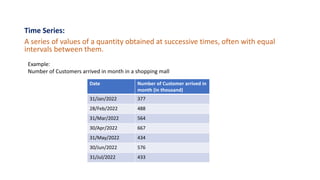

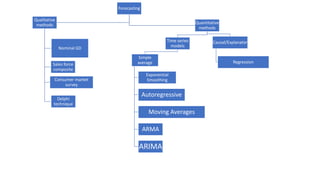

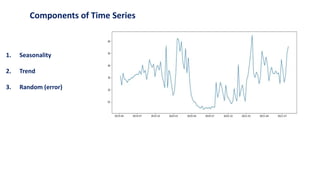

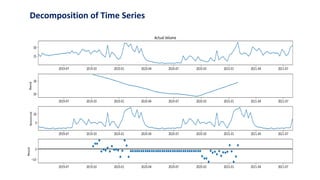

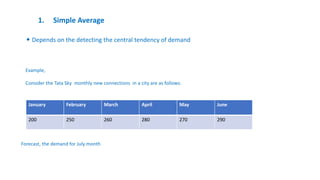

This document discusses time series forecasting using the ARIMA model in Python. It begins with an overview of forecasting and time series analysis. It then covers the key components of time series like trends, seasonality and randomness. Next, it explains techniques like simple average, exponential smoothing, ARMA and ARIMA models. Finally, it provides the major steps for time series forecasting using ARIMA in Python, including importing packages, decomposing the time series, checking stationarity, identifying p,q,d values, training and testing the model, making predictions and evaluating the model.

![2. Exponential Smoothing

Ft= F(t−1) + α[D(t−1)- F(t−1)] ------------------------- (1)

Where,

F= Forecast

𝛼 = Smoothing coefficient (0≤ 𝛼 ≤ 1)

D = Demand

t = is the period

t-1 = immediate previous period.

Expanding the exponential form, the equivalent form of equation (1) becomes,

Ft=α(1−α)0 D (t−1) + α(1−α)1 D(t−2) + α(1−α)2 D(t−3)](https://image.slidesharecdn.com/final-230918114229-b6410e35/85/final-pptx-10-320.jpg)

![Forecasting with ARIMA in Python

Important Codes:

import pandas as pd

import numpy as np

import matplotlib.pylab as plt

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.stattools import adfuller, acf, pacf

from statsmodels.tsa.stattools import arma_order_select_ic

from statsmodels.graphics.tsaplots import plot_acf,plot_pacf

from statsmodels.tsa.arima.model import ARIMA

from sklearn.metrics import mean_squared_error

from datetime import datetime

df['Date']=pd.to_datetime(df['Date'])

indexed_df=df.set_index(df['Date'])

ts=indexed_df['Actuals']

ts.head()

plt.plot(ts)

decompose=seasonal_decompose(ts_am)

fig=decompose.plot()

Major Steps

Step 1: install packages

numpy, pandas, matplotlib

Step 2: from statsmodels.tsa import

Decompose, MSE, ADfuller, ACF, PACF, ARIMA

Step 3: covert data to time series

Step 4: plot and decompose time series](https://image.slidesharecdn.com/final-230918114229-b6410e35/85/final-pptx-13-320.jpg)

![Forecasting with ARIMA in Python

Important Codes:

adftest=adfuller(timeseries)

print('pvalue of adfuller test is:', adftest[1])

plot_acf(ts_am)

plot_pacf(ts_am)

predict=model.predict(start=len(train),end=len (ts_w)-1)

error=np.sqrt(mean_squared_error(test,predict))

train.plot(legend=True, label ='train')

test.plot(legend=True, label ='test')

predict.plot(legend=True, label ='prediction ARIMA’)

final_model=ARIMA(ts_w,order=(1,0,2)).fit()

forecast=final_model.predict(len(ts_w),len(ts_w)+6)

ts_w.plot(legend=True,label='train')

forecast.plot(legend=True, label='forecast')

Major Steps

Step 5: Stationarity Check

Adfuller test

Step 6: finding p,q,d

ACF and PACF plots

Step 7: Test and Train Split

Step 8: predict values Using ARIMA model

Step 9: validity of model

Step 10: find the Forecast](https://image.slidesharecdn.com/final-230918114229-b6410e35/85/final-pptx-14-320.jpg)