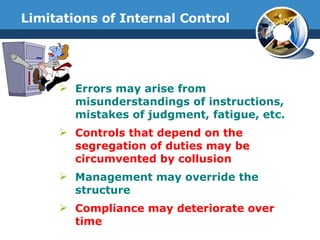

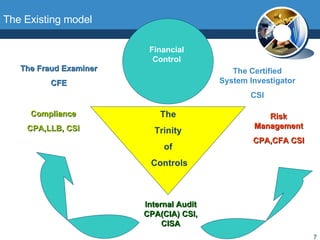

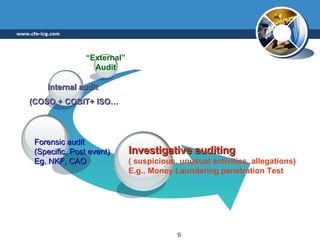

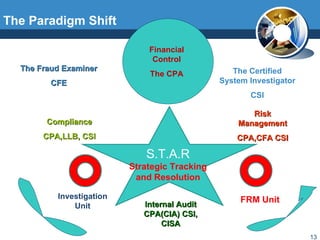

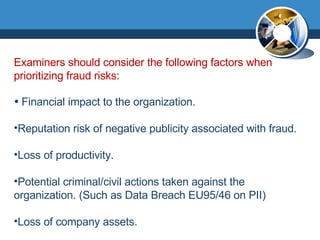

The document discusses the implementation and improvement of internal controls in organizations to prevent fraud, emphasizing the necessity of comprehensive fraud control procedures and the roles of internal audits and compliance. It outlines a systematic approach for identifying, prioritizing, and mitigating fraud risks, highlighting the importance of continuous monitoring and the need for a paradigm shift in fraud risk management responsibilities. Additionally, it describes the characteristics of individuals who commit fraud and presents steps for evaluating fraud risk factors and controls within an organization.