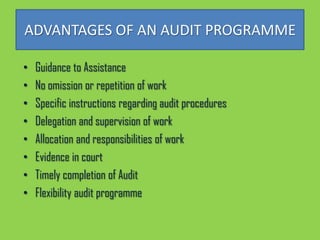

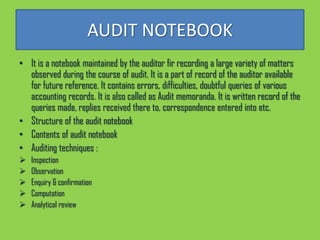

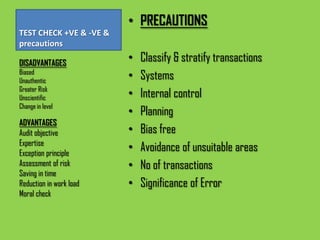

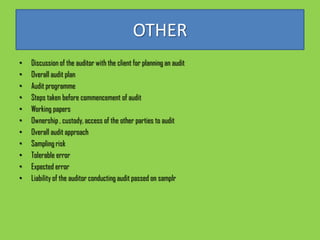

The document discusses audit planning procedures and documentation. It explains that audit planning involves planning the scope, depth, and resources needed to effectively and efficiently conduct the audit. Factors like complexity, client environment, and previous experience inform the audit plan. The document also outlines advantages and disadvantages of audit programs, the contents and purpose of audit notebooks, sampling methods and evaluation, and other audit planning considerations like discussion with the client and overall audit approach.