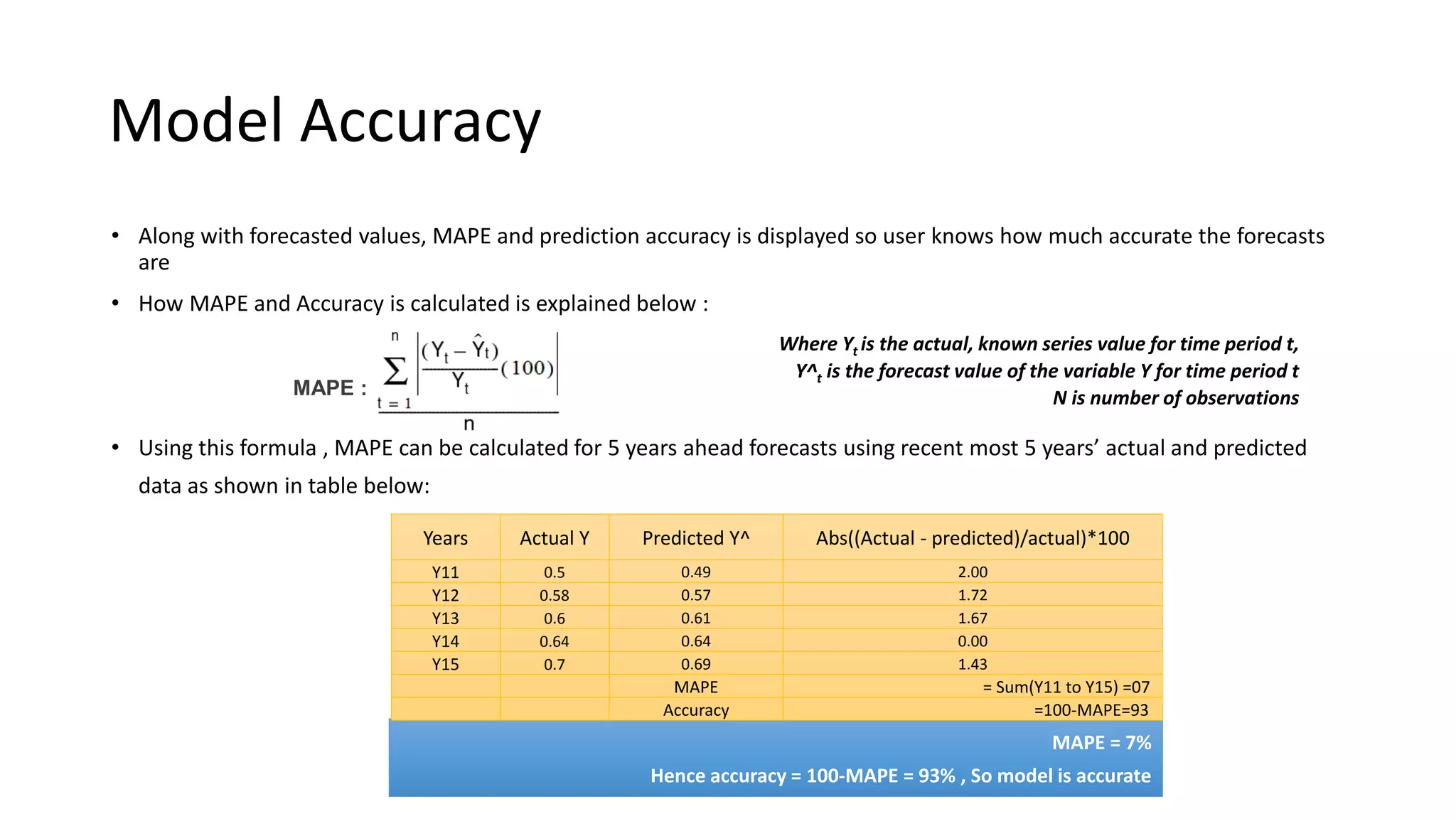

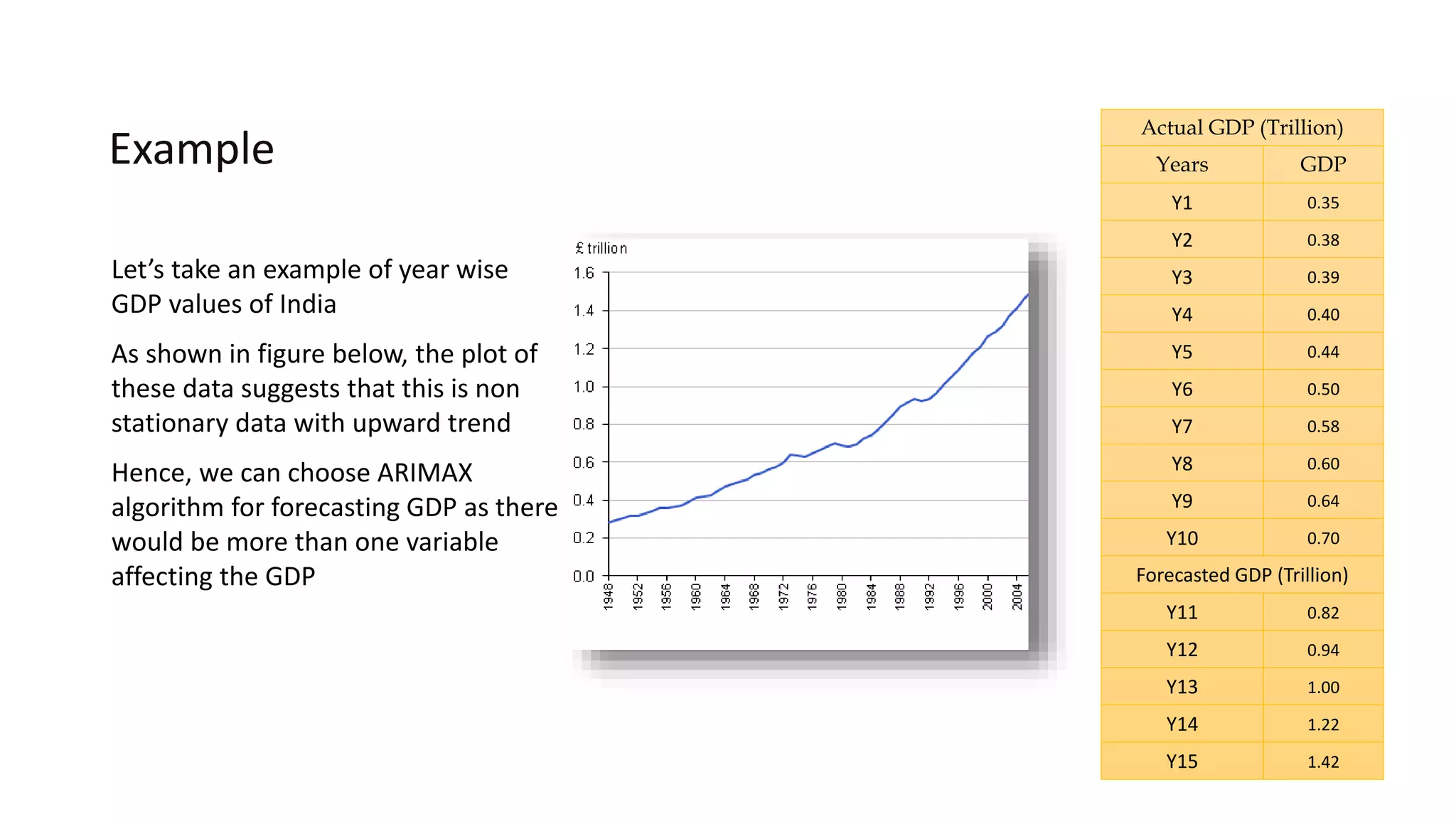

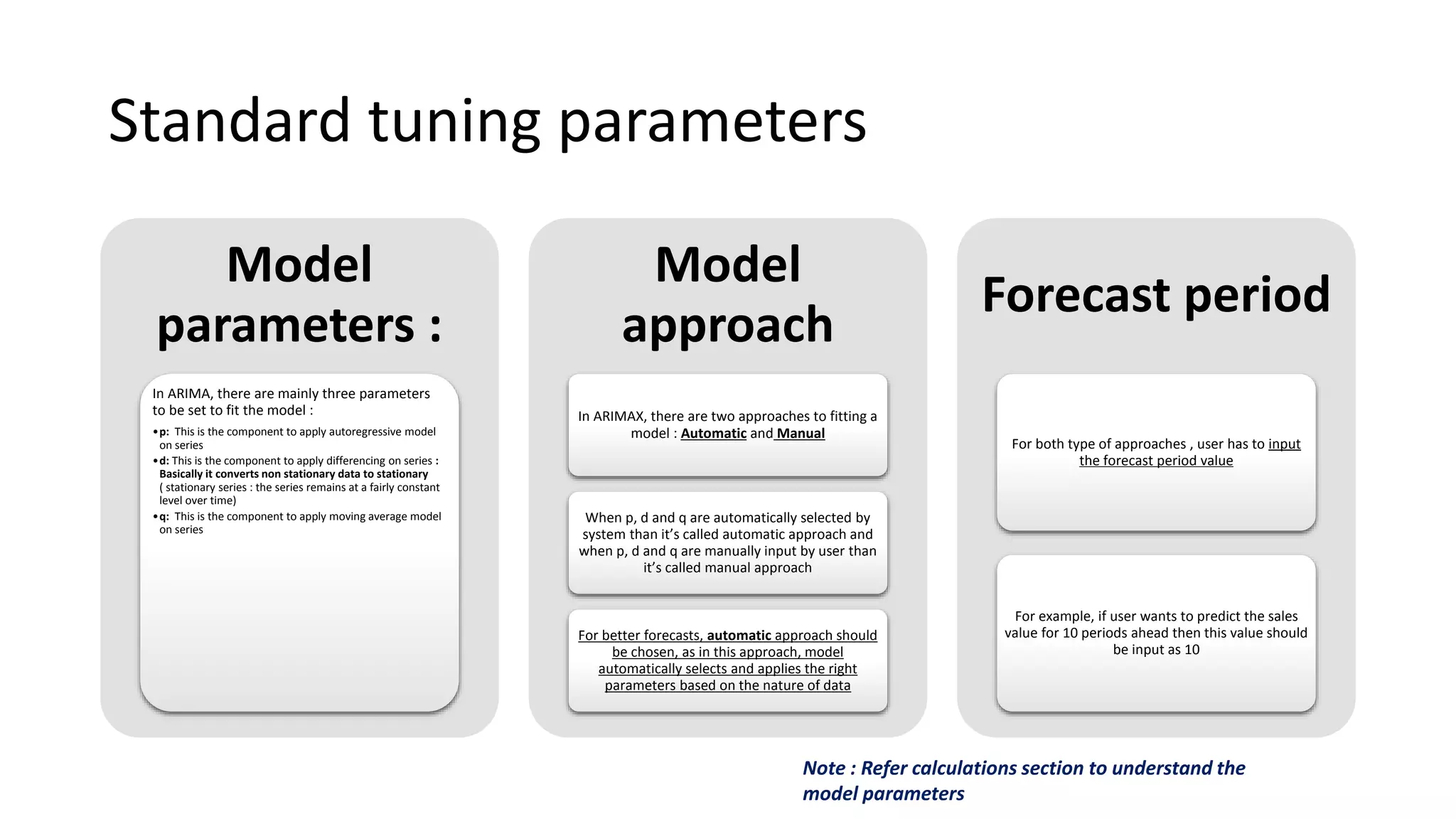

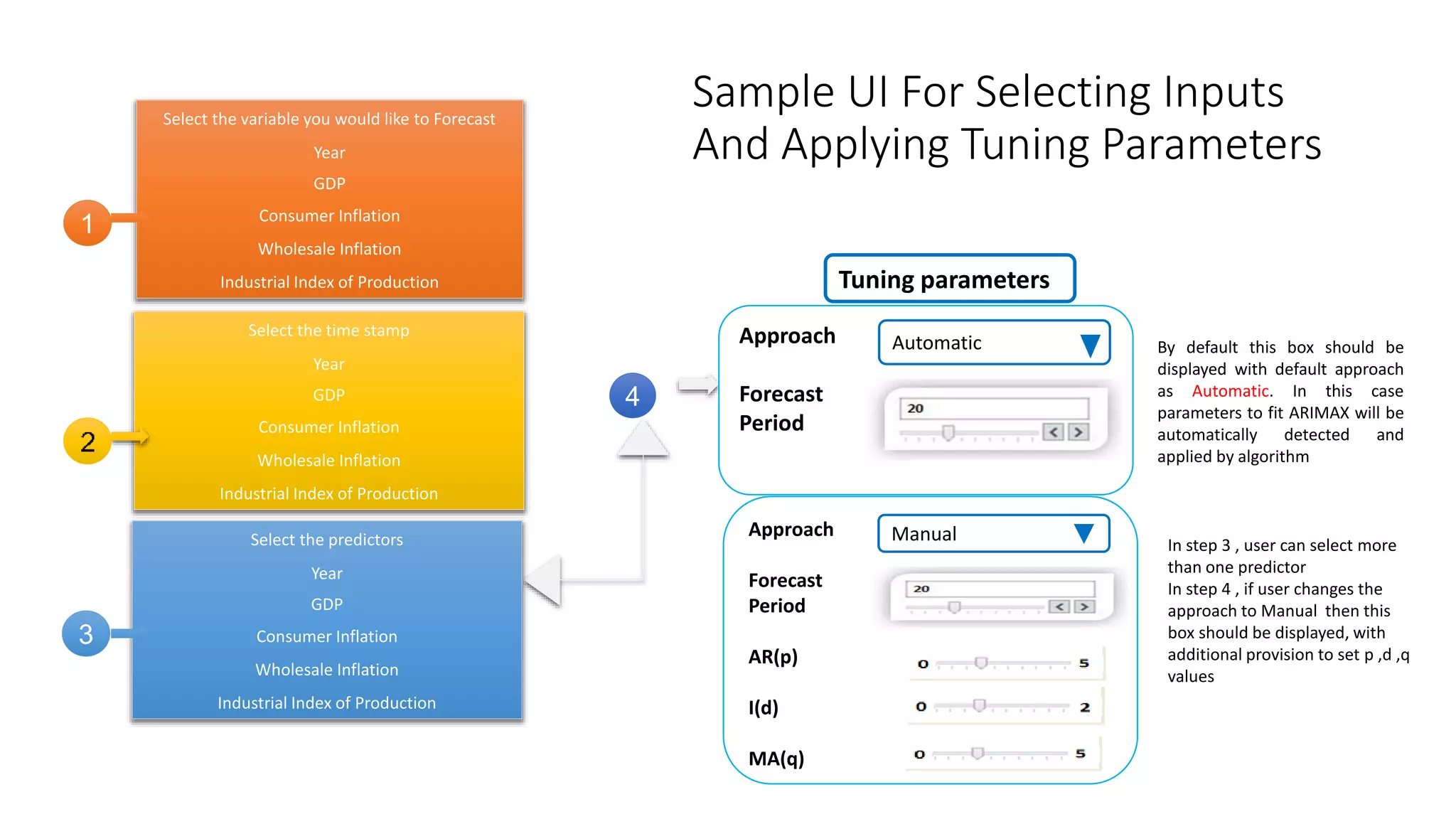

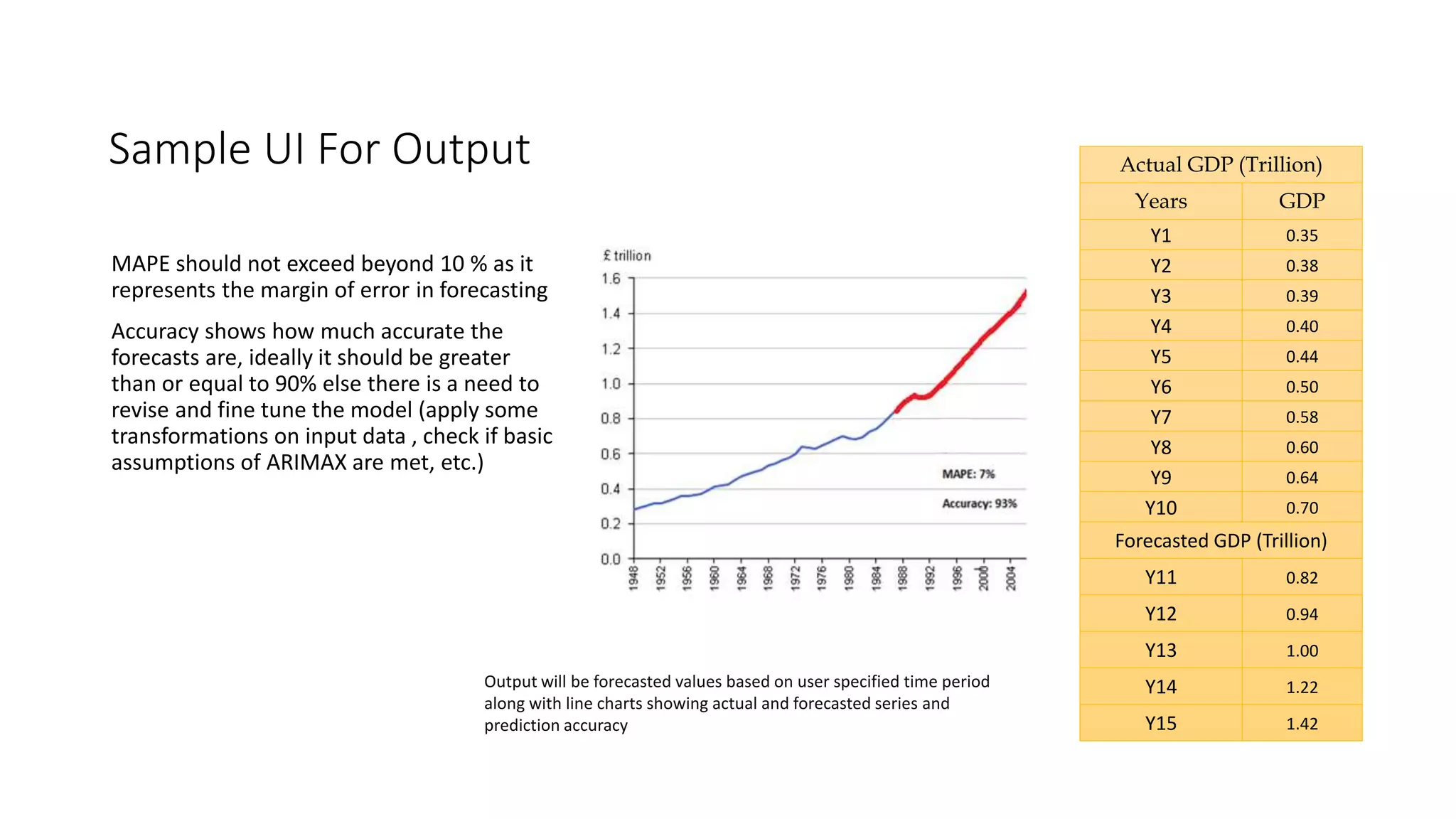

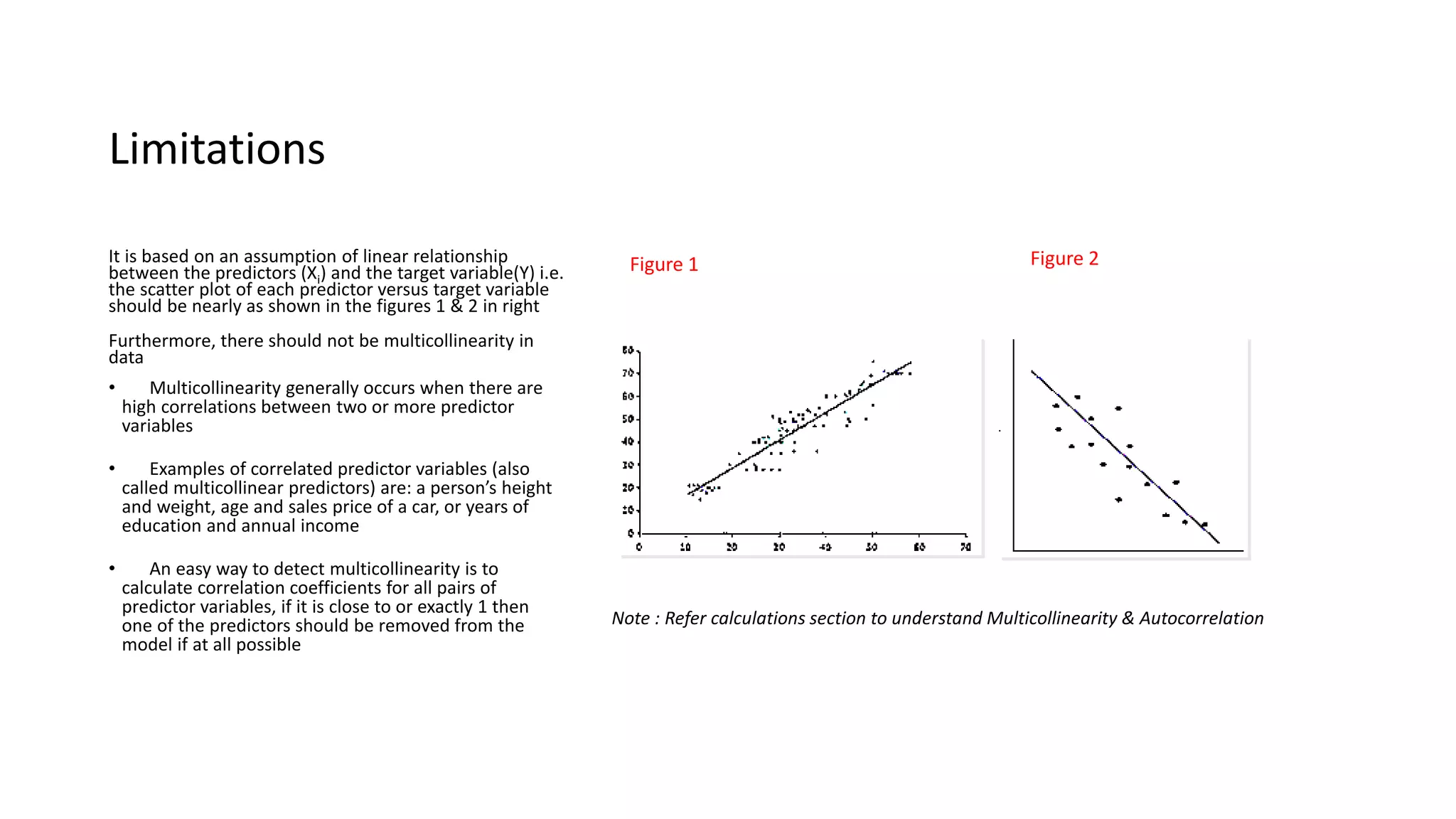

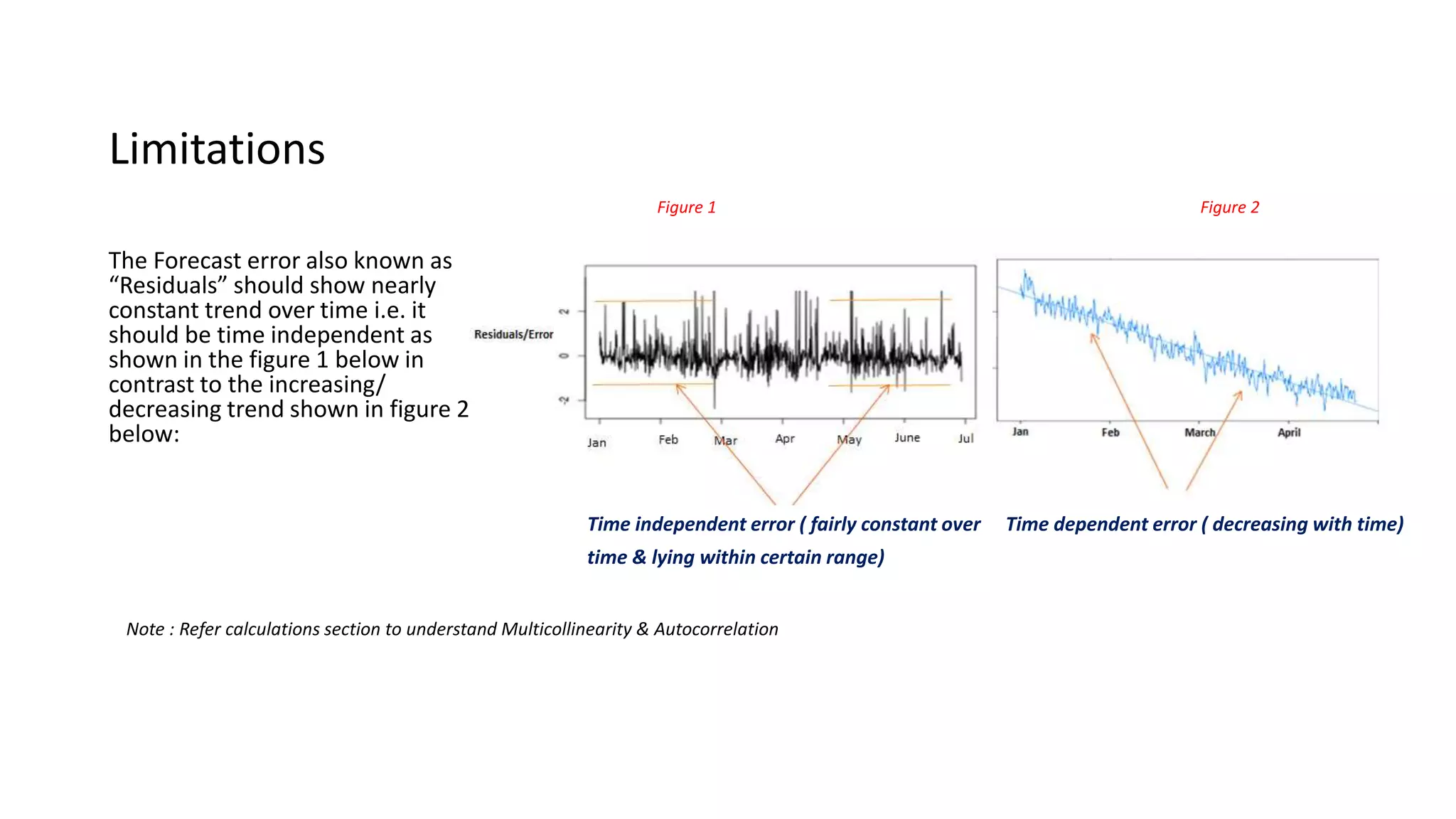

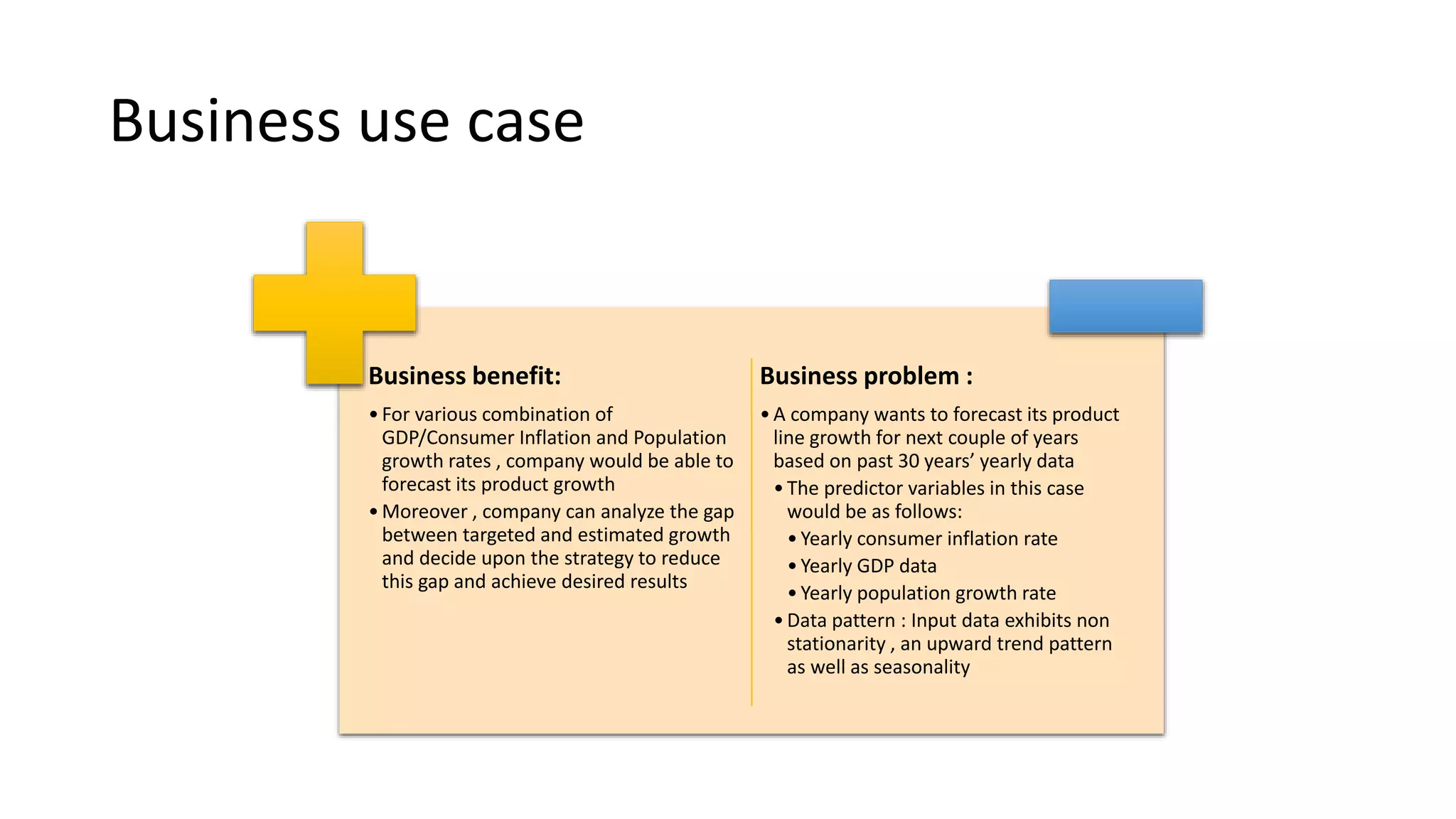

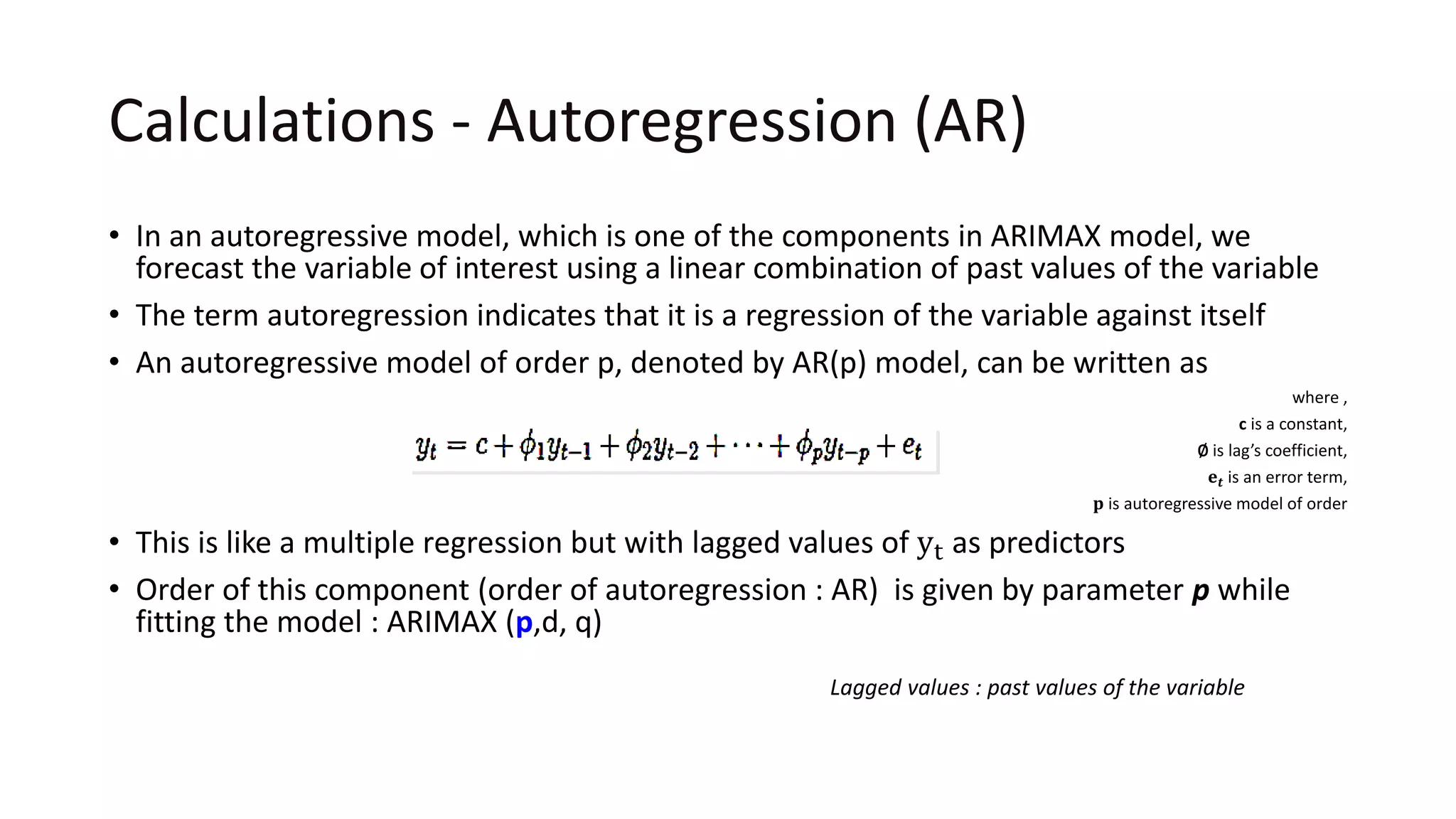

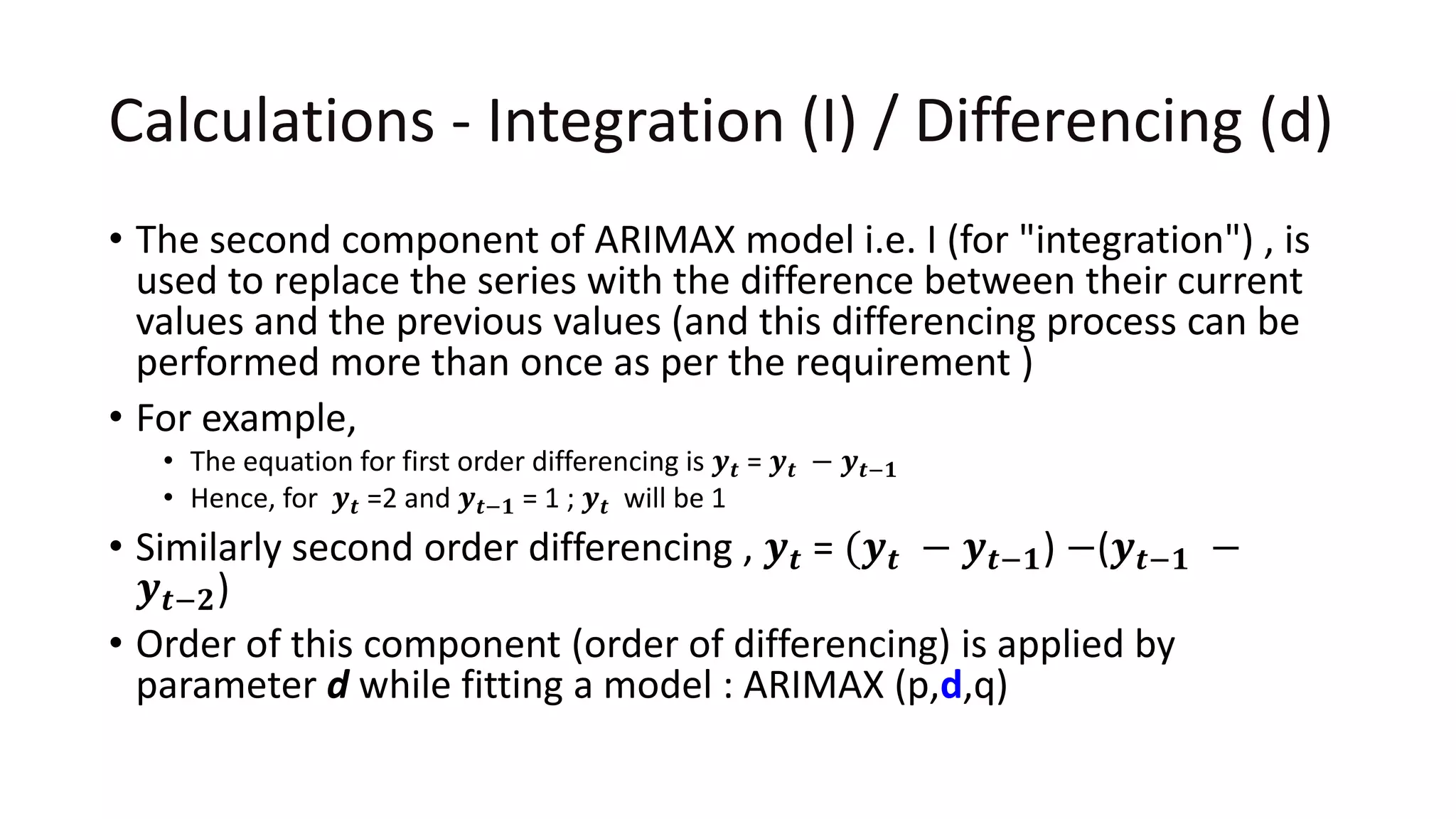

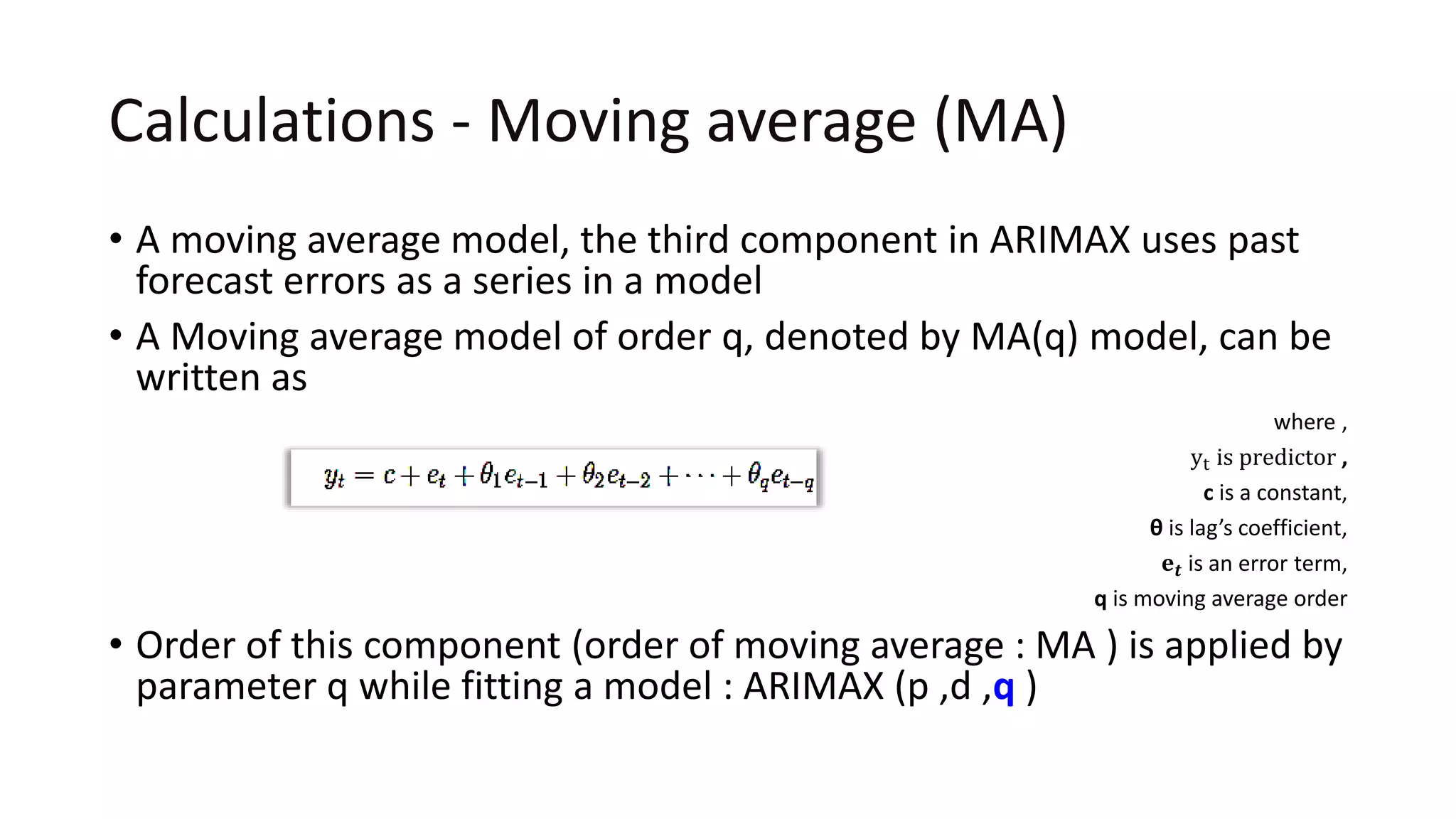

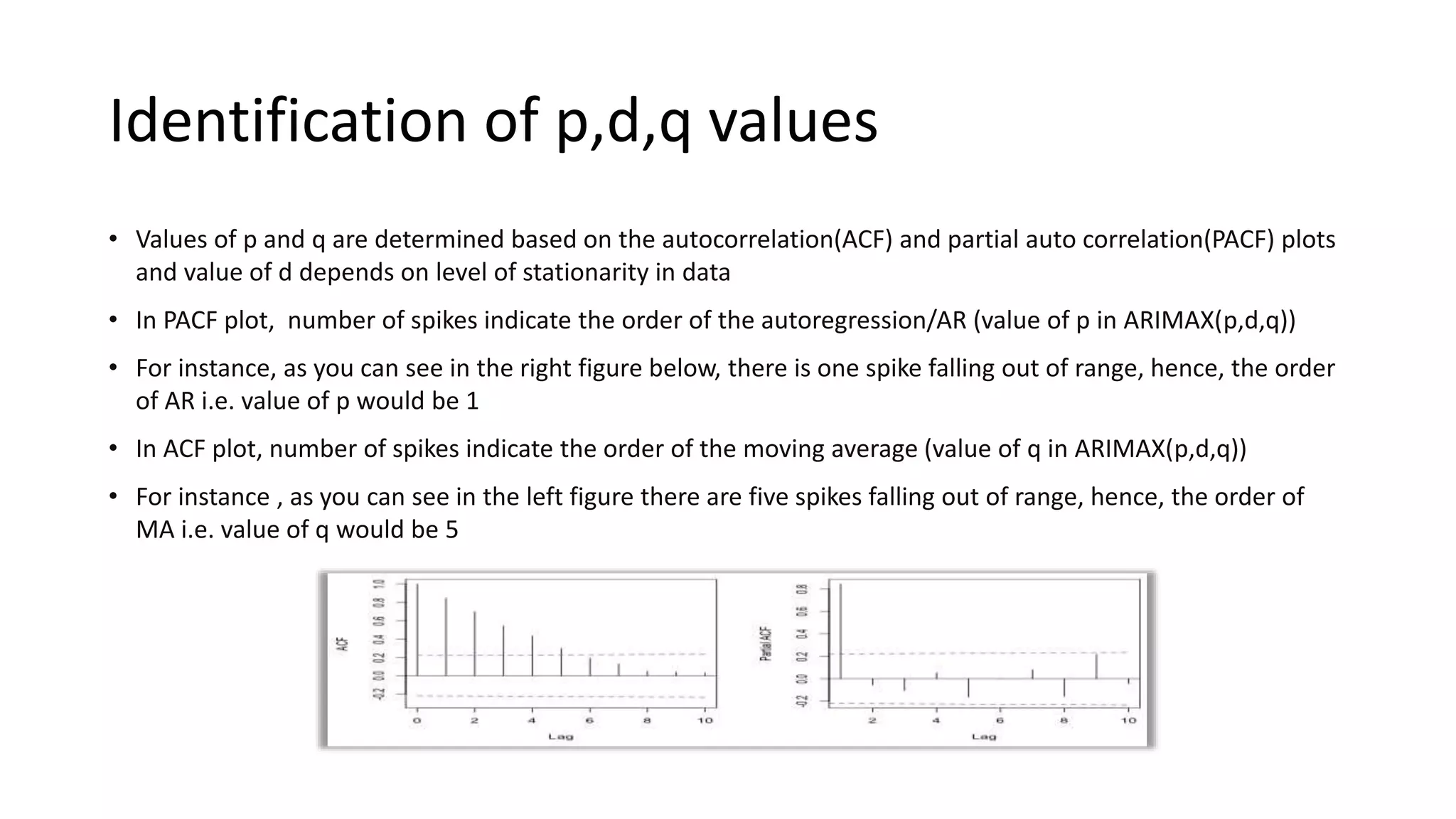

The document explains the ARIMAX (Autoregressive Integrated Moving Average with Exogenous variables) model for time series forecasting, suitable for both stationary and non-stationary data with various patterns. It outlines the parameters involved (p, d, q) for fitting the model, the approach to tuning parameters automatically or manually, and the importance of ensuring model accuracy through metrics like MAPE. Additionally, it touches on limitations such as multicollinearity and autocorrelation in the data.

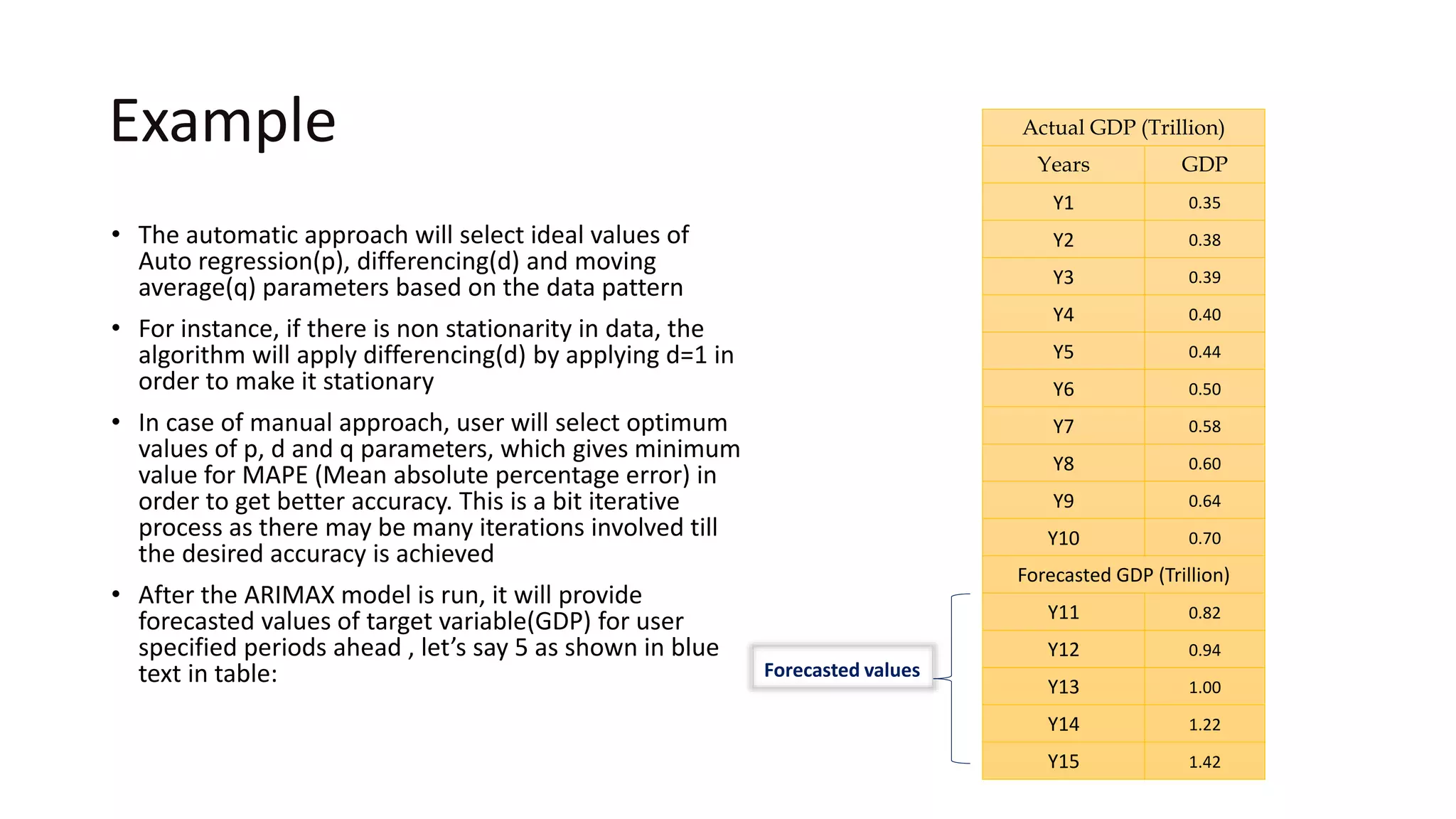

![Multicollinearity & Autocorrelation

• Multicollinearity means correlation between one or more predictors

• Variance Inflation Factor test is used to detect Multicollinearity in data

o For instance , VIF >5 depicts multicollinearity and hence one or more correlated variables

which are not significant for business should be dropped from the analysis

o Alternatively , predictors can be standardized([(x-min(x)/max(x)-min(x)] ) to reduce the

multicollinearity

• Auto correlated residuals mean a linear relationship between consecutive residuals

• To check autocorrelation Durbin–Watson test is conducted

o For instance, at 95% confidence interval, if p value <0.05 , then we conclude that auto

correlation exists in residuals. If p value >0.05 then auto correlation does not exist in residuals](https://image.slidesharecdn.com/arimaxparametertunningusecases-180629073133/75/What-is-ARIMAX-Forecasting-and-How-is-it-Used-for-Enterprise-Analysis-24-2048.jpg)