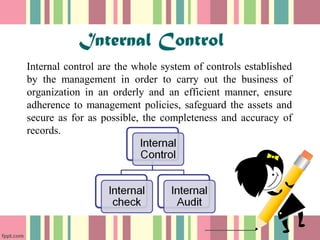

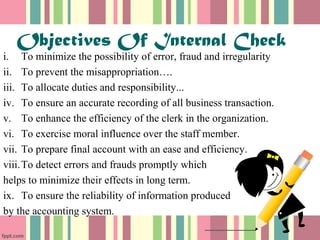

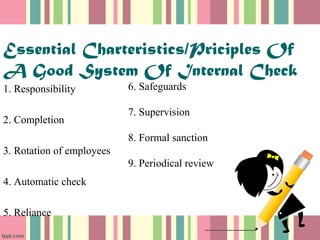

Internal control is a process designed to provide reasonable assurance that an organization achieves its objectives relating to operational effectiveness and efficiency, reliable financial reporting, and compliance with laws and regulations. It involves establishing policies and procedures to direct operations and monitor activities. Internal control aims to protect resources, detect and prevent fraud, and ensure accurate financial reporting. It includes internal checks, internal auditing, and other controls implemented by management. The objectives of internal control are reliable financial reporting, effective and efficient operations, and compliance with applicable laws and regulations.