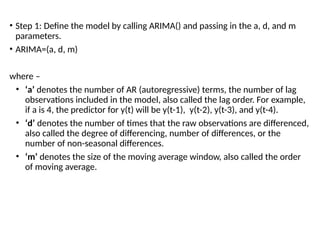

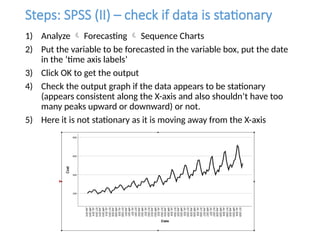

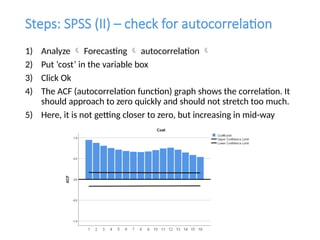

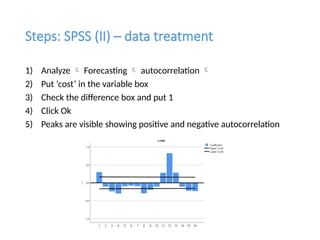

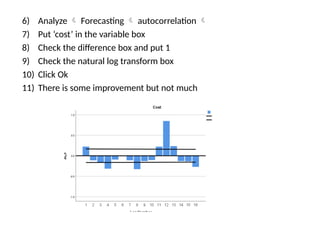

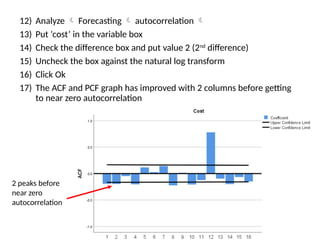

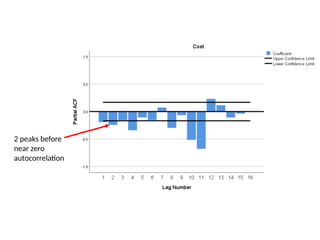

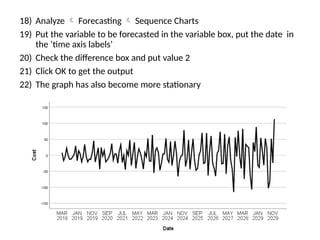

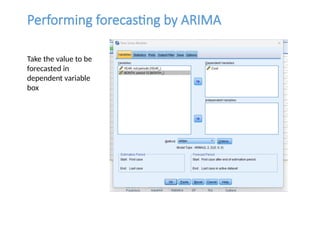

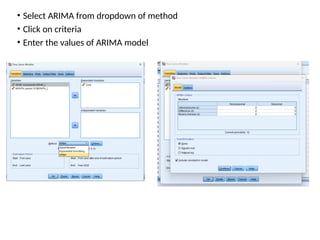

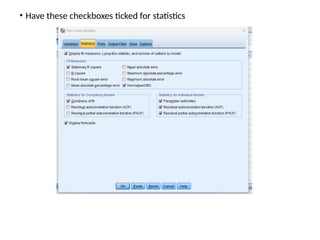

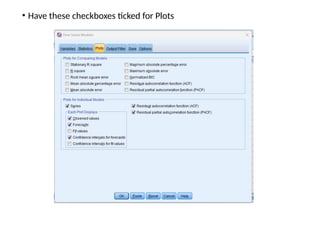

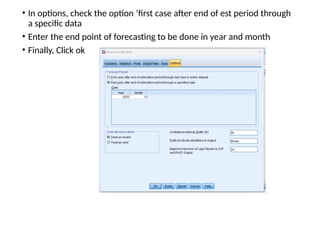

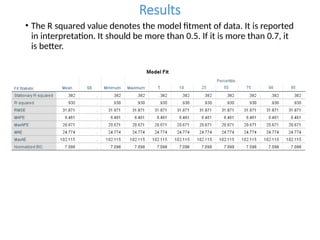

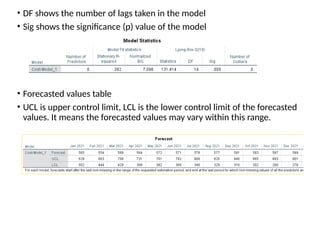

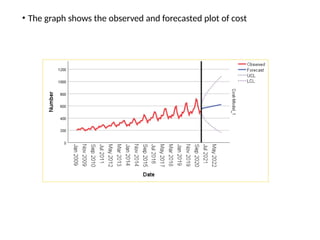

The document discusses forecasting HR costs using time series modeling, particularly the ARIMA method, essential for strategic managerial decision-making. It details the components of HR costs and outlines the steps in applying SPSS for checking data stationarity, autocorrelation, and performing the ARIMA forecast. The final results include model fit metrics, significance values, and forecasted cost ranges.