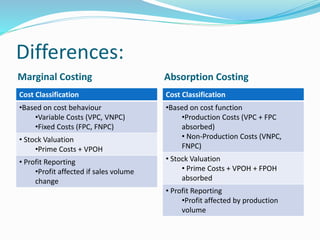

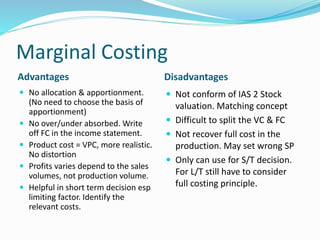

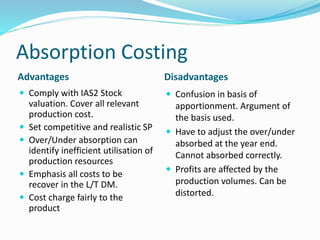

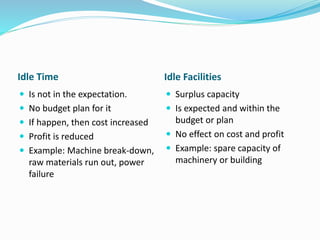

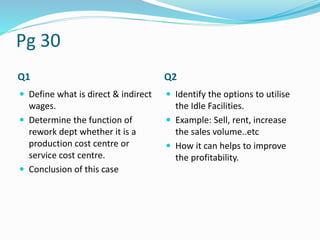

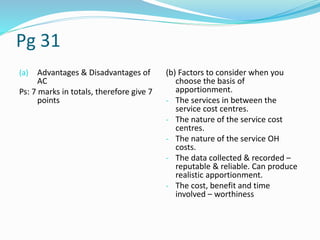

This document summarizes the key differences between marginal costing and absorption costing. It outlines how they classify and value costs, calculate profit, and their advantages and disadvantages. It also discusses how idle time and idle facilities are treated differently. Some example questions are provided at the end to test understanding of costing concepts.