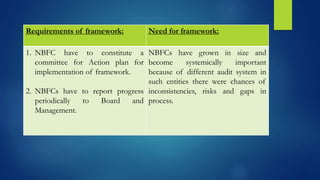

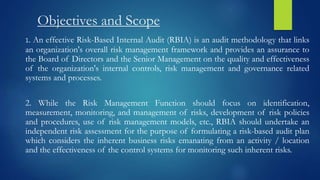

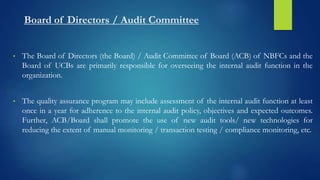

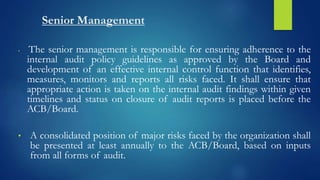

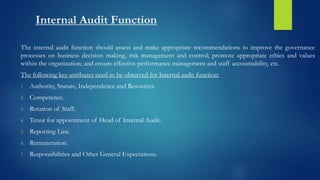

The document summarizes Risk-Based Internal Audit (RBIA) framework requirements for Non-Banking Financial Companies (NBFCs) in India. It specifies that all deposit-taking NBFCs and non-deposit taking NBFCs with assets over ₹5,000 crore must implement an RBIA system by March 31, 2021. The framework outlines objectives to provide assurance on internal controls and risk management. It details responsibilities of the board, senior management, and internal audit function to ensure independence, competency, appropriate resourcing and oversight of the RBIA system.