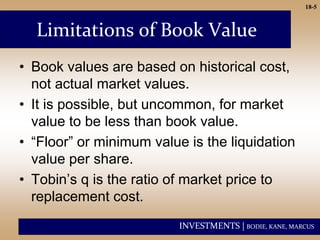

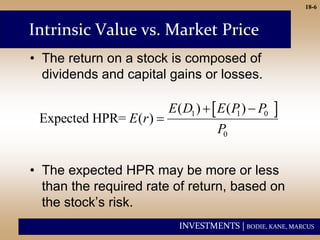

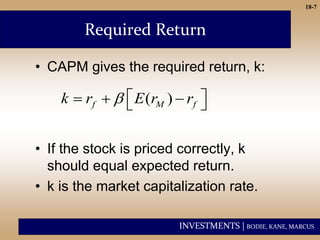

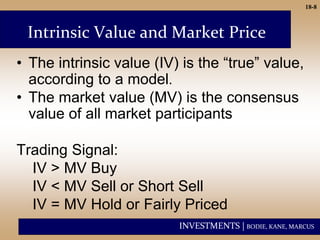

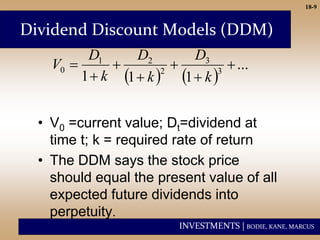

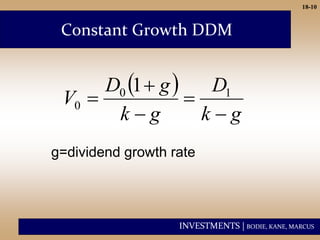

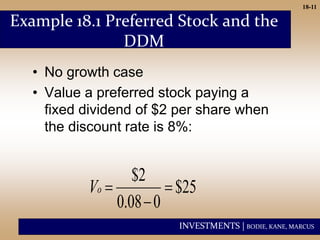

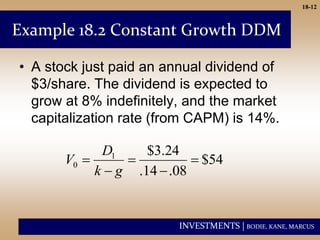

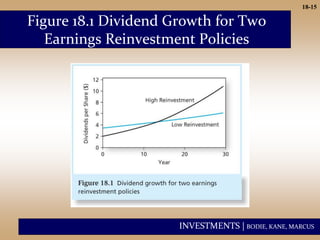

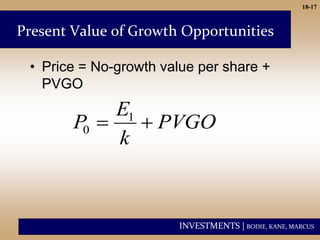

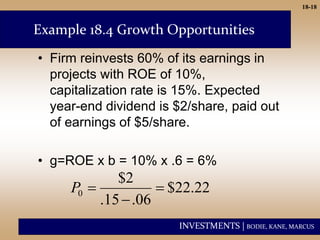

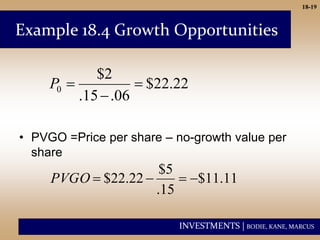

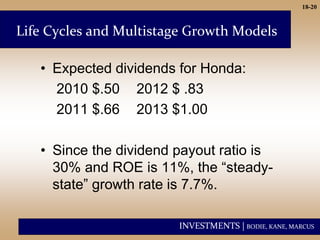

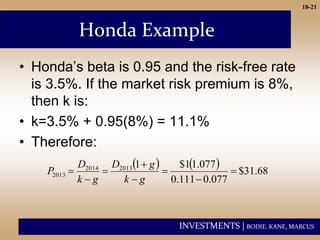

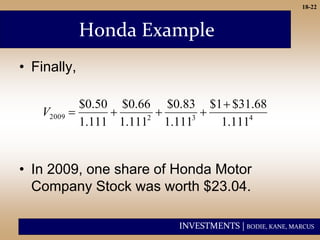

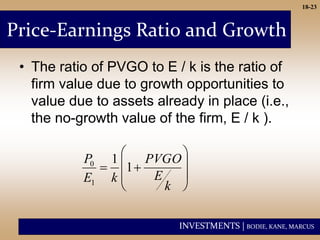

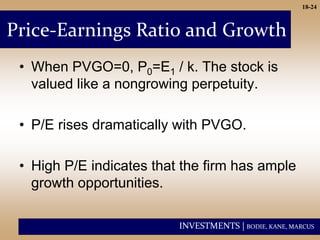

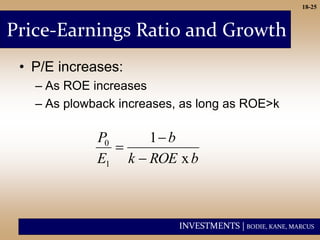

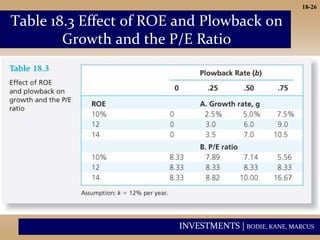

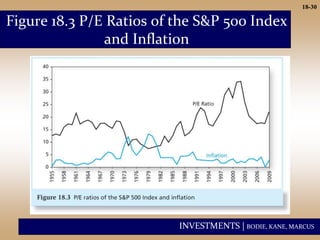

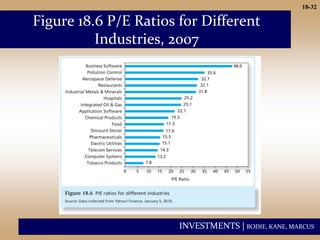

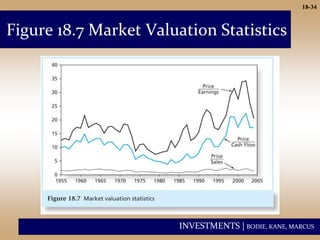

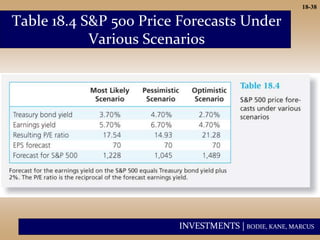

This document discusses various equity valuation models including fundamental analysis, balance sheet models, dividend discount models, price-earnings ratios, and free cash flow models. It provides examples of how to use the constant growth dividend discount model and multi-stage growth models to value stocks. It also examines how growth rates, payout ratios, and risk affect price-earnings ratios and discusses limitations of valuation models and ratios.