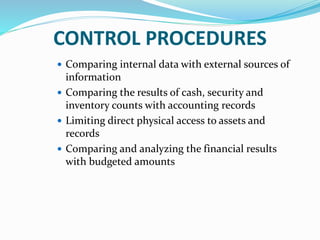

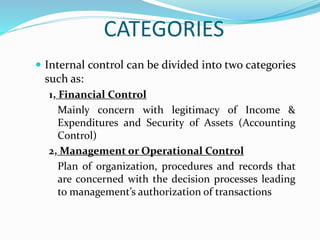

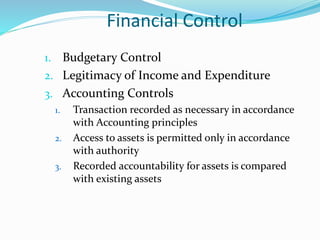

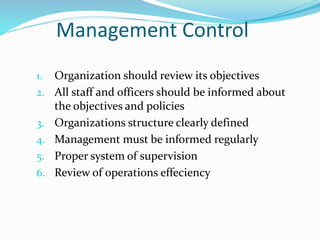

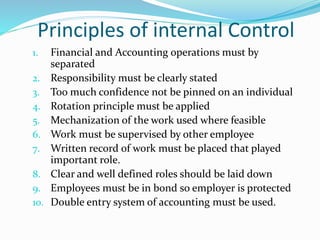

The document discusses internal controls and their importance for auditing. It defines internal controls as policies and procedures adopted by management to achieve objectives like ensuring orderly and efficient operations, safeguarding assets, and preparing reliable financial reports. The two main components of internal controls are the control environment and control procedures. The control environment reflects management's attitude towards controls, while control procedures are specific policies that help achieve objectives. Understanding internal controls is essential for auditors to plan the nature, timing, and extent of audit procedures.