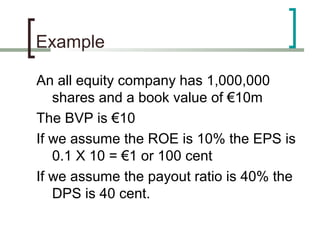

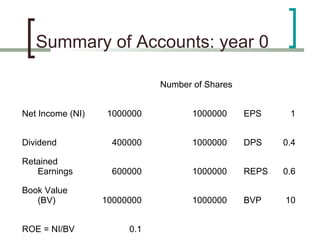

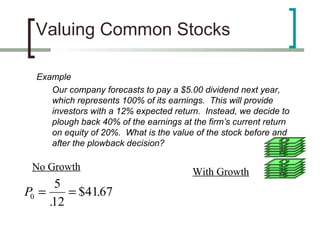

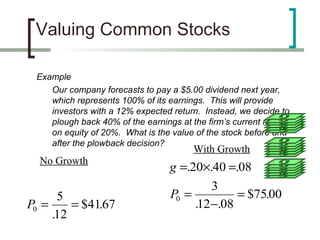

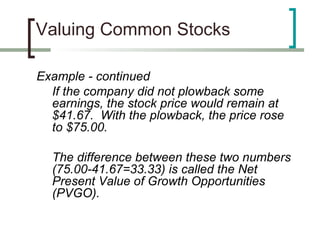

The document discusses various methods for valuing bonds and common stocks, including:

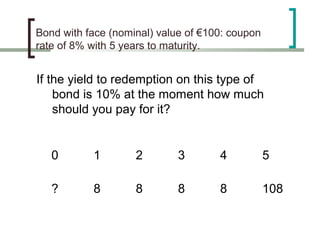

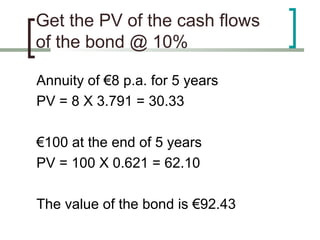

- Bond valuation using the present value of expected cash flows

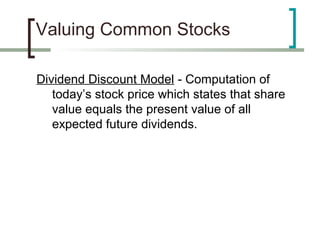

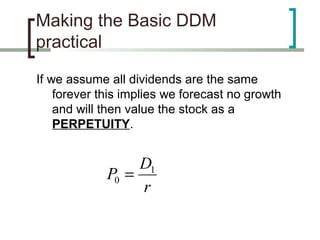

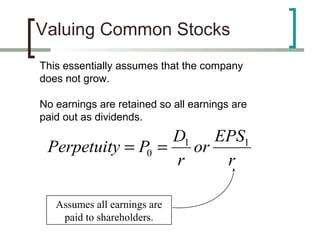

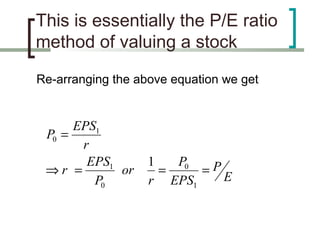

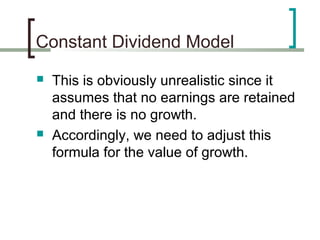

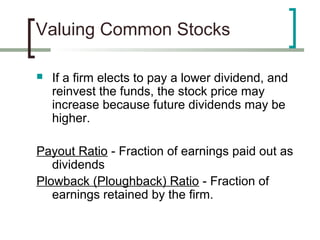

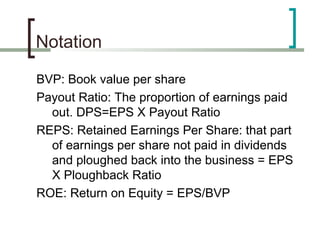

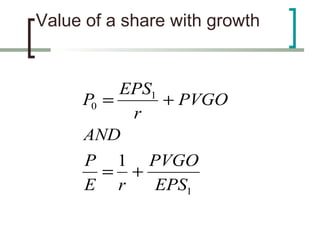

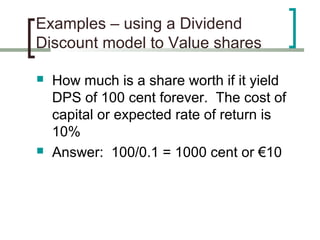

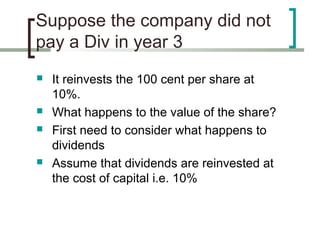

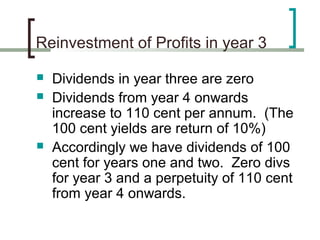

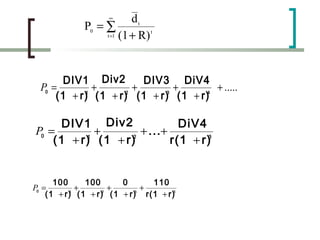

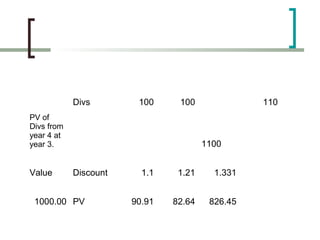

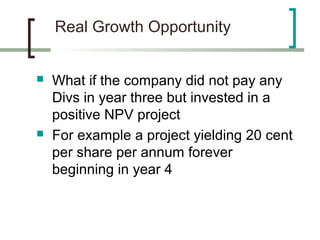

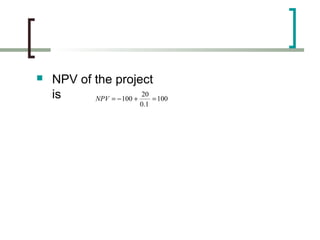

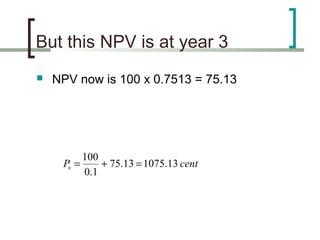

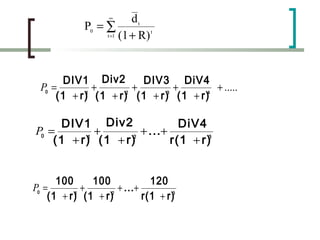

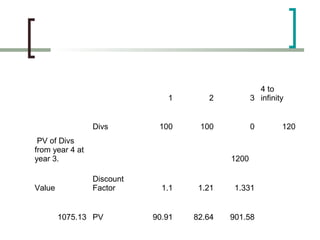

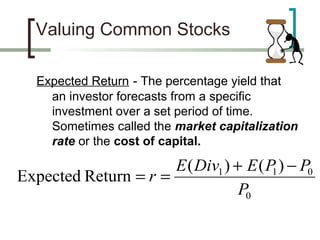

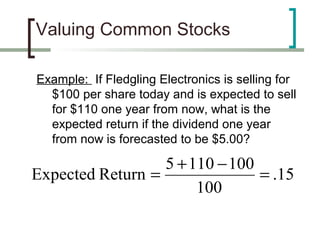

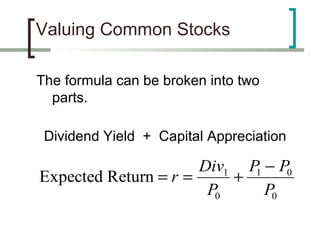

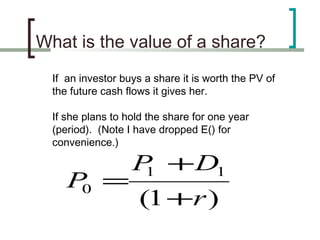

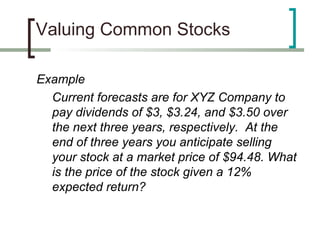

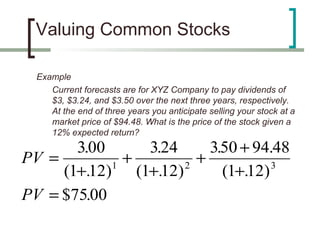

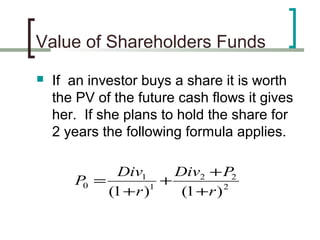

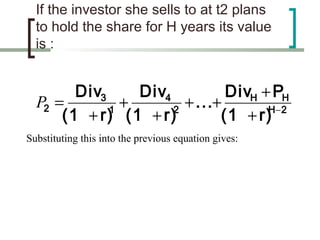

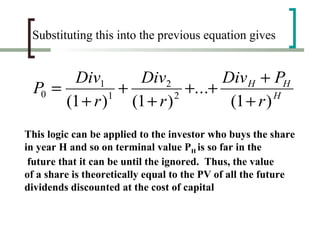

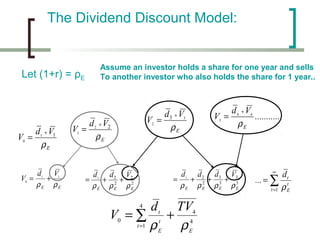

- Dividend discount models for valuing common stocks based on the present value of expected future dividends

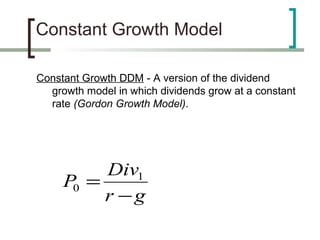

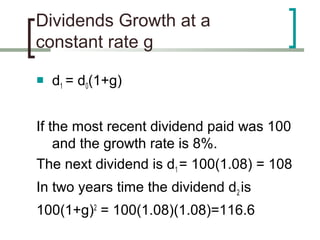

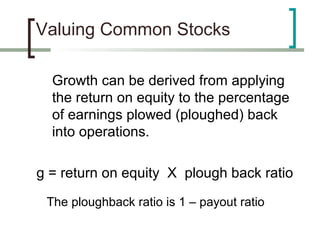

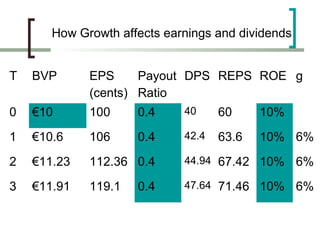

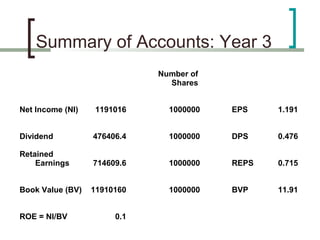

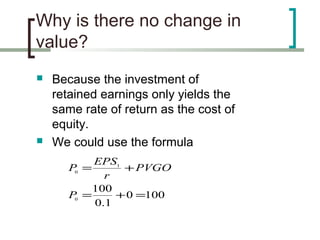

- Constant growth dividend discount models that incorporate a constant dividend growth rate

- How the sustainable growth rate is determined by a company's return on equity and plowback ratio

![The Basic Dividend Valuation

Model is:

~ ]

∞

E t [ d t+τ

Pt = ∑ τ

(PVED)

τ =1

RF

The value of a share is the present value of all

the dividends that It pays to infinity.](https://image.slidesharecdn.com/stocksbonds22141-121210041922-phpapp02/85/Stocks-bonds2214-1-17-320.jpg)