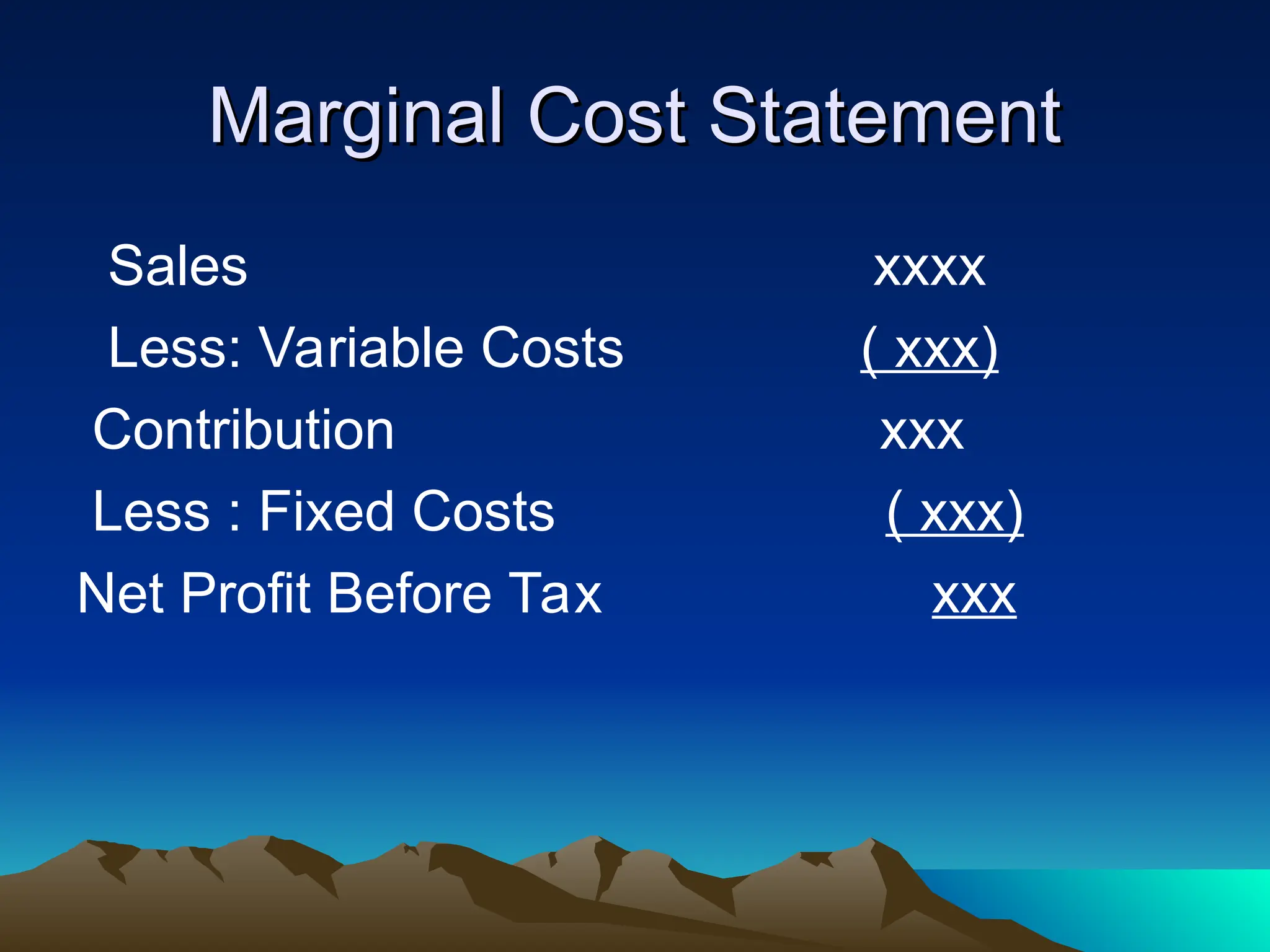

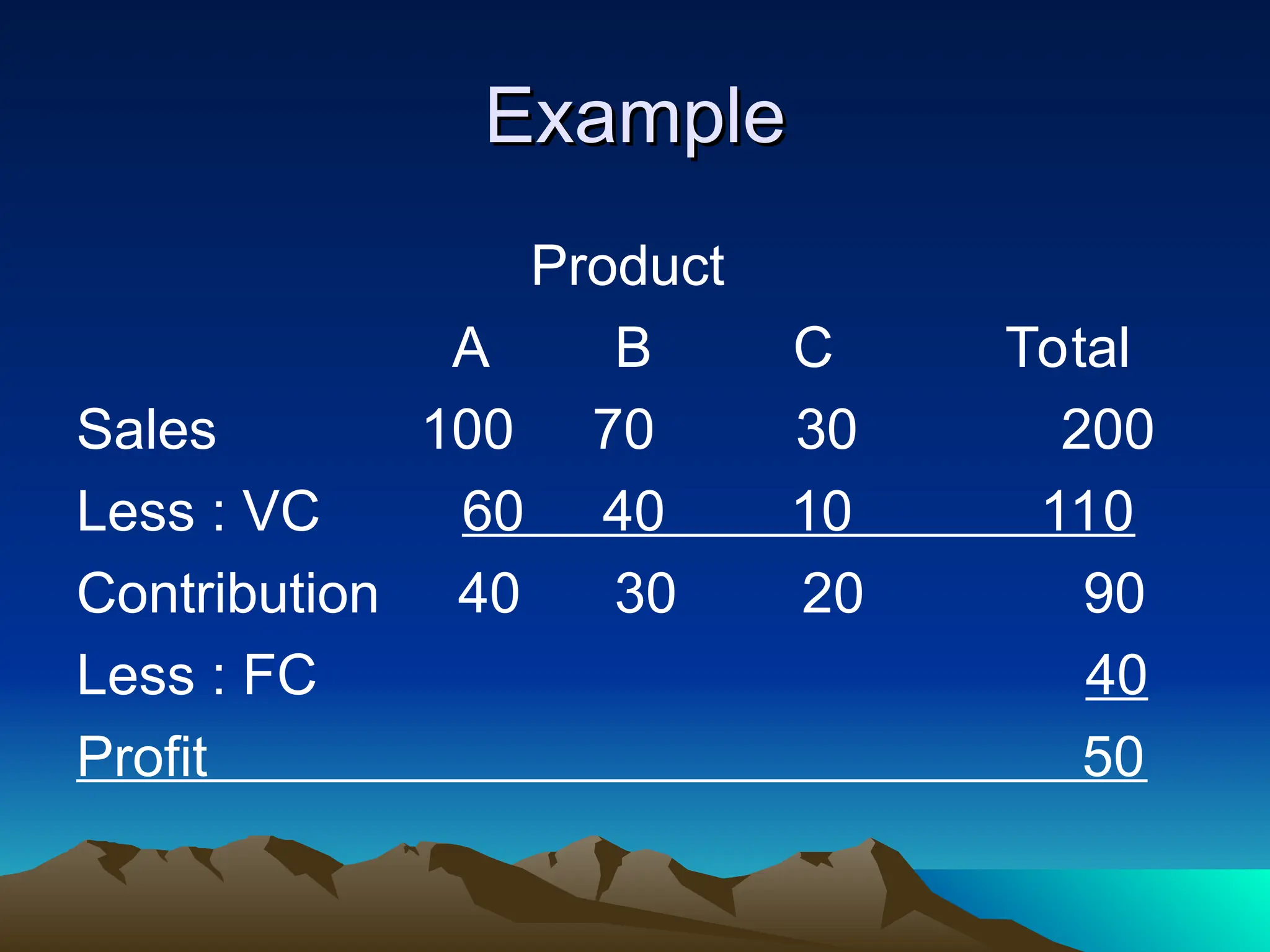

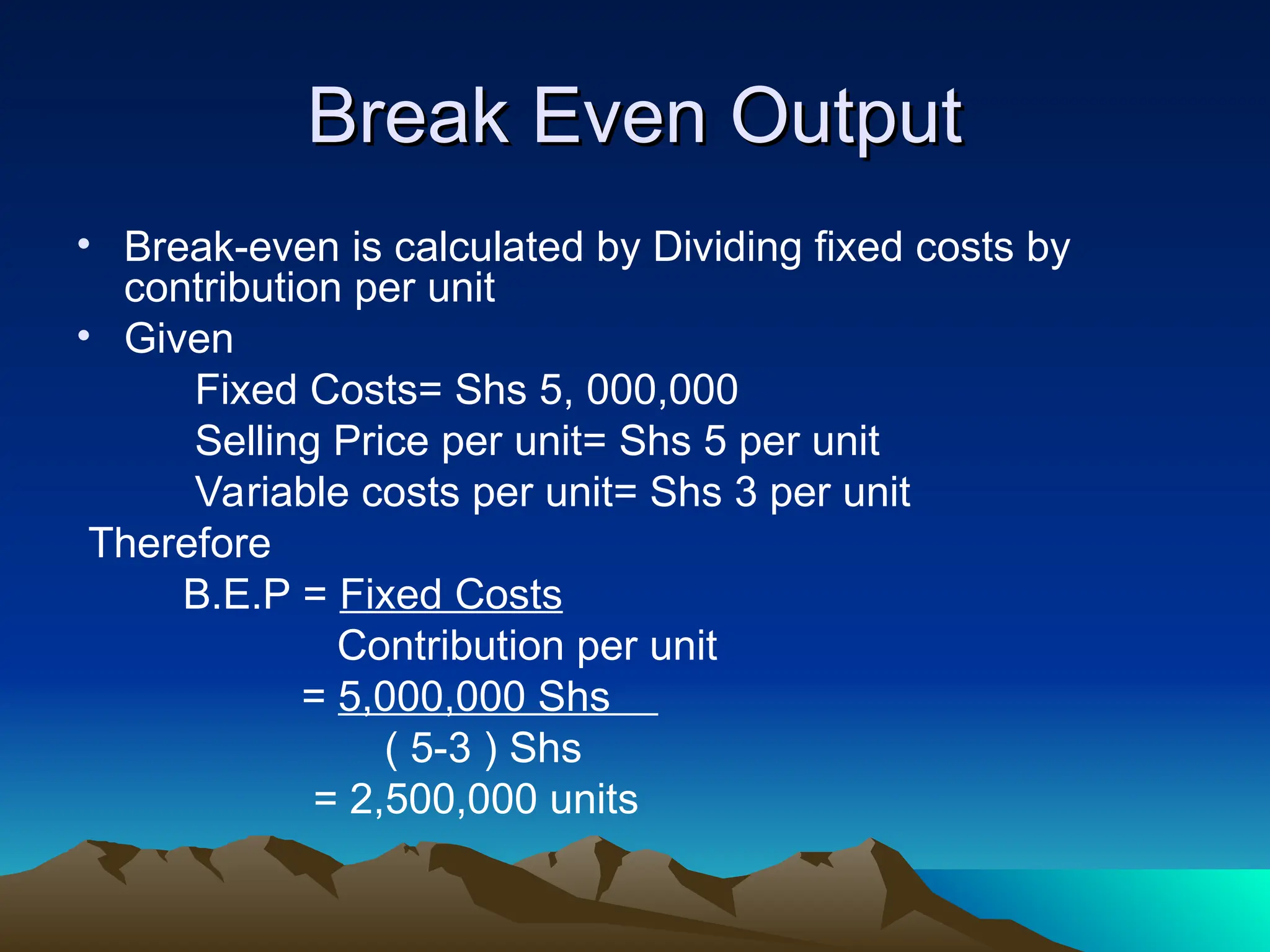

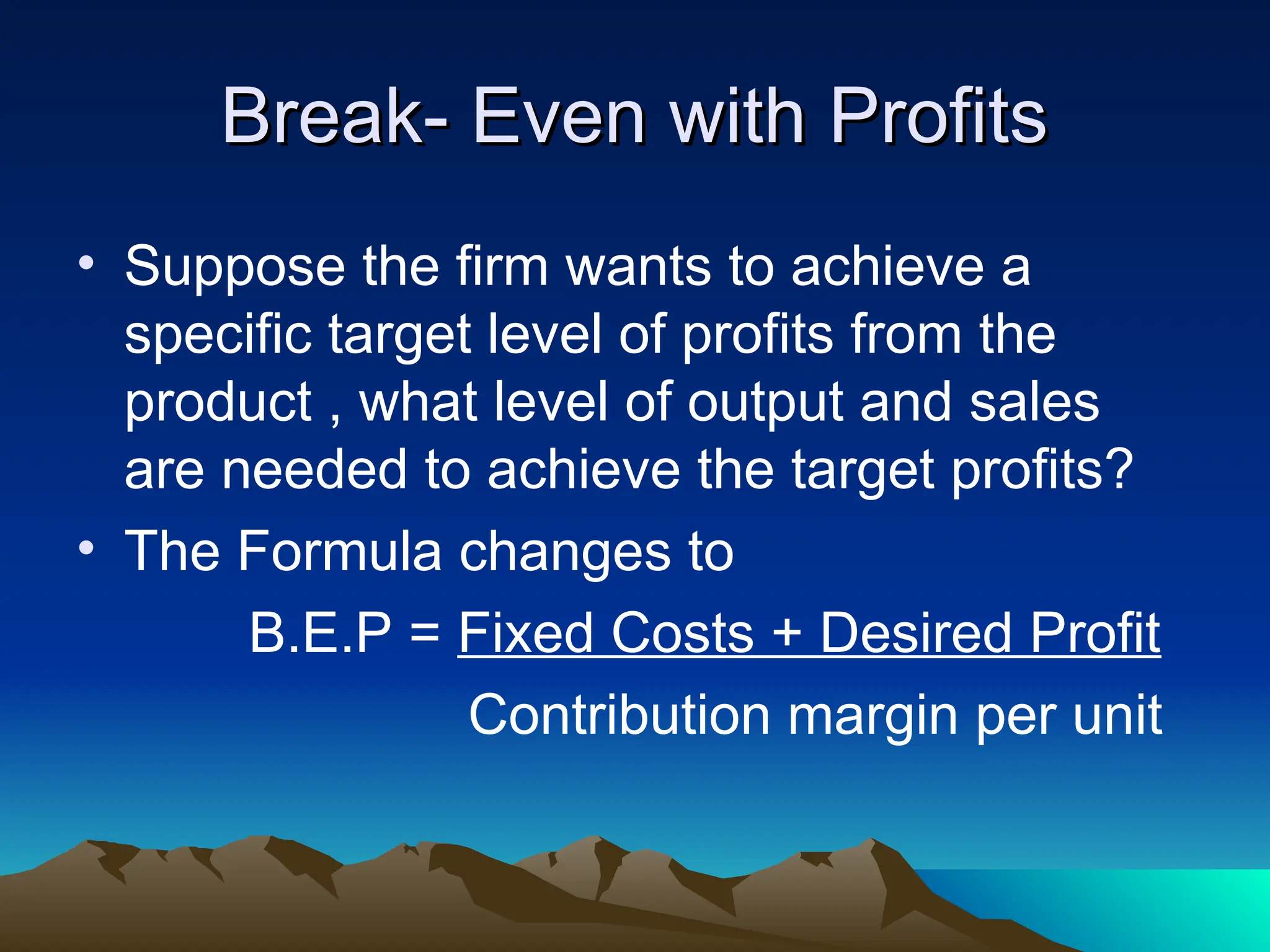

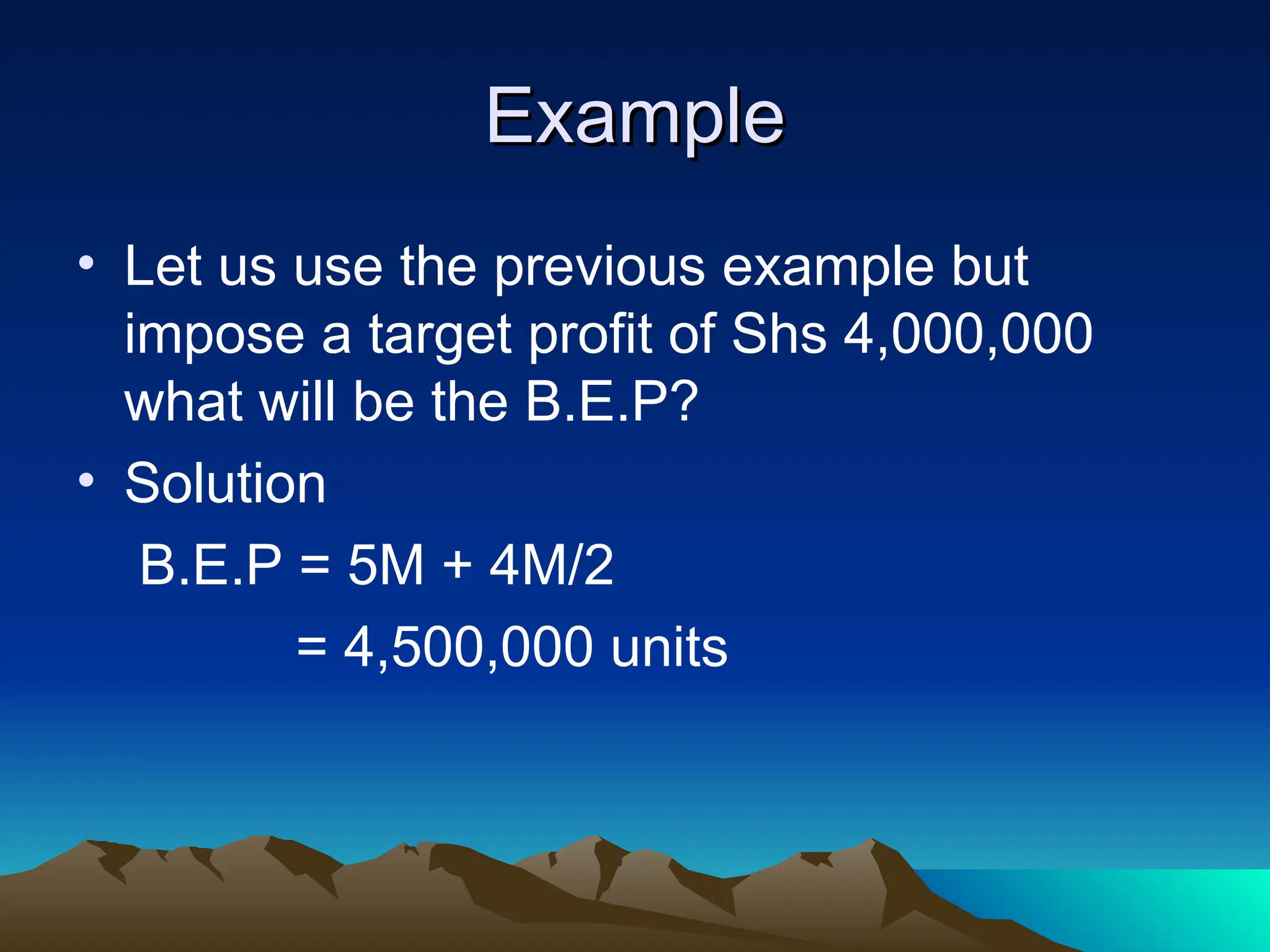

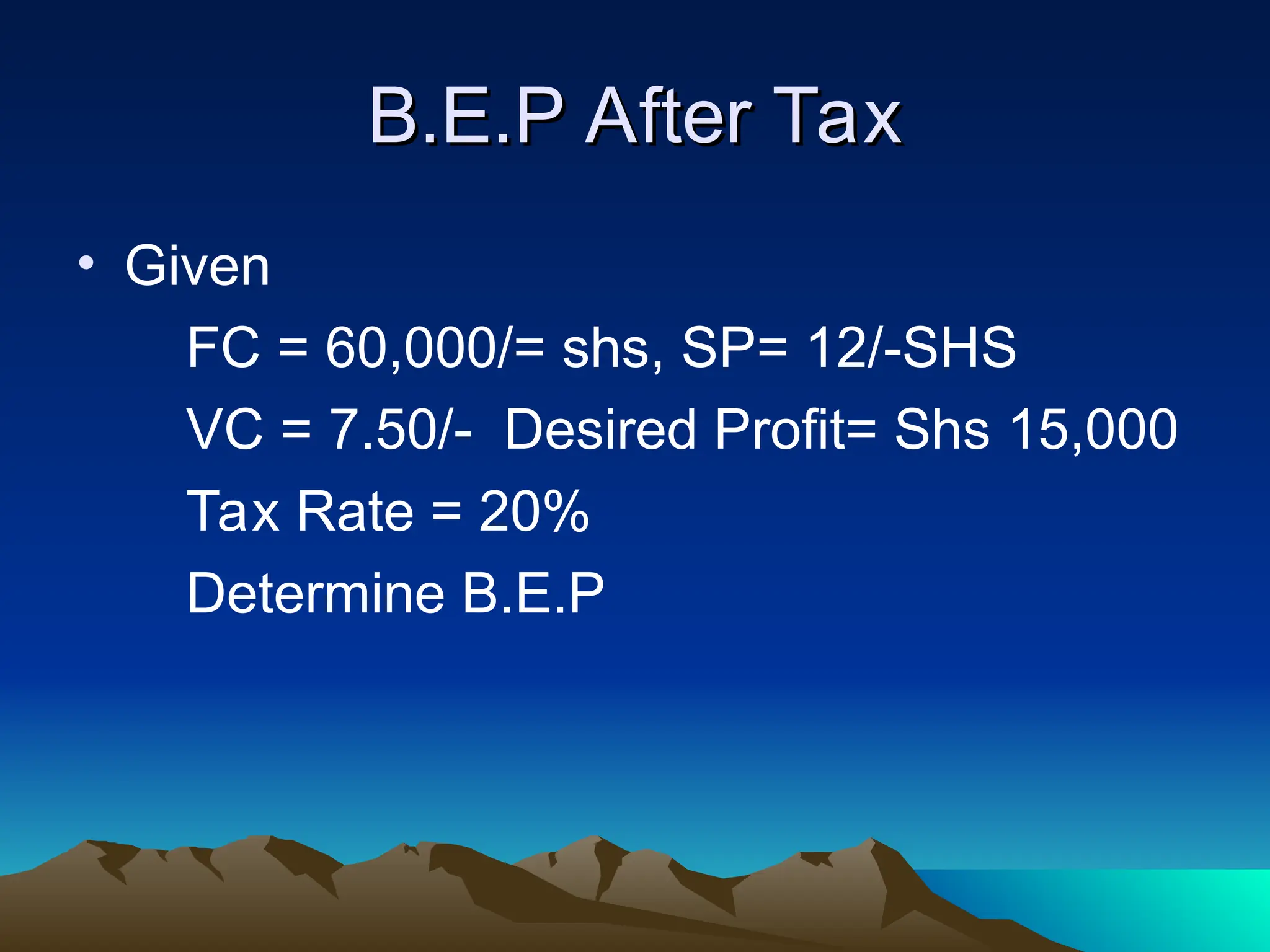

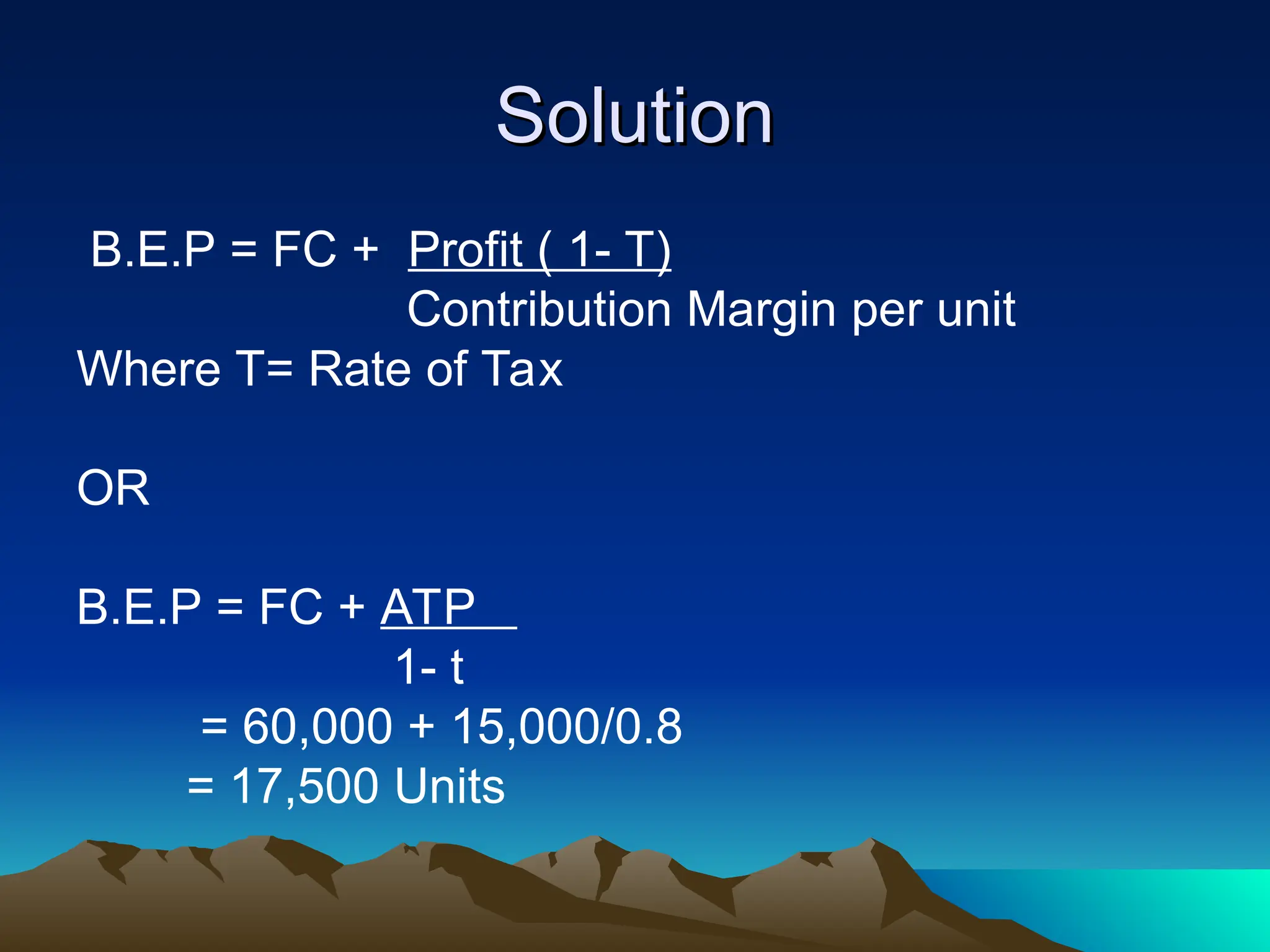

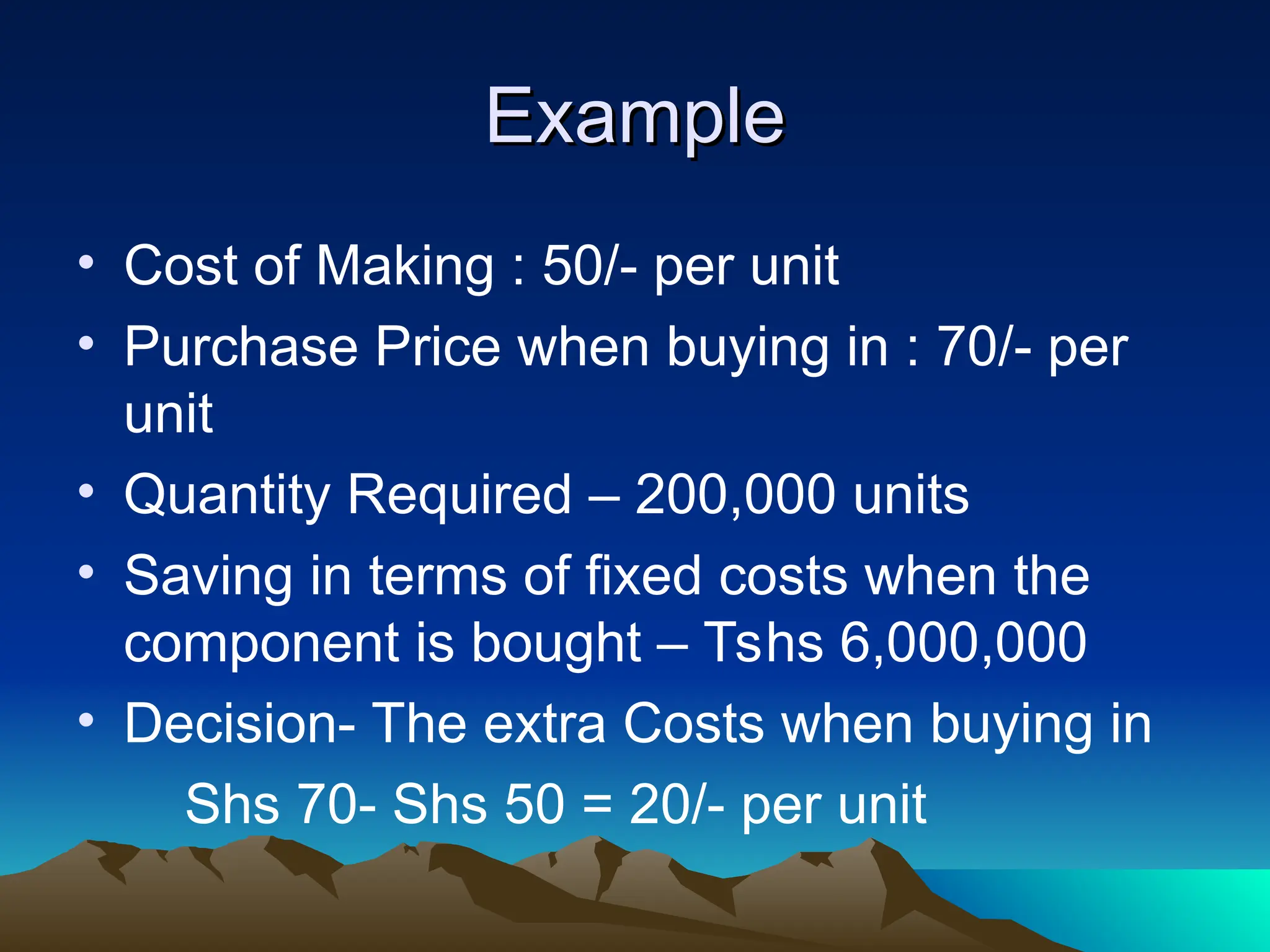

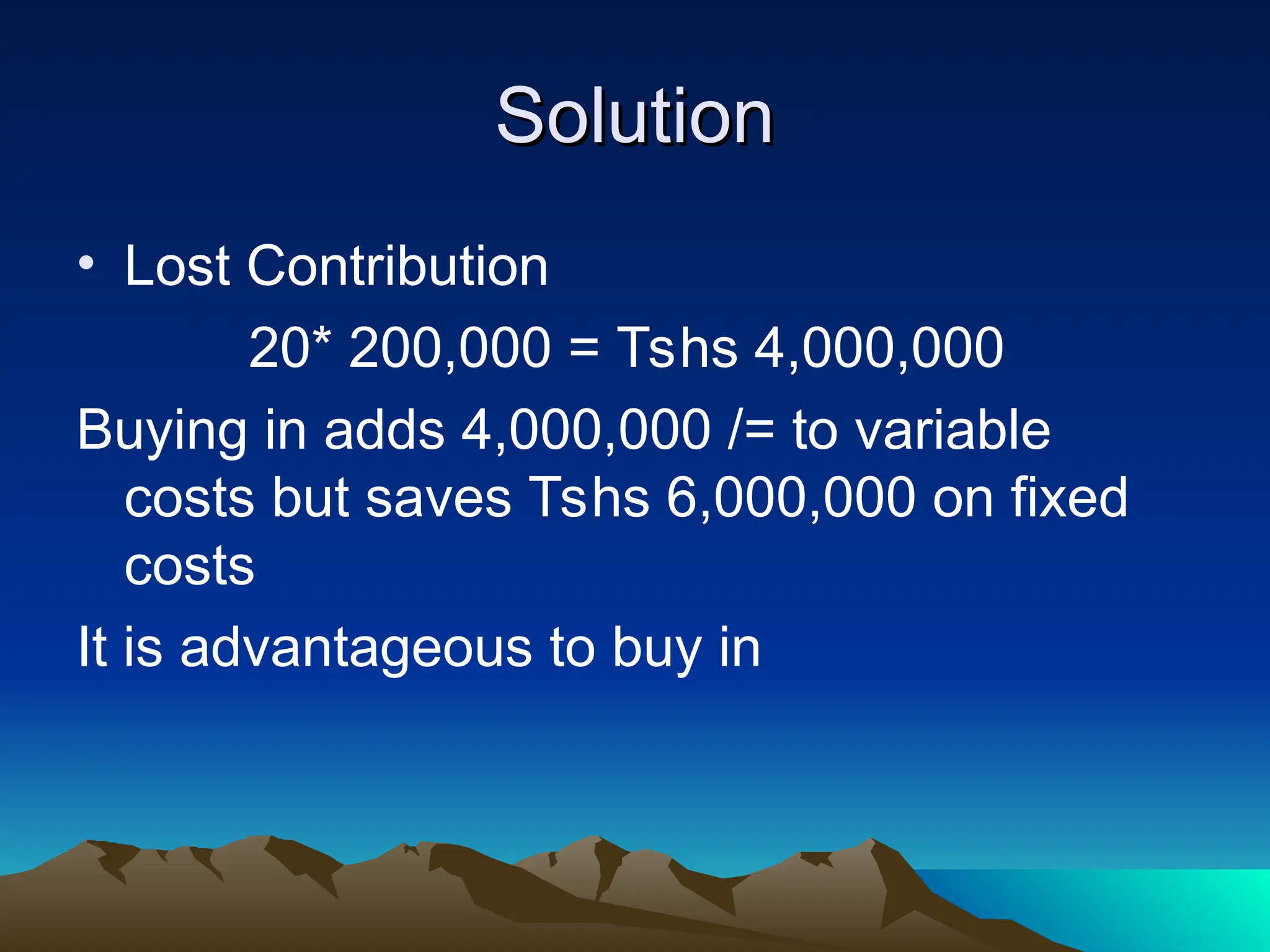

The document discusses cost-benefit analysis focusing on fixed, variable, and sunk costs, and the concept of contribution, which aids decision-making in contexts such as pricing and profitability. It explains marginal costing, its application in short-term decisions, and break-even analysis to determine output levels required to cover costs and achieve profit. Examples illustrate how businesses should evaluate special orders and make-or-buy decisions based on costs and contributions.