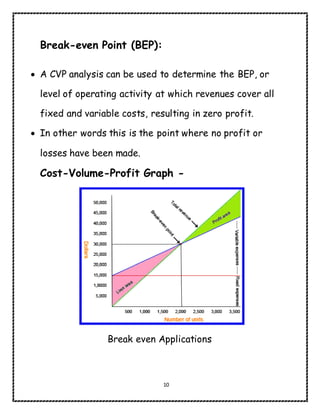

Cost-volume-profit (CVP) analysis is used to determine how changes in costs and sales volume affect a company's profits. It requires identifying all costs as either variable or fixed. CVP analysis explores the relationship between costs, revenues, and activity level to measure how costs and profits vary with sales volume. It is used for forecasting profits, budget planning, pricing decisions, determining sales mix, and more. The three elements of CVP are costs, volume, and profit. The break-even point is the sales volume where total revenue equals total costs. Relevant costs must differ between alternatives and affect the decision. Sunk costs do not affect decisions as they cannot be changed.