This document discusses strategic management concepts including strategy, competitive advantage, core competence, synergy, value creation, and emergent strategies. It provides examples of each concept from companies like Toyota, Reliance Industries, and Honda. The key points are:

- Strategy involves how a company distinguishes itself and competes in its industry to gain advantage.

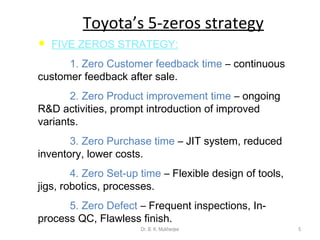

- Core competence refers to an activity a company excels in compared to competitors, like Toyota's focus on efficiency and quality.

- Synergy occurs when different business units work together to create value, as seen in integrated oil and gas companies.

- Value creation involves understanding customers and developing offerings that deliver the most benefit. Emergent strategies can arise from un

![Core (Internal) Competences [Chaston]

Clearly defined Market Opportunity

Adoption of appropriate Market Positioning

Formal Plan to exploit identified opportunity

Strategic

Competences

Financial Resources capable of

supporting Plan Resource Competences

Organizational competences

Dr. B. K. Mukherjee 7

INNOVATION

Effective or

requiring

improvement?

WORKFORCE

Appropriate

structure,

motivated and

competent or

requiring

Improvement?

PRODUCTIVITY

Adequate,

supported by

ongoing invest-ment

in Techno-logy

or requiring

improvement

QUALITY

Adequate and

regularly

assessed or

requiring

improvement?

SYSTEMS

Information

flows permit

rapid problem

resolution or

requiring

Improvement?](https://image.slidesharecdn.com/2-141013044800-conversion-gate01/85/2-strategy-concept-7-320.jpg)