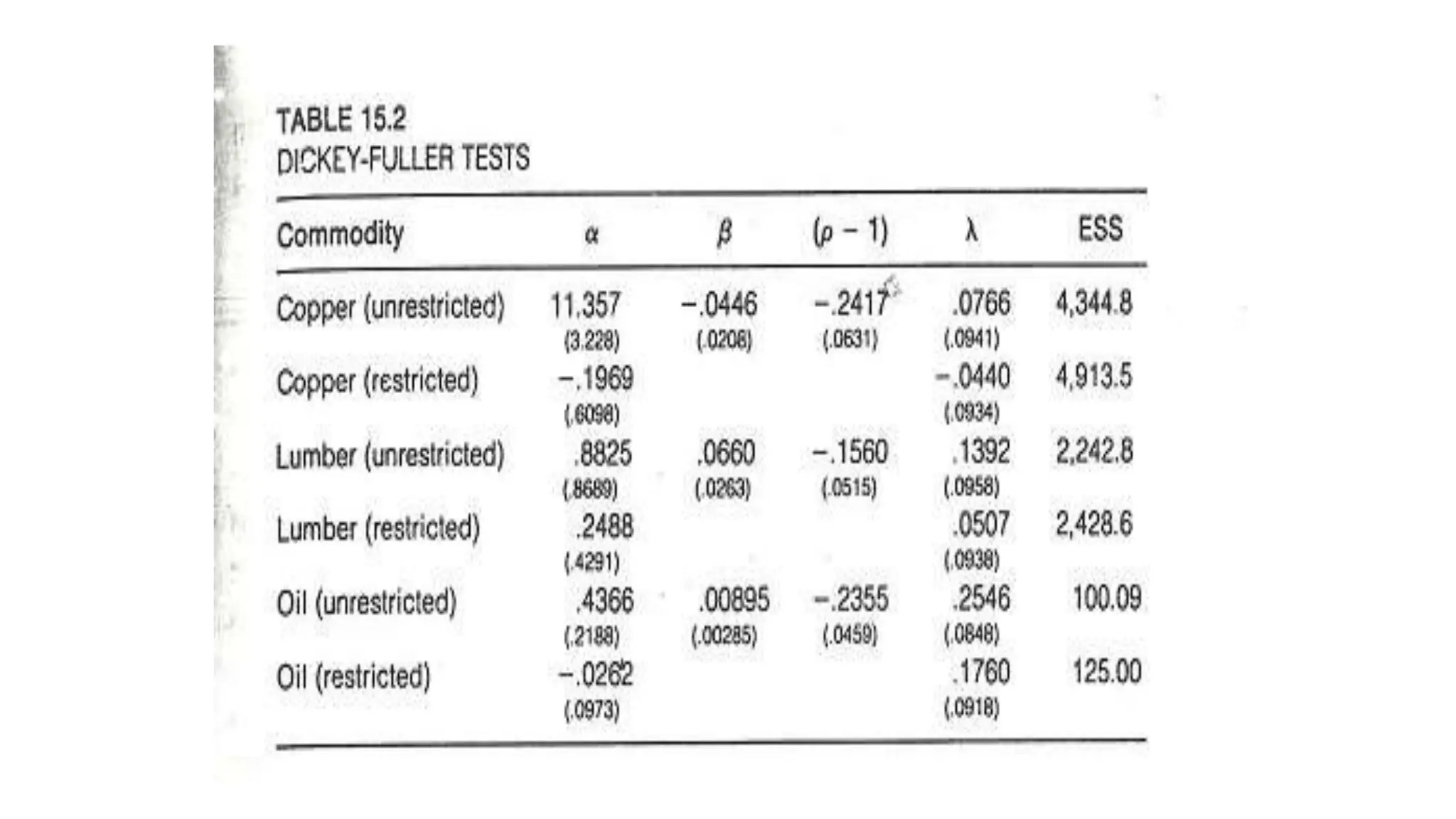

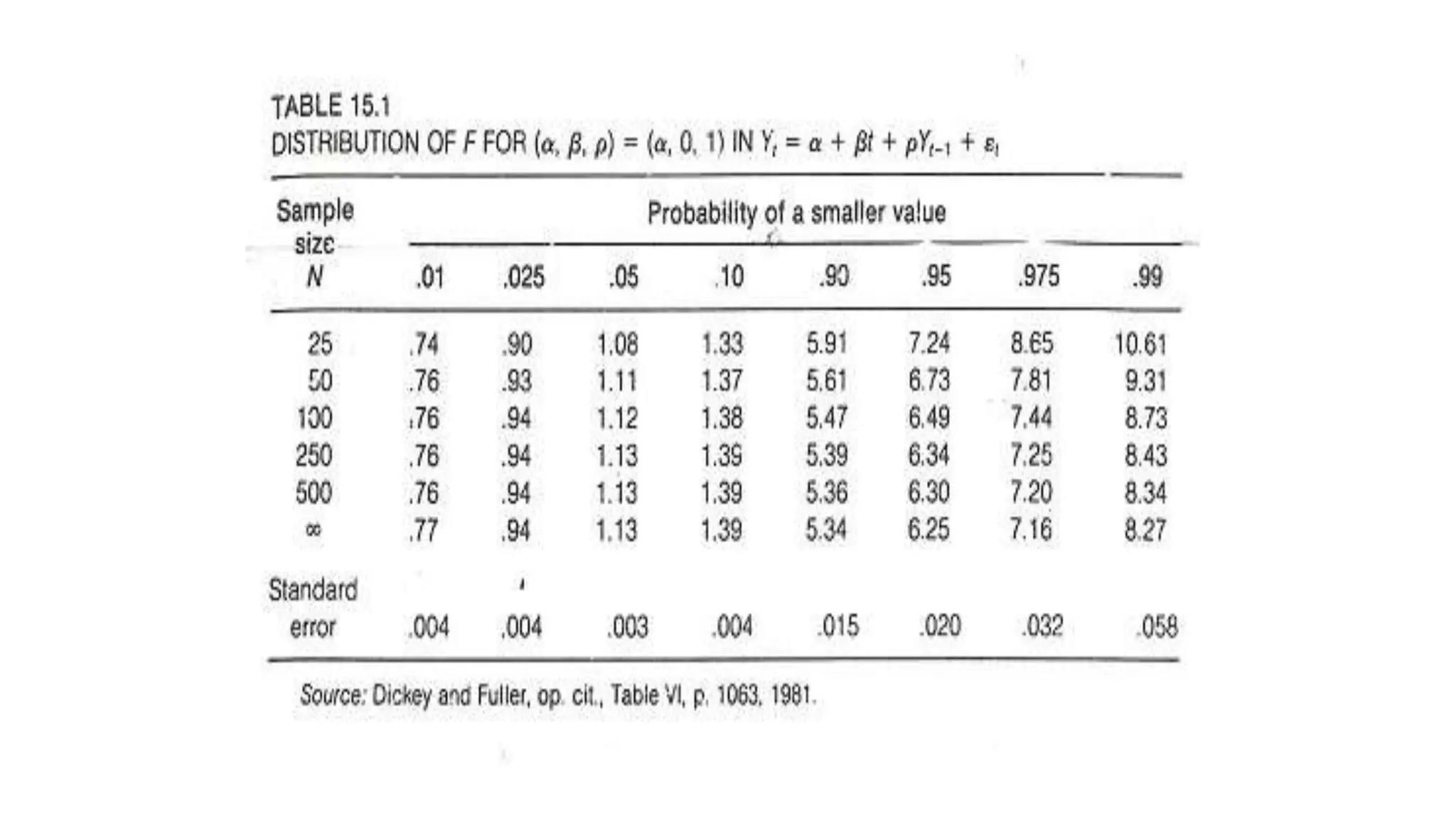

The document discusses unit root tests, which are used to determine whether a time series follows a random walk or stationary process. If a series has a unit root and follows a random walk, it has implications for regression analysis and economic forecasting. Common unit root tests introduced by Dickey, Fuller, and others test the null hypothesis that a time series has a unit root by examining the t-statistic on the coefficient of the lagged dependent variable. Standard OLS tests are invalid for unit root testing, so alternative test methods were developed.