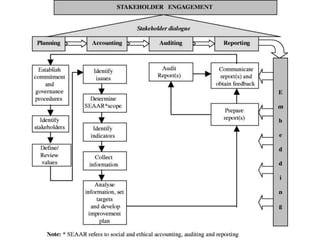

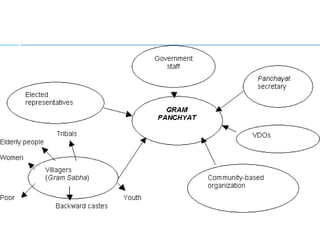

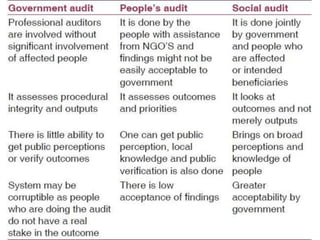

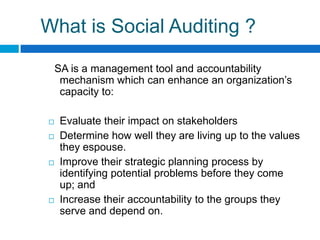

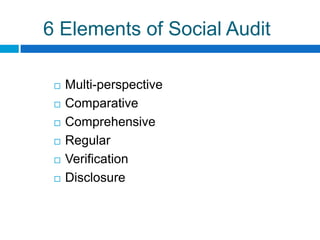

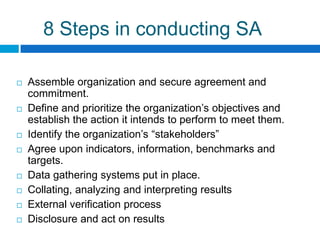

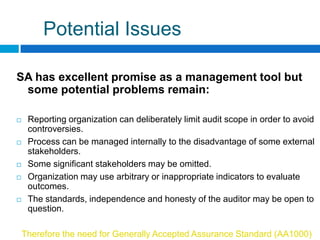

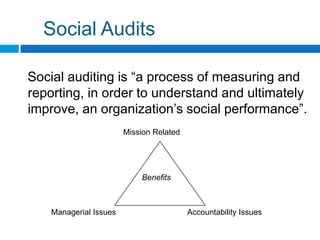

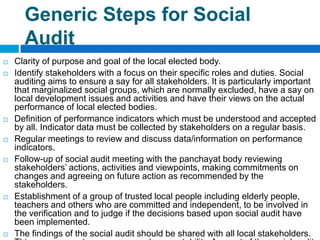

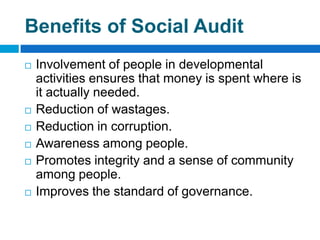

Social auditing involves regularly assessing an organization's social and environmental performance based on indicators agreed upon with stakeholders. It aims to evaluate impact on stakeholders, determine how well the organization lives up to its values, and improve strategic planning and accountability. The process involves defining objectives, identifying stakeholders, collecting and verifying data, analyzing and interpreting results, and disclosing findings publicly. Social audits empower communities and increase transparency and accountability in development programs.