This document discusses audit sampling, including:

1. The definition and purpose of audit sampling, which is using procedures on less than 100% of items to make inferences about the whole population.

2. Factors that affect sample size such as population size, confidence level, precision, risk, and materiality.

3. Types of sampling methods like simple random sampling, stratified sampling, and cluster sampling.

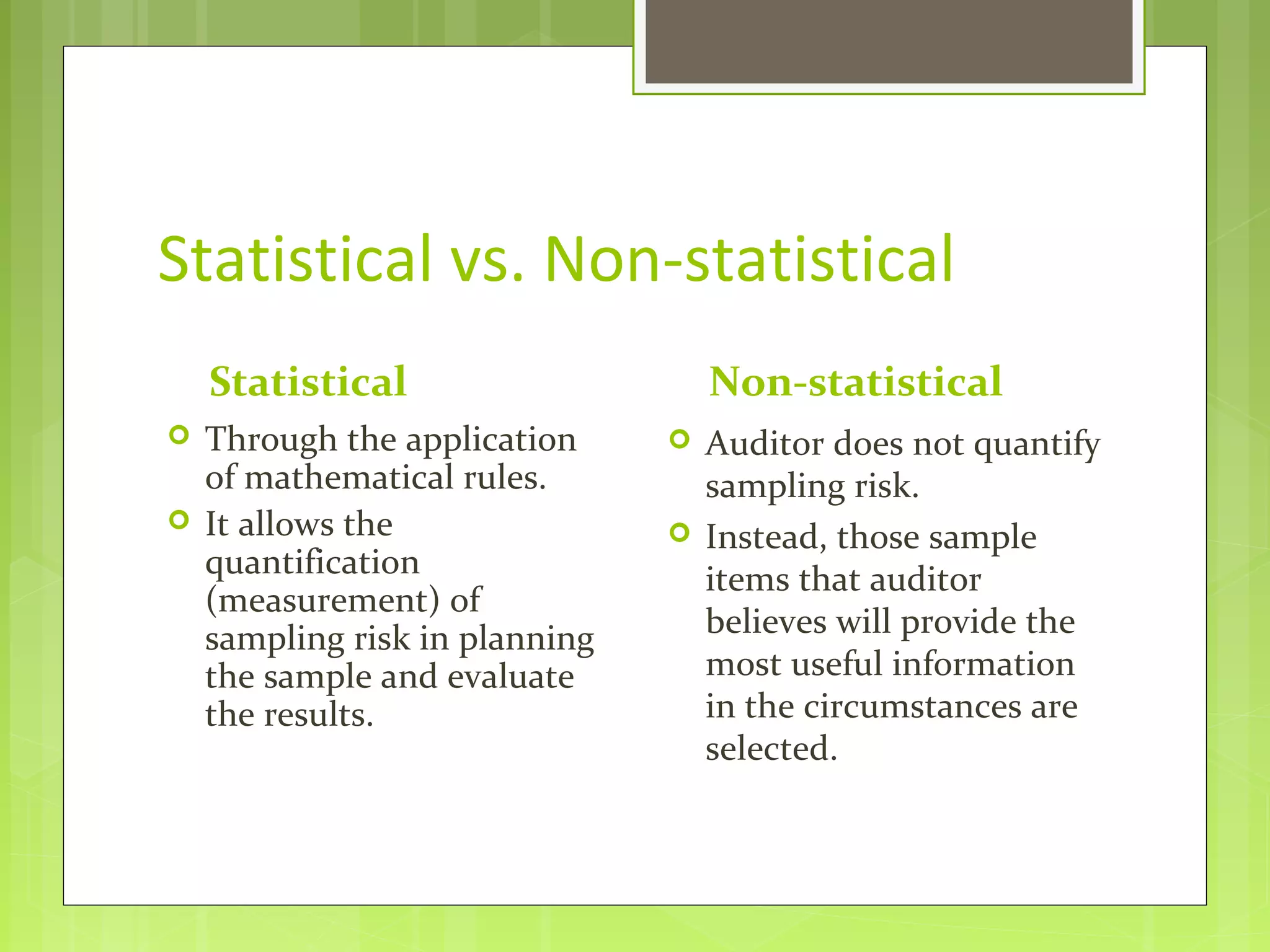

4. The differences between tests of control and substantive tests, and between statistical and non-statistical sampling.

5. Key concepts like type I and type II errors, tolerable error, and expected error in the population.