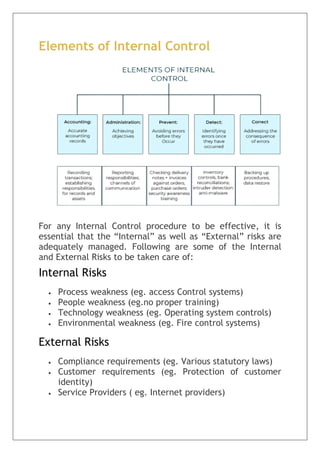

The document discusses internal financial controls (IFC) as required under Section 143(3)(i) of the Companies Act, 2013, emphasizing the auditor's role in assessing the adequacy and effectiveness of these controls. It outlines the significance of managing both internal and external risks, the need for regular risk assessments, and the implementation of effective monitoring procedures, including segregation of duties and proper documentation. Additionally, it introduces SBS Global as a provider of outsourced financial services, underscoring their qualifications and industry expertise.