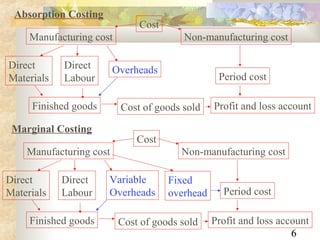

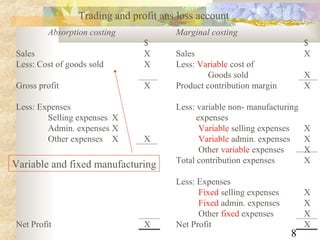

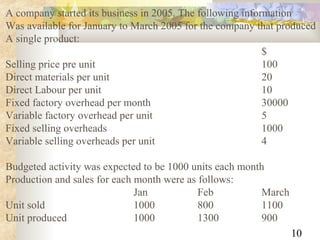

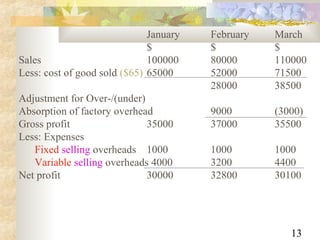

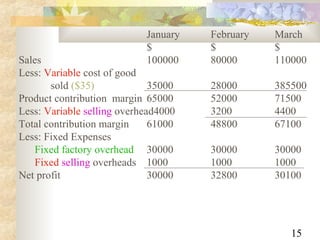

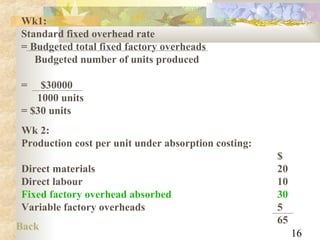

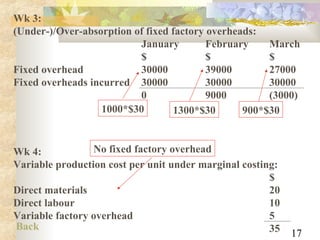

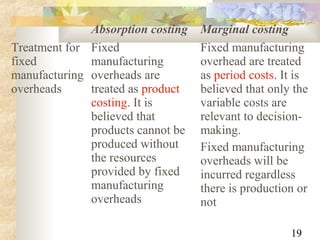

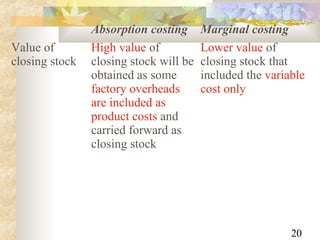

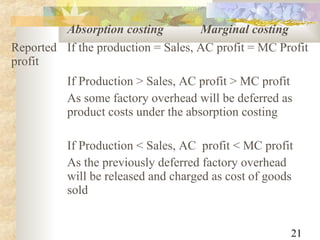

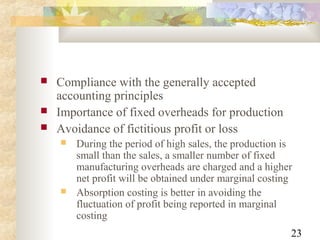

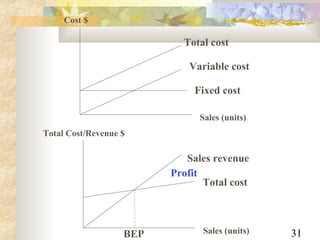

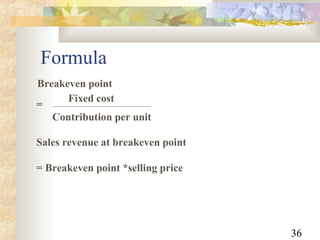

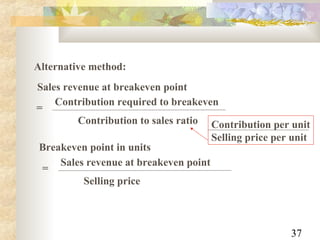

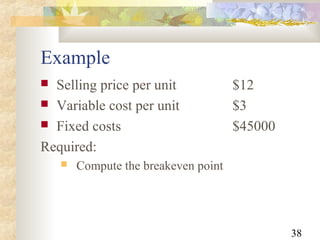

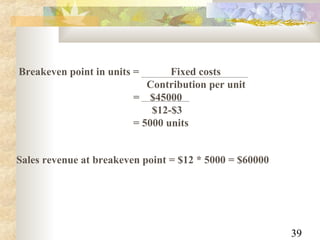

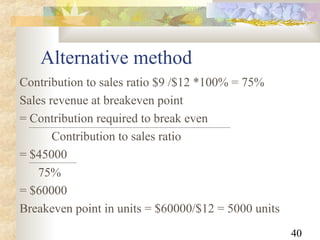

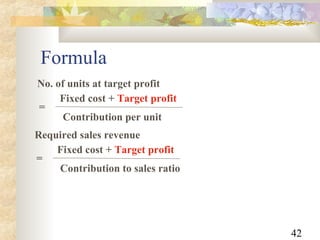

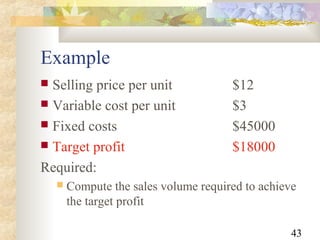

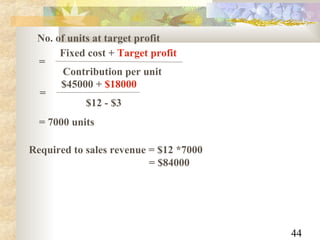

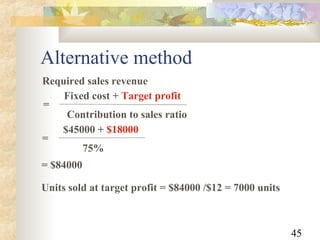

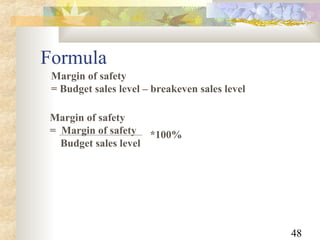

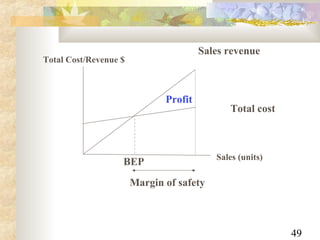

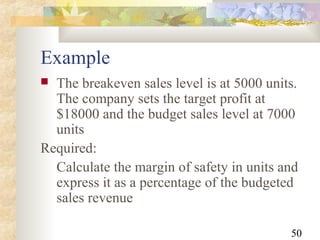

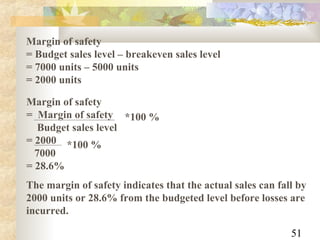

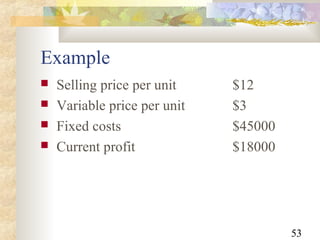

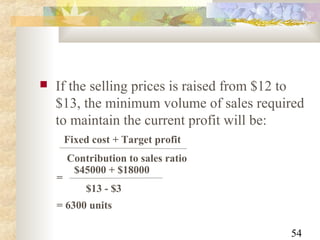

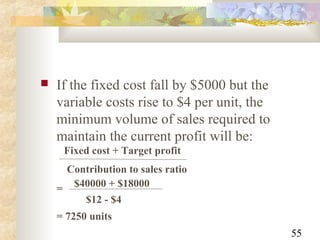

This document provides an overview of absorption costing and marginal costing. Absorption costing treats all manufacturing costs, including fixed costs, as product costs. Marginal costing treats only variable manufacturing costs as product costs and regards fixed costs as period costs. The document also discusses the treatment of fixed overheads, valuation of closing stock, and reported profit under each method. It then covers the concepts of break-even analysis including calculation of break-even point, target profit, margin of safety, and the impact of changes in cost and revenue components. The limitations of break-even analysis are also summarized.