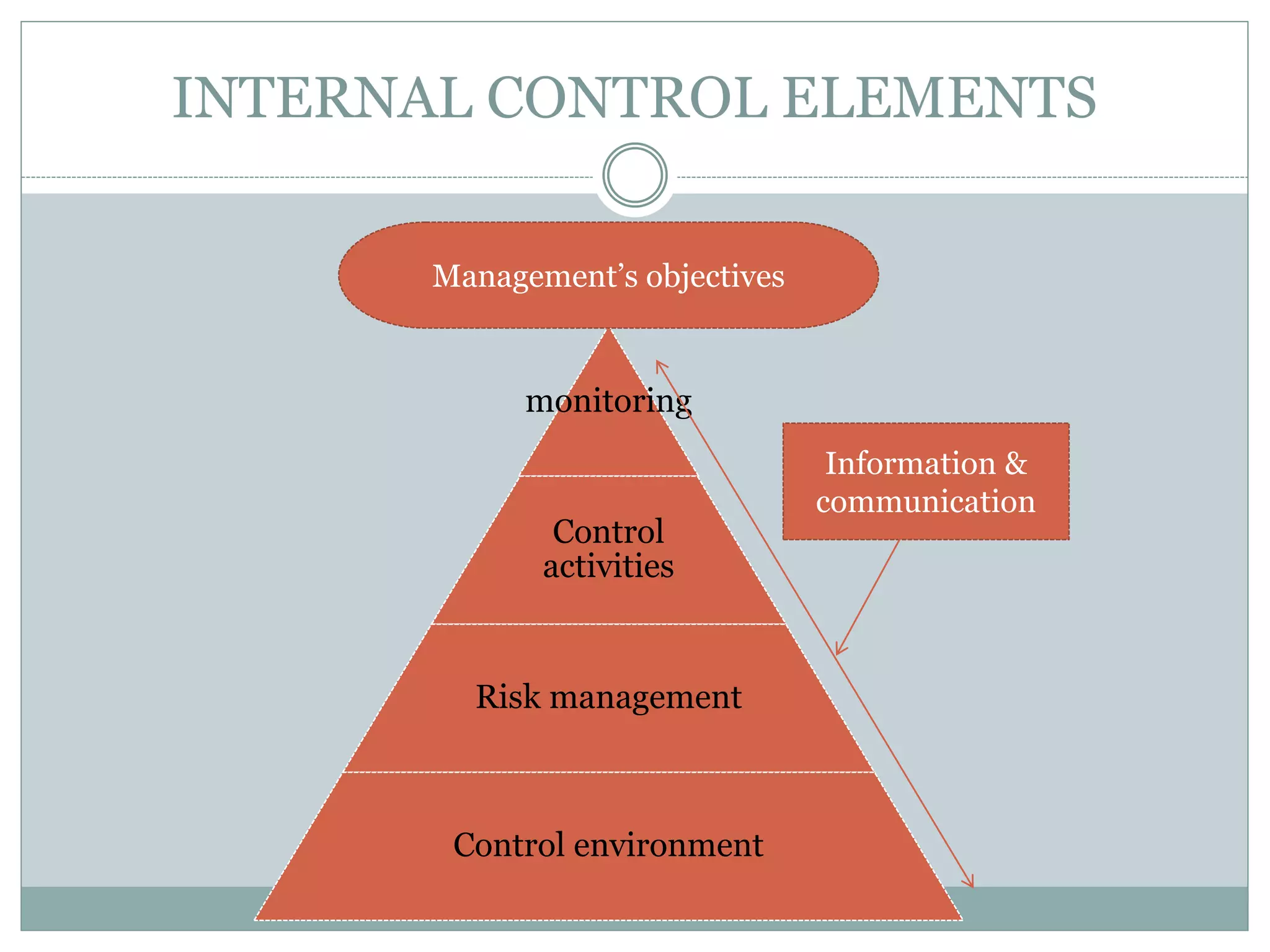

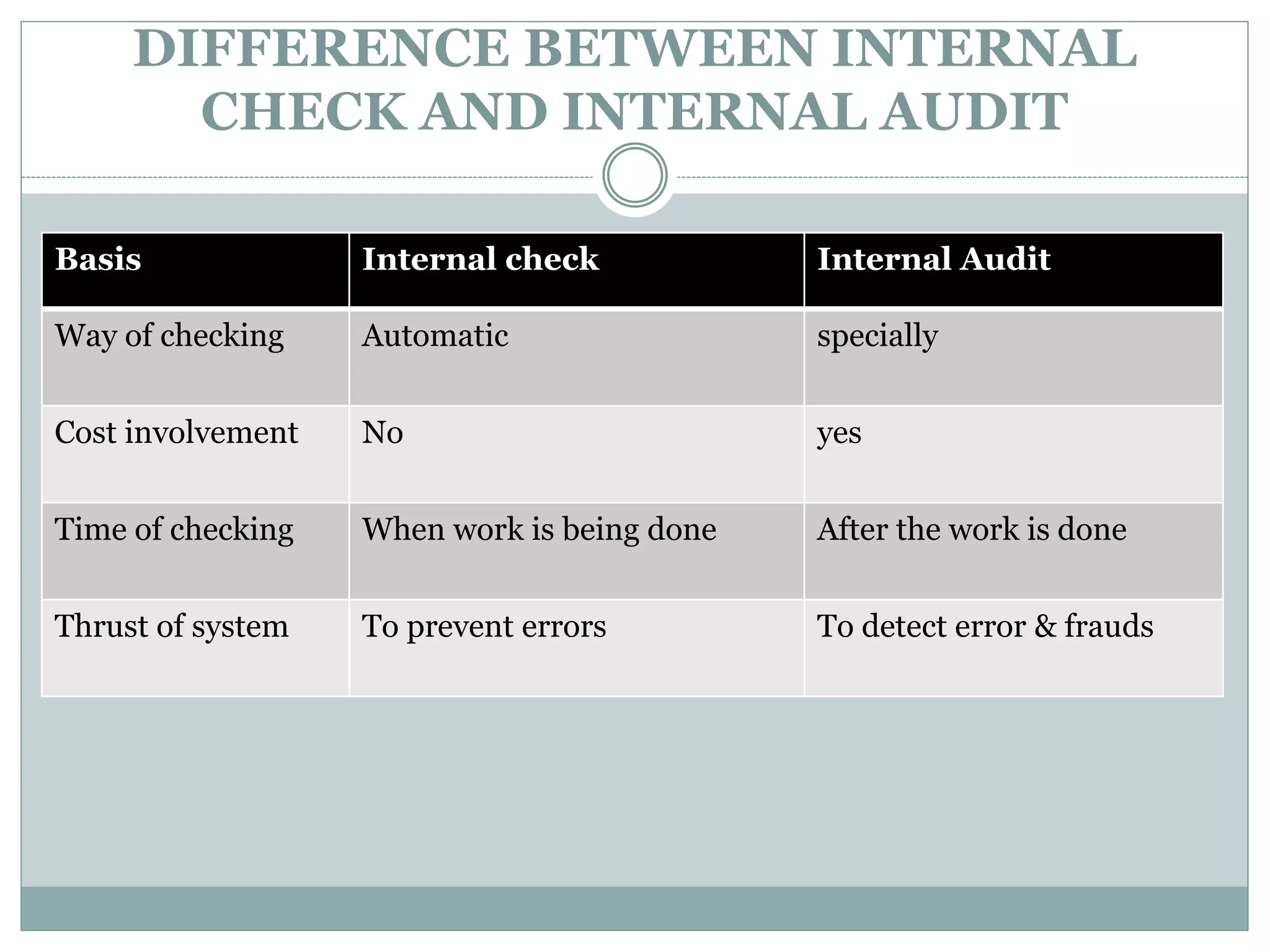

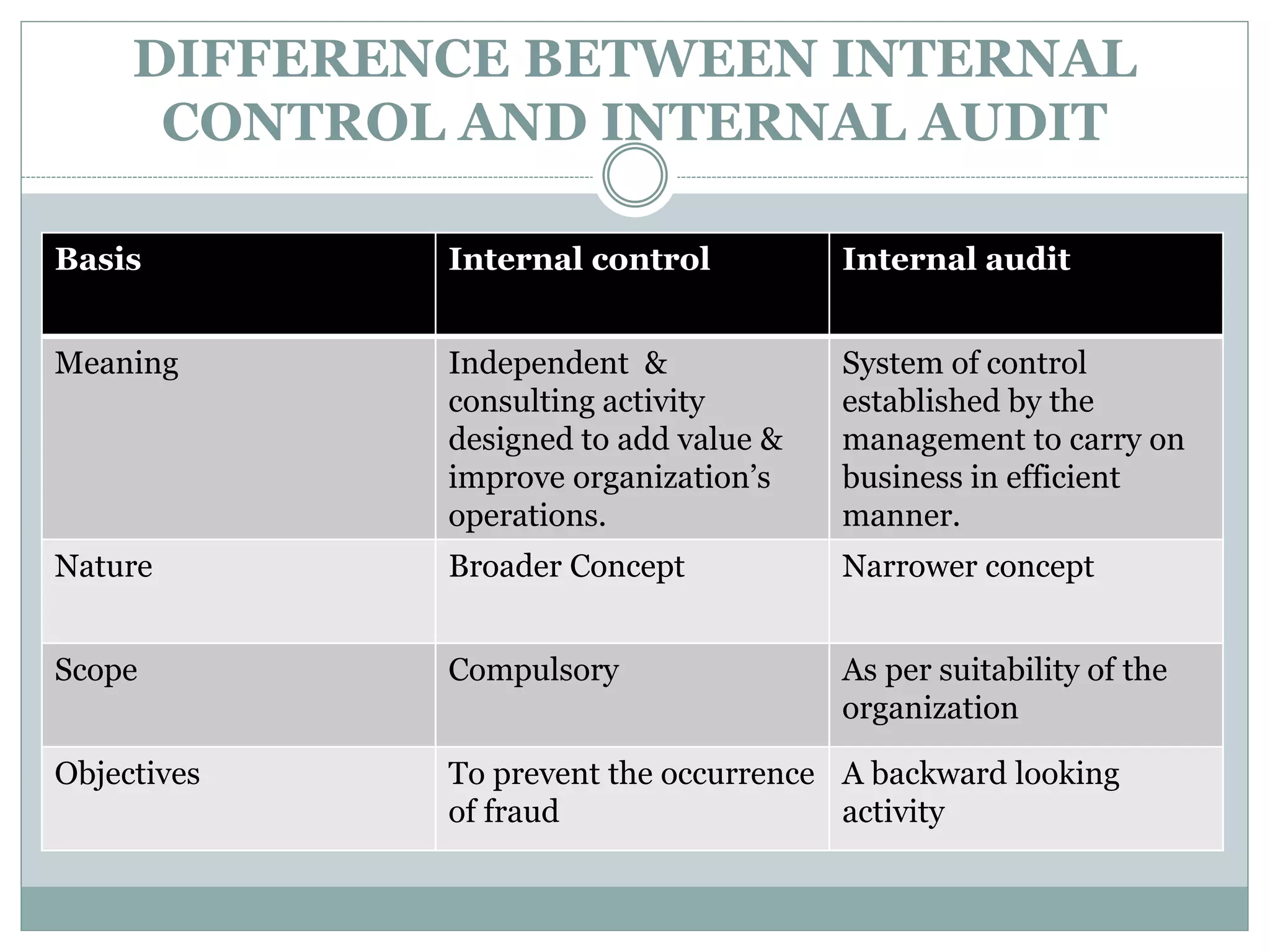

The document provides an overview of internal control systems, emphasizing their significance in financial reporting, compliance, and operational efficiency. It differentiates between internal checks and audits, describes control techniques, and touches upon audit sampling methods. Finally, it discusses inter-firm and intra-firm comparisons to evaluate performance and efficiency within organizations.