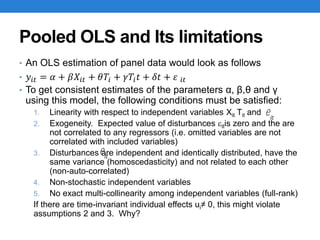

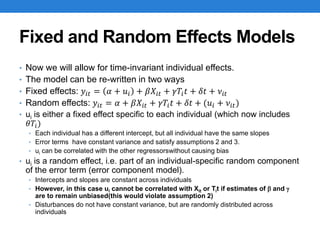

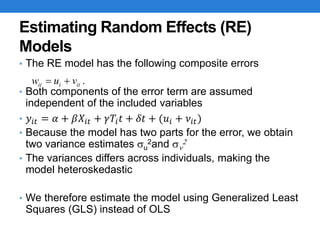

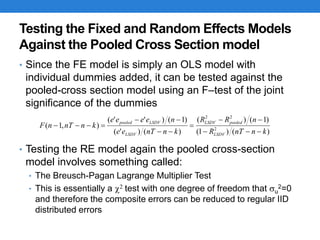

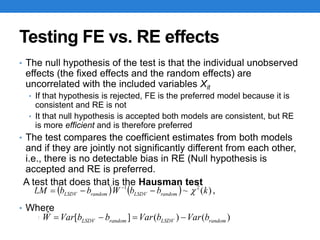

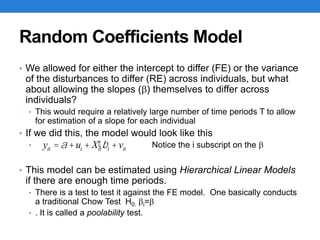

The document focuses on the use of panel data models for econometric analysis, specifically detailing pooled OLS and its limitations, as well as fixed and random effects models. It describes the necessary conditions for consistent parameter estimation and how unobserved time-invariant characteristics can be accounted for using these models. Additionally, it discusses methods for estimating and testing the validity of fixed and random effects models against pooled cross-section models, including the Hausman test.