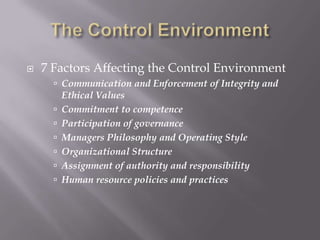

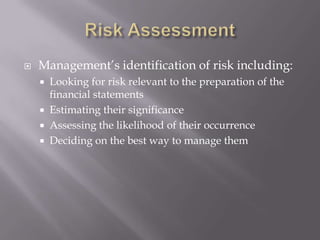

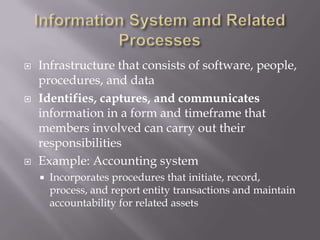

The COSO framework provides guidance for establishing effective internal controls. It is comprised of 5 components: control environment, risk assessment, control activities, information and communication, and monitoring. The control environment sets the tone at the top and influences employee conduct. Risk assessment involves identifying risks to financial reporting. Control activities are policies and procedures that help ensure management directives are followed. Information and communication systems identify, capture, and communicate pertinent information. Monitoring assesses internal control effectiveness over time.