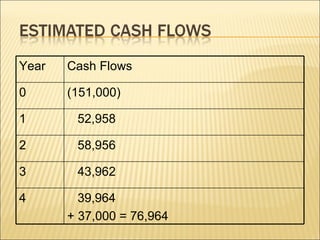

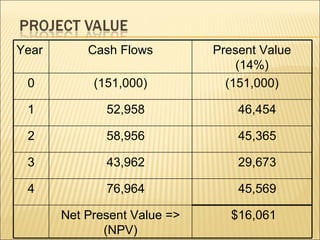

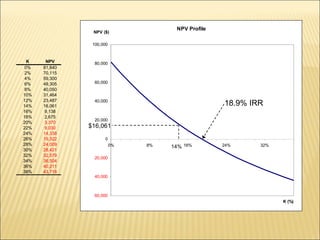

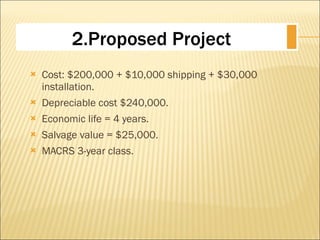

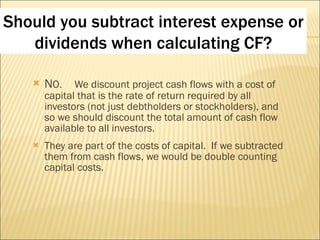

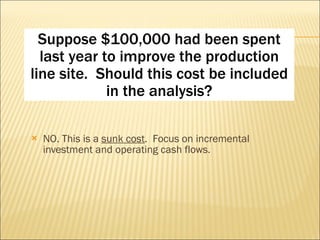

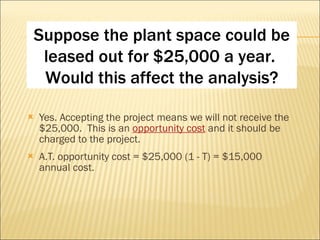

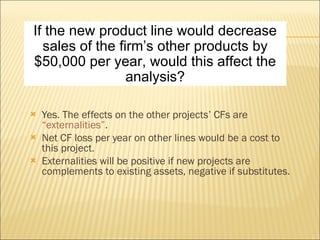

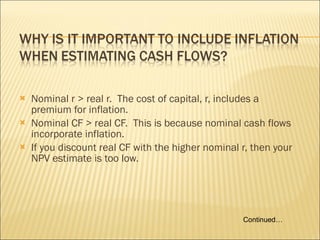

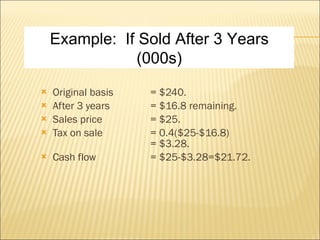

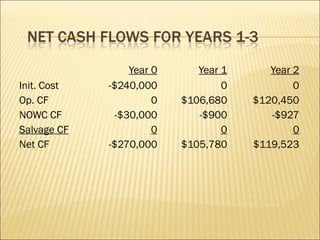

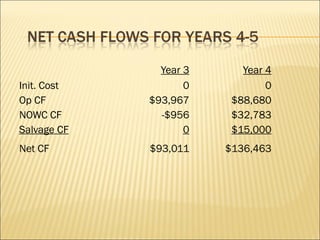

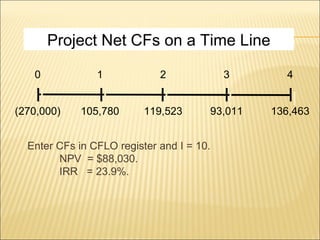

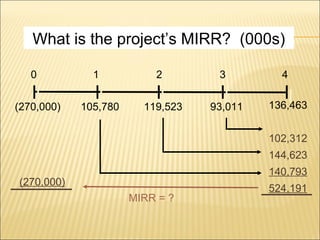

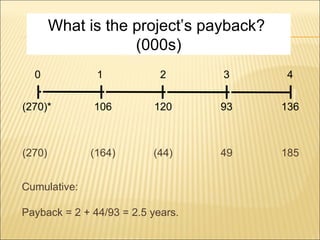

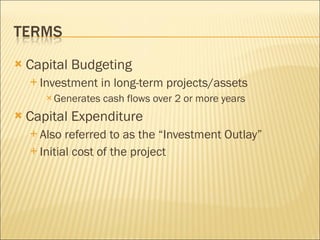

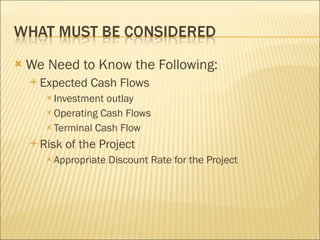

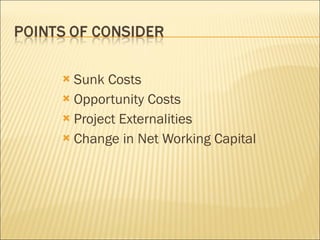

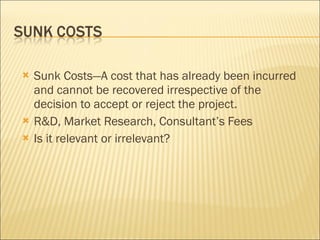

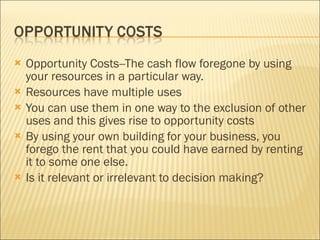

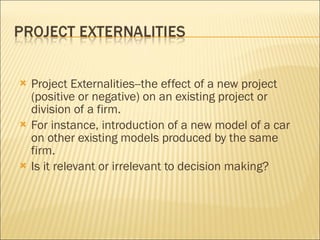

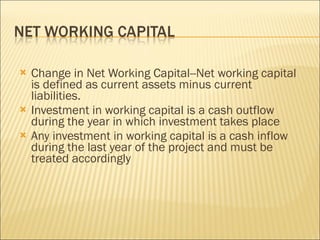

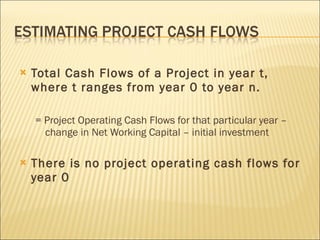

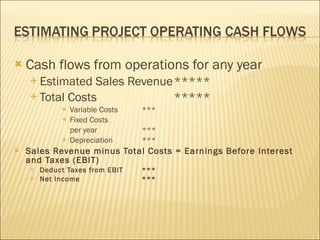

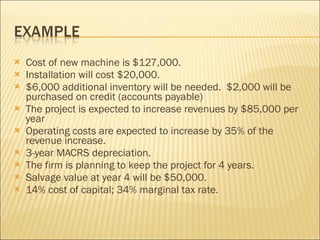

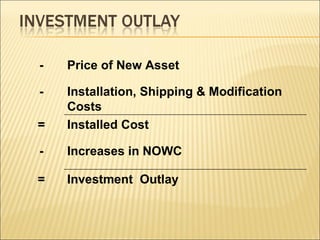

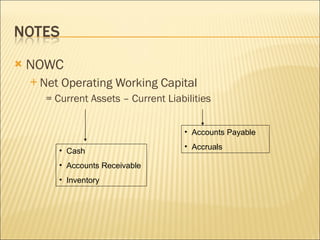

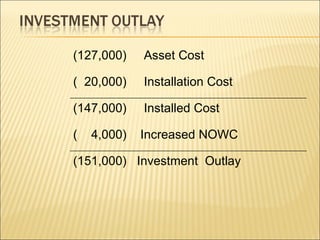

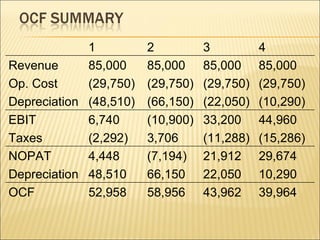

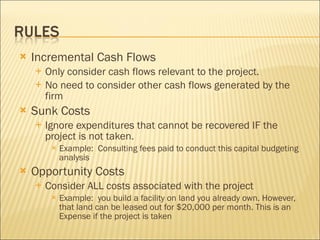

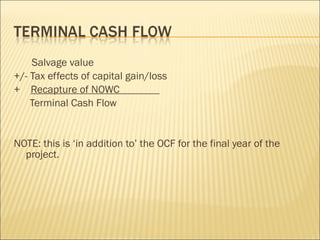

This document provides an overview of capital budgeting and cash flow analysis for investment projects. It defines key terms like capital expenditures, sunk costs, opportunity costs, and discusses how to estimate cash flows, including operating, terminal, and tax cash flows. It emphasizes the importance of using relevant cash flows to evaluate whether projects increase shareholder wealth.

![Salvage Value (SV) Market value of the asset at time of sale Book Value (BV) Installed Cost – Accumulated Depreciation Taxes on Gain from Selling Asset at Project End: Tax Liability = [SV – BV] * t “ t” = marginal tax rate](https://image.slidesharecdn.com/capitalbudgetingcashflowestimation-110920153513-phpapp02/85/Capital-budgeting-cash-flow-estimation-27-320.jpg)

![$50,000 Salvage Value of Asset (17,000) Taxes on Sale of Asset 4,000 Recovery of NWC 37,000 Terminal Cash Flow NOTE: tax = [SV-BV]*t = [$50,000 - $0] * 34% = $17,000](https://image.slidesharecdn.com/capitalbudgetingcashflowestimation-110920153513-phpapp02/85/Capital-budgeting-cash-flow-estimation-28-320.jpg)