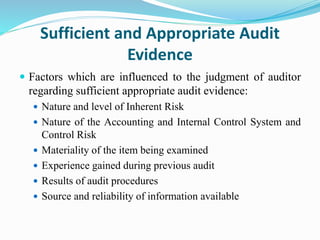

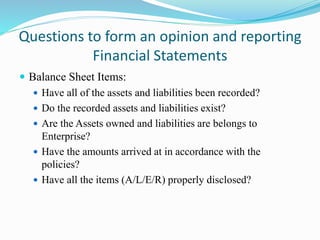

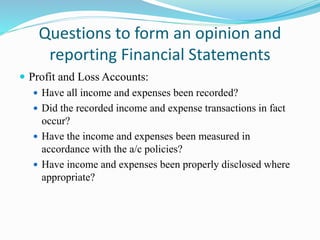

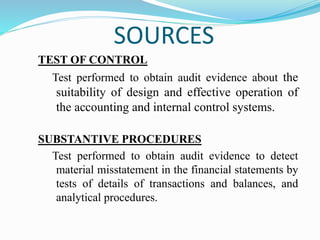

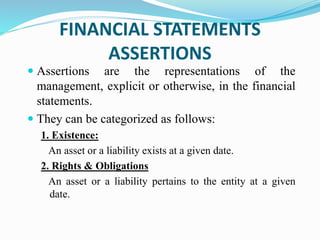

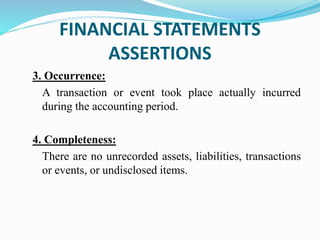

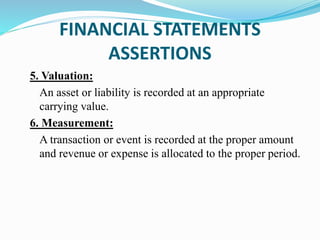

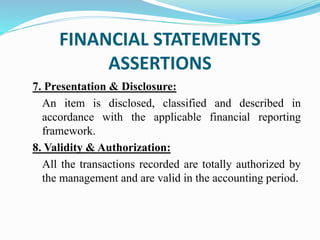

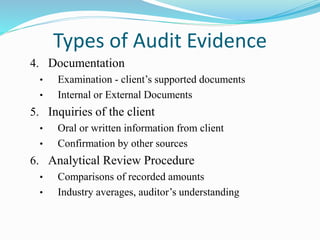

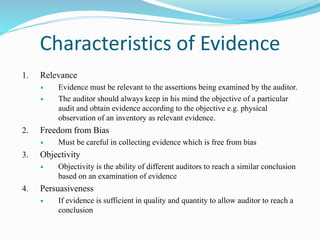

The document discusses audit evidence, which is information used by an auditor to arrive at conclusions to support the audit opinion. It should be sufficient and appropriate. Sufficiency refers to quantity and appropriateness to quality and relevance. The auditor considers inherent risk, control risk, materiality, and other factors to judge sufficient and appropriate evidence. Evidence comes from tests of controls, substantive procedures, and inquiries. It is used to evaluate financial statement assertions like existence, completeness, and valuation of assets and liabilities.