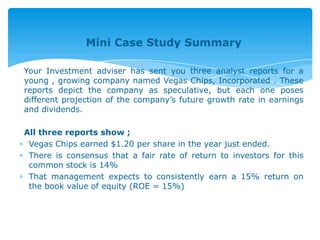

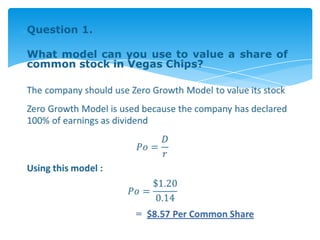

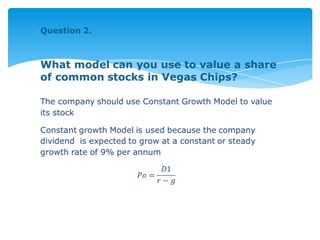

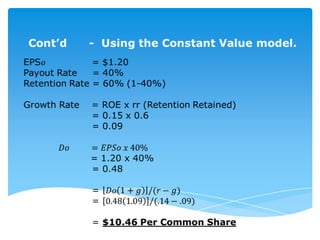

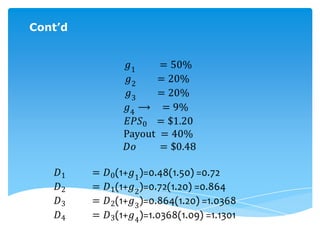

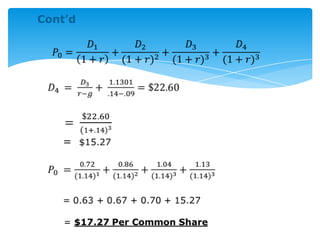

Three analyst reports were sent to an investment adviser about Vegas Chips, Inc., a young, growing company. The reports depicted the company as speculative but had different projections for future earnings and dividend growth rates. All three reports showed that in the last year, Vegas Chips earned $1.20 per share and that a fair return for investors is 14%. Management also expects to consistently earn a 15% return on book value. The variable growth model should be used to value the stock since the company's dividend growth rate is expected to vary, with rapid growth in the first few years becoming constant later.