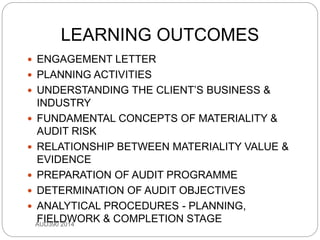

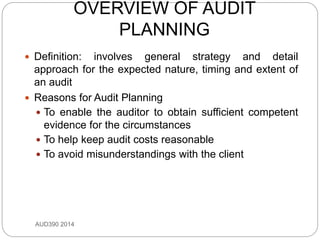

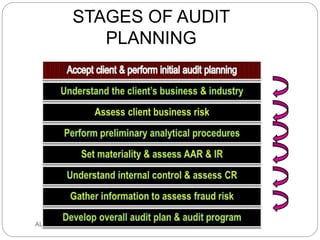

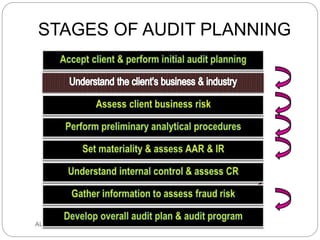

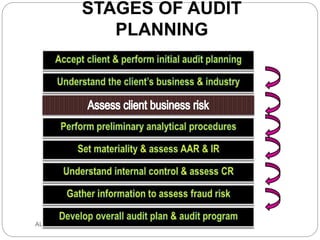

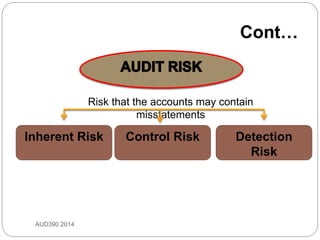

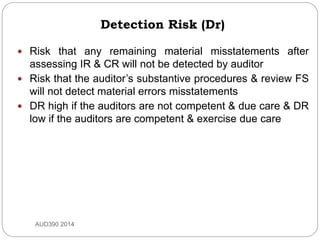

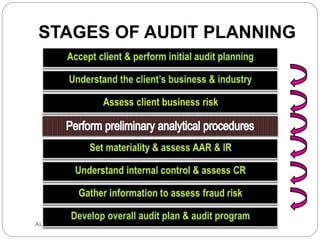

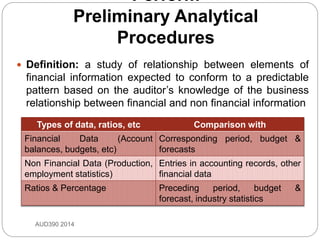

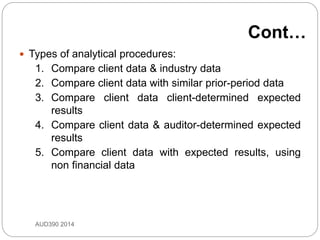

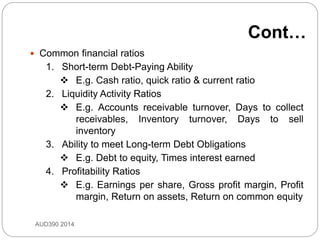

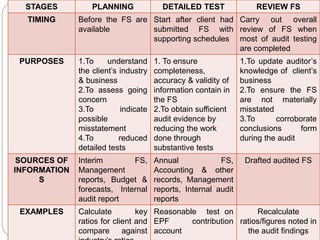

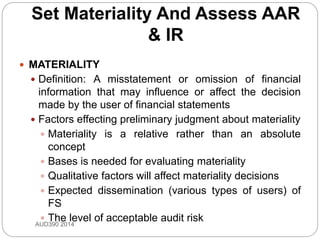

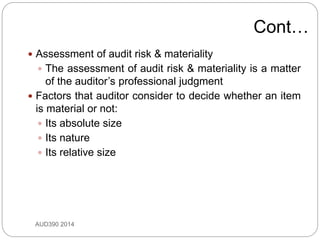

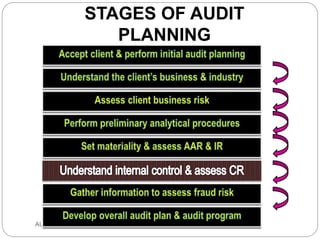

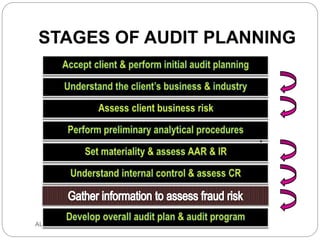

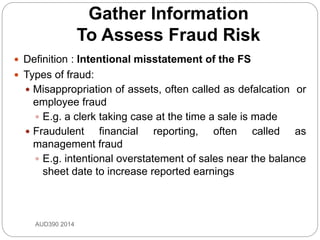

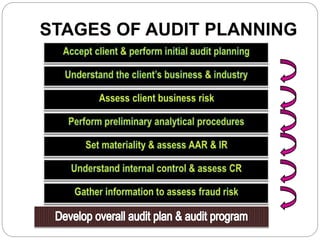

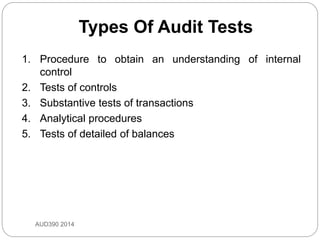

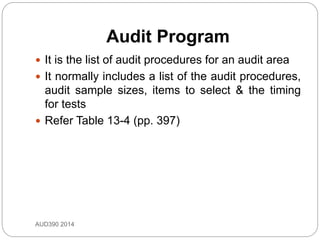

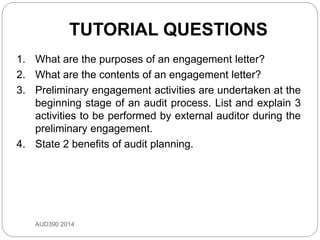

This document provides an overview of audit planning based on chapters 8 and 9 of an auditing textbook. It discusses the key stages and activities of audit planning, including understanding the client's business and industry, assessing risks, determining materiality, understanding internal controls, planning audit procedures, and developing an audit program. The overall purpose of audit planning is to obtain sufficient evidence for the audit in an effective and efficient manner.