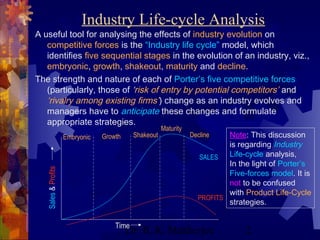

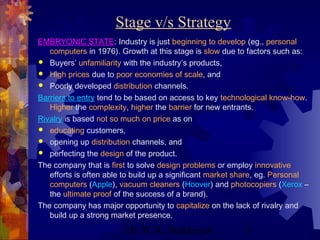

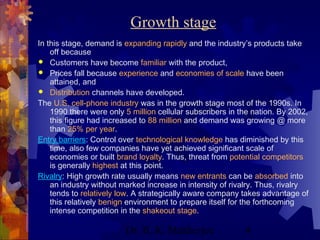

This document outlines the five stages of an industry life cycle: embryonic, growth, shakeout, maturity, and decline. It describes the characteristics of each stage, including how competitive forces change as industries evolve. Strategic managers must understand how their industry is progressing through the life cycle and adapt their strategies accordingly, such as preparing for intense competition during the shakeout stage or focusing on cost minimization as the industry reaches maturity. Recognizing the current stage is important for developing strategies that consider future changes in competitive dynamics.