The document discusses various strategic management concepts including:

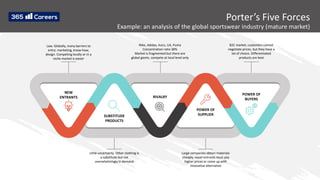

1. Porter's five forces model for analyzing competitive environments.

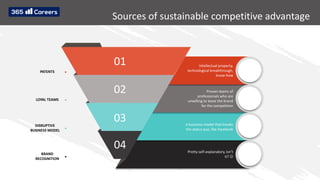

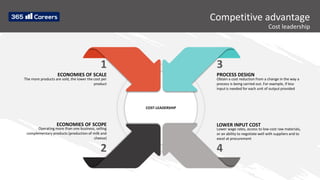

2. Different types of competitive advantages such as cost leadership, differentiation, and focus strategies.

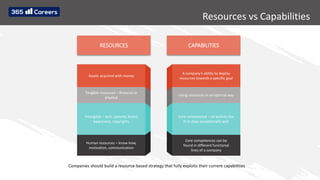

3. The importance of assessing a company's resources and capabilities to develop competitive advantages.

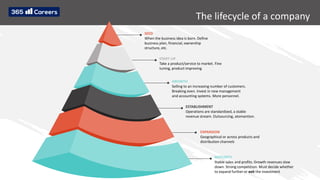

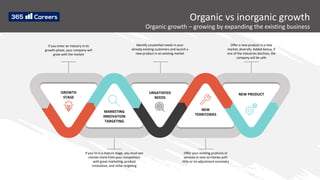

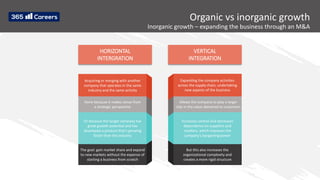

4. Organic growth strategies like developing new products or entering new markets versus inorganic strategies like mergers and acquisitions.

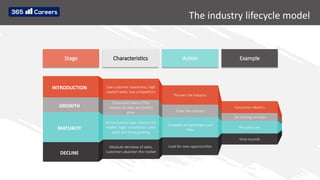

5. Tools for strategic analysis including SWOT analysis and the industry lifecycle model.