The document discusses online algorithms and their applications. It defines online algorithms as algorithms that process input sequentially without having the full input available from the start. This means online algorithms may not produce optimal results. It also discusses offline algorithms, which have the full input available, and competitive analysis, which compares online algorithms to optimal offline algorithms. It then provides an in-depth explanation of the secretary problem as an example online problem and discusses its optimal solution strategy. Finally, it briefly discusses potential applications of online algorithms to stock market prediction and portfolio management.

![Secretary Problem

Strategy to solve:

One strategy could be-

Always pick the ith candidate from some predetermined i ϵ [1,N]

P(Success) = 1/N

We can do much better than 1/N by applying the following rule, which yields the

optimal solution:

Interview and reject the first r applicants, for r < N. Accept the very next applicant

that is better than all the first r you interviewed.

P(Success) =P(r)

We will now show that the optimal solution is found by optimizing P(r) by the

standard route of solving:

P’(r) = 0](https://image.slidesharecdn.com/onlinealgorithmsandtheirapplications-150326124658-conversion-gate01/85/Online-algorithms-and-their-applications-7-320.jpg)

![Secretary Problem

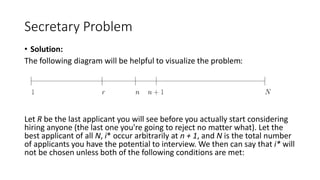

1. n ≥ r

2. The highest applicant in [1, n] is the same highest applicant in [1, r]

The probability of this happening for some given n is

This basically stems from the fact that the probability of i* occuring at

n+1 is 1/N and the probability of condition (2) is r/n . We can obtain

P(r) by summing over all possible n ≥ r :](https://image.slidesharecdn.com/onlinealgorithmsandtheirapplications-150326124658-conversion-gate01/85/Online-algorithms-and-their-applications-9-320.jpg)