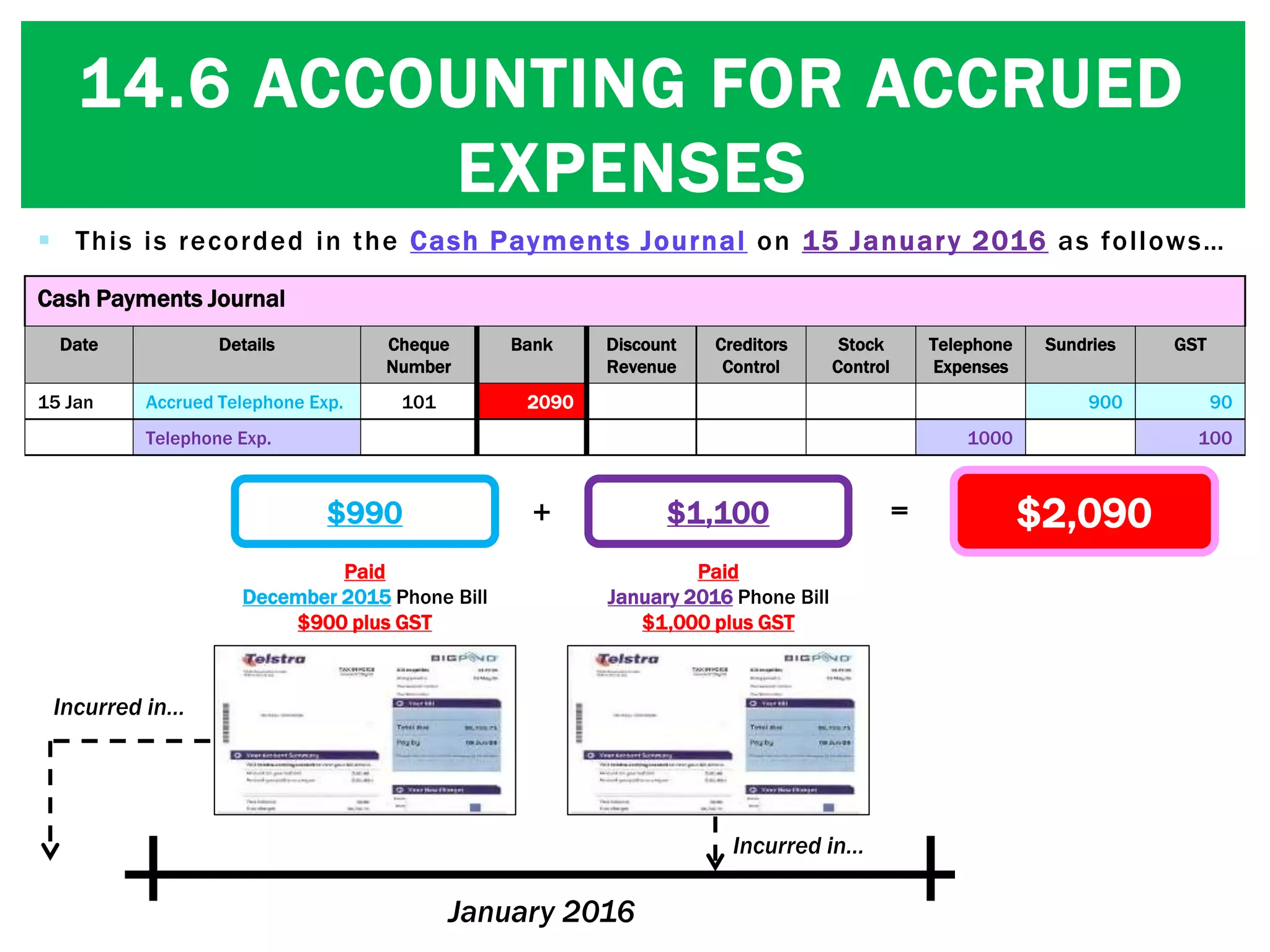

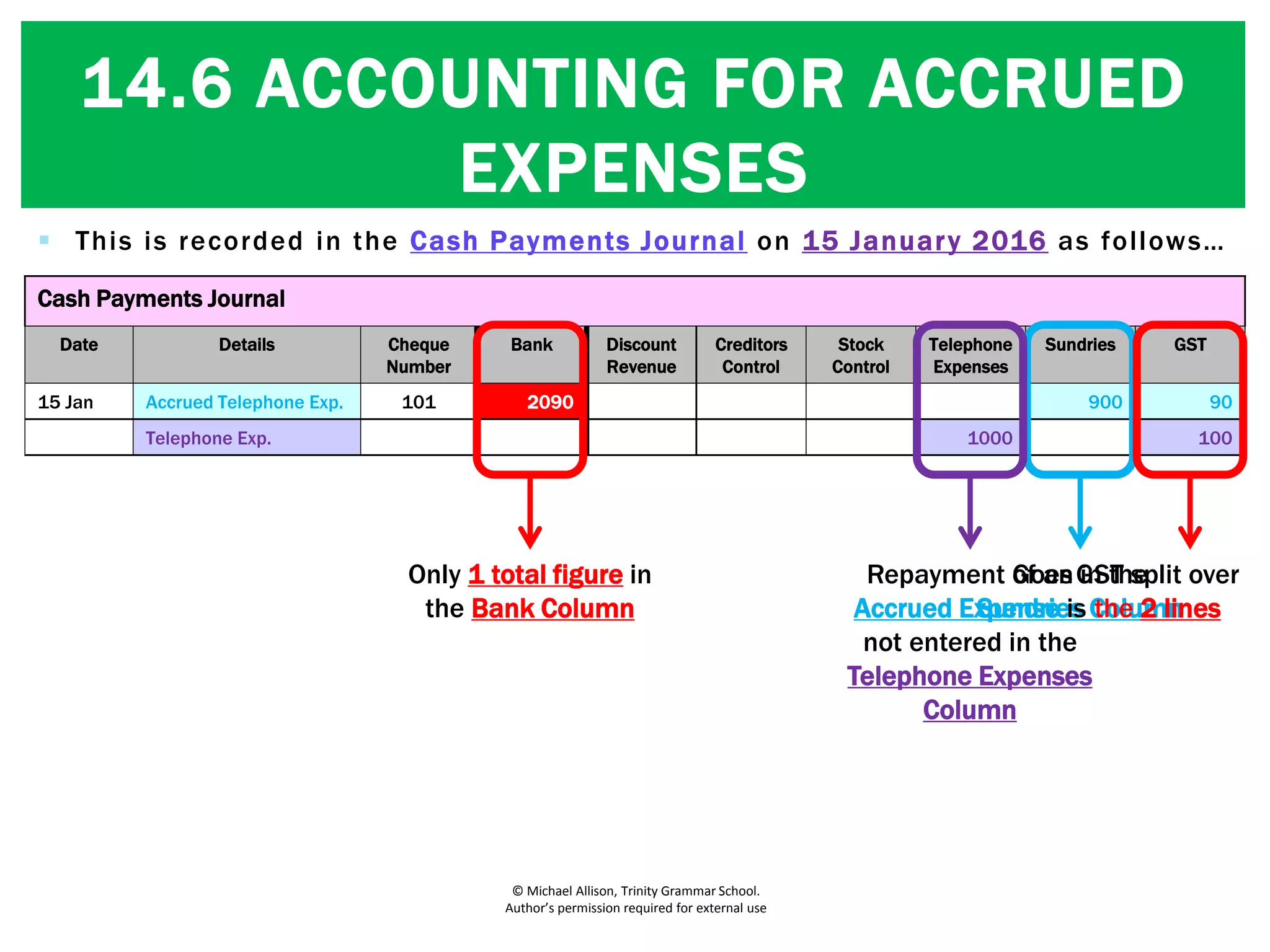

The Cash Payments Journal is then posted to the General Ledger at the end of

the month

Cash Payments Journal

Date Details Cheque

Number

Bank Discount

Revenue

Creditors

Control

Stock

Control

Telephone

Expenses

Sundries GST

15 Jan Accrued Telephone Exp. 101 2090 900 90

Telephone Exp. 1000 100

Accrued Telephone Expenses [L]

31 Dec Telephone Expense 900

Cash Payments Journal

Date Details Cheque

Number

Bank Discount

Revenue

Creditors

Control

Stock

Control

Telephone

Expenses

Sundries GST

15 Jan Accrued Telephone Exp. 101 2090 900 90

Telephone Exp. 1000 100

Accrued Telephone Expenses [L]

31 Jan Cash at Bank 900 31 Dec Telephone Expense 900

Accrued Telephone Expenses [L]

31 Jan Cash at Bank 900 31 Dec Telephone Expense 900

900 900

14.6 ACCOUNTING FOR ACCRUED

EXPENSES](https://image.slidesharecdn.com/14-150517121742-lva1-app6892/75/14-6-Accounting-for-Accrued-Expenses-10-2048.jpg)