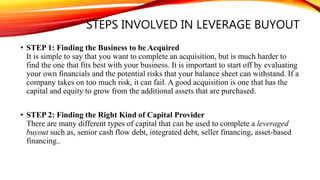

A leveraged buyout (LBO) involves using borrowed money to purchase a company, with the acquired company's assets and cash flows used to repay the debt over time. An LBO is similar to buying a house with a mortgage, where the "down payment" is equity and the "mortgage" is debt. Sources of funds for an LBO include bank loans, bonds, mezzanine debt, and seller financing. Successful LBOs involve mature companies with strong management, competitive advantages, and potential for cost cutting. Returns are measured using metrics like internal rate of return and cash-on-cash return, typically targeting 2-5x returns. Notable Indian LBOs include Nirma's acquisition of