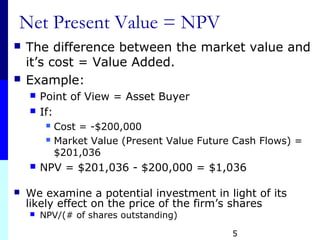

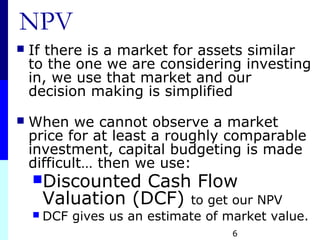

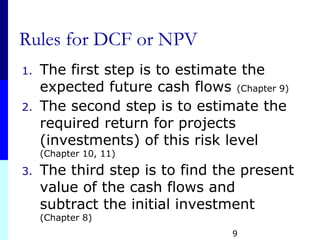

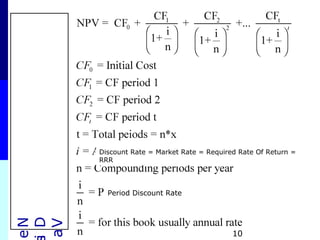

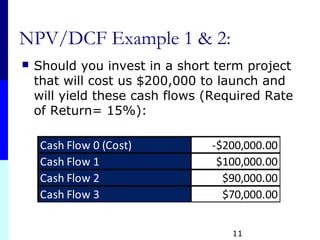

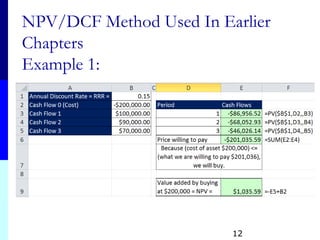

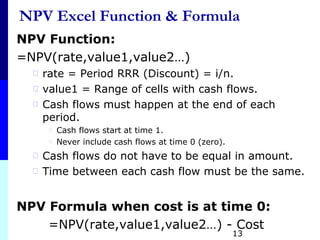

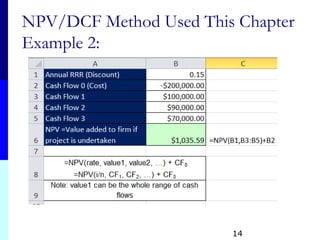

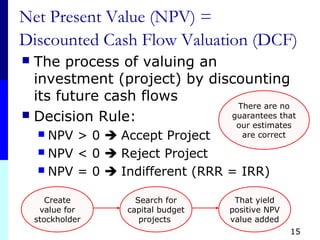

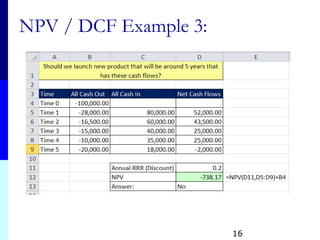

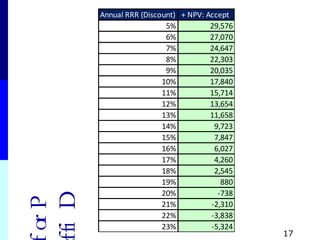

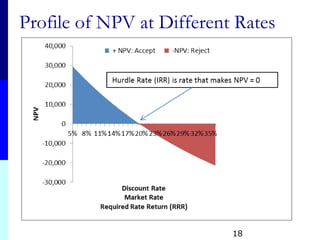

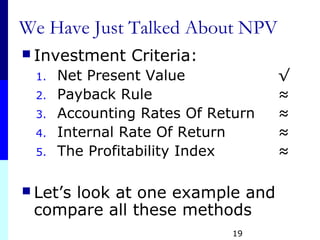

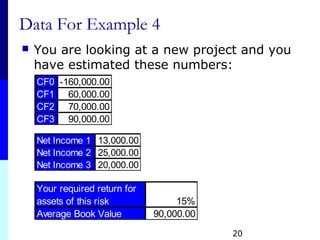

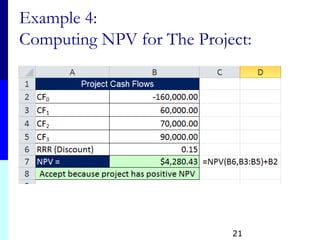

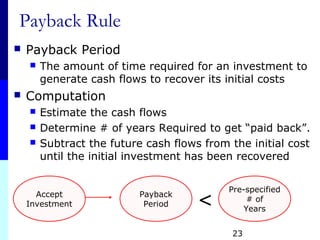

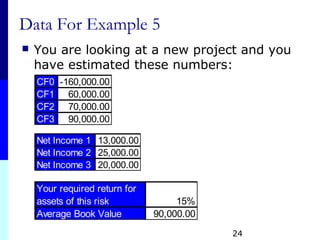

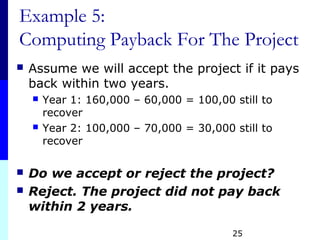

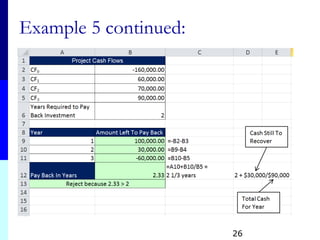

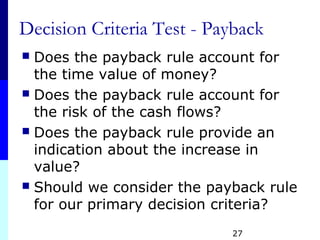

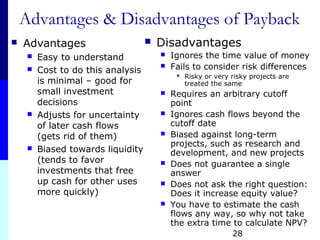

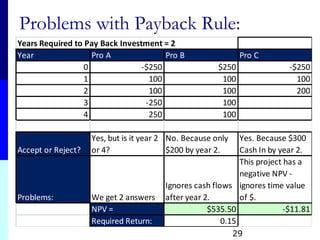

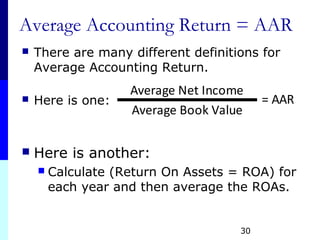

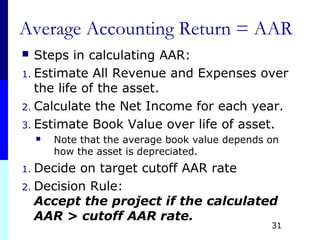

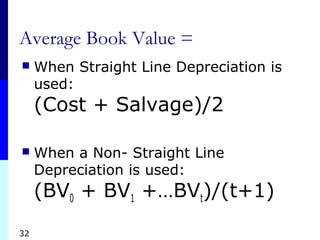

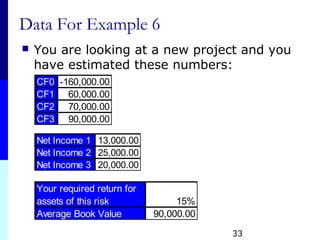

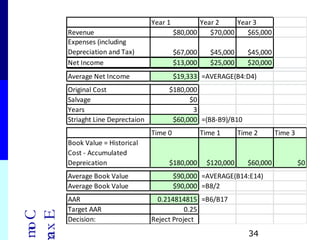

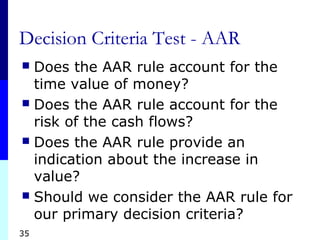

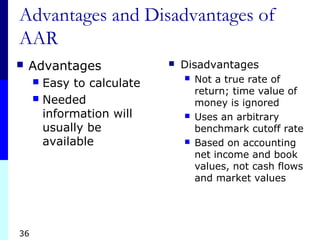

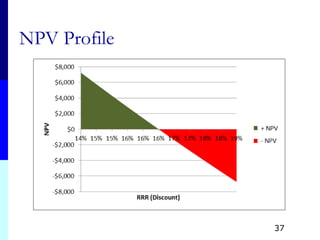

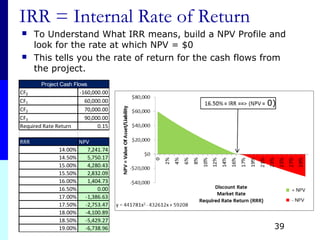

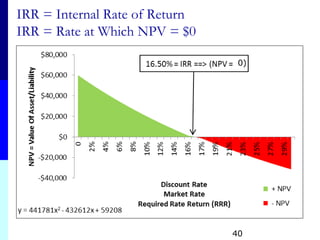

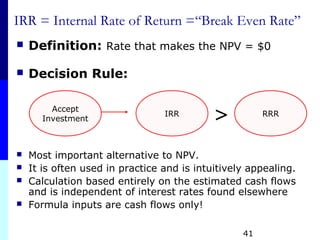

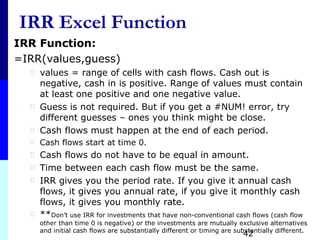

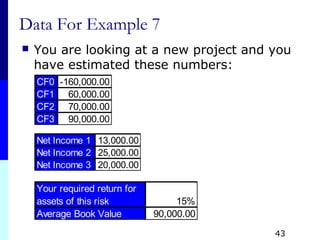

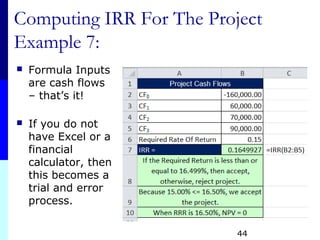

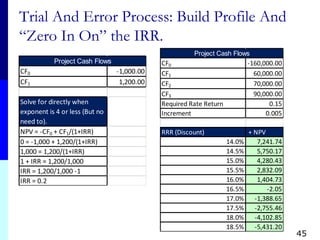

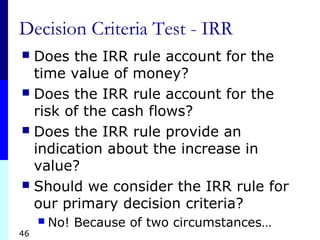

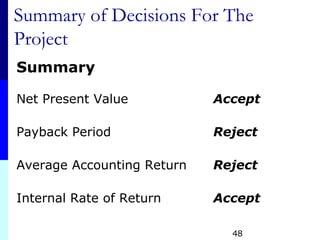

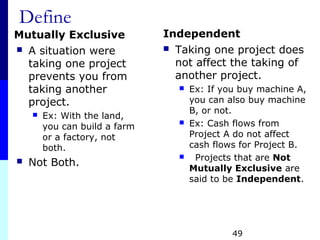

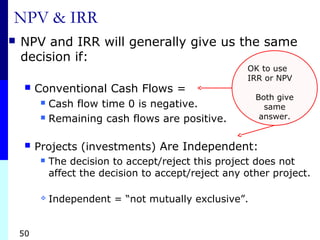

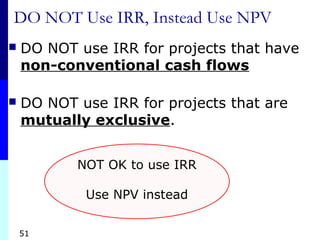

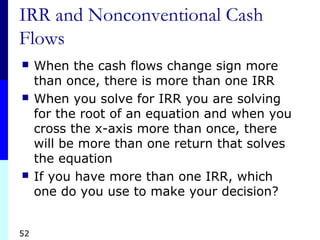

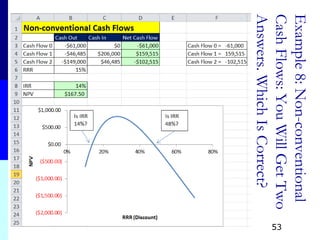

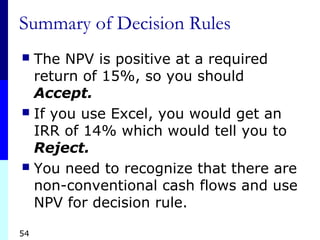

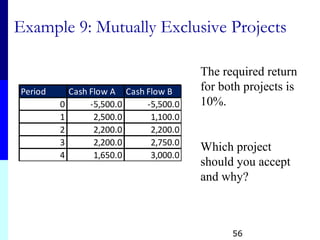

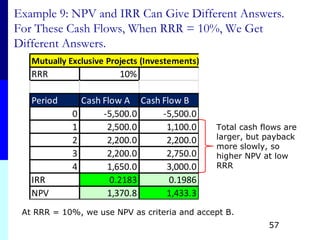

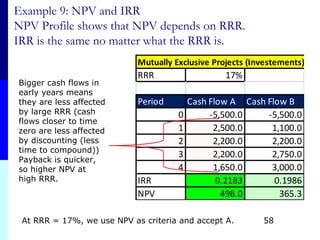

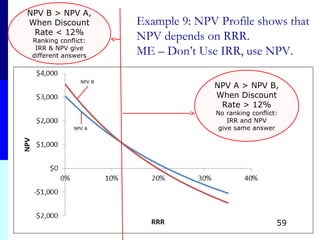

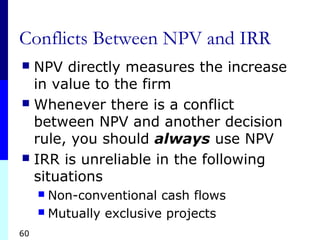

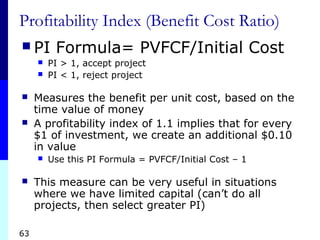

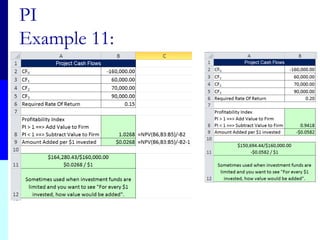

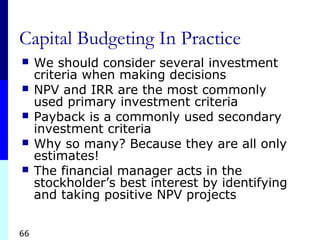

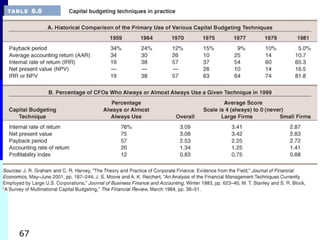

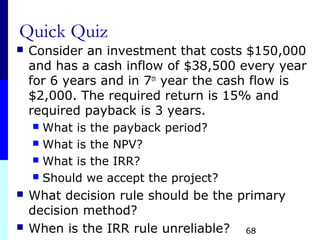

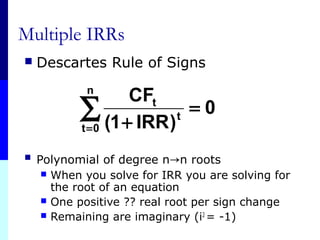

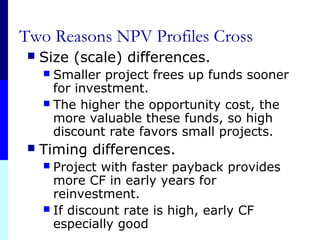

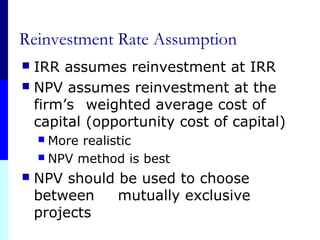

The document discusses various investment criteria for capital budgeting decisions, with a focus on net present value (NPV). It defines NPV as the difference between the present value of a project's expected future cash flows and the initial investment cost. The document also discusses other criteria like payback period, accounting rate of return, and internal rate of return. It provides examples to demonstrate how to calculate NPV and compares it to other criteria. It emphasizes that NPV is preferable because it considers the time value of money and risk, and indicates whether a project will increase firm value.