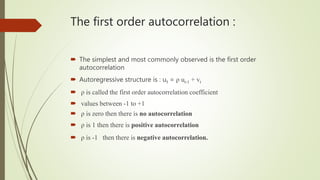

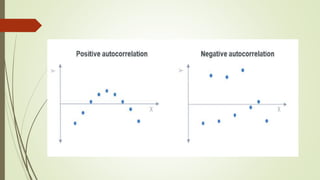

The document discusses the topic of autocorrelation. It begins by defining autocorrelation as data that is correlated with itself over successive time periods, rather than being correlated with other external data. It then explains the concept of autocorrelation and how it violates the classical linear regression assumption that disturbances are independent over time. Several potential sources of autocorrelation are described, including omitted variables, interpolation of data, and misspecification of the random error term. The document concludes by providing mathematical expressions that describe how the mean, variance, and covariance of autocorrelated disturbances differ from the independent case.

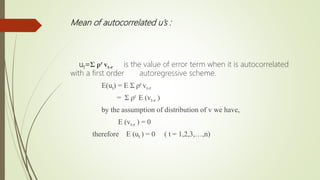

![Variance of the autocorrelated u’s :

By the definition of the variance we have

E(ut

2) = E [ Σ ρr vt-r ] 2

= Σ (ρr )2 E( vt-r ) 2

= Σ (ρr )2 var( vt-r)

= Σ ρ2r σ2

v

= σ2

v ( 1+ ρ2 + ρ4 + ρ6 + … )

E(ut

2) = σ2

v [ 1/ 1- ρ2 ]

Or var( ut) = σ2

v / (1- ρ2 )](https://image.slidesharecdn.com/autocorrelation-191030102708/85/Autocorrelation-13-320.jpg)

![Covariance of the autocorrelated u’s :

given that ut = vt + ρ vt-2 + ρ2 vt-2 + . . .

and ut-1 = vt-1+ ρ vt-2 + ρ2 vt-3 + . . .

we obtain

cov(ut ut-1) = E {[ut –E(ut)] [ut-1 – E(ut-1)]} = E [ut ut-1]

= E [(vt + ρ vt-1 + ρ2 vt-2 +…)(vt-1 + ρ vt-2 + ρ2 vt-3 +…)]

= E[{vt + ρ (vt-1 + ρ vt-2 +…)}(vt-1 + ρ vt-2 + ρ2 vt-3 +…)]

= E [(vt )( vt-1 + ρ vt-2 + ρ2 vt-3 +…)]+E[ ρ (vt-1 + ρ vt-2 +…)2]

= 0 + ρ E(vt-1 + ρ vt-2 +…)2

= ρ E(v2

t-1 + ρ2 v2

t-2 +…+ cross product)

= ρ(σ2

v + ρ2σ2

v + …+ 0)

= ρ[σ2

v (1+ ρ2+ ρ4 + ρ6+…)] = ρσ2

v ( 1/ 1- ρ2) ( for |ρ| ˂ 1)

= ρσ2

v

cont…](https://image.slidesharecdn.com/autocorrelation-191030102708/85/Autocorrelation-14-320.jpg)