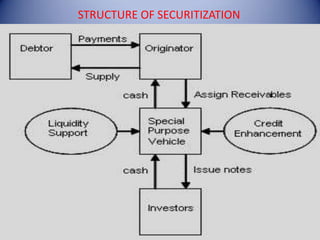

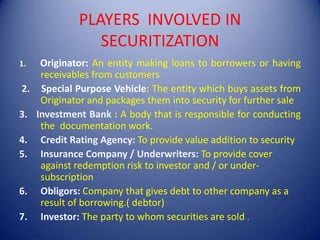

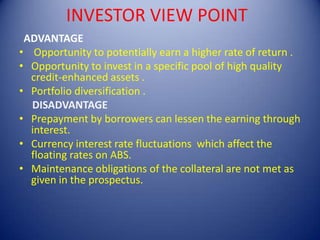

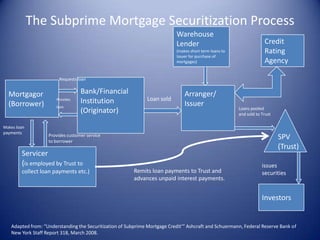

This document discusses securitization, which involves pooling various types of loan assets and converting them into marketable securities. The securitization process involves an originator selecting and packaging loan assets, which are then sold to a special purpose vehicle (SPV). The SPV then converts the assets into securities and sells them to investors. Various players are involved, including originators, SPVs, investment banks, credit rating agencies, and investors. Securitization allows originators to transfer risk and improve their balance sheets, while providing investors opportunities for returns through new financial products.