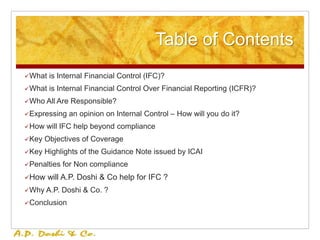

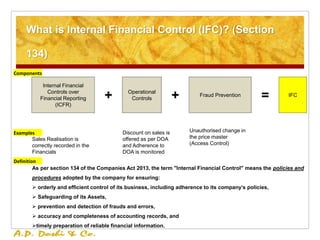

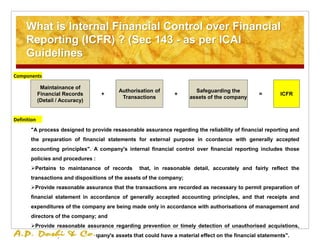

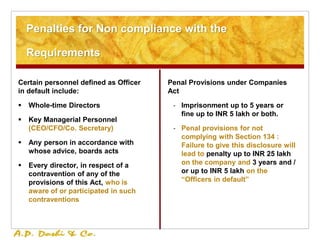

The document discusses internal financial controls (IFC) and internal financial controls over financial reporting (ICFR) as required by the Companies Act 2013 in India. It defines IFC and ICFR and explains who is responsible for them according to the Act, including directors, auditors, and audit committees. It outlines how IFC can help companies beyond compliance, the objectives of IFC coverage, key highlights from ICAI guidance, and penalties for non-compliance. Finally, it describes how the consulting firm A.P. Doshi & Co. can help companies with IFC implementation, documentation, testing, and reporting.